OGJ Newsletter

Markey summons majors for oil-price hearing

Responding to record crude oil prices, US Rep. Edward J. Markey (D-Mass.) announced Mar. 11 that the House Select Committee on Energy Independence and Global Warming, which he chairs, will summon chief executives from the five biggest major oil companies to testify at an Apr. 1 hearing.

“The American people deserve answers from Big Oil. The top five oil companies made record profits last year, and yet are continuing to hold on to tax breaks that could be used to advance the clean fuels of the future,” said Markey.

The committee has scheduled the hearing for Apr. 1, the first date available after Congress returns from its planned spring district recess.

“It’s time for these top oil company CEOs to look Americans in the face and tell them why they can’t support new solutions,” Markey said.

The House on Feb. 27 passed HR 5351, which would continue funding for alternative and renewable energy projects by denying oil and gas companies $18 billion in incentives. The bill faces an uncertain future in the Senate, and President George W. Bush has threatened to veto it.

Also on Mar. 11, the US Energy Information Administration issued its latest short-term energy outlook. The forecast retained its estimate that monthly average retail gasoline prices should peak around $3.50/gal in May but added, “There is a significant possibility that prices during some shorter time period, or in some region or subregion, will cross the $4/gal threshold.”

China lawmakers propose energy regulatory body

China plans to establish a full cabinet-level regulatory body aimed at consolidating and overseeing all of the fuel-related responsibilities now assigned to differing agencies.

The new commission, to be called the State Energy Commission, will be responsible for about 10 ministerial or subministerial agencies covering oil, gas, and other forms of energy such as the Energy Bureau of the National Development and Reform Commission, China National Petroleum Corp., and China Petrochemical Corp.

Conflicting interests and a lack of coordination among various ministries and commissions have made it difficult for the central government to regulate the sector from the perspective of national energy security.

“Such a body is urgently needed to oversee strategic oil reserves and overcome the country’s shortages of energy,” according to one industry source who said the change has come because of worries about energy security, especially as China’s dependence on imported oil edges towards 50% and oil prices reach $100/bbl or more.

Nearly 60% of China’s oil imports come from the Middle East, which makes the mainland vulnerable to any disturbance in international markets.

But the government estimates that it will need to import 70% of its oil and 50% of its gas by 2020.

Iraq still not recognizing KRG, IOC deals

Iraq has repeated its refusal to recognize any agreements for oil or gas signed between the country’s Kurdish Regional Government and international oil companies.

Iraq’s oil minister Hussain al-Shahristani said, “The central government is in charge of the administration of natural resources, and agreements not approved by the central government will not be recognized.”

KRG, against the wishes of the central government, already approved several contracts with international oil companies, including Crescent Petroleum, Sharjah; Reliance Industries Ltd., Mumbai; OMV AG of Austria; and a consortium led by South Korea’s state-run Korea National Oil Corp.

The Iraqi oil ministry considers such agreements illegal and has threatened to exclude and blacklist participating IOCs from future opportunities in the country.

As of Dec. 31, 2007, the Iraqi oil ministry suspended SK Energy’s term contract to import Basra oil because it refused to abandon its exploration project in the Kurdish region as part of the KNOC consortium. Last month, KRG Prime Minister Nechirvan Barzani planned to lead a delegation to Baghdad for talks with Iraqi Prime Minister Nuri al-Maliki on the status of the Oil and Gas Law, as well as recent and pending contracts KRG signed with international oil companies (OGJ Online, Feb. 8, 2008).

IOC in talks for equity in Canadian oil sands

In an attempt to secure oil supplies for its refineries and strengthen India’s energy security, state-owned Indian Oil Corp. (IOC) reported it is looking to acquire equity in oil sands blocks in Canada. IOC has initiated talks with BP PLC and Shell Canada Ltd.

An Indian delegation was in Canada last month to discuss the proposed investment. Other Indian firms interested in acquiring oil sands assets in northeastern Alberta include state-run Oil & Natural Gas Corp. and Oil India Ltd.

IOC has made several unsuccessful attempts to acquire equity stakes in overseas exploration and production blocks. The company doubts now that it will meet its 2012 target of sourcing 2 million tonnes/year of oil from its own overseas blocks.

