OGJ Newsletter

Senate Republicans pressed to support bill

Democratic leaders in both houses of the US Congress used record-high crude oil prices to press Senate Republicans to back a House-approved bill that would shift $18 billion in tax breaks from major oil companies to alternative and renewable energy projects.

Responding to news Mar. 3 that crude oil prices reached $103.95/bbl, breaking a record set in 1980 when adjusted for inflation, Senate Majority Leader Harry M. Reid (D-Nev.) said: “As oil prices reach record highs in a weakening economy, Democrats remain committed to repealing Big Oil’s tax breaks and instead use that money to expand incentives for investing in energy-efficient vehicles and renewable energy.

“Bush Republicans blocked our efforts to do so last year, but we will soon give them another chance to help lower prices at the pump and reduce our reliance on oil,” he continued.

In the House, which passed H.R. 5351 by 236 to 182 votes largely along party lines Feb. 27, Speaker Nancy Pelosi (D-Calif.) said that Americans are paying the price for years of a failed energy policy that has resulted in heavy reliance on imported oil and a growing threat from global warming in addition to record energy costs.

After Democrats assumed control of Congress in January 2007, she said, federal lawmakers enacted the first motor fuel economy increase in 32 years; dramatically boosted efficiency standards for buildings, lighting, and appliances; and invested in domestic biofuels. “This year, we again seek to repeal billions of dollars in unnecessary subsidies given to Big Oil at a time of record profits and invest these savings in clean, renewable energy initiatives that will create good-paying green jobs,” Pelosi said.

She and Reid urged President George W. Bush to drop his opposition to the measure, which he has said he would veto because it is aimed at increasing taxes in a single industry.

Chavez warns of war plans with Colombia

Oil production in Venezuela and Ecuador are not under any threat despite rising tensions with their neighbor Columbia, according to oil ministers from both countries.

Venezuelan Energy and Mines Minister Rafael Ramirez said his country’s oil industry infrastructure “has been protected for some time now” and that the country is “ready to protect” itself.

Ecuador’s Oil Minister Galo Chiriboga said his country’s oil output would not be affected by recent military movements in the region.

Both Venezuela and Ecuador have sent troops to their respective borders with Colombia in response to Colombia’s killing of a top rebel leader on Ecuadorian soil on Mar. 1.

Earlier, Venezuelan President Hugo Chavez warned that his country and Ecuador could go to war with Colombia over the military incursion into Ecuador by Colombian forces that killed Raul Reyes, the second most senior rebel commander for the Revolutionary Armed Forces of Colombia (FARC).

Colombian authorities said Reyes and 16 other guerrillas were killed in a raid on a FARC camp 1.8 km inside Ecuador’s border with Colombia. Documents recovered from Reyes’ captured laptop computer showed Chavez’s administration recently paid $300 million to the rebels, while high-level meetings had been held between rebels and Ecuadorian officials, Colombian officials said.

“We don’t want a war... (but) if we have to give (a war), we will, and it will be in Colombia,” said Chavez during a nationally broadcast radio and television show.

Ecuador “will always count on Venezuela for anything under any circumstance,” said Chavez, who ordered Venezuelan troops to his country’s border with Colombia.

Columbia justified the raid on grounds that the Colombian rebels were using Ecuador as a base to attack their homeland and that Venezuela had provided financial and military support.

“We cannot allow terrorists who seek refuge in other countries to spill the blood of our countrymen,” said Columbian President Alvaro Uribe, who added: “We are not warmongers, but we are not weak.”

US President George W. Bush backed Colombia, accusing Chavez of provocative maneuvers and warning he opposed any act of aggression in the region. For his part, Chavez says Uribe is a pawn in a US plot to invade Venezuela, the No. 4 oil supplier to the US.

European unbundling discussed at EU meeting

At a meeting of European Union Energy Ministers in Brussels Feb. 28, the Slovene presidency accepted an unbundling option proposed by Germany, France, and six other EU members. The unbundling initiative had been introduced as an alternative to the Energy Commission’s two options to separate energy production from distribution networks in order to obtain a truly competitive European integrated energy market.

There will be further discussions on the matter before the end of June. France assumes the presidency of the EU July 1.

