OGJ Newsletter

APPEA: Australia underweight in share of LNG

Australia has been called “underweight” in its share of the LNG supply market, given the size of the country’s gas resources, according to the Edinburgh-based UK consultants Wood Mackenzie Ltd.

Speaking at Australian Petroleum Production & Exploration Association’s annual conference in Perth, Ben Hollins, WoodMac’s head of European gas and power, said the pace of development of new LNG projects in Australia has been too slow because it is hindered by rising costs, disunity among joint venture partners, and obstacles to environmental approvals.

For example, Hollins pointed out that a jump in construction costs has delayed the Chevron Corp.-led Gorgon project.

Currently Australia has just two producing projects having a combined capacity of 15.2 million tonnes/year, and yet APPEA has set a target of up to 60 million tonnes/year of LNG production by 2017.

Hollins said that target looks increasingly unlikely to be met. WoodMac estimates Pacific Basin demand for LNG could jump 83% to 203 million tonnes by 2020, which is up from 111 million tonnes produced this year.

Hollins said there are at least 12 rival projects being proposed in Australia, and LNG buyers in Asia are frustrated at the slow rate of development. The buyers are also confused as to which projects might succeed.

“This creates a headache for them,” he said “and that’s not good for Australian interests either.”

Chevron’s Wheatstone Project and Shell’s radical floating LNG proposal for Prelude field in the Browse basin are recent examples of the scramble by gas owners to get their projects to the starting line to take advantage of the forecast boom in global demand for LNG.

Hollins believes the Australian government needs to play a part in ensuring that developments do proceed.

Seven arrested in rocket attacks in Sanaa, Yemen

The Al Qaeda terrorist organization, building on earlier claims, has taken responsibility for a rocket attack on a residential complex in Yemen that houses executives and the headquarters of Safer E&P Operations Co.

“Al Qaeda has issued a statement claiming the attack,” said a Yemeni security official. Residents reported no injuries after three rockets struck near the residences of US employees of the Yemen-owned Safer Oil Co.

The official said police had arrested seven people in connection with the attack, adding that three people had fired the rockets from a car on the edge of the complex of villas in the al Hadda district in southwestern Sanaa, the Yemeni capital.

The attack occurred 2 days after the arrest in Sanaa of Al Qaeda operative, Abdullah al Rimi, who was sought by the US Federal Bureau of Investigation. Al Rimi has been identified as taking part in attacks in Riyadh, Saudi Arabia, in 2003 and on the USS Cole in 2000 in the Yemeni port of Aden, which killed 17 US sailors and injured many others.

Suspected Al Qaeda militants have claimed several attacks in Yemen, the ancestral homeland of the terror network’s chief Osama bin Laden.

Recently, the Jund al Yemen Brigades, an Al Qaeda affiliate group, claimed responsibility for two operations carried out in Hadhramaut, including a Mar. 27 bomb attack on a pipeline belonging to Total SA in the Sah Valley and a Mar. 29 mortar attack on an unidentified Chinese oil company operating in Al-Khish’a.

Since the attacks on the USS Cole in 2000, several other foreign interests, specifically oil interests, have been attacked, according to the Yemen report by the US Energy Information Administration.

These include:

- The suicide bombing of the Limburg French oil tanker off the coast of Yemen, killing one and causing a massive fire and leakage of 150,000 bbl of oil into the Gulf of Aden (OGJ Online, Oct. 11, 2002).

- An unsuccessful firing of a surface-to-air missile at an oil company helicopter in 2002.

- The 2006 foiled suicide bomb attempt against two oil facilities.

- The more-recent attacks on oil company personnel near the border between the Marib and Shabwa governorates.

Colombia shortlists 20 firms for heavy oil projects

Colombia’s National Hydrocarbons Agency (ANH) has invited 20 companies to submit formal proposals in May to develop eight greenfield heavy-oil blocks in the East Llanos basin, the head of the agency told OGJ.

Companies that made the shortlist include ExxonMobil Corp., Royal Dutch Shell PLC, Nexen Inc., and OAO Lukoil. In an exclusive interview, Armando Zamora, director general, said ANH hopes to sign technical evaluation agreements with the winners by July.

