A looming royalty increase is aggravating a “recession” in Alberta’s conventional oil and gas industry, according to a veteran Calgary consultant.

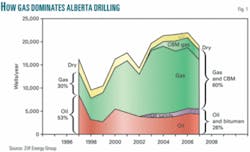

The province’s conventional industry is dominated by natural gas, drilling for which is plummeting, says Paul Ziff, chief executive officer of Ziff Energy Group (Fig. 1).

The Alberta government last October announced what it called a New Royalty Framework, rejecting a special tax on oil sands recommended by a review panel but lifting royalty rates overall (OGJ, Nov. 5, 2007, p. 34).

For natural gas, the framework raises the maximum royalty to 50% from 35% and eliminates tiers, starting in 2009. It retains and will revamp programs for special production categories such as deep formations and marginal wells.

“Based on the much lower price for natural gas than oil and today’s higher drilling and operating costs,” Ziff says in a recent report, “the new royalties on natural gas production are coming at a lousy time and are contributing to a sharp drop in current and future gas drilling activity.”

Prices, costs

The consultant notes that prices for natural gas in Alberta are half those of oil on an energy-equivalent basis and that most of the profits reported by big energy companies come from oil produced from mature fields (Fig. 2).

He also points to a “dramatic escalation in the cost to find new gas reserves.”

His firm estimates that the full-cycle cost of new gas supplies increased to $4.70/Mcf (Can.) in 2006 from $1.50/Mcf in 1995.

Of the 1995 estimate, $0.85/Mcf represents finding and development costs, including drilling, seismic work, land, and facilities; $0.40/Mcf reflects operating costs; and $0.25/Mcf is administrative cost. The 2006 cost breakout: $3.05/Mcf finding and development, $1.30 operating, and $0.35 administrative.

“Adding the producer’s return or profit, royalty, and taxes since 2006, the price of natural gas is not high enough to justify average new gas exploration,” Ziff says.

Spending drops

After announcement of the new royalty framework, he adds, “Conventional industry spending has dropped sharply,” while in neighboring Saskatchewan and British Columbia, it’s “booming.”

Gas drilling in the US, where the gas price is similar to that in Alberta but where costs and royalties are lower, continues to increase, Ziff says. In Western Canada (mainly Alberta), the annual average rig count fell 40% last year.

Even before the new royalty rate, producers faced rapidly rising costs, especially for labor, which is in short supply because of surging oil sands development. In addition, Ziff says, the strong Canadian dollar has cut about $3/Mcf from the Canadian gas price.

Many Canadian companies have said they’re cutting spending in Alberta, and many non-Canadian companies are quietly shifting spending away from the province.

“Ziff Energy estimates at least 80% of companies active in Alberta have reduced their planned conventional spending since the new royalty announcement,” the consultant says.

Most affected by the spending cuts are deep gas in western and northwestern Alberta and shallow gas and coalbed methane in the central and southeastern areas.

Layoffs begin

Some operators have announced layoffs in Alberta, and Ziff Energy expects more. Many service companies are laying off workers. Underutilized equipment is moving to the US and Russia.

According to Ziff, biweekly sales of crown land have dropped to their lowest level in almost a decade in a trend that will cut Alberta’s future royalty receipts.

The province’s slowdown jeopardizes the government’s target of a $1.4 billion increase in royalty revenue.

“Unless the proposed royalty program is revised, conventional gas activity will decline sharply, creating a ‘made-in-Alberta’ recession in 2008 outside of the oil sands,” Ziff says. “The increase in provincial net revenues of $1.4 billion in 2009 is a house of cards ready to tumble.”