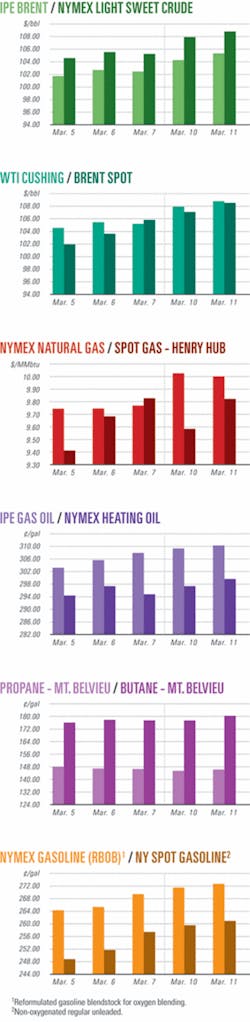

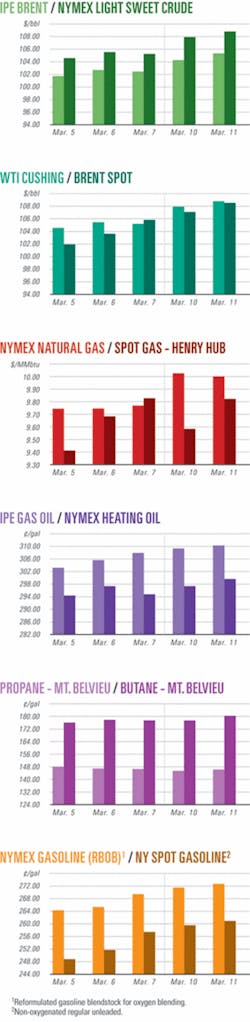

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesEni makes oil discovery in Timor Gap

Eni SPA’s Australian subsidiary Eni Australia, Perth, made an important oil discovery in the Joint Petroleum Development Area (Timor Gap) administered by Australia and East Timor.

Wildcat well Kitan-1, drilled on Permit JPDA 06-105 in the far northeast corner of the Timor Gap, flowed 6,100 b/d of oil on test.

“The data will now be interpreted to assess the potential dimension of the discovery,” reported Eni.

Kitan lies in the vicinity of the now-depleted Elang and Kakatua fields, about 500 km north of Darwin. The well was drilled to 3,568 m TD.

Eni is operator of the permit with 40%. Other interest holders are Inpex of Japan 35% and Talisman Resources Pty. Ltd. 25%.

Eni has a number of interests in the Timor Sea, including 100% of the Blacktip gas field under development in the Bonaparte Gulf, a 10.99% share in the Bayu-Undan gas-condensate field in the Timor Gap, and 80% in each of five exploration permits in East Timor waters to the north of the Gap boundary.

OMV wins another exploration license in Norway

OMV AG has secured another offshore exploration license in the Norwegian Sea, bringing its total allocation to five under the recent Awards in Predefined Areas licensing round.

OMV (Norge) AS will operate Block PL 471 and will work with Sagex Petroleum Norge AS on a 50-50 basis.

Helmut Langanger, OMV executive board member responsible for exploration and production, said the license strengthens the company’s E&P position in this core region. OMV described the block as being in a prospective area.

Exall tests Gilwood oil north of Edmonton

Exall Energy Corp., Calgary, said its Marten Mountain horizontal oil discovery in Alberta 140 miles north-northwest of Edmonton flowed 1,585 b/d of 40° gravity sweet oil and 575 Mcfd of gas at 850 kpa flowing pressure.

Exall, operator with 59.338% working interest before payout and 66% after payout, plans to drill a second horizontal well from the same pad and a vertical well nearby as soon as surface access permits, likely to be in the third quarter. The company has 66% interest in 6,080 surrounding acres.

The well, in 102/14-1-75-6w5, averaged 1,135 b/d and 475 Mcfd from Devonian Gilwood on a 21.7-mm choke. The Alberta allowable for the well is expected to be 285 b/d. The well penetrated 420 m of Gilwood sand.

MEO’s Timor Sea Blackwood finds gas sands

MEO Australia Ltd., Melbourne, has encountered a 98-m gross gas-saturated sand interval in its Blackwood-1 wildcat in the Timor Sea.

