SPECIAL REPORT: Exploration companies drawn to more of world’s remote areas

Exploration in remote basins is at a high level worldwide.

High oil and gas prices and strong demand have drawn more explorers into nonproducing and underexplored areas.

Seven such areas randomly selected are summarized in the following account: Ethiopia’s Danakil depression, Peru’s Talara and Sechura basins, the Central Depression in Armenia, Nigeria’s inland Anambra basin, Guyana’s inland Takutu basin, northern Chile’s Tamarugal basin, and the Chukchi basin off northwestern Alaska.

Danakil depression, Ethiopia

Afar Exploration Co., Tulsa, recently completed airborne gravity-magnetic data acquisition over parts of its 3.75 million acre block in the Danakil depression of nonproducing Ethiopia.

The Danakil depression is the hottest and lowest place on earth at 375 ft below sea level and as much as 145°.

Results of the surveys are the discovery of an evaporite basin to depths of 15,000 ft caused by a failed rift system parallel to the Red Sea. Reservoir rocks are the Miocene Desset sandstone at 5,000 ft and the Cretaceous Adigrat sandstone at 9,000 ft, both more than 1,000 ft thick.

Recoverable oil is expected to be in excess of 6 billion bbl.

The Dallol salt dome, 26 by 10 miles, is the main area of interest with active oil and gas seeps on its flank. The dome was discovered on a BHP Billiton field trip in the spring of 2007.

No exploration well has been drilled to date in the north half of Ethiopia. Afar Exploration expects to drill in the fall of 2008.

Other companies in the Afar region of eastern Ethiopia are Trans Global Petroleum and Lundin Petroleum.

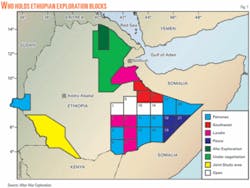

Even more are exploring other parts of the country (Fig. 1). Numerous operators have secured blocks in the Ogaden basin in southeast Ethiopia, and White Nile Petroleum and the Ministry of Mines are running gravity and magnetic surveys on a large block in southwest Ethiopia.

Ethiopia has had no oil discovery to date. Petronas of Malaysia drilled two dry holes in the Gambela region of western Ethiopia in 2007.

Talara-Sechura basins, Peru

A group led by Upland Oil & Gas LLC plans to explore 276,137-acre Block XXIV in northern Peru.

Covering part of the Talara and Sechura basins, the block has 80,000 acres in the Pacific and 196,000 acres on the coastal plain. Upland and state Perupetro signed the official contract on July 23, 2007, and EnDevCo Inc., Houston, took a 20% participation in the block in March 2008.

EnDevCo noted that other operators are drilling near Block XXIV. For example, Olympic Peru Inc. reported oil and gas discoveries in Cretaceous sands less than 5,000 ft deep in Block XII about 15 km north of the license boundary.

About 10 km south of Block XXIV, Olympic in March was reentering and completing existing wells in the Late Eocene Verdun formation and established 5 MMcfd of gas production from sands less than 2,000 ft deep.

In Block Z2B some 20 km southwest of Block XXIV, Petrotech International Corp., Houston, announced an offshore discovery at the San Pedro 1X well in 2007 reportedly producing as much as 4,000 bo/d from the highly fractured Paleozoic Amotape formation.

“Initial mapping of existing offshore seismic in Block XXIV has revealed at least four prospects similar to the San Pedro discovery located in water less than 200 ft deep,” said EnDevCo Chief Operating Officer Richard G. Boyce.

“Preliminary internal estimates of reserves on these offshore prospects range from a high case of 169 million bbl of recoverable oil to a low (risked) case of 26 million bbl. The onshore portions of the block are unexplored with seismic data, but airborne gravity reveals a significant undrilled basin in the interior of the block.

“The initial work program will acquire 100 km of 2D seismic across identified anomalies to better determine the prospective structures in the onshore portions of the block,” Boyce said.

The base royalty on initial production is 8% up to a level of 5,000 b/d and is a maximum of 15% on all oil and gas production thereafter. The exploration contract allows for an initial 7-year exploration period and a 30-year production period. Natural gas production infrastructure is available near Block XXIV for the development of shallow gas prospects for local sale.

Central Depression, Armenia

Blackstairs Energy PLC and Vangold Resources Ltd., Vancouver, BC, formed a 50-50 partnership to explore blocks 4, 5, and 6 covering 3.4 million acres in Armenia’s Central Depression.

The production sharing contract, signed on Apr. 27, 2007, is valid for 5 years with two 2-year extensions negotiable.

