OGJ Newsletter

Study assesses threats to oil market stability

Even as oil prices climb, threats to market stability are starting to abate, Amy Myers Jaffe told an energy forum last month at Rice University’s James A. Baker III Institute for Public Policy in Houston.

The institute’s new study, “The Global Energy Market: Comprehensive Strategies to Meet Geopolitical and Financial RisksThe G8, Energy Security, and Global Climate Issues,” identifies a series of policy frameworks that can be used to strengthen the current market system and ensure that it can respond flexibly to an array of possible threats.

The study assesses the US economy, financial markets, resource nationalism, terrorism, and climate change, as well as Iran’s nuclear standoff, risk scenarios for Russian natural gas, dynamics in China and Iraq, the militarization of energy, and growth in transportation fuel demand.

Jaffe, an energy fellow at the Baker Institute, said the key finding in the study is that many of the risks driving today’s oil price premium may be less catastrophic than they seem at first glance. And to achieve energy securityhere defined as reducing the vulnerability to a reduction or cut-off of energy suppliesconsumers must increase their elasticity of demand by increasing their flexibility and using alternative fuels.

Looking at cheap and available fuel supplies, the study says that while fuel subsidies in many countries are often justified on the grounds that they address income inequality and assist the poor, they mostly benefit the largest consumers of oil products, who are not society’s poorest members.

It’s in the US’s interest to work with international institutions such as the International Monetary Fund to help oil states liberalize their domestic energy markets and begin to foster energy efficiency by easing subsidy programs, replacing them instead with more sound fiscal policies to aid their poor, the study says.

Regarding energy security issues, the study says that consuming countries benefit when global oil production comes from as diverse a base as possible. “Active policies that attempt to use bilateral influence, aid, conflict resolution assistance, and other diplomatic leverage to remove some of the barriers to investment and technology transfer to oil producers in Indonesia, Central Asia, Russia, Asia, and Africa could dramatically reduce the pressure on oil markets in the years to come,” according to the study.

UK prime minister, oil leaders discuss challenges

UK Prime Minister Gordon Brown and his chancellor Alastair Darling have met with oil industry leaders in Aberdeen to discuss methods of controlling soaring fuel prices.

Brown warned that high oil prices were here to stay because global demand was outstripping supply over the long term. Members of the British legislature and the general public have called for policy changes on road and fuel taxes to help families and to thwart protests by the haulage industry that have disrupted traffic and increased pressure on Brown to address the problem.

The oil group focused on how investment decisions are made for projects on the UK continental shelf and analyzed various measures for advancing oil and gas developments and enhancing recovery from existing fields.

Oil and gas production in 2007 was 2.8 million boe/d, down from production of 4.2 million boe/d in 2001. The UK is estimated to have as much as 25 billion boe left to produce.

Malcolm Webb, chief executive of offshore trade association Oil & Gas UK, which met with Brown and Darling, said, “This was a highly constructive engagement, and the proposals discussed could have a significant impact on the near-term production. We look forward to continuing our discussions with government to develop these ideas.”

But the subsea operators also called on Brown to acknowledge their contribution to developing and producing the country’s resources. David Pridden, chief executive of Subsea UK, said, “With almost half of North Sea production now coming from subsea wells, the subsea sector has a significant role to play in more efficiently extracting the remaining hydrocarbons in the UKCS.”

Pridden said more government support was needed for the offshore industry, which he said could add “a further 10-15%” of reserves from the UKCS in the next few years, “i.e., a further 2-3 billion boe.” Last year the UK subsea industry generated £4.3 billion in revenues.

Brown wants the issue of high oil prices on the agenda for the Group of Eight summit in Japan. He’s also pressing the Organization of Petroleum Exporting Countries to increase its production.

The Department for Business, Enterprise, and Regulatory Reform (BERR), which grants licenses for the UK North Sea, has unveiled changes in its licensing regime to increase production. Secretary of State John Hutton said another 20,000 b/d of peak oil could be produced from 30 fields that would be created by carving them out from unprofitable areas of some existing fields.

“The change will mean production from these new fields would be unaffected by Petroleum Revenue Tax,” BERR said.

BERR received 193 applications covering 277 blocks in its 25th Offshore Licensing Round, the highest number since 1974. The round closed on May 22. The government has also just launched 97 new licensesa record numberthrough the 13th Onshore Round.

