US NATURAL GAS—1: Gulf-region transport bottlenecks pose future supply, price dislocation

Between 2010 and 2012, barring a drastic decline in the price of natural gas that would curtail the current growth trajectory of US production, incremental domestic production, combined with some nominal volume of increased LNG imports could exceed pipeline capacity out of the Southeast-gulf region.

It is possible that capacity use out of the region could reach 100%, resulting in a market scenario similar to the which affected Rockies pricing during summer 2007, displacing gas supplies that have traditionally moved into the Southeast-gulf region from the Midcontinent and West Texas into lower-value markets in the western US.

This first part of two articles outlines the infrastructural developments that will bring this about. The second, concluding article (May 12) will provide a detailed time line of projects in the region and explain how each will play into the potential for basis dislocation suggested here.

Background

The unprecedented natural gas infrastructure investment occurring in the Southeast US-Gulf Coast region has major implications not only for that region, but also for markets across North America and ultimately the world. The addition of such a large amount of new pipeline, LNG, and gas storage will affect flow patterns, commodity values, asset values, trading economics, and hedging strategies both in the near term and for decades to come.

While this development period will continue for several years, numerous projects are slated to enter service this year and during first-half 2009. Twenty-five natural gas pipeline projects totaling 18.6 bcfd of capacity and four LNG terminals with 7.1 bcfd of sendout capability are coming online between now and mid-2009. Another 11 new storage projects will add 6.3 bcfd of new deliverability to the growing capacity surplus.

An inadequate amount of regional takeaway in the face of this expected influx of new supply could lead to both supply and pricing dislocations, similar to what has occurred for the past several years in the Rocky Mountain region.

With winter 2006-07 and summer 2007 as reference periods, current maximum capacity out of the Southeast-gulf region totals 22.5 bcfd. An average of about 16.0 bcfd moves out of the region, increasing to 19.4 bcfd in peak periods. Ignoring the effect of variability in local demand, this implies room to move about an additional 6.5 bcfd on average days and 3.1 bcfd on peak days.

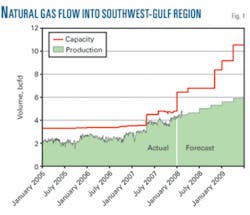

Fig. 1 suggests that even 6.5 bcfd of spare outbound capacity, however, may not be enough. Total new inbound pipeline capacity measures 6.6 bcfd, with supplies provided by feeder pipelines west of the region totaling 7.4 bcfd. New LNG terminal sendout adds 7.1 bcfd, with 3.6 bcfd of this from the Sabine Pass and Cameron facilities, both inside the region. While current domestic supplies will be inadequate to fill new pipeline capacity and there is considerable doubt as to the availability of LNG supplies to fill new terminal capacity, the potential for a significant surplus of gas supply into the region is increasing. The 11 new storage projects further exacerbate this risk.

Even though Table 1 shows 4.2 bcfd of new outbound pipeline capacity, most of this is subject to downstream constraints. In an extreme case, the total capacity from new inbound pipeline projects, LNG sendout, and storage deliverability (16.5 bcfd) could exceed the 6.5 bcfd capacity out of the region by more than two and a half times.

This scenario exaggerates the magnitude of the outbound capacity problem, since it excludes the effect of local demand, the likelihood of noncoincident demand peaks on different pipeline systems, curtailments of receipts from the East and South Texas corridors, and similar market developments. The numbers, however, still clearly show that intense competition will emerge between new and existing facilities for capacity out of the region.

Production limits

Production in the four basins driving much of the growth in pipeline infrastructurethe Fort Worth, East Texas, Arkoma, and Arkla basinsreached more than 10.7 bcfd in 2007 from 5.5 bcfd in 2001. Bentek projects production from these basins will reach 13.2 bcfd in 2009.

Four of the seven pipeline projects bringing gas into the region run roughly through the corridor between Carthage, Tex., and Perryville, La. These projects will add 5.8 bcfd of transportation capacity by mid-2009.

