OGJ Newsletter

Demand rising for unconventional oil, gas

Wood Mackenzie Ltd., Edinburgh, estimates unconventional hydrocarbons resources of 3.6 trillion boe worldwide. Unconventional resources include heavy oil, tight gas, coalbed methane, oil sands, and shale oil. WoodMac sees them playing a key role in the future world oil and gas supply mix.

In its study, “Unconventional Hydrocarbons-The hidden opportunity,” WoodMac said anticipated tightening global oil supply and tightening regional gas supply intensify the demand for unconventional oil and gas.

Recent high commodity prices are driving future development of unconventional assets. Development so far has focused on Canadian oil sands and US unconventional gas. “In the future, we believe that we will see more global development of these unconventional hydrocarbons,” said WoodMac analyst Rhodri Thomas.

Heavy oil development is seen as being particularly competitive and likely to be successful if the technologies can be proved and can remain viable for the long term.

WoodMac said unconventional oil is expected to supply at least 20% of oil production by 2020 compared with less than 10% of total worldwide oil production today.

Unconventional gas, meanwhile is expected to make up 42% of US gas supply in 2010, up from 27% in 2005.

Canadian oil sands production is expected to quadruple from today’s level to 4 million b/d by 2020.

Meanwhile in the US, oil shale deposits in Utah, Wyoming, and Colorado are attracting renewed interest. Companies will need both technology and a thorough understanding of the subsurface, the study said.

WoodMac identified technical, fiscal, and environmental challenges before unconventional development can proceed. “As unconventional resources are distributed widely around the globe, the key risk is not discovering the resource, but in identifying areas where the critical factors are in place to enable economic development,” said Phaedra Powilanska-Burnell, WoodMac analyst.

Regional and country-specific factors must be taken into account, the study said. Independents traditionally dominated unconventional oil and gas plays in the US and Canada. But integrated companies are beginning to take larger stakes in such projects.

“With conventional non-OPEC supply expected to peak within the next decade and the difficulties in discovering accessible gas reserves, international oil companies with growth ambition cannot afford to ignore these unconventional resources,” Powilanska-Burnell said.

FERC: Offshore gathering authority limited

The US Federal Energy Regulatory Commission is dropping efforts to expand its jurisdiction over offshore natural gas gathering facilities. But it still intends to intervene if an interstate pipeline’s gathering affiliate uses market power to benefit the pipeline as it supplies transportation and sales services to producers.

A Feb. 15 policy statement responds to comments received after FERC launched a notice of inquiry in September 2005 at Shell Offshore Inc.’s request to consider reexamining offshore gathering system regulation criteria established in a 1994 proceeding involving Arkla Gathering Service Co. FERC had previously ruled in Shell Offshore’s favor in a complaint relating to Transcontinental Gas Pipe Line Corp.’s North Padre Island offshore gathering system in Texas, but a federal appeals court vacated the order in 2004.

“The commission has tried a number of times to assert jurisdiction over offshore gathering facilities to protect against undue preference and the exercise of monopoly power but has been repeatedly rebuffed by the courts,” FERC Chairman Joseph T. Kelliher observed. “We must accept the judgment of the courts. Under current law, offshore gathering is an unregulated monopoly. That will remain the case unless and until the law changes.”

Gathering systems beyond state waters are not regulated, but FERC has tried to establish its authority by arguing that a pipeline and gathering system should be treated as a single entity if the gathering system circumvents the commission’s regulation of the pipeline. The Natural Gas Act allows FERC to invoke its authority in such instances, the commission said. It said it also does not need to determine that concerted action between the pipeline and gathering affiliate necessarily occurred in those cases.

FERC also denied Shell Offshore’s request for a rehearing of its complaint and suggested that the producer take the matter up with the US Department of the Interior since it has regulatory jurisdiction over offshore gathering systems under the Outer Continental Shelf Lands Act.

Ecuador to rejoin OPEC in second quarter

Ecuador will rejoin the Organization of Petroleum Exporting Countries in the second quarter of this year, Energy Minister Alberto Acosta said.

Ecuador, South America’s fifth largest oil producer, quit OPEC in 1992. It exports about 70% of its oil production, which late last year was 516,000 b/d.

Acosta called Ecuador’s withdrawal from the group a “mistake” and said belonging to the organization would bring “numerous benefits such as controlling the price of crude.”