“We have invited those with the financial muscle and expertise to do the work,” Zamora said. “We want companies that can engage in high risk exploration.” The successful companies will have a large area in which to gather data and drill stratigraphic wells, he added. They will then choose a limited area within the technical evaluation agreement (TEA) area. “We will sign a limited number of exploration contracts, depending on the size of the area,” Zamora said. “The rest of the block will be open to outside competition.”

Zamora anticipates that the ANH will select four to eight companies to work on the eight blocks, and they will have 3 years to perform TEA work.

According to a study carried out by Halliburton, the blocks hold an estimated 120 billion bbl of original resources in place. Heavy oil development is a major component of ANH’s strategy to help Colombia increase its reserves to 4 billion boe by 2020.

Colombia separately is offering 17 heavy oil blocks under its international bidding round to potential operators to sign exploration contracts by October (OGJ Online, Apr. 2, 2008).

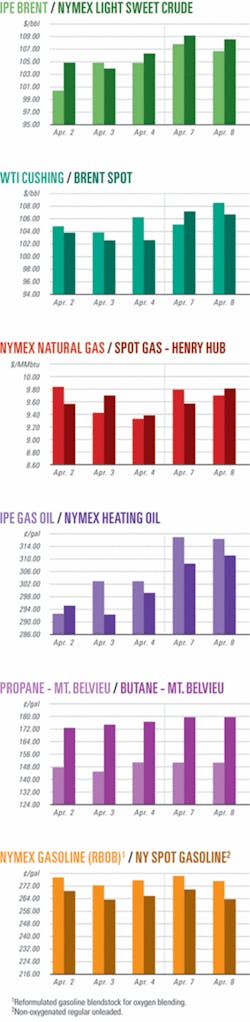

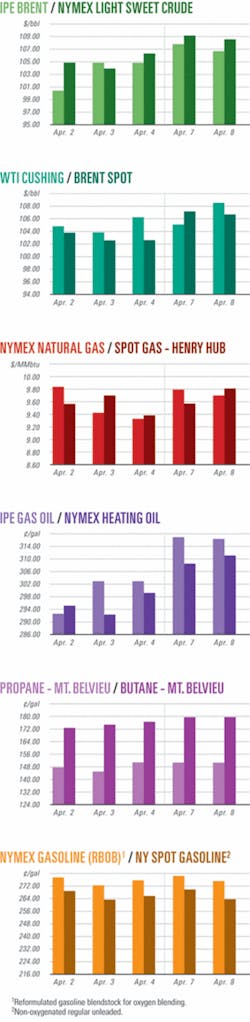

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesBP makes oil discovery on Kodiak prospect in gulf

BP Exploration & Production Inc. has made an oil find at its Kodiak prospect on Mississippi Canyon Block 771 in the deepwater Gulf of Mexico about 60 miles southeast of Louisiana.

The Kodiak discovery well was drilled to a total depth of 31,150 ft in 5,000 ft of water. BP reported the well hit 500 net ft of hydrocarbon-bearing sands in Middle and Lower Miocene reservoirs. The well was drilled using Transocean’s Deepwater Horizon semisubmersible drilling rig.

The well was deviated with a horizontal step-out of 7,400 ft. BP said further appraisal is needed to determine the size and commerciality of the find.

The Kodiak discovery well lies in the vicinity of BP’s 2003 Tubular Bells discovery, the company said. The lease was acquired at federal OCS Lease Sale 182 in March 2002.

BP operates the well with a 63.75% stake. Its partners are Eni SPA 25% and Marubeni Oil & Gas (USA) Inc. 11.25%.

Husky wins North Amethyst development nod

Husky Energy Inc. has received approval for subsea development of North Amethyst oil field, the first of three White Rose field satellites planned for development off Newfoundland (OGJ, Feb. 25, 2008, p. 37).

After completing agreements on royalties and benefits with federal and provincial governments, Husky let a €190 million contract to Technip for engineering, fabrication, and installation of 23.7 km of flexible flowlines and 5.4 km of umbilicals plus installation of manifolds and associated pipework.

Technip’s Deep Pioneer and Wellservicer vessels will install the equipment in 2009.

Husky expects to drill 11 North Amethyst wells for tie-back to the SeaRose floating production, storage, and offloading vessel moored in 120 m of water in White Rose field. Base-case production estimate for the satellite is 62,900-75,500 b/d.