A spokeswoman from OGUK told OGJ that the association has been talking to the Treasury for the past year seeking reform of the tax regime to attract investment. Talks are expected to close by the end of June. “We have been looking at targeted incentives to promote the West of Shetlands, for example, which is remote and technically challenging. Right now the group can’t develop it because it isn’t commercially viable,” the OGUK spokeswoman said.

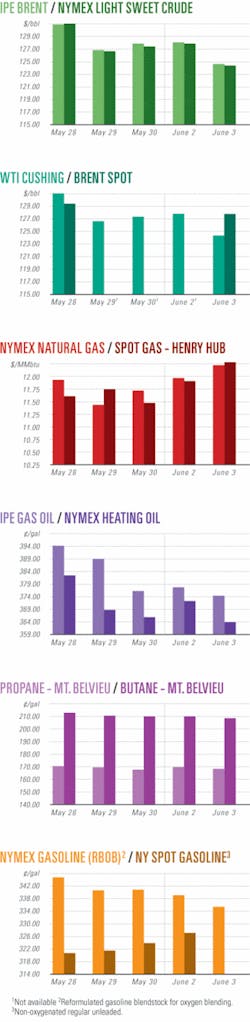

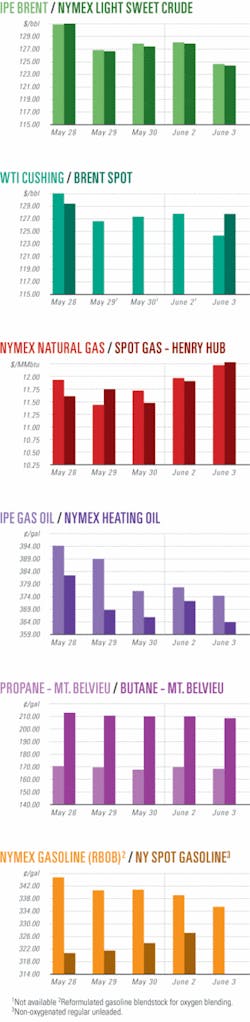

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesUK announces winners of onshore licenses

The UK government has awarded 54 companies onshore licenses in its 13th licensing round designed to encourage investment in the mature basin.

It awarded 97 petroleum exploration and development licenses to a variety of independent companies, including Northern Petroleum, Providence Resources, and IGas.

Northern Petroleum will operate PEDL240 in partnership with EnCore Oil on Blocks SZ38 South and SZ48 West South on the Isle of Wight.

Operator Providence Resources and its partner NP Weald will examine the Baxter’s Copse oil discovery and the Burton Down exploration prospect on Block SU91.

IGas, a coalbed methane developer in the UK, will explore seven blocks in northwestern England with its partner Nexen Exploration UK. The acreage is within 15 km of existing drilling operations.

Egdon Resources was offered six licenses covering eight blocks or partial blocks in the round in the East Midlands and Wessex basin. They expand the company’s acreage and opportunity base within core areas.

The government awarded Europa Oil & Gas an exploration license in North Lincolnshire. Europa will operate the license and hold a 50% working interest; Valhalla Oil & Gas Ltd. will hold the remainder.

The block is in the Humber basin, which contains Europa’s Crosby Warren oil field and the 90 bcf Saltfleetby gas field. One well has been drilled on the license area to date.

Long sidetrack appraises gulf’s Pony find

A 33,362-ft sidetrack well in Green Canyon Block 468 has successfully appraised Hess Corp.’s 2006 Pony discovery in the deepwater Gulf of Mexico.

The Pony-2 sidetrack, drilled from a surface location 7,400 ft northwest of the discovery well, encountered the same objective Miocene sands as the Pony-1 and Pony-2 wells. The main pay sand was oil filled throughout the interval drilled.

Hess is evaluating development concepts before making a final investment decision for Pony, which it now says has 200 million boe recoverable and is 100% owned by the company. It had previously estimated 100-500 million boe.

The acreage, just north of the Knotty Head area, is in 800-1,599 m of water (OGJ, July 24, 2006, Newsletter).

New Brunswick gas shale under evaluation

Corridor Resources Inc., Halifax, NS, plans a $32 million program this year and next to step up economic assessment of the Mississippian Frederick Brook shale near Elgin, NB.

Corridor will drill three widely spaced vertical wells on 2D seismic to obtain log and core data for full analysis followed by a horizontal well with a lateral as long as 1,000 m in the most prospective part of the shale and multiple fracs in all wells. It plans a 65 sq km 3D seismic program over the most promising area.