The Commission wanted the total breakup of fully vertically integrated gas and electricity utilities but proposed a complicated alternative that eight opponents rejected. It posed that ownership of production and transport networks be retained but that the assets be managed by a fully independent body.

Their third option was to set up the conditions for an “effective and efficient” dissociation between energy producers and transporters while maintaining ownership.

While France’s Energy Minister Jean-Louis Borloo was celebrating “a psychological victory” because the third option had been retained for discussion, Germany’s E.On AG was pulling the carpet from under the discussions by setting up a precedent for full unbundling: It was offering to sell its electricity grid to a fully independent buyer, a move rejected by German Chancellor Angela Merkel as likely to weaken the position of Germany and France.

A number of observers noted that, while it was possible to give up ownership of electricity networks, giving up ownership of gaslines would destroy the value of a company such as Gaz de France and involve questions of national security, as a company such as Gazprom is known to be ready to acquire networks that would appear on an open market.

Sakhalin-2 partners seek swifter financing

Sakhalin Energy, operator of the Sakhalin-2 gas and oil project, reported it is no longer seeking loans from the US Export-Import Bank or the UK’s Export Credits Guarantee Department due to possible delays on loan decisions.

A Sakhalin Energy spokesman said Ex-Im Bank might require lengthy consultations over the loans, but that the project’s tight start-up and operating schedule dictated the need to seek a swifter financing decision, not environmental or political concerns.

Sakhalin Energy, which needs a reported $5 billion for project financing, will continue to hold discussions with other potential creditors such as the Japanese Bank for International Cooperation and major commercial banks.

Phase 2 construction of the Sakhalin-2 project is nearing completion with some 90% of work already accomplished. The company hopes to finish the second phase by yearend and start production of LNG shortly after.

The company’s work plan this year includes starting of drilling at platform Piltun-Astokhskoye-B and start-up of the Molikpaq tie-in modules to establish year-round production of oil.

Also in the plan for this year are continued drilling at gas platform Lunskoye-A; commissioning the OPF to receive hydrocarbons from all three offshore platforms; completion of the onshore pipelines and booster Station 2 construction; and the commissioning of Trains 1 and 2 of the LNG gasification plant.

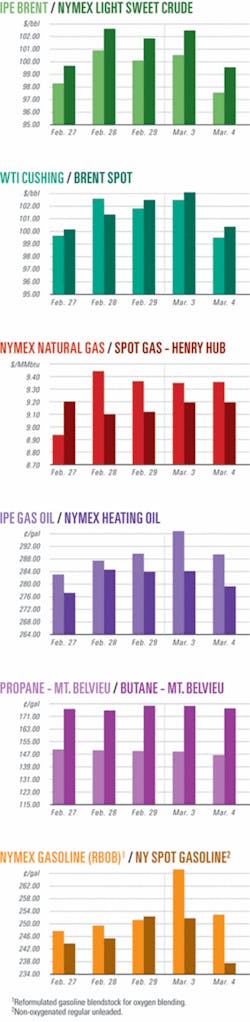

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesExxonMobil to explore block off Libya

ExxonMobil Corp. will shoot seismic surveys and drill an exploration well under a production-sharing agreement with National Oil Corp. (NOC) of Libya covering offshore Area 21.

NOC said ExxonMobil agreed to acquire 4,000 line-km of 2D seismic data and 2,000 sq km of 3D data under a $97 million work commitment. It also will fund training or scholarships during the exploration period and improve schools in Libya.

Area 21 encompasses four blocks covering a total of 2.5 million acres in the Sirte basin 110 miles offshore. It is adjacent to the east of Area 20, for which ExxonMobil also holds a production-sharing agreement (OGJ, Feb. 12, 2007, Newsletter).

USGS reports Permian basin oil, gas estimates

There is roughly 40.58 tcf of undiscovered natural gas, 1.02 billion bbl of natural gas liquids, and 1.26 billion bbl of oil in the Permian basin, the US Geological Survey said.

Most of the gas (about 35.38 tcf) and gas liquids (about 785 million bbl) is in unconventional formations in the Delaware and Midland basins, USGS said in a publication released on Mar. 1. “Given that few wells have produced from these assessment units, there is significant geological uncertainty in these estimates,” the agency said.