Angola joined OPEC Jan. 1. Sudan also is considering membership.

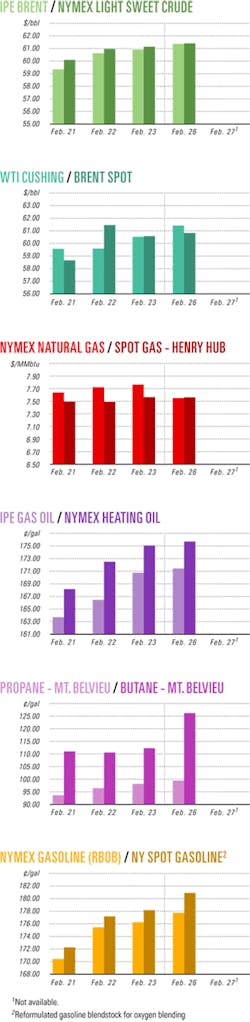

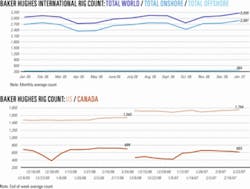

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesAramco makes oil discovery with Dirwazah well

Saudi Aramco reported an oil discovery in Saudi Arabia about 70 km southeast of Gawar field and 280 km south of Dharan field. The Dirwazah-1 well tested in the Unayzah reservoir at 15,310 ft.

The well flowed 3,915 b/d of oil with 11.9 MMscfd of gas at 4,466 psi wellhead pressure through a 32/64-in. choke.

Under normal production completion, the well is expected to flow at a higher rate. Aramco did not provide further details on the rate that might be expected.

Sherritt to shoot Cuba gulf blocks, export oil

Sherritt International Corp., Toronto, plans a $6 million 3D seismic survey on four Gulf of Mexico blocks off Cuba in the second quarter.

The company also plans to export part of its Cuban North Coast heavy crude this year for the first time.

Sherritt holds Blocks 15, 23, 24, and 33 north of the western part of the island.

The eastern part of Block 15 abuts the boundary with US waters along the US Minerals Management Service Rankin and Dry Tortugas planning areas (see map, OGJ, Dec. 11, 2000, p. 42).

Block 15 is 145 miles west-southwest of Key West, Fla., and 130 miles west of Cuban Block 27, where Repsol-YPF SA drilled Yamagua-1 in 2004 to TD 3,410 m in 1,660 m of water. The well found evidence of oil generation and an excellent carbonate complex (OGJ Online, Oct. 12, 2005).

Sherritt recently said it averages 30,000 b/d of oil production from mostly heavy oil fields along Cuba’s northern coast.

The company forecast 2007 capital expenditures in Cuba at $130 million, including eight wells on blocks in which Sherritt has 100% interest and 10 wells on Block 7, in which it has 45% interest. Four wells are to be exploratory or appraisal wells, and more appraisal wells may be required.

Gross working interest oil production could climb 5-10% from 2006 levels, and limited demand for the domestic heavy oil could allow exports, the company said.

Sherritt is appraising Majaguillar field, obtaining greater efficiencies at the Canasi water treatment plant, and improving recovery from other production activities. Majaguillar is expected to be declared commercial this year.

Deep South Louisiana, shelf prospects score

McMoRan Exploration Co., New Orleans, reported apparent discoveries at two deep Tertiary prospects in South Louisiana and the Gulf of Mexico shelf.

Logs at the Laphroaig exploratory well onshore in St. Mary Parish indicated a potential 56 net ft of hydrocarbon-bearing sands in a 75-ft gross interval. The well is drilled to 20,250 ft measured depth, 19,060 ft true vertical depth, and is near production infrastructure. Working interests are McMoRan 50%, Energy XXI (Bermuda) Ltd. 31.5%, and a private partner the rest.

The Hurricane Deep well, in 12 ft of water on South Marsh Island Block 217, is drilling below 20,600 ft TVD and projected to 21,500 ft.

“Logging while drilling tools have indicated that an exceptionally thick upper Gyro sand was encountered totaling 900 gross ft. The top of this Gyro sand is credited with a potential of 50 ft of net hydrocarbons in a 53-ft gross interval,” McMoRan said. “These exceptional sand thicknesses suggest that prospects in the Mound Point/JB Mountain/Hurricane/Blueberry Hill area may have thick sands as potential Gyro reservoirs,” it said.