This exceeded the anticipated most-likely predrill estimate of 57 m. However the significance has yet to be determined in a production test.

The Blackwood gas appears to have low carbon dioxide content.

This success could relieve some disappointment of the company’s earlier program at Heron-2, which also found gas but failed to flow commercial volumes to surface.

Blackwood, like Heron, lies within the large Epenarra structure, which is a broad, low-relief anticline with a mapped closure of 1,200 sq km. The contingent gas resource of Epenarra is said to be about 6 tcf.

If Blackwood flows at commercial rates, it could revive MEO’s plans for an artificial island with an LNG and methanol plant planned for nearby shallow water at Tassie Shoals 300 km north of Darwin, for which environmental approval has been obtained.

AED, Sinopec form JV for Timor Sea assets

AED Oil Ltd., Melbourne, has agreed to form a joint venture with Sinopec International Petroleum Exploration & Production Corp. of China in which Sinopec will acquire 60% of AED’s assets in the Timor Sea.

These involve permits AC/P22, AC/L6, and AC/RL 1, which include producing Puffin oil field and Talbot oil field held under retention license.

Sinopec will become operator of the JV under the new arrangement, which will become effective Mar. 31.

The transaction, which values AED’s hitherto wholly owned assets at $1 billion (Aus.), is subject to government approvals, including that of Australia’s Foreign Investment Review Board.

AED said it will use the funds to retire debt, settle creditors, and fund its JV interest and ongoing development and exploration opportunities in the permits. The company owes Norwegian oil services firm AGR Group $41.5 million (Aus.) for production services and lease of the Puffin field floating production, storage, and offloading vessel.

AED’s Puffin production is less than the originally anticipated 30,000 b/d of oil from the two producing wells, Puffin-7 and Puffin-8. Flow was limited to 10,000 b/d due to downhole problems now attributed to drilling and completion flaws.

Redcliffe gauges Halfway oil find at Wapiti

Redcliffe Exploration Inc., Calgary, tested a Triassic Halfway sour oil and gas discovery at Wapiti in the Peace River arch area of west-central Alberta.

Redcliffe, operator with 72% working interest, said the well will go on production in the second quarter and that it will maximize producing rates “due to the current royalty rate and incentive program that are proposed to be changed effective Jan. 1, 2009.”

On a 4-day initial production test, the well stabilized at 750 b/d of 48° gravity oil and 2.6 MMcfd of gas on a 20⁄64-in. choke with more than 1,900 psig flowing tubing pressure, considered to be virgin reservoir pressure.

The company plans to drill at least one more well into the pool this year.

Drilling & Production - Quick TakesPakistan firm signs rig deal

Petroleum Exploration (Pvt.) Ltd., operator, signed a long-term contract with Weatherford Drilling International for a new National Oilwell Varco 1,500-hp IDEAL drilling rig.

The rig is in Houston and will be shipped to Pakistan following its expected Apr. 7 commissioning. The spud date for the first exploration well of the proposed drilling program on the Jura concessions in Pakistan is expected in July, depending on shipping availability.

In the last year, 1,523 km of 2D seismic data were shot over the Jura concessions. In addition, more than 1,600 sq km of 3D data are available over the Badin IV North and Badin IV South blocks.

ConocoPhillips to decommission Ekofisk units

ConocoPhillips let a contract to Heerema Marine Contractors to decommission its nine Ekofisk platforms in the Norwegian and UK sectors of the North Sea by 2013.

Heerema will work with Norwegian demolition and recycling company AF Decom Offshore to carry out the work. The award includes options to remove other platforms and installations as well.

Decommissioning of the platforms, which gathered production from Ekofisk, Eldfisk, Embla, and Tor, will occur in phases so that Heerema can fully utilize the Hermod and Thialf semisubmersible crane vessels.

“The Ekofisk topsides and jackets will be removed and taken to a yard in Vats, Norway, for recycling and disposal. An estimated 96-98% of the material recovered will be recycled by 2014,” Heerema said.

The value of the decommissioning contract, which covers engineering, offshore preparation, removal, and onshore recycling, was reported to be $1 billion.