The remaining crude is more evenly divided between an estimated 747 million bbl of conventional resources and 510 million bbl from unconventional deposits, the report said.

The primary estimates were means of assessments using the total petroleum system concept which range from 5% to 95% probability. The study assessed the potential for technically recoverable resources in new field discoveries only and did not include field or reserve growth in conventional fields, USGS said.

Total to invest $2 billion on Anguille redevelopment

Total Gabon reported it will drill a dozen wells in Anguille field in Gabon under its redevelopment program and expects oil recovery to improve to 23% from 13%.

The redevelopment will cost $2 billion for additional proved and probable reserves of about 150 million bbl, with production peaking at more than 30,000 b/d in 2013-14.

The Total unit said production is expected to increase in 2008, with operating costs falling by refocusing operations onshore.

Under the first phase of redevelopment, associated surface facilities will be debottlenecked, and Total will increase the number of drainage points, in particular in the northern part of the field, and boost well productivity by hydraulic fracturing and massive waterfloods.

“Running from 2009 to 2011, Phase 2 entails installing new offshore infrastructure and decommissioning obsolete process units, building an onshore plant (power generation, fluid treatment, gas compression) and drilling an additional 30 or so wells,” Total added.

The Anguille redevelopment is an important project to eliminate wasteful gas flaring in the country by 2011, as well as coastal discharges of production water.

Anguille lies 20 km off Port-Gentil in 30 m of water in the Grand Anguille Marine concession, which is wholly owned by Total Gabon.

Discovered in 1962, Anguille came on stream in 1966 and produced 7,500 b/d in 2007 prior to redevelopment.

Eni, PDVSA to develop Orinoco belt block

Eni SPA will develop Junin Block 5 in Venezuela’s Orinoco oil belt under a strategic agreement with Venezuela’s energy ministry, and Petroleos de Venezuela SA.

The companies will form a joint venture to assess reserves and draw up a development program to initially produce 30,000 b/d and reach a long-term production plateau of 300,000 b/d. The 670 sq km block is in the state of Anzoategui, 550 km southeast of Caracas, with a resource estimated at over 2.5 billion boe.

Eni will make available to the venture proprietary slurry technology to convert heavy oils, bitumens, and asphaltenes into high-quality light products. It says the technology eliminates production of liquid and solid refinery residues.

PDVSA will have a 60% stake in the joint venture and Eni, 40%.

EOG makes Barnett shale oil discovery

EOG Resources Inc. announced an oil discovery in the Barnett shale region near Fort Worth, Tex., where EOG has drilled for natural gas since 2004.

During a Feb. 28 conference call, EOG executives told analysts they drilled and tested eight horizontal crude oil wells. EOG plans to develop its Barnett shale oil play north of gas-prolific Johnson County.

EOG is still delineating its oil discovery, and executives estimate possible crude oil reserve potential at 225-460 million boe net on its 250,000 net acres in Montague, Clay, and Archer counties.

Oil production from EOG’s holdings in the Barnett shale is forecast for 2009.

Drilling & Production - Quick TakesPemex to boost output in Cantarell field

Average output at Mexico’s Cantarell oil field will decline by as much as 20% this year as the field matures, a Petroleos Mexicanos executive reported.

Carlos Morales Gil, Pemex exploration and production director, said the state firm will reverse the decline when the company installs new production equipment at the field. The energy ministry has said investment in Cantarell would reach $5 billion this year.

Morales said output at Cantarell will range from 1.2-1.3 million b/d this year, compared with an average of 1.5 million in 2007.

According to figures published by the energy ministry, Cantarell’s output had already slipped to 1.27 million b/d in January, down some 230,000 b/d from the 1.6 million b/d in January 2007.

In fourth-quarter 2007 Pemex drilled five new development wells at Cantarell and repaired nine major wells and 10 smaller wells. During first-quarter 2008, the company plans to complete a nitrogen recovery unit in the field.

Despite Cantarell’s decline, Morales said the company will produce an average 3.1 million b/d this year, the same as in 2007, as other fields compensate for declines at Cantarell.