The work program in the initial 5 years consists of geological studies, gravity and geochemical studies, satellite remote sensing, and 170 km of 2D seismic for a total of $2.4 million.

Gerry Sheehan, Blackstairs managing director, said the commercial terms “are attractive and serve to ensure that even quite small accumulations of either oil or gas will be viable for commercial development. Armenia currently imports all of its hydrocarbons, and there is a ready open market for any indigenous hydrocarbons.”

Sheehan noted that Armenia’s sedimentary basins are relatively underexplored (OGJ, Aug. 12, 2002, p. 36). The geological history is complex due to the major Caucasus mountain-building structural events.

Two main sedimentary basins are recognized, the southwestern basins extending west to Armenia’s border with Turkey, and the Central Depression covering the central part of the country and extending east to the border with Azerbaijan and south towards the border with Iran.

These basins contain a series of smaller, complex subbasins. The structural style identified in these basins displays good potential for the development of multiple hydrocarbons traps with widespread evidence of folding, faulting, and complex fault thrusts.

The Central Depression covers most of the joint venture’s license area and contains a broad age range of sediments from the oldest Devonian era sequences up to thick recent sediments. This broad sequence offers the potential for the development of various reservoir, source, and seal combinations.

In southernmost Block 6, near the Iran border, a Jurassic-Cretaceous subbasin is virtually unexplored and may offer large hydrocarbon potential, Blackstairs said.

Previous hydrocarbon exploration has been patchy and unsystematic and undertaken using fairly basic geological and geophysical techniques, Sheehan said. From 1947 to 1990, the former Soviet authorities undertook fairly sporadic programs of seismic and drilling, often lacking in geological and adequate seismic control.

Two key well results emerged from this phase of exploration. The Shorakhpur-1P well east of the capital Yerevan encountered minor oil. Farther west at Armvir the Oktemberyan-13E well flowed gas at low rates for 6 months. Numerous other boreholes encountered indications of both oil and gas, and several oil and gas seeps scattered widely throughout the license area are well documented.

This phase was followed in the 1990s by a seismic and drilling campaign by Armenian American Exploration Co. Its Azat-1 well went to 3,524 m and encountered minor oil shows before being terminated for operational reasons.

Transeuro Energy Corp. drilled the Kamir-1 exploration well in 2007 and reported an extensive reservoir interval with well logs indicating a thick zone of low gas saturation. Transeuro also reported that this well has been suspended until more logging and testing can be carried out later in 2008.

Blackstairs-Vangold said the exploration programs to date “offer sufficient encouragement to infer the development of a working petroleum system. However, a more systematic geological and geophysical evaluation program is required to advance our understanding of the hydrocarbon prospectivity.”

The joint venture is developing a new geological model for the area. Historical data are being carefully analyzed and incorporated to a modern GIS database and “are already yielding valuable geological information and greatly assisting in the evolution of a new geological model for the area,” Blackstairs said.

In order to understand the major controls on structure formation and sedimentation, a high-resolution satellite remote sensing study was completed in 2007. This is being followed up with more focused evaluation of certain areas highlighted from the initial phase, and field validation of newly identified geological trends is progressing.

A 5,000-station gravity survey on blocks 4 and 5 began in 2007 and is to resume in early summer 2008. This will serve to elucidate the subsurface structural trends and will be integrated with the satellite imagery and field structural and geological mapping.

“The ultimate objective of these studies,” Blackstairs said, “is to highlight areas for a focused program of 2D seismic acquisition targeted at significant structural trends in promising fairways for reservoir, seal, source rock, and migration route development. Ultimately the joint venture aims to assemble a good quality prospect portfolio and rank these individually for a future drilling campaign.”

Anambra basin, Nigeria

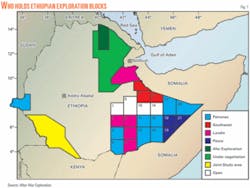

A joint venture of Afren PLC and Global Energy Co. Ltd. of Nigeria plans drilling in 2009 to appraise decades-old gas-condensate and gas and oil discoveries in Nigeria’s nonproducing Anambra basin (Fig. 2).

The company refers to Anambra as Nigeria’s second most prospective basin. The OPL 907 and 917 total 3,500 sq km.

The partnership of Afren Global Energy Resources became operator of and took 41% interest in OPL 907 and 42% interest in OPL 917 in the underexplored basin. The Anambra basin, with a gas resource estimated at more than 5 tcf, has 30 wells and six discoveries.

On OPL 907 the group will evaluate existing data, shoot 1,000 km of 2D seismic, and drill one or more appraisal wells near the Akukwa discovery.

