OGJ Newsletter

Alberta adjusts ‘New Royalty Framework’

The Alberta government, citing “unintended consequences” of its “New Royalty Framework,” is easing terms for production from deep oil and gas wells.

Energy Minister Mel Knight said the government introduced two programs “to develop those oil and gas resources that are the most costly to access but offer the greatest potential.”

As published last year, the New Royalty Framework will take effect next year and raise royalty receipts by 20% above the level projected under the previous regime in 2010 (OGJ, Nov. 5, 2007, p. 34).

Producers and analysts have warned that the increase will discourage drilling, especially for natural gas (OGJ, Mar. 17, 2008, p. 30). One of two new adjustments to the framework will offer exploratory wells deeper than 2,000 m as much as $1 million or 12 months of royalty offsets for oil production, whichever occurs first.

The other adjustment, for gas wells, applies to wells deeper than 2,500 m. Royalty relief will be applied on a sliding scale by depth, up to $3,750/m.

In other changes, the province will apply four par prices instead of two in calculations of oil royalties. Gas royalties will be calculated according to the sum of vertical drill depth and all laterals in an effort to encourage development of coalbed methane with lateral completions.

EU assured of Turkmen natural gas supplies

On a recent visit to Turkmenistan, European Union External Relations Commissioner Benita Ferrero-Waldner received assurances from Turkmenistan President Gurbanguly Berdimuhamedow that 10 billion cu m of natural gas would be available for EU members every year, beginning in 2009, the commissioner’s spokeswoman Christiane Hohlmann told OGJ.

Hohlmann said this was the first time the president has given “a specific volume for these supplies, and such a ‘political assurance’ from one of the Central Asia’s gas producers was very important.”

The assurance of new gas supplies bolsters the EU’s efforts to diversify its gas sources away from Russia’s dominant position for reasons of both political security and safe supplies.

In a “Viewpoint” published in France’s economic daily La Tribune, Ferrero-Waldner said the commission is “working with other partners” to enhance its gas supply security.

Agreements have been confirmed with Azerbaijan, Kazakhstan, and Ukraine. Besides Algeria in the south, “with whom we are negotiating a strategic partnership,” she said, agreements had been finalized with Egypt, Morocco, and Jordan and when finalized with Libya “would open up serious prospects” of supply reinforcements from that country.

The commission, she said, is also studying new interconnections with the Middle East and North Africa, and an energy partnership is being discussed with Iraq. She said she would soon travel to Gulf Cooperation Council countries (Bahrain, Qatar, Kuwait, Oman, Saudi Arabia, and the UAE) to deepen the partnership with them.

UK farmin wells require $2 billion by 2010

Operators will need to invest over $2 billion over the next few years to develop 70 exploration prospects in the UK North Sea under farmin agreements, according to a new report published by consultancy Hannon Westwood LLP.

High rig rates have increased the level of investment, and the report said that more than 180 wells are scheduled to be drilled by 2010. Over the past 6 months, operators have moved towards discovery appraisal drilling. The UKCS holds a total future production potential of about 24 billion boe, including current production, existing development projects and discoveries, and exploration potential.

Other details in the report were:

- 25 wells are to be fully funded through farmin agreements.

- 12 wells are to be partially funded through farmin agreements to date.

- 70 wells are estimated to be partially or fully available for farm out by independent operators.

Chris Bulley, executive director at Hannon Westwood, said there was “a 25% plus turnover in farmin opportunities since the November 2007 report.”

The UK government recently launched its 25th offshore licensing round with 2,297 blocks up for grabs.

Operators are seeking help for 35 of the farmin wells in the central North Sea. This has fallen from 50 in mid-2006 and 83 in late 2007. The southern North Sea has 18 farmin opportunities, while the northern North Sea and west of Britain have 9 and 8 respectively.