Morales acknowledged that the decline in Cantarell’s production is forcing Pemex to move into more difficult production zones on land and in deeper waters in the Gulf of Mexico.

Much of the company’s new drilling is at the Tertiary Gulf Oil project in the northern states of Veracruz and Puebla, where output rose to 41,000 b/d by yearend 2007. By 2015, Pemex hopes production in the region will rise to nearly 600,000 b/d following investments now pegged at $1.7 billion.

Pemex also hopes to boost output at Ku-Maloob-Zaap offshore field, in which seven new wells were completed and a new production platform installed by yearend 2007. Pemex also plans to begin construction of the Maloob C drilling platform in early 2008.

Yemen to raise oil production by 2010

Yemen plans to increase its oil production to 500,000 b/d by 2010 from the current 317,000 b/d, according to the country’s oil minister, Khaled Bahah.

“The current oil production decreased from 438,000 b/d in 2002 to 317,000 b/d in 2007,” he said, adding that his country is looking to increase production by selling new licenses as well as by improving output at existing sites.

According to the US Energy Information Administration, Yemen’s total oil production in 2006 was about 380,000 b/d, down from 400,000 b/d in 2005.

Citing Yemen’s Petroleum Exploration and Production Authority (PEPA), EIA said the decrease is due to declining production in Masila and Marib, the country’s two largest basins.

EIA’s Short-Term Energy Outlook currently projects oil production of 360,000 b/d for 2007 and 350,000 b/d in 2008.

Minister Bahah’s upbeat remarks coincided with statements by Austria’s OMV AG that it plans to drill new 40 oil wells by 2010 in Yemen’s S2 block (Al Uqlah) in the Armah district of Shabwa governorate.

OMV aims to increase its production to more than 30,000 b/d, said the firm’s in-country director during a meeting with Shabwa Gov. Mohammed Shamlan.

Last year, OMV AG announced that it began production of 1,000 b/d of oil from its Kharwah-1 well on Block S2 and that it plans to deliver 11,000 b/d of oil by 2008 (OGJ, Jan. 8, 2007, Newsletter).

Interest holders in Block S2 are OMV (Yemen Block S2) Exploration GMBH 44%, Sinopec International Petroleum Exploration & Production Corp. 37.5%, Yemen General Corp. for Oil & Gas 12.5%, and Yemen Resources Ltd. 6%.

EOG to start Horn River gas production

EOG Resources Inc. expects to begin natural gas production in June from British Columbia’s Horn River basin.

The Houston independent estimates initial production potential from the basin to be 3.5-5 MMcfd.

EOG has accumulated leaseholds on 140,000 net acres near British Columbia’s northern boundary. Production is expected to be ramped up significantly starting in 2010, EOG executives told analysts during a Feb. 27 conference call.

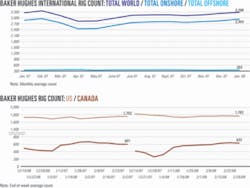

US drilling slips 8 units

US drilling activity slipped to 1,763 rotary rigs the week ended Feb. 29, 8 less than the previous week but up from 1,752 during the same period last year, said Baker Hughes Inc.

All of the latest loss was in land operations, down 13 units to 1,681 working. US offshore drilling increased by 4 to 59, including 58 in the Gulf of Mexico. Inland waters gained 1 rotary rig to 23.

Texas lost 7 rigs this week, down to 859 drilling. Alaska’s rig count dipped by 3 to 8. Colorado and Wyoming were down 2 rigs each to respective counts of 110 and 72. Oklahoma declined by 1 rig to 200, and Louisiana was unchanged with 144 rigs drilling. California’s rig count increased by 2 to 35 units. New Mexico was up 3 to 68.

Transportation - Quick TakesMexico’s CFE gets LNG bids for new terminal

Mexico’s Comision Federal de Electricidad said it has received bids from three consortia to receive, store, and regasify LNG at the new terminal at the Port of Manzanillo on the country’s Pacific Coast.

One bid was tendered by Energia Occidente de Mexico, a consortium of Canada’s TransCanada, Argentina’s Techint, and Belgium’s Tractebel.