Fig. 1 brings these two assessments together, showing the relationship between flow and capacity between Carthage and Perryville through mid-2009. The blue line represents flows on the corridor. The red line depicts actual and projected capacity. The green area represents historical and forecast production.

Fig. 1 shows a lack of new incremental production available to fill the new capacity between Carthage and Perryville during 2008 to mid-2009. This production deficit has three important market implications:

- Demand for gas at the west (Carthage) end of the corridor to fill surplus capacity will drive up relative prices in this area. Holders of capacity on the new pipelines will bid up prices in East Texas markets to secure volumes to fill the new pipeline capacity. This pattern has already become apparent in the spot market following start-up of Gulf South’s East Texas-to-Mississippi expansion in February and March 2008.

- Capacity holders on the new pipelines may bid prices high enough to pull gas from other pipelines already operating in the region.

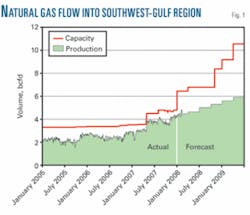

- While limits exist on the availability of incremental production to fill new pipeline capacity, enough new gas supplies will reach the eastern (Transco Station 85) end of the region to put downward price pressure on the premium Southeast market. Given downstream constraints from that region, this pressure could threaten Transco Zone 4’s traditional pricing premium, particularly after first-quarter 2009 completion of the Gulf Crossing pipeline. At that point the difference between inbound capacity and outbound capacity will reach its highest level (Fig. 2).

Costs, differentials

Efficiencies of the new, large diameter pipeline projects and the rate design benefits that frequently reflect those efficiencies will lower the average cost of moving gas through most sectors of the region, particularly northern sectors where most of the new construction is taking place. The weighted average incremental cost to move gas on the new pipelines from Carthage to Perryville is $0.107/MMbtu, 30% lower than the $0.155/MMbtu average of traditional pipelines in the region.

An even more dramatic shift will occur between Perryville and the premium Southeast market. A total of 4 bcfd will be added on this route, increasing total capacity by almost seven times. The average ITC on this new capacity is only $0.105/MMbtu, 50% below traditional pipelines.

The sector between the Houston ship channel and Henry Hub has run consistently full since autumn 2007. New construction will increase capacity on that sector by just 0.8 bcfd.

Since most of the new pipeline capacity consists of additions to the northern route (Carthage-Perryville) and the southern route is at capacity on most days, the northern route will emerge as the primary path for incremental production to move from Texas into the Southeast.

To the extent that new supplies are available to fill the capacity, these supplies will flow to new pipelines in the northern sectors. When the 4.2 bcfd of new pipeline capacity enters service between Perryville (and Carthage) and Southeast consuming markets in summer 2009, there will only be about 2.0 bcfd of new production to fill it, leaving 2.2 bcfd of demand (spare capacity) in East Texas.

This development will further reinforce the increase in new demand for supplies in the Carthage area, but will also add enough new supply to the Southeast to pressure those prices, resulting in a reduction in the price differential between the two points.

Terminology

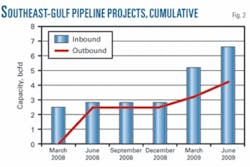

The Southeast US-Gulf Coast region can be viewed as a dense web of interconnected pipeline systems that crisscross in a network that defies traditional analyses of natural gas flows and capacities. Bentek has developed a simplifying model to help understand Southeast-gulf flows and capacities. The resulting flow structure resembles a horizontally stretched letter I (Fig. 3). The I model simplifies analysis by assigning each existing and new pipeline segment in the region to one of five regional pipeline sectors.

Sector I-1 runs west-to-east from Carthage, Tex., through Perryville, La. Sector I-2 includes pipelines that move gas in a west-to-east flow from the Houston ship channel area into the region around Henry Hub in Louisiana.

Sector I-3 runs from South Louisiana north to Perryville and includes some pipelines that can flow gas south from Perryville to South Louisiana. Sector I-4 extends from North Louisiana eastward to Transco Station 85 in Choctaw, Ala. Sector I-5 extends from the Henry Hub area in South Louisiana to pipeline connections in the premium Southeast, including Florida Gas Transmission Zone 3.