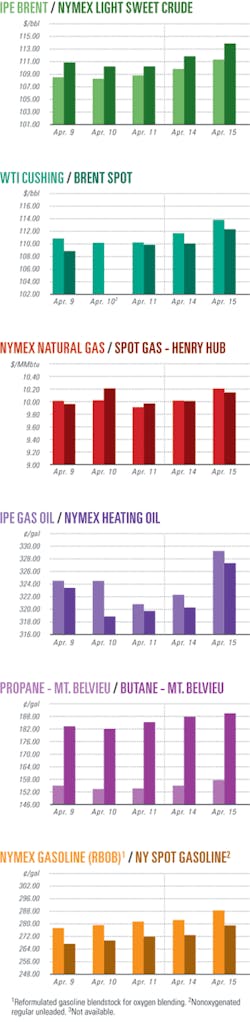

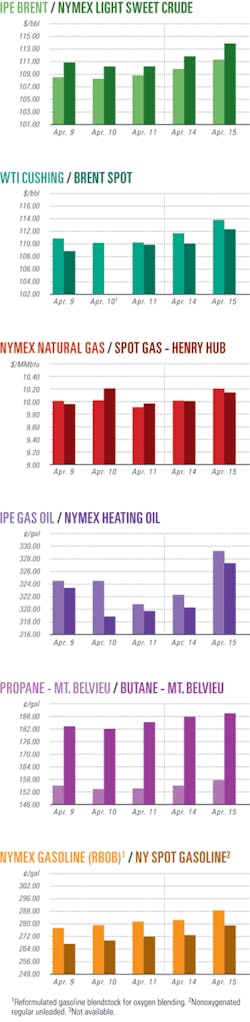

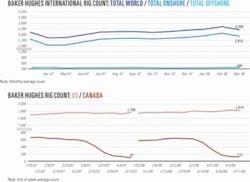

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesPlains E&P strikes deal to develop off California

Plains Exploration & Production Co. reached an agreement with environmental groups in which Plains will phase out oil and gas production off Santa Barbara County, Calif., and in Lompoc Valley.

The Houston independent producer agreed to stop offshore production by 2022 and to shut down its Lompoc oil and gas plant in exchange for development of Tranquillon Ridge field off Lompoc.

The Environmental Defense Center (EDC), Get Oil Out, and Citizens Planning Association of Santa Barbara negotiated the agreement.

The agreement remains subject to approval from regulators. The Santa Barbara County Planning Commission was scheduled to consider the agreement at an Apr. 21 meeting in Santa Maria.

If county officials approve the agreement, then it will go before the California Lands Commission, the California Coastal Commission, and the US Minerals Management Service.

Assuming all approvals are granted, Plains believes it could drill a well in the fourth quarter, a company spokesman told OGJ.

Terms call for curtailing production of existing oil and gas operations off Lompoc and Gaviota coast. Plains also agreed to donate land for parks.

EDC secured what it calls “an unprecedented agreement” from an oil company for zero net greenhouse gas emissions from the project. Plains agreed to contribute $1.5 million to a local fund for the purchase of hybrid buses.

Linda Krop, EDC spokeswoman, said the agreement stipulates that oil and gas development in both Tranquillon Ridge and Point Pedernales fields end Dec. 31, 2022.

The agreement followed Plains’s proposal to expand its existing production from Platform Irene in federal waters (see Fig. 2, OGJ, Aug. 7, 2006, p. 20).

The proposed expansion would involve directional drilling from Irene into Tranquillon Ridge field in state tidelands between Plains’s existing federal lease and the shore. Irene is in 242 ft of water 4.7 miles from land.

Santa Barbara County officials rejected a similar proposal in 2002 from Nuevo Energy Co. to develop Tranquillon Ridge field. Environmental groups opposed Nuevo’s proposal.

To win the support of environmental groups, Plains offered to shut existing and new development operations in phases, all to be ended by or in 2022.This applies to the existing Point Pedernales project, Lompoc onshore oil fields, and the Point Arguello project, including platforms Hidalgo, Harvest, and Hermosa, and the Gaviota processing site.

Tofkat-1 strikes oil on Alaska’s North Slope

The Tofkat-1 well struck oil-bearing sandstone in the Kuparak formation on Alaska’s North Slope, said partner Bow Valley Energy Ltd.

Tofkat-1 awaits evaluation to determine its commerciality. Log analysis confirmed an interval of 10 ft of gross pay and 6 ft of net pay.

No oil-water contact was observed, and no production test was attempted. Brooks Range Petroleum Corp., the operator, drilled two sidetrack appraisal wells.

Tofkat-1 was suspended for possible re-entry as a future production well. The well is east of the Colville River (OGJ, Jan. 28, 2008, p. 42).

Partners are acquiring 210 sq miles of 3D seismic survey to be analyzed by late 2008 in preparation for an appraisal drilling program in the 2009 winter drilling season.

The 3D seismic will also be used to evaluate uphole potential in the Brookian formations.

