BC’s Muskwa shale shaping up as Barnett gas equivalent

An Upper Devonian shale gas play, emerging the past 2-3 years in remote northern Northeast British Columbia, has the potential to become one of North America’s larger gas fields.

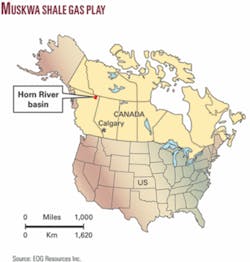

The play is for gas in the Muskwa shale in the Horn River basin 775 miles northwest of Calgary.

EOG Resources Inc., Houston, with 140,000 acres in the play, estimates 70 tcf of gas in place in the shale of which a net 6 tcf seems recoverable. Gas in place in the Muskwa on EOG lands averages 318 bcf/sq mile, 2.5 times that of the Barnett shale in Johnson County, Tex., in the Fort Worth basin south of Fort Worth.

EnCana Corp. and Apache Corp. hold a combined 400,000 acres in the play in a 50-50 area of mutual interest. Other independents have smaller leaseholds, and the total area under lease is estimated at 600,000-700,000 acres.

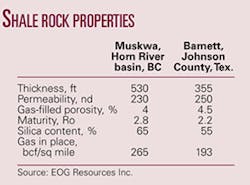

EOG said its land is in the richest gas-in-place portion of the play, where the Muskwa is half again as thick as its thickest Johnson County Barnett shale.

The play is sparsely drilled so far, so much so that Apache told analysts it is still determining whether it is commercial. If commercial, it would expose Apache to 3-6 tcf of net recovery.

EOG said it expects Muskwa to develop more slowly than the Barnett.

The company estimated that industry will have drilled a total of 17-21 horizontal wells in the play by the end of 2008. EnCana-Apache will drill nine horizontal wells and EOG two vertical and four to eight horizontal wells this year.

Formations compared

The Muskwa shale, which lies at about the same depth as the Barnett, is thicker and has higher pressure than the Barnett in the Northeast BC area south of Fort Liard, NWT, EOG said.

Muskwa is geologically less complex than the Barnett, with equivalent permeability of 230 nanodarcies, equivalent 4% gas-filled porosity, 2.8% vitrinite reflectance, better silica content at 65%, and no water.

The Muskwa has continuous gas thicknesses in the upper and lower parts of the formation, which will smooth completions. EOG has a large proprietary data base of core, log, and microseismic data from area wells that were drilled through the formation.

The Muskwa has limited faulting, and the carbonate that underlies it has no sinkholes, EOG added.

EOG’s expectations in the Barnett grew from a 10-12% recovery factor in 2004 to as much as 20% by late 2005 to 30% maximum in early 2007 and then to 50-55% in late 2007.

In the Muskwa, the company initially assumes 20-30% recovery. Using 20% recovery and viewing 60% of its acreage as prospective is how the company reached the initial estimate of 6 tcf recoverable. The calculation takes into account 12% carbon dioxide in the gas and 85% net revenue interest.

Wells would likely be on 40-acre spacing initially.

Early drilling

Two large gas pipelines flank the Muskwa play.

EOG plans to begin production in June 2008 from its first two wells through a 15-km gathering line to a 24 MMcfd conditioning plant and doesn’t see important contributions of production until 2010-11.

Apache, which has referred to the shale as “Ootla,” plans to experiment with different multistage fracs this year to enhance flow rates.

EOG’s first vertical Muskwa well, in 2006, made 750 Mcfd after a two-stage frac.

Its first horizontal well in 2007 tested 5 MMcfd after a six-stage completion in 3,000 ft of mostly off-azimuth (to formation fractures) lateral. Reservoir simulation of that well indicated ultimate recovery of 4-6 bcf/well if the full length of the lateral had been on azimuth.

EOG’s second horizontal well tested 4.2 MMcfd after a five-stage completion in a 1,700-ft lateral. Its third well made 3.5 MMcfd with a five-stage completion in a 1,600-ft lateral.

A 120 MMcfd gas processing plant at Fort Nelson, BC, has a 450 MMcfd capacity if existing trains are restarted, and even more capacity will be needed if the play turns out to be as large as the Barnett, EOG said.

Other considerations

EOG sees at least four reasons for caution in its expectations for Muskwa play progress.

It has few drilling results, although the company reported a one-third drilling time reduction on its second 2008 horizontal well.

The longest an existing well has been on production is 10 months.

Permits must be obtained from native corporations that own much of the basin’s surface rights.

Assembling a technical staff to operate in the remote basin will be a challenge.

Overall, it estimated that the play’s rate of return will not be quite that of the Barnett shale but will still be acceptable.

EOG floated early development well cost assumptions of $9.4 million/well plus $600,000 for leasehold and tie-in, but Apache indicated that much lower costs should be obtainable.

Other participants in the play include Nexen Inc., Devon Energy Canada, and Crew Energy Inc., Calgary. Storm Ventures International Inc. and Storm Exploration Inc. were pursuing acreage in late 2007, and the province is to offer more leases this month and next.