Logs indicated that the well previously cut 27 net ft of hydrocarbon-bearing sands in a 200-ft gross interval in a laminated Rob L section and a potential 20 ft of hydrocarbon-bearing sands in a 70-ft Operc section. The well is near production facilities. McMoRan’s interest is 25%.

HI-31 find to produce from Pan Andean platform

Hunt Oil Co., Dallas, has made an oil and gas discovery on High Island Block 31, just 800 m from the borders of High Island Block 30, another shallow-water block in the Gulf of Mexico off Galveston, Tex.

Pan Andean Resources PLC is the operator and 63% interest owner of High Island Block 30.

Encouraged by the close proximity of Hunt Oil’s discovery, PanAndean said it will reassess the exploration potential of its block.

Pan Andean and Hunt Oil have agreed to tie in production from the discovery to Pan Andean’s platform on High Island 30. The agreement also allows Hunt Oil to become operator of the platform.

The agreement will improve the cash flow from Block 30 through a monthly production handling fee of $40,000 and will lower expected operating costs, extend the life of the platform by an expected 7 years, and improve prospectivity of the block, where little prospecting has been conducted in the past 3 decades.

Pan Andean said tying in the new discoveries and refitting the platform will take upwards of 6 weeks. In addition, ownership changes at High Island 24 have delayed refurbishment of the High Island 24 platform, which will pump the oil from High Island Blocks 30 and 31 to shore.

It is anticipated that all facilities will be on stream during the second quarter. Oil production from High Island 30 is expected to start at over 300 b/d.

Drilling & Production - Quick TakesSakhalin-1 hits first-phase production peak

Exxon Neftegas Ltd., operator of the Sakhalin-1 project off eastern Russia, has reached its targeted first-phase peak production rate of 250,000 b/d of oil.

The first phase of the Sakhalin-1 project includes the Chayvo field onshore processing facility and a 140-mile pipeline, which transports crude west across Sakhalin Island and the Tatar Strait to the DeKastri terminal in the Russian Far East.

The project’s natural gas production for the 2007 peak winter season has been 140 MMcfd and is being marketed to two domestic customers in the Khabarovsk Krai.

Consisting of three offshore fields-Chayvo, Odoptu, and Arkutun Dagi-the Sakhalin-1 project, over its life, will provide Russia with direct revenues of more than $50 billion. The Russian content of contracts awarded to date for the Sakhalin-1 project exceeds $3.6 billion.

The project’s future phases of development are expected to sustain export gas production from all three fields to 2050.

Petrobras eyes oil in Jordanian shales

Brazil’s state-owned Petroleo Brasilerio SA (Petrobras) signed a memorandum of understanding with Jordan’s Ministry of Energy and Mineral Resources to study the technical and economic viability of Petrobras’s patented Petrosix mining technology at the Attarat Umm Ghudran (AUG) oil shale deposit 50 miles south of Amman.

Petrobras international and downstream representatives will conduct the 24-month study, which covers 11 sq km Block AUG 21. Jordan’s Natural Resources Authority estimated that the block has a potential of 1.7 billion bbl of oil.

Cretaceous shales in the entire 348 sq km AUG deposit average 70 m thick with 45-62 m of overburden, a Jordanian report said.

Petrobras mines oil from Permian Irati shale using the Petrosix process at Sao Mateus do Sul in Parana State. Production averaged 4,200 b/d in 2006 (OGJ, June 12, 2006, p. 37). The Irati formation bituminous shales cover parts of Sao Paolo, Parana, Santa Catarina, Rio Grande do Sul, Mato Grosso, and Goias states.

As oil prices have remained relatively high in recent years, Jordan, Morocco, the US, and China have contacted Petrobras to discuss shale oil production partnerships, Petrobras said. Jordan has numerous shale deposits but no commercial shale oil production.

Processing - Quick TakesFire delays Porvoo refinery diesel line start-up

A small-scale fire Feb. 25 caused by a flange leak at Neste Oil Corp.’s Porvoo refinery in Finland will delay to mid-April the commissioning of the new diesel production line at the refinery. Start up of the more than €700 million diesel expansion was originally expected by yearend 2006, then was rescheduled to late March.

No other part of the refinery was affected in the incident. Neste said, “Personnel were not injured in the fire that caused damage primarily to some electric cables.” Neste said in 2003 it would expand diesel production by 1 million tonnes/year at the sophisticated 200,000 b/d refinery, and construction began in 2004.