Joint venture partners are Brooks Range Petroleum, TG World Energy Inc., Bow Valley Alaska Corp., and Ramshorn Investments Inc.

Apache lets contract for Devil Creek development

Apache Energy in Perth awarded the $260 million (Aus.) Devil Creek Development Project to Perth-based engineering firm Clough Ltd.

The work involves establishment of a shore plant to process gas from Apache’s Reindeer gas field off Western Australia. Devil Creek is 65 km southwest of Karratha in the Pilbara region.

Clough will provide engineering, procurement, and construction for onshore facilities that will include gas processing trains, compressors, and accommodation facilities.

The plant will treat and dehydrate the gas, stabilize condensate content, provide storage and road load-out facilities for the liquids as well as gas compression and metering. The site will be connected by a short pipeline to the main natural gas trunkline from Dampier to Bunbury.

Apache said Devil Creek will be built for a capacity of 300 terajoules/day of gas. Phase 1 of the project will source gas from Reindeer at about 110 terajoules/day. The gas will be used for domestic supply in Western Australia.

Phase 2 expansion will come with the sanction of the Julimar field, which is still being appraised but which has a substantial gas reserve that will take the plant up to its planned capacity.

Liquids production is expected to be 500 b/d. Phase 1 will be on stream in early 2010 and Phase 2 probably in 2011.

Drilling & Production - Quick TakesStatoilHydro drills long horizontal Gulltopp well

StatoilHydro drilled and completed the 9,910 m-long horizontal Gulltopp well from the Gullfaks-A platform, in 439 ft of water.

Drilling began in April 2005. Gulltopp began producing this month from the shallow Brent reservoir at 2,430 m subsea. Platform rig contractor Seawell Ltd. drilled most of the wellpath at an inclination of 7º. In order to counteract the friction, Seawell filled the 8-km casing with air, instead of drilling mud, and “floated” the casing in the nearly horizontal well. “This was the key to success,” said StatoilHydro.

The company had to upgrade the brake system on the drilling rig and the power supply for the platform in order to complete the well. StatoilHydro initially estimated the cost of drilling the extended reach well at $43.9 million, about 25% of the cost it estimated necessary to develop Gulltopp using a subsea template and dedicated multiphase flowlines (OGJ, Feb. 9, 2004, Newsletter).

StatoilHydro said in an Apr. 14 press release that the well was “considerably more expensive than initially assumed.”

Gulltopp is in the Tampen area of the northern Norwegian North Sea, 5 km north of Gullfaks satellite fields Gullveig and Rimfaks. It’s operated by majority owner StatoilHydro 70%, on behalf of license partner Petoro AS 30%.

Petrofac gets Syrian contracts worth $1 billion

Oil and gas facilities service provider Petrofac announced two major gas field development contracts with Syria worth a total $1 billion.

The first contract, worth $454 million, calls for construction of a plant to treat 4 million cu m/day of gas from Jihar field near Palmyra. The field is operated by Hayan Petroleum, which is a joint venture of Croatia’s INA-Naftaplin and Syrian Petroleum Co. The plant is scheduled for completion in 2011.

Petrofac’s scope of work includes engineering, design, and construction of gas processing facilities, an LPG recovery system, LPG storage and loading facility, gas gathering and collection systems, satellite gathering station, well sites, flow lines, utilities and offsite facilities, gathering pipelines, and living quarters.

The second contract, worth $477 million, was awarded by Petro-Canada for the processing of gas and liquids from the Al-Shaer and Cherrife fields in central Syria, which are expected to produce some 2.5 million cu m/day of sales gas and 150 tonnes/day of LPG from 2010. Sales gas and condensate will be fed into the Syrian pipeline grid, and LPG will be transported via tankers.

Petrofac’s work scope includes engineering, design, and construction of a gas treatment plant, pipelines, gas gathering station flow lines, and well sites.

Iraq confers with majors to boost oil production

The Iraqi ministry of oil said it is in discussions with BP PLC, Chevron Corp., ExxonMobil Corp, Royal Dutch Shell PLC, and Total SA to increase production at several oil fields in the country.

Chevron and Total confirmed that their discussions were aimed at finalizing a 2-year technical support agreement to boost production at the West Qurna Stage 1 oil field near Basra. West Qurna has reserves estimated at 15-21 billion bbl.

The oil ministry intends to add 100,000 b/d to the field’s current capacity of 180,000 b/d. Prior to the outbreak of war in Iraq in 2003, West Qurna had an estimated production capacity of 250,000 b/d. In December, Shell, BP, ExxonMobil, and Chevron submitted technical and financial proposals to develop five fields in southern and northern Iraq.