Shell drilled four shallow core holes before Shell and British Petroleum discovered Akukwa in 1955 and drilling Akukwa-2 in 1956. Akukwa has estimated gas in place of up to 400 bcf.

The other participants in OPL 907 are Buston Energy Resources Ltd. 25%, Allenne Exploration & Production Ltd. 14%, Bepta Oil & Gas Ltd. 10%, Kaztec Engineering Ltd. 5%, VP Energy Ltd. 3%, and De Atai Oil Services International Ltd. 2%.

On OPL 917 a different group will evaluate existing data, shoot 2D seismic over the 1971 Igbariam discovery, and identify leads and prospects before drilling appraising Igbariam.

Shell and BP’s Igbariam-1 encountered a reported 196-ft net gas column and a 30-ft condensate-oil column in Cretaceous sandstones. The well was not tested. The 1972 Ajire-1 well was water wet.

Besides Afren Global, OPL 917 participants are Petrolog Oil & Gas Ltd. 18%, VP Energy 17%, Goland Petroleum Development Co. Ltd. 13%, and De Atai Oil Services 10%.

Takutu basin, Guyana

A farmout agreement signed in March 2008 could lead to drilling around the end of the year in southern Guyana’s Takutu basin.

Groundstar Resources Ltd., Vancouver, BC, and a company it did not name signed the agreement relating to the company’s petroleum prospecting license.

The farmee is to pay 100% of exploration expenses up to $12 million to earn 55% working interest in the block. It also has the option to hike its working interest to 65% by July 22 by issuing to Groundstar $1 million (Can.) worth of its securities.

Groundstar has three large seismically defined prospects on the license. The Karanambo-1 exploration well drilled by Home Oil Ltd. in 1982 tested 411 b/d of 42° gravity oil without water on a 5-hr drillstem test, which proved that the basin has the essential elements of a petroleum system. The well was never placed on production.

The farmout is expected to lead to the drilling of at least two exploratory wells.

The fiscal terms of the PPL are very favorable. Groundstar signed the four-year license in 2005.

Tamarugal basin, Chile

March Resources Corp., Calgary, said last month that its Pica-1 wildcat in the nonproducing Tamarugal basin in northernmost Chile cut 500 m of gas-charged volcanic tuff and sand intervals in the upper section of the well.

March noted that at the time the well had not yet reached its main gas targets, which were expected at 2,800-3,300 m. It also cautioned that despite the favorable results, the well cannot be considered commercial until tests are conducted.

The company later cased the well to TD just below 3,100 m and said it plans to perforate 12 to 17 prospective zones.

March said, “Several controlled gas kicks have been observed at surface during drilling breaks, in what is anticipated to be fractured rock.

“The samples taken from a depth of 900 m to 1,550 m have had mud gas isotope analyses conducted on them in an independent lab in North America. The hydrocarbon gas composition results indicate that the gases sampled to date have a high percentage of methane but also include varying percentages of ethane, propane and traces of condensate.”

Cuttings analysis indicated that the zones “consist of varying amounts of volcanic tuff and orthoquartzite, tight volcanic sands that appear to have varying fracture concentrations at various depths. This type of volcanic sand has shown very strong production results in other areas of the world, as it typically responds favorably to mechanical fracturing.”

March said the main target in the well is a “thrust zone that cuts vertically through any existing black shales in the hanging wall or the footwall of this structure. The black shales are considered to be the source rock in this basin. The surface expression of this thrust has a north-south extension of approximately 30 km, which was seen in the original 2D seismic lines previously shot.”

It explained that this is the type of structure that exists in the overthrust belts of Canada and Montana-Wyoming, as well as the known structural formations in the Neuquen basin of Argentina and the Llanos basin of Colombia.

The company plans to spud the Pica-2 well shortly.

Chukchi basin, Alaska

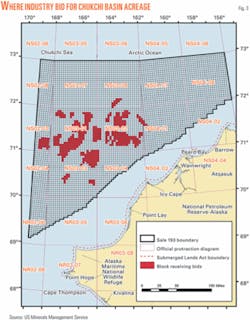

The US Minerals Management Service is evaluating the more than $2.6 billion in high bids offered Feb. 6 for leases in the Chukchi basin off northwestern Alaska (Fig. 3).

Industry submitted a total of 67 bids for 448 blocks in the area of more than 29 million acres where only five exploration wells have been drilled previously. Previous leasing was in 1988 and 1991.

The leases offered extend from 25-50 miles to 200 miles offshore, but the closest tract that drew a bid is 54 miles off the coast.