Porvoo produces high quality, low-emission motor fuels from residue oil. Although the overall capacity of the refinery will remain the same, Neste said, the diesel production line will enable an increase in the refining of heavy oil or other crude into products such as sulfur-free diesel to meet strict European and North American environmental standards.

Marubeni plans biodiesel project in Brazil

Japan’s Marubeni Corp. and Dutch grain trader Agrenco Group jointly plan to start producing biodiesel fuel from soybean oil produced in Brazil beginning in 2008.

In a bid to tap growing demand amid heightened concerns over global warming, the joint venture partners-Agrenco 66.7% and Marubeni 33.3-plan to produce 400,000 tonnes/year of the alternative fuel. The JV, Agrenco Energia, will construct two mills for extracting oil from soybeans and three additional facilities to process the soybean oil into biofuel.

The bioenergy complexes are designed to produce pure B100 biodiesel, which the firms said can be used “in any vehicle without adaptation.” The biofuel, to be produced in compliance with European Community EN 14424 regulation, will first be sold in Brazil, which will require diesel fuel to contain 2% biodiesel starting in fiscal 2008.

Under a 10-year supply agreement signed by the two companies in 2005, Marubeni has priority sales rights for Agrenco’s products, including biodiesel, from South America to Japan and other Asian markets except China.

Pembroke refinery FCC unit to be revamped

Chevron Corp. has let an engineering, procurement, and construction management contract to AMEC PLC for a revamp of the 90,000 b/d FCC unit at its 210,000-b/cd refinery in Pembroke, Wales.

AMEC said the project will improve reliability of the unit’s main fractionator and improve product yields. The complex refinery produces about 3.5 million gal/day of gasoline.

Sabic mulls site change for China petchem plant

Saudi Basic Industries Corp. (Sabic) is growing impatient with Chinese delays concerning a planned $5.2 billion petrochemical plant for Dalian, Liaoning Province, and may seek another location, according to the company’s chairman.

Prince Saud bin Thunayan al-Saud said his state-owned firm had been in talks about the project with Sinopec and Dalian Shide for 3 years, and that the companies have been waiting 18 months for Chinese authorities-the National Development and Reform Commission-to approve the project.

“We hope this approval gets completed so that we can go ahead with our investment in the project,” Al-Saud said, adding that Sabic has alternatives in more than one country and that there are many other opportunities worldwide. However, he conceded that “there isn’t a specific alternative to China.”

He said, “We still believe the China market is promising and that the opportunity to invest in China is a good one,” adding that “there is no doubt any project or economic feasibility study depends on a certain timeframe.”

In October 2004 Sabic announced the 50-50 joint venture project that is to include a 1.3 million tonne/year ethylene plant and a 10 million tonne/year refinery. At the time Sabic hoped to see the facility online by 2010.

China, foreign partners to expand Fujian refinery

Subsidiaries of China Chemical & Petroleum Corp. (Sinopec), ExxonMobil Corp., and Saudi Aramco jointly signed two separate contracts for a related project to triple refining capacity at a Fujian Province refinery. The projects seek to meet China’s rapidly growing demand for petroleum and petrochemicals.

One contract is for the Fujian Refining & Ethylene Joint-Venture Project, which will increase the existing 80,000 b/d refinery in Quanzhou City to 240,000 b/d. The expanded refinery primarily will refine and process sour Saudi Arabian crude.

The project also will include construction of an 800,000 tonne/year ethylene steam cracker, an 800,000 tonne/year polyethylene unit, a 400,000 tonne/year polypropylene unit, and an aromatics complex to produce 700,000 tonnes/year of paraxylene. In addition, a 300,000-tonne crude berth and utilities, including cogeneration facilities of 280 Mw, also will be built.

Electricity generated by the cogeneration facilities will provide about 80% of the power requirement for the project, which is expected to start up in early 2009.

Interest in this project will be held by Fujian Petrochemical Co. Ltd. (a 50:50 Sinopec-Fujian government partnership) 50%, ExxonMobil China Petroleum & Petrochemical Co. Ltd. 25%, and Saudi Aramco Sino Co. Ltd. 25%.