Last year Husky said White Rose, in the Jeanne d’Arc basin 350 km east of St. John’s, Newf., was producing an annual average 120,000-125,000 b/d of 30º gravity oil. It trimmed output to 90,000-95,000 b/d in January while performing maintenance on the FPSO and halted production during Apr. 1-3 because of an ice threat.

Apache logs Australian gas discovery

Houston independent Apache Corp. logged 195 ft of net pay across five intervals of the Triassic Mungaroo Sandstone in the Julimar Southeast-1 discovery on Australia’s North West Shelf.

Apache has drilled five gas discoveries on License WA-356-P, including Julimar-1, Julimar East-1, Brunello-1, and Brulimar-1.

The latest discovery, which was not tested, was drilled in 502 ft of water about 1.9 miles from Julimar-1, which logged 132 ft of net pay and test-flowed a combined 85 MMcfd of gas from two zones.

“Julimar Southeast-1 encountered both the stratigraphically oldest and structurally deepest gas pay in the field to date,” said G. Steven Farris, Apache president and chief executive officer. “Two additional wells are planned on the block in 2008, and we believe the ultimate size of this gas accumulation could be in the range of 2-4 tcf,” he said.

Apache owns a 65% interest in the block, with Kuwait Foreign Petroleum Exploration Co. holding the remainder.

Apache said the Halyard-1 discovery test-flowed at a peak rate of 68 MMcfd of gas and 936 b/d of condensate from 91 ft of net gas pay in the Cretaceous Halyard sandstone.

The Halyard-1 was drilled in 366 ft of water in Permit WA-13-L, the same production license as Apache-operated East Spar field. Apache owns 55% interest in the block; Santos Ltd. owns the remaining interest. The discovery is on a trend with Apache-operated John Brookes field, which is producing 240 MMcfd of gas from three wells.

That test was on 54 ft of perforations in two intervals beginning at a measured depth of 8,525 ft. It was constrained by the capacity of surface equipment.

“Halyard-1 is our first test of a series of recently identified stratigraphic traps along the front edge of the Barrow Delta,” Farris said. “The production test confirms the presence of high-quality reservoir sandstones and their capacity to deliver gas at commercial rates. Apache has identified several other undrilled geologic features with similar geophysical characteristics in the same area.”

The company said production from Halyard could be brought to Western Australia’s gas market via an existing Apache-operated pipeline 10 miles south of the discovery and through the Varanus Island processing and transportation hub. This proximity to existing transportation facilities is likely to reduce the time and expense required to develop the project.

Pioneer developing Raton Pierre shale gas

A shale gas play on the Colorado side of the Raton basin has recovery potential exceeding 2 tcf of gas net to Pioneer Natural Resources Co. from about 21 tcf in place on its acreage, the Dallas company said.

The play covers 134,000 acres of the 318,000 acres the company has leased in the basin, all of which is held by coalbed methane production. Planned Raton basin drilling of 175 wells in 2008 will include 15 Pierre shale wells.

Pioneer said five wells are producing 2 MMcfd of gas from one of five prospective zones in Cretaceous Pierre laminated shale, and five more wells are in early stages of completion and production to test play boundaries. Gross thickness of the Pierre, a Mancos equivalent, is 2,200-2,800 ft at 4,000-6,000 ft. The lowermost interval is 200-400 net ft thick.

The company, which identified the play 18 months ago, said it has 1,200 risk-adjusted potential drilling locations based on 80-acre spacing. Wells will be drilled from new and existing pads, and gas will be produced through the CBM facilities.

Pioneer expects its Pierre proved reserves to reach 70 bcf by the end of 2008 and more than 200 bcf by the end of 2010. It recorded 18 bcf of proved reserves as of Dec. 31, 2007.

The first two vertical Pierre shale discovery wells have been producing from the lowest interval only for 16 and 10 months, respectively. The next two shallower intervals have been identified as productive.

Pioneer plans to assess the potential upside from horizontal drilling, which is under way, and the potential to produce from the shallowest two shale intervals.

The company expects to average $1 million/well plus $200,000 per frac interval for an average finding and development cost of $10-15/boe and to average a before-tax internal return rate of 40% at $8/Mcf.

“Pierre shale activity is expected to accelerate in 2009, supporting a compounded average annual production growth rate from the Raton basin of 10-15%,” Pioneer said.

Drilling & Production - Quick TakesCOSL to enter onshore drilling market

China Oilfield Services Ltd. (COSL) plans to enter the onshore drilling market this year for the first time.

