OGJ Newsletter

Lehman: Global E&P spending to jump 20% in 2008

Worldwide exploration and production expenditures will increase 20% to $418 billion this year, according to a midyear survey of 398 companies by Lehman Bros.

The survey indicates greater acceleration in 2008 spending plans in North America and elsewhere than those indicated 6 months ago in the firm’s previous survey.

E&P expenditures will rise 15% to $98 billion in the US, 11% to $27.5 billion in Canada, and 22% to $293 billion total in all other countries. Lehman said this represents a record percentage increase over a 6-month period from December to June since the firm began conducting these surveys.

Lehman’s December 2007 survey indicated growth of just 3.5% in the US, a 12% spending reduction in Canada, and a 16% rise in spending elsewhere.

The latest survey indicates that operators added $35 billion to this year’s budgets worldwide, with the largest boost to projects outside North America, an $18 billion increase in 2008 capital spending, said analyst James D. Crandell. Operators added $13 billion to their 2008 US budgets and $4 billion to budgets for spending in Canada.

In 2007, companies overspent their budgets by $8.5 billion, Crandell said. Outside North America, budgets were overspent by $5.5 billion, and US budgets were overspent by $3.5 billion, partially offset by $500 million of underspending of budgets in Canada.

This year’s budget additions are being driven by higher commodity price expectations. The average price on which companies are basing their 2008 budgets has risen to $85.23/bbl for oil, up 25% from the level indicated in December, and $8.07/Mcf for US natural gas, up from $6.78/Mcf indicated in the December survey.

Of all the integrated oil companies, independents, and national oil companies Lehman surveyed, 70% anticipate that E&P spending growth will continue into 2009, with gains of at least 10% expected by 80% of these companies.

EU energy ministers reach unbundling compromise

At their June 6 meeting in Luxembourg, European Union energy ministers reached a compromise on the ownership unbundling dispute. Germany and France, which had led the opposition with six other EU countries, may retain ownership of their champions: Electricite de France and Gaz de France in France, and E.On AG and RWE in Germany. The two countries had been the strongest opponents to the dismantling of their integrated gas and electricity utilities.

The terms of the compromise are tough, however. Energy Commissioner spokesman Ferran Taradellas Espuny told OGJ that what was achieved at the Luxembourg meeting was that the die-hard unbundling proponentsthe UK and the Netherlands together with about half the 27 member statesaccepted a less drastic solution than the full ownership unbundling of production and transport. The final agreement will be shaped after the EU Parliament’s formal vote in mid-July. While the sale of the transport-marketing networks has been avoided and ownership retained, the units will be operated independently from their parent company and supervised by a watchdog regulator with bolstered powers. If the compromise is approved, the integrated groups will have to introduce a number of measures to make sure the separation of production and networks is really “effective.” The supervisory body of the network will be competent on all the main subjects that fall within the scope of the shareholder such as investments, debt, and return on investments.

It will be managed completely by an independent transmission operator, and the transmission network personnel will be strictly distinct from personnel of the historic operator.

The adoption of the relevant directives involving the full reorganization of the integrated groups should not take place before 2009 after which member states will have 2 years to incorporate them into their legislation.

Commenting on the compromise, Energy Commissioner Andris Piebalgs praised the good will that led to it, adding, “The agreement covers a wide package of measures, including unbundling, real powers and independence of national energy regulators, and the establishment of a new agency that will be responsible for ensuring much more effective and easy cross-border trade in electricity and gas.”

Dorgan opposes CFTC chairman nomination

US Sen. Byron L. Dorgan (D-ND) said he opposes the nomination of Walter L. Lukken, acting chairman of the Commodity Futures Trading Commission, to become chairman because Lukken has not adequately addressed energy market speculation.

Speaking to the North Dakota and South Dakota Bankers Association in Bismarck June 9, Dorgan charged that the run-up in crude oil prices to nearly $140/bbl has been caused by speculators who are running circles around the federal agency, which is supposed to stop damaging commodities speculation.

Lukken appeared as a nominee on June 4 before the Senate Agriculture, Nutrition, and Forestry Committee, along with current CFTC member Bart Chilton and Scott O’Malia, minority clerk on the Senate Appropriations Committee’s Energy and Water Development Subcommittee, who have been nominated as CFTC commissioners. The committee has not yet acted on the nominations.