The second bid was tendered by Terminal KMS de GNL, a consortium of Japan’s Mitsui and South Korea’s Samsung and Korea Gas Corp.

The third bid was filed by the consortium Controladora LNG Manzanillo, formed by Spain’s Iberdrola, Mexico’s ICA, and Japan’s Tokyo Gas and IHI.

After starting at 90 Mcfd in 2011, supply will be scaled up to 500 Mcfd by 2015 at increments of 180 Mcfd, 360 Mcfd, and 400 Mcfd. The gas from Manzanillo will feed the new 3 Gw capacity CFE intends to install in the region.

CFE, which will announce its decision on Mar. 10, awarded Repsol Comercializadora de Gas a 15-year, $15 billion contract in September 2007 to supply the Manzanillo terminal with Peruvian gas.

Inpex considers Darwin LNG landfall

Japanese company Inpex Australia is considering Darwin as an optional site for its proposed LNG plant, which will use gas feedstock from its Ichthys field in the Browse basin off Western Australia (OGJ Online, Feb. 2, 2007).

Inpex also is considering a larger plant for a Darwin operation, although it has not specified the precise size.

The company and partner Total SA have a preferred site on the Maret Islands off the Kimberley coast of Western Australia that calls for a two-train LNG plant for a total 7.6 million tonne/year output.

However, that site is facing increasing opposition from green groups and a drawn-out approvals process from Western Australian authorities.

In addition, Australia’s federal and state (Western Australia) governments are considering the sanction of just one common-user LNG hub on the Kimberley coast for all Browse basin gas fields.

Inpex said its original schedule to produce its first LNG shipments by 2012 will be delayed as the company reviews its project budget and development program.

The company recently signed a project facilitation agreement with Northern Territory under which the joint venture will take a considered look at the Middle Arm Peninsula near Darwin as a potential LNG site.

The NT government is keen to have the project and says the agreement ensures that a whole-of-government approach is taken to the development of Ichthys. This includes facilitating necessary environmental and planning approvals, provision of land at Middle Arm, and port access.

The company is now undertaking a range of technical and engineering studies to fully assess the Darwin option to compare it with the Maret proposal.

One difficulty is the length of pipeline required for a Northern Territory landfall.

An Ichthys-to-Darwin pipeline would be 850 km compared with an Ichthys-to-Maret line of 190 km.

Inpex has a 76% interest, and Total holds the remaining 24%.

Consultant forecasts tighter 2008 tanker market

McQuilling Services LLC expects a rebound in both tanker spot rates and time-charter revenues during 2008, with demand outpacing supply in most sectors. McQuilling’s annual Tanker Market Outlook doesn’t anticipate much growth in demand, but instead sees the market tightening due to accelerated exits from the fleet for conversion.

Beyond 2008, McQuilling expects the tanker market to weaken as surplus tonnage grows. Strength once anticipated post-2010, driven by the scheduled phase-out of single-hull vessels by that year, has disappeared on a combination of asset owners’ converting these vessels early and a 600,000 b/d softening in global oil demand growth for 2010 compared with last year’s projections.

McQuilling also anticipates double-digit tonnage supply increases in 2009.

For 2008, however, McQuilling expects demand for crude and dirty products tonnage to grow 1.2-4.1%, depending on the vessel sector, with 3.3% demand growth expected for very large crude carriers (VLCCs) in 2008 vs. no growth in 2007. VLCCs (265,000 dwt) operating on AG-Far East routes drew world-scale spot rates of 72 in 2007. McQuilling expects this level to continue on average through 2012, but with a 2008 spike up to WS 85. Other tanker segments will follow a similar spot-rate pattern, according to McQuilling.

For time-charter equivalent daily revenue, McQuilling expects VLCC’s, which earned $39,800/day in 2007, to peak this year at $51,400/day before slipping to an average of $38,300 through 2012. This stands in contrast, however, to McQuilling’s revenue forecast for the balance of the tanker market, which calls for a steady decline from 2007 through the end of the forecast period in 2012.

Suezmax (130,000 dwt) vessels operating between West Africa and the US Atlantic Coast, for example, earned $39,100/day in 2007 but are expected to earn $37,700/day this year and $31,000/day through 2012.