COSL Chief Executive Officer Yuan Guangyu said the firm has decided to focus on the onshore market as a primary area of business expansion and as a main driver of financial growth.

This year COSL will deploy five drilling rigs in PetroChina’s Changqing oil field in Shaanxi province, where it will provide drilling services for 3 years at a rate of $15,000-20,000/day.

COSL last year won a $100 million contract to supply an unnamed Libyan drilling company with four onshore rigs for 3 years, starting last month, each drilling to 5,000-7,000 m.

COSL has signed a preliminary agreement to provide onshore drilling in Myanmar, and is in talks to provide services to shallow water oil and gas project operators in the Gulf of Mexico, where it already has built four rigs for Mexico’s Petroleos Mexicanos, Yuan said.

Petrobras leases five deepwater rigs for $4 billion

Petroleo Brasileiro SA (Petrobras) has signed a memorandum of understanding with Noble Corp. to lease five deepwater rigs over a period of 29 rig years at a potential cost of $4 billion. The contracts are subject to the approval of Petrobras’s top management.

Petrobras currently is employing the two semis and three drillships off Brazil.

Noble said the new contracts could increase its total backlog to more than $10 billion. The deal includes performance bonuses, a 1-year option on the Noble Paul Wolff, and paid shipyard time during upgrades for three dynamically positioned drillships.

The deal would include:

- The Noble Paul Wolff dynamically positioned semisubmersible for a 5-year primary term beginning in November 2009, with a 1-year option. The fourth generation semi can drill in 9,200 ft of water. With an 18% performance bonus, the total cost is $1.08 billion.

- The Noble Roger Eason drillship rated to drill in 7,200 ft of water. Contract is for 6 years, beginning in March 2010. The lease will cost $888 million, including a 15% performance bonus.

- The Noble Leo Segerius drillship, rated to drill in 5,600 ft of water, for a 6-year term, beginning in the second or third quarter of 2009. Cost to Petrobras is $769 million, including a 15% performance bonus.

- The Noble Muravlenko drillship for 6 years beginning in March 2009. The drillship can drill in 4,900 ft of water. Its lease will cost $744 million, including a 15% performance bonus.

- The Noble Therald Martin conventionally moored semisubmersible that can drill in 3,900 ft of water. It will lease for a 5-year term beginning in October 2010. Cost of the lease is $542 million, including a 10% performance bonus.

Noble will proceed with planned upgrades on each of the three drillships. The upgrades will cost about $175 million/ship and will take each rig out of service for about 150 days. Petrobras will pay about $90,000/day for up to 150 days for each rig’s scheduled shipyard stay.

StatoilHydro awards 5-year drilling contract

StatoilHydro awarded Aker Drilling ASA a 5 billion kroner contract for 5-year drilling operations in the Norwegian Sea.

StatoilHydro awarded the contract last December but had yet to finalize its duration beyond a minimum of 3 years.

Aker Drilling’s Aker Spitsbergen sixth-generation newbuild rig will work at Halten Nordland in the Norwegian Sea where deep water and harsh weather are great challenges on the Norwegian continental shelf. “The construction of the rig is now in full progress at the Aker Kvaerner yard at Stord,” Aker Drilling said. Aker Spitsbergen is slated for delivery by July.

Processing - Quick TakesSasol proposes Project Mafutha CTL plant

Sasol Technology (Pty.) Ltd. has hired Foster Wheeler South Africa (Pty.) Ltd. to carry out a prefeasibility study for the Project Mafutha coal-to-liquids (CTL) plant in South Africa. The contract value was not disclosed.

Project Mafutha, a greenfield CTL facility, would produce 80,000 b/d of synthetic fuel using Sasol’s proprietary low and high temperature Fischer-Tropsch processes and refinery technology for converting the Fischer-Tropsch products into fuel products. Foster Wheeler will investigate a location for the plant.

“The project will also include other processing units, utilities and offsite facilities necessary to support the development,” a Foster Wheeler spokesperson said. “Foster Wheeler’s scope for the study will also include the integration of other venture elements, such as the mining operation, into the overall venture scope.”

ACS: Preparation key to HDS catalyst

Oxford Catalysts announced Apr. 9 at the American Chemical Society Meeting, New Orleans, that a new approach to catalyst preparation could provide major improvements in the performance of hydrodesulfurization (HDS) catalysts.