ConocoPhillips has begun decommissioning its 25,000 Ekofisk storage tank with its topsides and is preparing for in-place disposal finishing by yearend.

Processing - Quick TakesChevron tests heavy oil hydrocracking technology

Chevron Corp. plans to build a precommercial plant at its 330,000 b/d Pascagoula, Miss., refinery to test the technical and economic viability of a technology to upgrade heavy oil.

This proprietary vacuum resid slurry hydrocracking (VRSH) technology has the potential to increase yields of gasoline, diesel, and jet fuel from heavy and ultraheavy crude oil and could be used to increase and upgrade production of heavy oil resources, said company officials.

“Given the increasing role of heavy oil in meeting the world’s growing energy demand and our significant heavy oil resources, this technology could provide a unique pathway to increase supplies of clean-burning fuels for the marketplace,” said Mike Wirth, executive vice-president of global downstream operations for Chevron.

The Pascagoula precommercial plant will have a capacity of 3,500 b/d. All necessary permits have been secured, and construction is expected to begin later this year.

Chevron has been developing VRSH technology since 2003. The patented process has undergone successful preliminary testing on a wide range of feedstocks in multiple pilot plants at Chevron’s research center in Richmond, Calif.

The company’s research shows that the technology can achieve up to 100% conversion of the heaviest feedstock versus less than 80% conversion by the best current commercial refining technology.

The Pascagoula refinery, Chevron’s largest wholly owned petroleum refinery, has been operating for more than 40 years.

Total lets contract for Port Arthur refinery

Total SA let a $1.9 billion contract to Fluor Corp. for engineering, procurement, and construction of certain units at Total’s Port Arthur, Tex., refinery.

The EPC contract covers a 50,000-b/d coker and desulfurization, vacuum distillation, and related units at Total’s 231,000 b/d Port Arthur refinery.

The $2.2 billion increase in the refinery’s deep-conversion capacity will boost output of ultralow-sulfur automotive diesel by 3 million tonnes/year. Commissioning is scheduled in 2011.

The new contract follows Fluor’s completion of front-end engineering and design work at the Port Arthur refinery.

ExxonMobil lets Singapore plant contract

ExxonMobil Asia Pacific Pte. Ltd. authorized John Wood Group subsidiary Mustang Engineering to begin detailed engineering, design, and construction management for the process control of a second world-scale steam cracker complex in Singapore.

The project will be integrated with the existing Singapore site, providing feedstock, operating, and investment synergies with both the chemical plant and refinery.

The petrochemical project will employ ExxonMobil’s latest proprietary technologies, enabling a broad range of feedstocks to be processed and converted into higher-value products.

The project will include a world-scale, 1 million tonne/year ethylene cracker, two 650,000 tpy polyethylene units, a 450,000 tpy polypropylene unit, a 300,000 tpy specialty elastomers unit, an aromatics extraction unit to produce 340,000 tpy of benzene and an oxo-alcohol expansion of 125,000 tpy. Project start-up is expected in early 2011.

Mustang also was awarded the upgrade of the process controls of the existing steam cracker complex. In 2006, Mustang completed the front-end engineering design contract for process control, which was used to launch the detailed design of this project.

Transportation - Quick TakesChevron approves Platong Gas II project

Chevron Corp. and its partners have approved construction of the Platong Gas II natural gas project in the Gulf of Thailand at a cost of some $3.1 billion with startup scheduled for first quarter 2011.

The Platong Gas II development, which lies in shallow water 200 km offshore, is designed to add 420 MMcfd of gas processing capacity. The project feeds the growing demand for gas in the domestic market.

In December Chevron signed an agreement with Thailand’s Ministry of Energy to increase its contract quantity of gas by 500 MMcfd to 1.2 bcfd by 2012 from offshore Blocks 10, 11, 12, and 13.

Platong Gas II is expected to be the major source of this increase in production. In October 2007, the company received 10-year lease extensions until 2022 for Blocks 10-13. Chevron has ownership interests in these blocks ranging from 60-80%.

Chevron is operator of Platong II and holds a 69.8% participating interest with Mitsui Oil Exploration Co. Ltd. 27.4%, and PTT Exploration & Production PCL 2.8%.