Corridor’s Elgin licenses, excluding McCully field area holdings, cover 118,000 acres.

Meanwhile, the company has a $14.4 million plan to drill a horizontal development well to the overlying Hiram Brook sands in northeastern McCully field and horizontal wells in the Hiram Brook A sand in the most productive part of the field to hike production in its central part.

Drilling & Production Quick TakesShell launches Perdido spar production facility

Royal Dutch Shell PLC is transporting by barge its enormous Perdido spar production facility from the shipyard in Pori, Finland, to Ingleside, Tex., to prepare for installation in the ultradeep Gulf of Mexico on Alaminos Canyon Block 857.

Perdido, which has the capacity to produce 130,000 boe/d, will float on the surface in nearly 8,000 ft of water. “The spar will be secured in place by nine chain and polyester rope mooring lines, spanning an area of the seafloor roughly the size of downtown Houston,” Shell said. Production will start by 2010.

On the Alaminos Canyon seafloor, 22 wells, each drilled to more than 14,000 ft below the water’s surface, will be linked to the Perdido spar above. Oil will be brought to the surface against the extreme pressure of the deep water by 1,500-hp electric pumps, and gas will be separated on the sea floor to rise naturally to the production unit on the surface.

“The remotest producing platform in the entire Gulf of Mexico region, Perdido will float 220 miles from Galveston, Tex., and will provide living quarters for 150 industry personnel. The helicopter landing deck also will set new industry records, simultaneously accommodating two long-range Sikorsky S92 helicopters, each holding as many as 24 passengers and crew,” the company said.

Shell, the 35% shareholder of the Perdido Regional Development Spar, is operator on behalf of partners BP PLC 27.5% and Chevron Corp. 37.5%.

Gupco starts output from Egypt’s Saqqara field

Gulf of Suez Petroleum Co. is delivering more than 30,000 b/d of oil from offshore Egyptian Saqqara field in the Gulf of Suez and will start gas production shortly.

Saqqara is 12.5 m in the central Gulf of Suez and was discovered in mid-2003 (OGJ Online, May 13, 2005).

The technically complex field was developed via a jacket and unmanned topsides, four wells, and a 13 km pipeline to a new dedicated onshore separation and gas processing plant at Ras Shukeir, Gulf of Suez.

It began production May 15 and has been ramped up to its current output following commissioning.

Gupco is a joint venture of BP PLC and Egyptian General Petroleum Corp.

Kambuna gas flow to start off Indonesia

Serica Energy PLC, London, plans to start production by yearend from Kambuna gas field in the Malacca Straits 40 km off North Sumatra, Indonesia.

The company, operator of the 380-sq-km Glagah Kambuna Technical Assistance Contract with a 65% working interest, has installed a wellhead platform in 40 m of water and is completing production tests of three development wells.

Bow Valley discovered Kambuna field in 1986 south of the undeveloped 1985 Glagah oil discovery by Caltex. Serica began Kambuna development drilling in 2005 (OGJ, Oct. 24, 2005, p. 56).

Serica expects plateau production 50 MMscfd of gas and 5,000 b/d of condensate from proved reserves estimated at 19 million boe.

A 14-in., two-phase pipeline to be laid in the fourth quarter will carry production to an onshore gas plant and tie into pipelines to a power plant at Belawan and to the city of Medan.

The Serica Kambuna-2 and Kambuna-3 wells tested at a combined rate of 73 MMscfd from Early Miocene Belumai sandstone at 7,152-7,342 ft below mean sea level.

Serica is completing the Kambuna-4 deviated well and expects to test it within a few weeks.

GFI Oil & Gas Corp., Calgary, holds the other 35% of the block.

Processing Quick TakesStatoilHydro lets contracts for refinery simulator

StatoilHydro has let a contract to Honeywell International Inc. for a plant process simulator and operator training system that will be used at the company’s Kalundborg refinery in Denmark.

The refinery is Denmark’s largest, with an annual throughput capacity of 5.5 million tonnes of oil, and its oldest dating back to the early 1960s.

The new simulator, using Honeywell’s trademarked simulation technology, will be installed in three phases, with final delivery planned for yearend 2009. StatoilHydro will use the simulator to train new plant operators and provide refresher courses and self-training modules.