Dorgan, who serves on the Energy and Commerce Committee as well as the Agriculture Committee, told the bankers that testimony before both panels in recent months has convinced him that the fundamentals of supply and demand do not justify current oil price levels. He said he believes prices are 30-40% higher than is justified.

Dorgan urged US President George W. Bush to withdraw Lukken’s nomination and select a nominee who will provide more leadership to address speculation. His remarks came one day before the CFTC’s Energy Markets Advisory Committee was scheduled to hold its first meeting at the commission’s Washington headquarters. The CFTC also plan to hold its second annual international antimanipulation conference June 11-12 with senior enforcement officials from other countries’ commodity trading regulatory agencies.

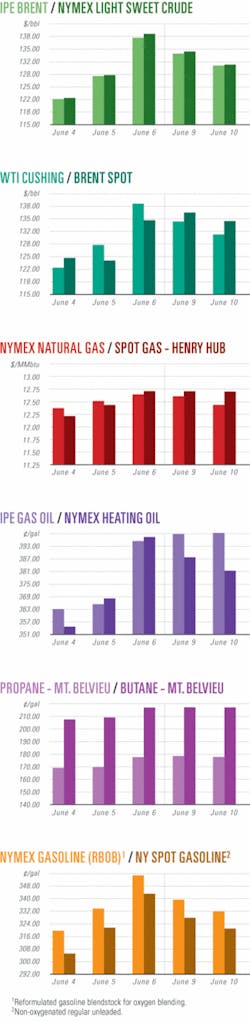

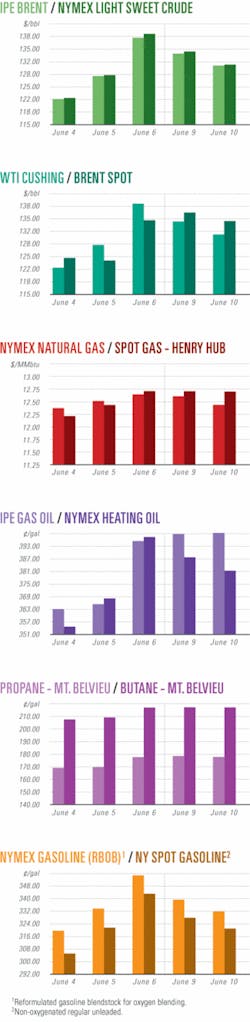

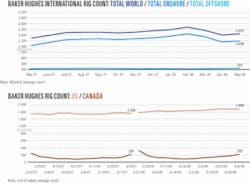

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesTullow tests oil from Jubilee field off Ghana

Tullow Oil PLC has tested 5,200 b/d of 36° oil and 5.3 MMcfd of associated natural gas from its Mahogany-2 well in Jubilee field off Ghana. The appraisal well is part of its program to assess the productivity and reservoir model.

The well, drilled by the Songa Saturn drillship, reached 3,443 m TD in 1,080 m of water on the West Cape Three Points license. Tullow said it was confident that Jubilee could flow more than 20,000 b/d when it comes on stream in 2010 (OGJ Online, May 26, 2008, p. 20).

Tullow Chief Executive Officer Aidan Heavey said the results support the decision by the Jubilee partnership to fast-track the project.

A single zone covering an interval of 17 m was tested through a 40/64-in. choke, resulting in a flowing tubing head pressure of 1,540 psi, Tullow said.

Later this year, the Blackford Dolphin and Eirik Raude deepwater rigs will carry out an appraisal, development, and exploration drilling program in both the West Cape Three Points and the Deepwater Tano licenses.

GDF, Dana test WEB prospect gas well off Egypt

Gaz de France has made a natural gas discovery on Egypt’s West El Burullus (WEB) prospect off northeast Alexandria in the Mediterranean Sea. Gaz de France is operator in a 50-50 partnership with Dana Petroleum PLC.

The WEB-1X exploration well was drilled on the 1,364 sq km acreage within a production-sharing contract that became effective in late 2005. A 3D seismic survey shot in 2006 led to the WEB- X1 well’s being drilled in 19 m of water.

The partners used the Ocean Spur jack-up to drill the well to 2,403 m TVD, targeting a Pliocene prospect consisting of a turbidite sandstone channel system. The well encountered good quality gas-bearing sands, the company said, and extensive wireline logs were run to maximize the acquired data.