Premium Southeast refers to a number of key trading hubs that typically enjoy relatively high pricing, including Transco Zone 4, Texas Eastern Zone M1, Florida Gas Zone 3, and Sonat Louisiana.

Inbound surplus

New Southeast-gulf pipelines and LNG terminalstotaling 25.4 bcfdwill add inbound capacity exceeding takeaway capacity out of the region. Another 6.3 bcfd of new storage deliverability will add to surplus. Current capacity out of the Southeast-gulf averages 22.5 bcfd. Average utilization of capacity out of the region equals about 71%, increasing to 90% on peak winter days and 93% on peak summer days.

This pattern will change dramatically as 25 natural gas pipeline projects, four LNG terminal facilities, and 11 storage projects come online in 2008 and first half 2009. Thirteen pipeline projects to the west of the Southeast-gulf region will deliver new Barnett, Woodford, Fayetteville, and Bossier Sands production into pipelines feeding the Southeast-gulf. Boardwalk Pipeline Partners Gulf South pipeline expansion and Gulf Crossing pipeline, the MidContinent Express pipeline, and other projects will add 6.6 bcfd moving new gas into Perryville and to markets farther east.

LNG and storage projects will add 13.7 bcfd of additional gas supply. Pipeline projects to move gas across and out of the region, however, total only 4.2 bcfd. To the extent that gas supplies are available to fill the net new capacity in the region, peak deliverability could exceed current takeaway capacity by more than two-and-one-half times.

New LNG terminals and associated storage projects started development a few years ago when it was widely determined that existing supply sources in North America would be inadequate to meet demand over the long term because of steady growth in the residential and commercial sectors and even greater growth in the power generation sector. The same price signals that triggered initial interest in additional LNG and storage capacity also prompted rapid development of unconventional domestic gas resources. Many of the new pipeline projects will handle production growth from shales, tight sands, and other unconventional gas plays.

Price differentials

While these new pipeline projects will bring additional gas into the region, the ability to move incremental gas out of the region will remain constrained, at least for the next 2-3 years. Operators are only developing 4.2 bcfd out of the region, 2.4 bcfd less than inbound capacity. Net capacity additions to the region will come in successive waves, with an increment of inbound capacity coming online in one time frame and a lesser increment of outbound capacity coming online at a later date. The resulting oscillation of changes in net pipeline capacity, combined with supply variations, will create volatility in regional price differentials.

Eastward deliverability

GulfSouth’s Southeast Expansion and Gulf Crossing pipelines and KinderMorgan-Energy Transfer Partners’ MidContinent Express project terminate at Transco Station 85 in Choctaw County, Ala., in Transco Zone 4. While these pipelines will bring a total of more than 3 bcfd into Station 85, downstream capacity there is constrained on most days during the winter.

Downstream capacity on Transco at Station 180, just before Transco reaches densely populated areas in Virginia and Maryland, experiences near 100% utilization most of the time. This constraint effectively prevents incremental flows from reaching northern markets. Until Transco expands capacity north of those constraints, any new supplies that come into Transco Zone 4 will displace traditional pipeline flows into the area. Similar downstream constraints will affect flows from the Centerpoint-Spectra Southeast Supply Header project into Florida.

Incremental production

Although rapid production in the Southeast-gulf region is driving much of the region’s pipeline expansion, in the short and medium term there will not be enough incremental supplies to fill the new capacity. Several of the new pipeline projects with favorable tariff structures for commodity and fuel rates will displace gas from traditional pipelines that deliver gas into and across the region.

The surge of new natural gas infrastructure development to move gas west-to-east across the Southeast-gulf region will initially exceed the volume of supplies available to fill that capacity, causing the differential between gas prices in the Barnett, Woodford, and Fayetteville shales and the Bossier sands region to narrow relative to the premium Southeast markets at Transco Zone 4, TETCO M1, FGT Zone 3, and Sonat, La.