The other contract is the Fujian Fuels Marketing Joint-Venture Project, which will market diesel and motor gasoline products produced by Fujian Refining & Ethylene Joint-Venture Project, as well as manage and operate about 750 service stations and a network of terminals in Fujian Province. It will be owned 55% by Sinopec, ExxonMobil 22.5%, and Saudi Aramco 22.5%.

Both JVs will be formed upon government approval.

Transportation - Quick TakesTwo Mississippi LNG projects get FERC nod

The US Federal Energy Regulatory Commission approved two LNG terminal projects in Mississippi that could add supplies totaling 3.1 bcfd of gas.

The terminals, which would adjoin each other, are the Bayou Casotte project, next to Chevron USA’s Pascagoula refinery, and the LNG Clean Energy project proposed by Gulf LNG Energy LLC. The first will deliver as much as 1.6 bcfd of regasified LNG to an interstate grid through five pipeline interconnections, while the second will send vaporized LNG through a new pipeline and a gas processing plant owned by BP America Inc.

“These are significant import projects, with a combined capacity nearly equal to the projected capacity of an Alaskan gas pipeline. More importantly, we find that these projects meet our high safety standards,” FERC Chairman Joseph T. Kelliher said in the commission’s Feb. 15 announcement.

FERC also authorized expansion of a 42-in. pipeline proposed by sponsors of the recently authorized Creole Trail LNG project 18.1 miles west in Cameron Parish, La., to intersect with the terminus of a pipeline system originating at another recently authorized LNG terminal at Sabine Pass. Both terminals and pipelines will be operated by Cheniere Energy of Houston.

The commission also approved Maritimes & Northeast Pipelines LLC’s application to expand capacity of its existing facilities by 418,000 dekatherms/day to 833,317 dekatherms/day to accommodate imports of regasified LNG from the Canaport LNG terminal in Canada.

It also approved Maritimes’ request to amend its Presidential Permit to allow the increased imported gas from Canada and to construct and operate an additional interconnection at the US-Canada border near Goldboro, NS. The proposed project will cost an estimated $321.3 million, FERC said.

Second Rockies Express pipeline segment online

Kinder Morgan Energy Partners Natural Gas Pipelines (KMP), operator of the proposed 1,663-mile Rockies Express Pipeline (REP) gas system, has initiated service on a 192-mile, 42-in. pipeline section from the Wamsutter Hub in Wyoming to Colorado’s Cheyenne Hub.

The pipeline is the second section completed on the Western leg of the $4.4 billion system. REP will transport as much as 1.8 bcfd of gas from prolific Wyoming and Colorado basins to upper Midwest and eastern US markets. The owners have received binding firm commitments from shippers for almost all of the pipeline’s capacity.

The first segment-136 miles of 36-in. pipeline from the Meeker Hub in Colorado to the Wamsutter Hub-began interim service in February 2006. Capacity on the combined 328-mile first two segments is 500 MMcfd. That capacity will increase to as much as 750 MMcfd when the Enterprise Gas Processing LLC plant at Meeker goes into service later this year.

KMP Pres. Scott Parker said he expects to receive Federal Energy Regulatory Commission approval this spring for the final 713-mile, 42-in. western leg of REP from Weld County, Colo., to Audrain County, Mo. Construction is expected to begin shortly thereafter and, subject to regulatory approvals, REP-West will be in service in December.

REP-East, a 622-mile segment from eastern Missouri to the Clarington Hub in Ohio is expected to be in interim service as early as Jan. 1, 2009, and fully completed by June 2009.

Nigeria misses gas supply deadlines to Ghana

Nigeria has delayed supplying gas to Ghana through its $560 million West African Gas Pipeline because of militants’ vandalism on infrastructure in the Niger Delta.

According to local reports, Ghana-one of the customers of the 678-km WAGP system-has constructed its section of the line and other facilities and expected to receive gas in March. Ghana is expected to take 122 MMcfd of gas.

Nigeria is evaluating the status of the pipeline with the shareholders in West African Gas Pipeline Co. (WAGPCo), which is managing the project.

Project leader Chevron Corp. said WAGPCo is aiming for first gas deliveries in the second quarter.

Nigeria’s Energy Minister Edmund Daukoru said the 470 MMcfd pipeline should have been completed in December, 18 months after the final investment decision was taken by the shareholders.

Gas through the WAGPCo system will be used for electric power generation and industrial development in Ghana, Togo, and Benin.