In addition to West Qurna, other areas include Rumaila and Zubair fields near Basra, Kirkuk oil field in the north, and Akkas natural gas field in the west.

Petrobras inks contract for Gulf of Mexico FPSO

Petrobras America Inc. signed a certified verification agent (CVA) contract with Det Norske Veritas (DNV) to ensure that the Gulf of Mexico’s first floating production, storage, and offloading vessel meets US regulations.

The FPSO is expected to be installed in deepwater Chinook and Cascade fields in early 2010 with production scheduled to start during first-quarter 2010. The FPSO will have a storage capacity of 600,000 bbl of oil, a processing capacity of 80,000 b/d of oil, and natural gas export facilities of 16 MMscfd (OGJ, Jan. 14, 2008, Newsletter). Petrobras will build a pipeline to transport the gas to shore.

The FPSO will be installed in 2,600 m of water, which DNV said is among the deepest waters in which an FPSO has been installed. Both Chinook and Cascade fields are on Block 425 of the Walter Ridge area.

As the CVA, DNV will ensure that the project complies with US Minerals Management Services requirements. DNV is an independent foundation offering technology expertise to help safeguard life, property, and the environment.

Petrobras last fall hired BW Offshore Ltd. to convert, install, and operate the FPSO. The project also includes delivery and installation of a disconnectable submerged turret production buoy, including fluid swivel and an appurtenant mooring system to be supplied by BW Offshore’s subsidiary Advanced Production and Loading AS. In the event of a hurricane, the turret and swivel will enable the FPSO to disconnect from its moorings and seek sheltered waters with minimum disruption to operations.

Technip was selected to provide engineering, procurement, construction, and installation of subsea facilities to develop the fields (OGJ, Jan. 28, 2008, Newsletter). Its Deep Blue and Constructor vessels will install five free-standing offshore hybrid riser systems for both fields along with infield flowlines and the gas export pipeline to shore. Work includes welding and installation of about 120 km of 6-in. and 9-in. steel pipelines, design and fabrication of 10 pipeline end termination, and 2 inline tees.

Petrobras is the fields’ operator with 50% of Cascade and 66.67% of Chinook. Devon Energy Corp. owns the remaining 50% of Cascade, and Total E&P USA Inc. owns 33.33% of Chinook.

Processing - Quick TakesUK launches 2.5% biofuels transport requirement

Environmentalists and charities have criticized the UK government’s requirement that all fuels must have 2.5% of biofuels, claiming the measure is raising food prices and damaging the environment through land conversion and increased usage of chemical fertilizers.

The new policy became effective Apr. 15 under the government’s Renewable Transport Fuels Obligation (RTFO) to ensure that it meets European Union regulations. By 2010 the share will reach 5% and is expected to reduce carbon dioxide emissions by 2.5 million tonnes.

A spokesperson for the Environmental Transport Association said: “This initiative may be well intentioned, but it is highly flawed. Loopholes allow subsidized fuel from unsustainable sources to be certified. Companies are entitled to answer ‘unknown’ to the question of what the previous land use was and still be eligible for [an RTFO] certificate.”

The Department for Transport will publish a report in June reviewing the use of biofuels, after which ministers may postpone or drop plans to increase the amount of biofuel in petrol and diesel to 10% by 2020.

Oxfam International warned that millions of indigenous people in Asia, Africa, and South America would lose their homes as land is cleared to build biofuel plantations such as palm oil.

But Jeremy Woods, leader of the biofuels working group at the Royal Society, said the RTFO could succeed if it promotes the best biofuels. This would be achieved by changing the RTFO to support the fuels with the lowest emissions by including a greenhouse reduction target.

“The RTFO helps send a message to industry that it is worth their while to significantly invest in improving existing biofuels and accelerate the development of new ones,” he commented.

Soaring food prices have led India to curb rice exports, and higher fuel prices have also seen uprisings in Indonesia and Ivory Coast among other places. According to Oxfam, about 30% of recent food price inflation is due to biofuel production.

A survey commissioned by Friends of the Earth found that 9 out of 10 people did not know that their vehicles would now use renewable fuels.