Fayetteville-Greenville expansion gets final EIS

Texas Gas Transmission LLC’s proposed Fayetteville-Greenville expansion project would have limited adverse environmental impacts if recommended mitigation measures are used, the Federal Energy Regulatory Commission’s staff concluded in a final environmental impact statement on Mar. 8.

The Owensville, Ky., company’s proposal involves construction of two 36-in. natural gas pipeline laterals in central Arkansas and central Mississippi, according to company information.

It said the Fayetteville lateral would extend 167 miles from Conway County, Ark., to Texas Gas’s main line in Coahama County, Miss., and would have 1.1 bcfd of capacity. The 750 MMcfd Greenville lateral would start near the company’s compressor station near Greenville, Miss., and end at a Gulf South Pipeline Co. LP line near Koskiusko, Miss.

FERC said the proposed project also would include a 10,560 hp compressor station near Koskiusko and related aboveground facilities along both laterals. It said the Fayetteville lateral would use existing rights of way for about 90.5 miles, or 54%, of its length.

Texas Gas indicated that it will use recommended plans and procedures covering erosion control, water body crossings, storm water pollution controls, and other measures to control the project’s environmental impact, according to FERC. “Horizontal directional drill construction methods would be used to cross many sensitive resources,” it said.

FERC said commissioners would consider the final EIS and staff recommendations before issuing the final permit for the project. Texas Gas said this could occur during second-quarter 2008 after which it would soon begin construction.

Service is projected to begin in the third quarter on the Fayetteville lateral segment from Grandview to Latona, Ark., and during first-quarter 2009 on the Greenville lateral and the segment from Latona to Lula, Miss.

Chevron to develop Wheatstone as LNG

Chevron Australia Pty. Ltd. reported plans to develop its wholly owned 2004 Wheatstone gas field discovery on the North West Shelf as a stand-alone LNG project with facilities placed on the northwest coast of mainland Western Australia.

The company says the initial plan is to establish a 5 million tonne/year LNG facility and allow for later expansion of additional trains. The plant would also produce gas for the domestic market.

Preliminary engineering and design on the project is under way, and front-end engineering and design should commence next year.

Wheatstone field, which has estimated gas reserves of 4.5 tcf, lies on retention lease WA-17R about 145 km off Dampier in 200 m of water.

The news of a stand-alone development has puzzled the industry in Australia because discovery of the field had been touted more as a potential gas-to-liquids project than LNG.

Its close proximity to the North Rankin and Goodwyn fields also makes it a logical addition to the Woodside-operated North West Shelf LNG project (of which Chevron is a participant) rather than a new greenfield LNG project in the same vicinity.

In addition, at one point Wheatstone was suggested as a candidate for development alongside Woodside’s nearby Pluto field, possibly as a supply of gas for Pluto 2’s second train LNG development.

Chevron appears to have rejected those options.

The company says it is preparing design studies at Wheatstone for development and production, site evaluation, and further field appraisal work.

CFE lets LNG terminal to Japanese-Korean group

Mexico’s Federal Electricity Commission (CFE) has awarded a $900 million contract for the construction and operation of an LNG receiving terminal on Mexico’s Pacific coast to Terminal KMS de GNL, a consortium of Mitsui & Co. 37.5%, Samsung Corp. 37.5%, and Korea Gas Corp. 25%.

The terminal, to be built at the Port of Manzanillo, will be comprised of two LNG tanks, a regasification facility, and a pier. Commercial start-up is scheduled for midyear 2011.

The company will manage and operate the facilities for 20 years based on a service contract with CFE. The partners said they will charge a regasification fee of 40¢/Mcf to process the gas.

After starting at 90 Mcfd in 2011, supply to the facility will be scaled up to 500 Mcfd by 2015 in increments of 180 Mcfd, 360 Mcfd, and 400 Mcfd. The gas from Manzanillo will feed the 3 Gw of capacity CFE intends to install in the region.

CFE earlier awarded Repsol Comercializadora de Gas a 15-year, $15 billion contract in September 2007 to supply the Manzanillo terminal with Peruvian gas (OGJ, Mar. 10, 2008, Newsletter.)