In a multiflow rate drillstem test of the reservoir sequence, the well flowed at up to 27 MMcfd of gas.

The acquired data will now be analyzed and an appraisal program defined. Numerous additional prospects have been identified by Gaz de France and Dana within the WEB exploration and production license. In addition, other exploration targets within deeper horizons such as the Miocene and Oligocene will be considered. West El Burullus was described by the two companies as having “outstanding exploration potential.”

PA Resources spuds another well in Didon field

PA Resources AB, Stockholm, has spudded another well on its wholly owned Didon field off Tunisia. The horizontal oil producer Didon-9 is being drilled into the western compartment, which is expected to hold recoverable oil.

Didon, on the Zarat block, is 75 km west of the Tunisia-Libya border in 75 m of water. Last March the field’s average production was 20,000 b/d of oil.

The well is being drilled by the Ensco 85 jack up through a slot on the Didon platform.

The rig recently completed the Didon-7 horizontal production well, which is now producing 12,500 b/d of oil. The field’s reserves will be increased after Didon-7’s pilot hole encountered the top reservoir 5 m higher than originally estimated.

Wireline logs and pressure data confirmed good reservoir properties and a 30-m oil column, PA Resources said. A 500-m long drain was completed within the two upper layers of the reservoir at a horizontal level of 2,714 m, it added. Didon-7’s length was 4,015 m.

The Didon-5 well, which was shut in before the Didon-7 start-up, is being hooked up for production and is also expected to resume operations by the end of June.

The Didon-9 well also will be a horizontal oil producer in the crestal area of the western compartment on the field. A vertical pilot hole will first be drilled to confirm reserves and gather data, including pressure and saturation profiles, which will provide information on oil-water contact. Data also will be used to determine the optimal placement of the Didon-9 horizontal well, after which the horizontal production drain will be drilled, the company said.

“This new well Didon-9 is expected to recover oil from the western compartment and contribute with additional reserves and production capacity,” said PA Resources Pres. and Chief Executive Officer Ulrik Jansson.

Upon completion of Didon-9, the Ensco 85 will continue with the exploration drilling program on the Zarat permit, including the Didon North prospect.

Drilling & Production Quick TakesNorway averts oil production strike

Oil workers on the Norwegian continental shelf have pulled their strike threat after reaching an agreement with trade unions over pay.

Offshore wages will be increased by 6.1%, effective from Apr. 1, said the Norwegian Oil Industry Association (OLF) after it arrived at a compromise with trade unions Industry Energy, the Federation of Oil Workers’ Trade Unions, and the Norwegian Organization for Managers and Supervisors (Lederne).

A 5% wage increase, to start from June 1, was agreed to under the oil service agreement.

Lederne had threatened to stop producing 155,000 b/d starting June 6.

OLF described the negotiations as tough because the unions had high demands and priorities that differed from those in discussions held earlier in the year.

Staff in operating companies, drilling, and catering are covered by the agreements, which are valid until the next tariff revision occurs in 2010.

Marathon’s Alvheim oil field begins production

Marathon Petroleum Norge AS has begun producing oil from Alvheim field off Norway via its floating production, storage, and offloading vessel. It expects to increase output with a third development later this year.

Alvheim and Vilje fields are expected to ramp up production to 75,000 boe/d by early next year from a reserves base estimated at 250 million boe. Six wells have been drilled and completed on production licenses 203 (PL230), 088BS, and 036C on the Norwegian continental shelf.

Volund is a satellite scheduled to start production in the second half of 2009 on nearby PL150. Marathon operates Volund with a 65% stake, and its partner Lundin Norway AS has a 35% interest.

Plans originally called for Alvheim to come on stream by yearend 2007, but production was delayed because of the tight supply market for oil equipment. It is a significant asset for Marathon and Norway. The company spent $1.2 billion developing the project, which lies 224 km from Stavanger in 125 m of water. The Alvheim purpose-designed FPSO vessel has a design capacity of 120,000 b/d of oil and 125 MMcfd of natural gas with storage capacity of 560,000 bbl of oil.

Marathon will send gas to the existing UK SAGE system using a new 38 km cross-border pipeline. “The Alvheim FPSO will serve as a central hub in the area,” the company said. “The nearby Vilje field is already tied back to Alvheim. As a regional hub, the Alvheim FPSO is well positioned to deliver significant production for the long-term.”