The simulator also will be used as a design, development, and implementation platform for advanced process control in order to improve operational efficiency at Kalundborg.

In addition, Honeywell will supply tools that allow process and system data to be imported into the simulator, thereby supporting alignment with any future configuration changes at the refinery. The value of the deal was not reported.

North West Upgrading awards LCFining prefab

Privately owned North West Upgrading Inc., Calgary, has awarded KBR a $275 million (Can.) contract to construct and fabricate an LCFining processing system for the heavy-oil upgrader it is building 45 km northeast of Edmonton in Sturgeon County, Alta.

KBR will prefabricate 40 modules to be assembled later. This phase of the project is expected to take 30 months.

The LCFining technology is being supplied by Chevron Lummus Global LLC (CLG)a 50-50 joint venture of Chevron USA Inc. and ABB Lummus Global. CLG is providing the engineering package, including reactor design, follow-up technical support during detailed engineering design, training prior to start-up, ICR catalysts, and start-up support during commissioning of the upgrader (OGJ, Nov. 27, 2006, Newsletter).

The upgrader, which will produce light, low-sulfur products such as ultralow-sulfur diesel and diluent, will have a total processing capacity of 231,000 b/d of blended feedstock over three phases. It will have an initial design capacity to process 77,000 b/d of bitumen blend, with two subsequent 77,000 b/d expansions planned for the future.

Site preparation has begun for the $2.4 billion first phase. All three phases are expected to be operating by 2016.

UOP LLC, Des Plaines, Ill., was awarded design and licensing of a hydroprocessing unit for the facility (OGJ, Aug. 15, 2005, Newsletter). This integrated distillate Unionfining and Unicracking unit will produce a synthetic crude oil blend. It will have parallel reactors for hydrotreating naphtha and distillate-range feedstock and partial conversion hydrocracking of distillate and vacuum gas oil-range feedstock. A common section will stabilize reactor effluent and compress recycle gas.

“An important element of [the upgrader is its] use of gasification to make hydrogen from the heaviest components of the bitumen, and its carbon capture-ready design,” said North West.

The company also said it has concluded a commercial arrangement to sell carbon dioxide for enhanced oil recovery, thereby sequestering most of its greenhouse gas emissions.

Aramco taps Axens for Jubail refinery units

Saudi Aramco and Total SA have awarded a contract to Axens, Paris, to design a 32,000 b/d vacuum gas oil fluid catalytic cracker and other units for the planned 400,000 b/d refinery in Jubail, Saudi Arabia.

Aramco and Total recently confirmed plans to construct the refinery under a joint venture company, whereby Aramco will supply Arabian heavy crude and both companies will share marketing responsibilities.

Axens will also produce an aromatics complex with a capacity of 700,000 tonnes/year of paraxylene and 143,000 tonnes/year of benzene. The refinery will start operations in 2012.

Axens said the technology suite comprises a 68,000 b/d naphtha hydrotreater and continuous catalytic regeneration reformer to produce gasoline blend stock and mixed xylenes.

The FCC unit is designed to produce more than 10 wt % propylene.

Transportation Quick TakesPetrobras plans ethanol export pipelines

Jose Sergio Gabrielli, president of Petroleo Brasileiro SA (Petrobras), said the state-owned firm plans to have its first ethanol pipeline operating by yearend 2009.

“We are currently working on several phases of this pipeline and believe that the first phases should be operating by the end of 2009,” said Gabrielli, who explained that the line is part of a larger export strategy.

“Petrobras has a very clear strategy of becoming a great international player in the trade and logistics of ethanol,” he said. “We are establishing an export program, mainly to Japan, establishing logistics chains to take the product from the new areas to ports, through two large ethanol pipelines.”

Petrobras announced plans to construct the two lines last year: an ethanol line from Goias state to Sao Sebastiao, Sao Paulo state port, and a line for both ethanol and biodiesel, to run from Cuiaba, Mato Grosso, to Paranagua in Parana state (OGJ, June 11, 2007, p. 31).

Of the two, Gabrielli said this week, the most advanced is the $1 billion, 1,150-km line that will connect Senador Canedo in the state of Goias to the Paulinia Terminal in the state of Sao Paulo.

The line will pass through the cities of Uberaba, Ribeirao Preto, Guararema, and Sao Sebastiao, as well as the Ilha d’Agua terminal in Rio de Janeiro. The project also includes a stretch connecting the Tiete-Parana Waterway to the Paulinia Terminal.

