Refining margins dampen first-quarter earnings

Record-high worldwide oil prices and strong natural gas prices drove oil and gas company earnings in the first quarter of 2008, but weak downstream margins weighed on profits.

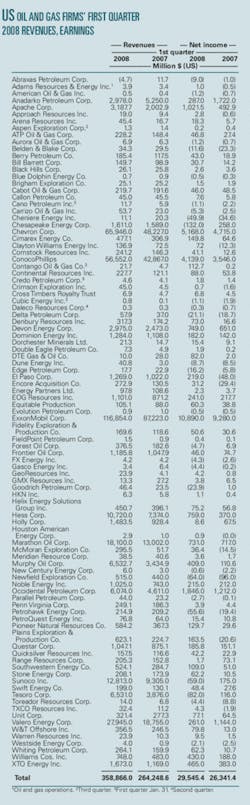

Samples of oil and gas producers, transporters, and refiners based in the US and Canada posted double-digit earnings gains from last year’s first quarter, and a sample of mostly US-based service and supply companies reported a combined 22% jump in first-quarter profits.

The US-based sample of operators recorded a collective 12% earnings increase, although 27 of them reported a loss for the quarter. Meanwhile, two of the 14 Canadian companies sampled had a loss for the quarter, but the group’s combined earnings surged a total 35% from first quarter 2007.

US firms’ results

Robust oil and gas price realizations propped up returns for most producers in the sample of US companies, but high oil costs slashed refining margins.

All of the integrated firms in the sample reported stronger first-quarter profits this year compared with the same period last year.

Murphy Oil Corp. posted $409 million in net income in the recent quarter, up from $110.6 million a year earlier. Murphy’s income from exploration and production operations was $428 million vs. $88.8 million a year earlier, boosted by larger production volumes and higher sales prices for both oil and gas.

The company’s refining and marketing operations posted income of $10.2 million in the recent quartermostly in the UK, with just $1 million from its two US refineriescompared to $35.7 million a year ago.

Chevron Corp.’s revenues were up 37% from first quarter 2007, and its net income climbed 9.6%. The company said while its first-quarter 2008 upstream earnings of $5.1 billion benefited from the increase in crude prices from a year ago, its US downstream results were essentially break-even at $252 million.

ExxonMobil Corp.’s first-quarter earnings set a record at $10.89 billion, up 17% from the first quarter of 2007. Revenues were $117 billion, up 34%. Lower refining and chemical margins and higher operating costs partly offset higher commodity realizations. Also, the company reported lower production volumes for the recent quarter, down 5.6% worldwide from a year earlier.

US independents

Anadarko Petroleum Corp. reported declines to first-quarter revenues and earnings from a year earlier. Although the company’s oil, gas, and natural gas liquids sales were up, revenues from gathering, processing, and marketing were down from first quarter 2007. Anadarko recorded a $40 million loss on divestitures and other items for the recent quarter.

Apache Corp. doubled its earnings in the first 3 months of this year to $1 billion despite higher taxes, costs, and other expenses compared with first quarter 2007. Revenues climbed 59% to nearly $3.2 billion on 4% larger production volumes, which were driven by higher oil output in the US, the North Sea, and Egypt.

Oil and gas production gross revenues for Abraxas Petroleum Corp. were $21.86 million, while the company’s rig revenues were $306,000 and its realized hedge loss was $883,000. But the San Antonio-based oil and gas producer also incurred a hedging loss of $26 million. This resulted in negative revenues for Abraxas for the quarter.

The company said this unrealized hedge loss was incurred by Abraxas Energy Partners LP, of which Abraxas Petroleum owns 47%.

Abraxas Petroleum said that on a stand-alone basis, it has zero debt and no hedges in place, which allows it “to fully participate in the run-up in commodity prices over the past several months.”