Marathon’s partners in the Alvheim development are ConocoPhillips Skandinavia AS with a 20% working interest, and Lundin Norway AS, with a 15% stake. Ashley Heppenstall, president and chief executive of Lundin Petroleum, said its production would increase the company’s output by 50%.

Seadrill to buy four newbuild jack up rigs

Seadrill has ordered four newbuild jack up rigs from KFELS and PPL Shipyard in Singapore under contracts totaling $850 million. Seadrill’s fleet will increase to 12 units, up from 8, when the rigs are delivered 2010.

According to the $420 million contract with KFELS, two of the rigs will have the capability to operate in 400 ft of water and reach drilling depths of 30,000 ft. They will be built at KFELS and will be based on the KFELS Mod V ‘B’ design. These will be ready for delivery in June and November 2010. They will be the fifth and sixth jack up orders that Seadrill has placed with KFELS.

The rigs to be built by PPL Shipyard will be able to operate in 375 ft of water and drill to 30,000 ft. They will be modelled on the Baker Marine Pacific Class 375 Deep Drilling design. Deliveries are scheduled in March and November 2010. The contract price is $430 million. Seadrill said these were the second and third jack up orders it has placed with PPL Shipyard.

The company also has struck option agreements for additional jack up newbuilds in 2011.

Alf C. Thorkildsen, chief executive of Seadrill Management AS, said the offshore rig market would remain tight in the years to come. “The decision to initiate the $850 million building program was taken based on expected high return on invested equity due to the following factors: the current jack up order book is less than 20% of the existing aging fleet (which has an average age of 23 years), the newbuild jack up capacity before 2011 at first class yards is limited, and the number of term contract for jack ups is increasing, he said.”

Petrobras to study oil shale development in Utah

Brazil’s Petroleo Brasileiro SA (Petrobras) has signed an agreement with Oil Shale Exploration Co. LLC (OSEC), Mobile, Ala., and Japanese investment and trading company Mitsui & Co. Ltd. to jointly conduct a study into the development of oil shale projects in Utah.

“Petrobras will undertake a technical, economic, and environmental commercial feasibility study testing its oil shale technology called Petrosix on mineral resources controlled by OSEC in Utah,” Petrobras said. Petrobras said that, along with Mitsui, it obtained the right to acquire a 10% to 20% stake in the OSEC project.

The Petrosix oil shale processing technology is a proprietary retort technology, developed by Petrobras.

“The OSEC oil shale project in the state of Utah encompasses the lease of a oil shale property from the Bureau of Land Management for oil shale research, development, and demonstration and the recent purchase of more than 22,000 acres of privately owned oil shale property in the Green River Basin of Utah,” said Petrobras.

“The combined lease and owned property provides OSEC with ownership or rights to more than 30,000 acres of oil shale property, with a discovered resource base in the range of 3 billion bbl, according to Norwest Corporation estimates,” it said.

In June 2007 the US Department of the Interior issued a research, development, and demonstration lease to OSEC for 160 acres of public land in eastern Utah. An analysis determined that the project would have no significant environmental impacts (OGJ Online, June 16, 2007).

Processing Quick TakesUK motorists urged for calm over planned strike

The UK government has urged motorists not to buy petrol in a panic ahead of a planned strike by oil tanker-truck drivers on June 13.

The drivers, protesting poor wages among other things, are threatening to strike for 4 days, which would seriously impact oil supplies at service stations across the country.

The tanker-truck drivers supply oil to nearly 1,000 of Royal Dutch Shell PLC’s garages, small airports, and factories. According to Unite, the union representing the drivers, the strike will hit 14 terminals across mainland UK.

The Department for Business, Enterprise, and Regulatory Reform (BERR) estimated that Shell had one in 10 filling stations in the UK and that it was “inevitable” that there would be fuel shortages at some.

The government is preparing contingency plans to address the potential crisis and has suspended competition rules to allow oil companies to cooperate with each other on sharing oil distribution information.

The union is seeking a 13% pay increase,which it believes would cost Shell less than £1 million to settle. It has accused Shell of applying pressure on the haulage companies, Hoyer UK and Suckling Transport, to keep their salaries low.