The project is based on a joint venture agreement signed between Petrobras, Mitsui & Co., and Brazilian construction company Camargo Correa, creating PMCC Ethanol Transport Projects SA (OGJ, Mar. 24, 2008, Newsletter).

Regarding the second planned line, connecting Cuaiba and Paranagua, Brazilian Energy Minister Edison Lobao announced in March the development of viability and environmental impact studies.

The studies, to be undertaken by Petrobras and technicians from the states of Mato Grosso do Sul and Parana, are expected to be completed in June 2008.

Meanwhile, in April, Brazil Renewable Energy Co. (Brenco) said it plans to invest $1 billion to build a 1,100-km, 4 million l./year ethanol pipeline extending from Alto Taquari in Mato Grosso state to Santosthe country’s largest portin Sao Paulo state on the country’s south Atlantic seaboard (OGJ Online, Apr. 29, 2008).

Pipeline would ship gas from Bakken play

A proposed 100-mile, 16-in. pipeline in northwestern North Dakota would transport associated gas from the Mississippian-Devonian Bakken oil play in the Williston basin.

Capacity would be 100 MMcfd expandable to double that volume. The pipeline would be in service in mid-2010 subject to shipper commitment and regulatory approvals, said Williston Basin Interstate Pipeline Co., a subsidiary of MDU Resources Group Inc. affiliate WBI Holdings Inc. An open season is to run from June 16 through July 11.

The Bakken pipeline would originate at an interconnect with Williston Basin’s existing pipeline in Mountrail County, ND, near Tioga, and extend to the Alliance Pipeline in Bottineau County.

The pipeline will provide producers the option to deliver certain natural gas liquids out of the Bakken play in Montana and North Dakota, reduce gas processing requirements, and provide market opportunities for NGLs that do not currently exist.

FERC authorizes Rockies Express for REX-East line

The US Federal Energy Regulatory Commission authorized Rockies Express Pipeline LLC to construct and operate its planned 1.8 bcfd REX-East interstate natural gas pipeline. REX-East will have a 42-in. OD and extend 639 miles from the eastern terminus of Rockies Express’ REX-West pipeline in Audrain County, Mo., to an interconnection with the Dominion Transmission Inc., Dominion East Ohio, and Texas Eastern Transmission LP pipelines at the Clarington Hub in Monroe County, Ohio.

The REX-East project also will entail the construction of two compressor stations on Rockies Express’ already existing facilities; one in Carbon County, Wyo., the other in Phelps County, Neb.

REX-East is the third leg of a project to bring Rockies gas to Midwestern and Eastern markets. REX-Entrega, which extends 327 miles from Colorado and Wyoming to the Cheyenne Hub in Weld County, Colo., at a capacity of as much as 1.1 bcfd, entered service Feb. 14, 2007. REX-West consists of 717 miles of pipeline between the Cheyenne Hub and Audrain County, Mo., with a capacity of as much as 1.5 bcfd, Its first 503 miles entered service in January at a rate of 1 bcfd (OGJ, May 12, 2008, p. 68), with the balance authorized for service on May 16.

FERC ordered work on REX-East to be completed in time for the pipeline to enter service within 18 months.

Independence Trail pipeline resumes operations

Enterprise Products Partners LP has completed repairs to the flex-joint assembly of the Independence Trail natural gas pipeline, the source of a leak that occurred Apr. 8, and had forced production to be halted since. Dive teams successfully replaced the flex-joints’ o-ring gasket. Initial test results showed the flex-joint operating normally.

The flex-joint, in about 85 ft of water, allows the pipeline to withstand movements of the Independence Hub platform. Reduced volumes began moving through the line while final testing was under way, with the pipeline’s 1 bcfd full capacity expected to be reached during the first half of June.

The gas trading community had been expecting a mid-May restart of the pipeline and production hub, consistent with the outside edge of Enterprise’s own initial predictions that service would be restored in 1-4 weeks. However a mid-May announcement that repairs would take until mid-June prolonged the current gas price upsurge, which began in September 2007 (OGJ Online, May 14, 2008).

Independence Hub, stationed in Mississippi Canyon Block 920 in 8,000 ft of water, produces its 1 bcfd from 10 initial anchor fields. The 24-in. Independence Trail pipeline extends 134 miles on the seafloor from the hub to an interconnect with Tennessee Gas Pipeline at West Delta Block 68.