Nippon Oil to shutter Toyama refinery

Nippon Oil Corp., Japan’s largest refiner, will shutter its smallest refinery, the 60,000 b/d Toyama facility operated by subsidiary Nihonkai Oil Co. Ltd., according to press reports. The facility will be converted to a site for importing oil products from other Nippon refineries in Japan.

When the 40-year-old refinery on Japan’s west coast is shut down by the end of March 2009, it will become the first Japanese refinery to be mothballed since 2003. The reasons for its closure include high costs, overcapacity, and diminished demand in the world’s third-largest oil-consuming nation.

Closure was first considered last year because the refinery cannot process heavier grades of crude. The subsequent spike in crude prices has since reduced its profitability even more.

Transportation - Quick TakesTransCanada hoping to work with ANS producers

TransCanada Corp. said it will seek alignment with Alaska North Slope natural gas producers to build an Alaska natural gas pipeline, adding that it is unclear how a proposed joint pipeline by ConocoPhillips and BP PLC fits into requirements outlined by the state of Alaska.

TransCanada said it was “encouraged that two of the three producers are ready to advance the project and get Alaskan gas to markets in the Lower 48 states.” ExxonMobil Corp. is the other ANS producer.

ConocoPhillips and BP announced Apr. 8 plans to build a 4 bcfd gas pipeline called Denali that would extend from ANS to Canada and potentially on to the US (OGJ, Apr. 14, 2008, p. 30).

BP and ConocoPhillips called the proposed Alaskan gas line the “largest private-sector construction project ever built in North America.” They plan to spend $600 million over the next 36 months on an open season, which is slated to begin before yearend 2010.

TransCanada spokeswoman Cecily Dobson told OGJ Apr. 10 that TransCanada has sought for several years and continues to seek alignment with the three ANS gas producers and the state of Alaska. “We continue to believe that the alignment of these five parties is the best and fastest way to get the project completed,” Dobson said. “If alignment with producers does not occur, this could turn out to be a competitive environment.”

The TransCanada project is the only proposal sanctioned by Alaska’s state government. TransCanada retains Canadian rights to an Alaska pipeline from approvals granted 30 years ago when the line was first proposed.

Alaska earlier this year adopted the Alaska Gasline Inducement Act (AGIA), legislation designed to advance construction of a gas pipeline from ANS. It requires a pipeline project builder to meet certain requirements that will advance the project, in exchange for a license that provides up to $500 million in matching funds.

These funds would help reduce the financial risks that such a huge project faces in its early stages.

Dobson said TransCanada is at stage two of the process and awaits Gov. Sarah Palin’s decision whether or not to recommend TransCanada’s project to the legislature. “We expect to receive the decision the week of May 19,” Dobson said. “If recommended, our application would go to the legislature for approval. At this point, it’s unclear on where [the] BP and ConocoPhillips proposal fits.”

TransCanada gauges Pathfinder Pipeline support

TransCanada Corp. started a binding open season process to gauge support for a proposed pipeline that would move natural gas from US Rocky Mountains basins to Midwest markets.

The proposed 500-mile, 42-in. Pathfinder Pipeline will extend northeastward from Wamsutter, Wyo., through Montana and North Dakota to the Northern Border Pipeline Co. “at a location commercially attractive for delivery into the Ventura and Chicago area markets,” officials said. Initial capacity is to be 1.2 bcfd, with an ultimate capacity of 2 bcfd. The project includes an option to build a 140-mile supply zone spur connecting Meeker, Colo., to Wamsutter. It is anticipated to be in service in late 2010.

To meet further growth in Rockies gas supply, TransCanada proposes later to extend Pathfinder 275 miles from the Northern Border Pipeline to Noyes, Minn., and Emerson, Man., where gas can be shipped to eastern markets or storage facilities using the Great Lakes Gas Transmission system and TransCanada’s Canadian Mainline system.

“TransCanada is evaluating different options to move an increasing supply of natural gas from the Rocky Mountains,” says Hal Kvisle, president and chief executive.

TransCanada will accept through May 22 binding bids for firm gas transportation capacity from Meeker and from Wamsutter to Northern Border Pipeline. TransCanada also is seeking nonbinding expressions of interests for the future extension of the pipeline to Minnesota and Manitoba.

A segment of the proposed line follows the same route as the proposed Bison Pipeline project. TransCanada is a partial owner in the Bison project through its interest in TC PipeLines LP. The two projects are coordinating preliminary field activities as they develop commercial support. Final design and location of Pathfinder will reflect the commercial support obtained, input of stakeholders, and the federal regulatory process.