Unite will hold last minute peace talks with the haulage companies, Shell’s contractors, at the Advisory, Conciliation, and Arbitration Service (ACAS). But there is little hope that the talks will be fruitful, although the government, motoring organizations, and Shell have urged the parties to reach an agreement.

The strike action follows shortly after the shutdown at Grangemouth refinery, where employees walked out after pay discussions collapsed (OGJ Apr. 30, 2008, Newsletter). These incidents are worrying the government as they echo similar protests in 2000 when truckers protested soaring fuel prices and nearly brought the UK to a standstill in a “drive slow” action.

Across Europe, the haulage industry, farmers, and fishermen are also increasing pressure on their governments to address high fuel prices because of its negative effect on their businesses (OGJ Online, May 30, 2008).

Pakistan PVC producer to raise plant capacity

Pakistan’s primary producer of polyvinyl chloride (PVC) resins, Engro Asahi Polymer & Chemicals Ltd. (EAPC), is planning to expand its PVC resin production capacity by 50,000 tonnes/year to 150,000 tpy.

PVC resin demand in Pakistan has steadily increased, reaching 120,000 tpy in 2006 from 62,000 tpy in 2000. PVC resin demand is expected to reach 168,000 tpy in 2010, EAPC said.

In 2006, EAPC’s share of the PVC resin market was 92%.

Transportation Quick TakesAussie gas flow may take 60 days after fire

Apache Energy Ltd. reported it will be 2 months before partial gas supplies are restored following a fire and explosion that ripped through its gas processing plant on Varanus Island, about 100 km from Karratha on Australia’s North West Shelf.

“Our specialist team of engineers, including assessment and recovery experts, have made an initial assessment that partial restoration of gas supply is likely to take a couple of months,” said Tim Wall, managing director, Apache Energy.

Apache reported the accident on June 3, saying that no one had been injured and 153 people were evacuated. It said the incident involved a pipeline transporting oil and gas from offshore production facilities to the island’s processing facilities. Thirteen people remain on the island to monitor the situation, the company said.

Wall said the incident caused visible damage to piping infrastructure and to some supporting equipment. He said the firm’s engineering team is working to determine the full extent of damage.

The operations at Varanus Island, which provide 30% of Western Australia’s domestic gas requirements, account for 330 MMcfd of gas and 8,000 b/d of oil; Apache’s net production is about 200 MMcfd and 5,000 b/d.

“The majority of the gas delivered through Varanus Island is supplied to industrial customers,” Wall said. He said Apache, which has declared force majeure, would keep the state government informed and would be in “ongoing dialogue with all stakeholders to reduce the impact on the state’s gas supply as best as possible.”

Woodside Petroleum Ltd., which operates the NWS venture and is now the state’s only major domestic gas source, will be able to make up about 25% of the lost gas Apache Energy was producing before the explosion.

“There’s minimal spare capacity,” a Woodside spokeswoman said. “We’re likely to supply up to 100 terajoules[/day], depending on the conditions of the day.”

As a result of the accident, many mining operators in the region have been forced to switch to diesel power or to temporarily shut down operations.

Alcoa Inc., which sources about 25% of its energy needs for its Pinjarra and Kwinana alumina refineries from Apache, is said to be using diesel power to keep both plants at full capacity, while mineral sands miner Iluka Resources Ltd. has shut down operations as it seeks an alternative source of gas.

Other companies that could be adversely affected include BHP Billiton Ltd., Newcrest Mining Ltd., Newmont Mining Corp., and Minara Resources Ltd.

It’s the second time this year that industrial users have faced disruption to their supplies of natural gas. In January, an electrical fault shut down the gas plant at the NWS joint venture, which provides about 65% of the state’s gas.

Shell unit to assess Sonatrach pipelines

Sonatrach has contracted Shell Global Solutions to review the integrity of its pipeline transmission networks to ensure that they meet stringent legislative standards. Shell’s report will help Sonatrach reduce its risk of pipeline failures and offer recommendations to improve the reliability and availability of the system.

Shell will identify the integrity and reliability management process for Sonatrach’s pipelines and evaluate the technical integrity of part of the pipeline system. Sonatrach operates more than 16,000 km of transmission pipelines.

Hocine Chekired, vice-president of Sonatrach’s pipeline transportation branch, said the assessment would enable it “to get an accurate assessment of where we are now and how to best optimize moving forward.”