According to Tiancun Xiao, cofounder of Oxford Catalysts, experiments suggest that the preparation method, rather than the type or combination of metals, has the greatest influence on HDS catalyst performance.

Oxford Catalysts’ experiments reveal that monometallic, bimetallic, and trimetallic HDS catalysts prepared using organic matrix combustion perform better than HDS catalysts of similar compositions prepared using impregnation methods.

“This result was a surprise,” said Sergio Gonzalez-Cortes, research scientist for Oxford Catalysts. “We don’t yet understand why this happens, but we think that it may be due to the strong interaction between cobalt and nickel.”

Transportation - Quick TakesShell mulls $2.1 billion floating LNG project

Shell Australia is considering a $2.1 billion (Aus.) floating LNG facility at its Prelude gas field in the Browse basin off Western Australia.

The company believes the time has come for development of relatively small gas fieldsthose having reserves of less than 5 tcf of gasusing the radical floating facility approach as opposed to the conventional fixed platform with pipeline to shore.

For the Prelude discovery, which lies about 450 km north of Broome on the Kimberley coast of Western Australia, a pipeline to shore could cost more than $3 billion.

The Shell find, made last year in the permit adjacent to Inpex’s Ichthys field, was once thought to be an extension of the Ichthys structure.

Speaking Apr. 7 at the Australian Petroleum Production & Exploration Association Conference in Perth, Royal Dutch Shell PLC’s Linda Cook, executive director of gas and power, denied that allegation, saying Prelude is a separate structure with a reserve of about 2-3 tcf. This is the type of project that would suit a floating LNG development.

Such a project would avoid the environmental sensitivities of bringing gas ashore on the pristine Kimberley coast where competing projects have prompted the Western Australian and federal governments to research a single gas production hub to reduce the environmental impact on the region.

Cook said it was still early in the proposal’s evaluation, but Shell believes the floating LNG technology has potential in both Australia and Asia.

Shell has lodged an environmental review application with the Australian government for the Prelude project, which it says could be in production by 2012.

The company says it expects to issue a tender for the building of the first of its floating LNG vessels in the third quarter.

Sempra to send more Costa Azul LNG gas to US

Sempra Energy, San Diego, has completed expansion of its 140-mile Baja North pipeline, enabling it to carry natural gas from its Energia Costa Azul LNG regasification terminal in Baja California, Mexico, to additional markets across the US border in California and Arizona.

The expansion is expected to be in operation later in the second quarter, Liparidis said.

Sempra Pipeline & Storage Chief Executive Officer George Liparidis, speaking at an analysts’ conference, said the $250 million expansion included a 45-mile, 42-in. spur along with compression upgrades and looping along the existing 30-in. mainline.

Gasoducto Bajanorte SRL operates the pipeline, which originates at an interconnection with North Baja Pipeline LLC west of Algodones and continues west through the cities of Mexicali and Tecate, Mexico.

The existing mainline, which has a capacity of 500 MMcfd of gas, serves new and existing power plants and industrial customers in northern Baja California and Southern California.

Liparidis said Sempra soon will have access to another extension as wellthe Yuma lateralto transport gas from the terminal to gas-fired power plants operated by major Arizona utilities in the Yuma, Ariz., area.

Construction on the lateral is under way, and completion is expected in early 2009.

Chinese-built LNG carrier for NWS delivered

The North West Shelf Joint Venture partners have taken delivery of the first of three Chinese-built LNG carriers that will transport LNG from the Burrup Peninsula plant to Dapeng receiving terminal in Guandong Province, China.

The Dapeng Sun carrier was delivered at Hudong-Zhonghua shipyard in Shnaghai by Yue Peng LNG Shipping.

The second vessel, Dapeng Moon, will be completed during the third quarter. Each of the JV companies has 5% equity in Yue Peng LNG.

The NWS group’s 25-year supply deal with the Guangdong consortium buyer was signed in 2002 for 3.3 million tonnes/year of LNG to Dapeng on a fob basis, and the agreement became effective in December 2004.

Separately, in another NWS project, Woodside Petroleum Ltd. awarded a $200 million (Aus.) contract to a JV of Australian engineering group Clough Ltd., Perth, and Interbeton, the Netherlands, to construct the LNG jetty for the Pluto LNG project on the Burrup Peninsula.

The 300 m-long jetty will be completed by yearend 2009.