Completion at the same time of the Rockies Express pipeline into Lebanon and Clarington, Ohio, will provide another boost to Rockies prices, put downward pressure on Ohio Valley prices, and displace gas that has traditionally moved from the Southeast-gulf region. These developments will combine to flatten basis differentials across the Southeast and into the Ohio valley area (OGJ, Apr. 2, 2007, p. 56).

Henry Hub

New pipeline capacity being built from northeast Texas around Carthage into eastern Louisiana near Perryville will exceed new capacity being built to move gas eastward from Perryville. Surplus Perryville supplies can move either north into the Midwest and Ohio valley, or south by either physical movement or displacement, into pipelines along the South Louisiana corridor to the Henry Hub, and then north and east to premium markets.

These capacity developments, in conjuction with unpredictable market conditions, will tend to make pricing flip-flop between the northern and southern pipeline corridors. Production growth will eventually fill available capacity into Perryville, increasing surplus supplies at that location. Capacity limitations to move gas north and east out of Perryville will then reverse some flows that have traditionally moved north out of South Louisiana. Those flows will instead move south into the Henry Hub and surrounding pipelines.

Four new LNG terminals are also scheduled to be completed in the Southeast-gulf region within the next 18 months, adding 7.1 bcfd of sendout capacity on the Louisiana and Texas coast. Two of the new facilities, plus the existing Lake Charles terminal, will add 6.0 bcfd of peak LNG sendout capacity within 75 miles of Henry Hub.

Whether more than a few token deliveries of LNG arrive at US Gulf Coast terminals over the next few years remains uncertain. But any cargoes which do arrive will likely do so in the summer, when demand in Europe and Asia is at its lowest.

When surplus LNG arrives in the Southeast-gulf region, the gas may either move immediately into the pipeline grid and presumably on to market-area storage, move into existing and new high-deliverability gulf-region storage, or some combination of the two. More than enough pipeline capacity should exist to handle LNG volumes delivered into gulf-region storage. Withdrawals, however, are another matter. Market conditions will encourage withdrawals from existing and new storage facilities during relatively narrow time frames, resulting in excess demand for pipeline capacity out of the region.

Incremental costs

Most of the new pipeline projects are large diameter, high-capacity lines, which translate into lower charges for fuel and lost and unaccounted for gas in the pipelines’ tariffs. Lower incremental gas transportation costs translate into more competitive pricing for new pipeline supplies, a situation already seen regarding Rockies Express’ start-up (OGJ, Apr. 2, 2007, p. 56). Several of the major pipelines traversing the Southeast-gulf region, however, have postage stamp rates, such as Florida Gas Transmission, or feeder-cost arrangements that economically favor already operating Southeast pipelines.

Henry Hub’s location at the pivot point of new domestic and LNG supplies will increase near-term price volatility both there and at surrounding pricing hubs when LNG imports enter the region. The tendency of new transportation and storage capacity to compress regional price differentials and dampen the volatility of price differentials across the entire market will offset this trend. When combined, these diverging developments suggest basis as measured by the difference between Henry Hub and other market regions will become more volatile and more heavily influenced by localized market forces in the Southeast-gulf region.

The authors

Porter Bennett ([email protected]) is president and CEO of Bentek Energy LLC located in Golden, Colo. In his early career, Bennett held positions with consulting companies specializing in energy market analysis. He holds an MS in mineral economics from the Colorado School of Mines and an MA in international affairs from Columbia University in New York. He received a BA in history from Lewis & Clark College in Portland, Ore.

E. Russell (Rusty) Braziel ([email protected]) is vice-president, marketing and sales and chief technology officer for Bentek. He was previously vice-president of business development for the Williams Cos., vice-president of energy marketing and trading for Texaco, and president of Altra Energy Technologies. Braziel holds BBA and MBA degrees in business and finance from Stephen F. Austin University, Nacogdoches, Tex.

Jim Simpson ([email protected]) is vice-president, operations for Bentek. Before joining Bentek, Simpson modeled large structured transactions in both gas and power for Enron North America. Subsequently he led natural gas marketing and trading at MarkWest Hydrocarbon Inc. Simpson holds a BBA in finance from Texas A &M University.