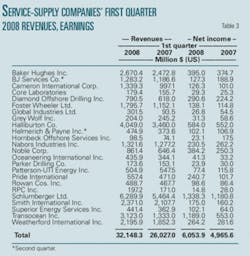

Refiners

The US-based refiners in the sample of companies reported weaker results for the first 3 months of 2008. High crude costs, especially for light crudes, crushed refining margins.

While Frontier Oil Co., Holly Corp., and Valero Energy Corp. recorded net earnings for the quarter, Sunoco Inc. and Tesoro Corp. each posted a net loss for the period.

Sunoco’s refining loss was larger than expected, said analyst Eitan Bernstein of Friedman, Billings, Ramsey & Co. Inc. “Operating losses of $123 million were larger than our expectation,” Bernstein said. “Gross margins averaged $3.45/bbl, 50% below comparable year-ago levels, primarily due to rapidly rising sweet crude oil prices. More importantly, we estimate Sunoco’s cash costs at a high $5.50/bbl, reflecting lower throughput volumes and higher fixed costs,” the analyst said.

Valero’s net income declined 77% to $261 million for the most recent quarter. Bernstein said the company’s operating earnings of $517 million were above forecast, primarily due to higher-than-expected Gulf Coast margins.

Valero recorded relatively strong margins on the Gulf Coast at $9.51/bbl, partially offset by pronounced weakness in West Coast margins at $7.89/bbl and in the Northeast at $6/bbl.

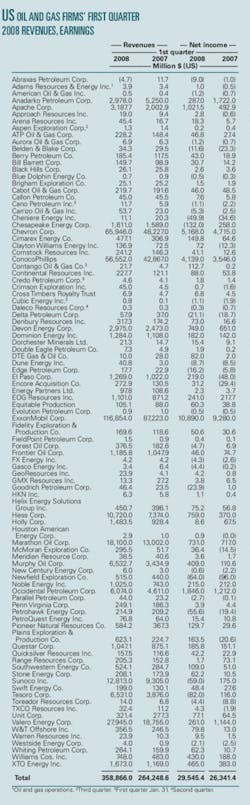

Canadian operators

In a sample of firms based in Canada, eight of the 14 improved on first-quarter earnings from 2007, as the group’s combined revenues grew 31%.

Nexen Inc. posted the largest earnings gain in the first quarter, as its first-quarter net income increased to a record $630 million (Can.) from $121 million (Can.) in the first quarter of last year. The climb was led by a 12% increase in production volumes before royalties as well as by higher commodity prices and high operating margins.

Although it recorded a 20% increase in first-quarter revenues, EnCana Corp. posted an 81% earnings decline to $95.6 million (Can.).

EnCana reported increased production volumes, but the Calgary-based company incurred higher operating and administrative costs compared with a year earlier, and its refining margins were weaker. EnCana said the primary reason its earnings declined, though, is that it incurred an after-tax unrealized mark-to-market loss on risk management activities of $737 million (US).

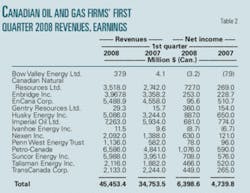

Service, supply firms

A group of 24 service and supply companies all reported positive net income for this year’s first quarter, but nine of them posted an earnings decline from first quarter 2007. One of these is Global Industries Inc., which announced revenues of $301.5 million in the first quarter, up 9% from a year earlier. Net income was down 51% to $26.8 million.

A Houston-based offshore oil and gas services company, Global Industries said its net income in this year’s first quarter was negatively impacted by low activity in the Gulf of Mexico due primarily to adverse weather conditions, nonrecovered vessel costs, and delayed mobilization of vessels in West Africa due to security and logistical issues. Earnings in first quarter 2007 included higher margin work from post-hurricane projects in the Gulf of Mexico and from Pemex projects in Latin America. Global Industries said during the first quarter, profitability was lower than what it could have been in the Gulf of Mexico, West Africa, and in its Asia-Pacific and Indian operations due to the unavailability of certain vessels undergoing drydocking activity. Nonrecovered vessel costs incurred during these regulatory drydockings were about $11.3 million, the company said.