OGJ Newsletter

GOM ‘top deepwater hunting grounds’ in 2006

Exploration in the deepwater Gulf of Mexico marked an exceptionally successful year during 2006, consultancy Wood Mackenzie Ltd. said in a recent report entitled “Treasures of the Deep: A Review of 2006 Exploration.”

Zoe Sutherland, WoodMac gulf analyst, called the gulf “one of the top deepwater hunting grounds in the world.” She told OGJ in a telephone interview from her Edinburgh office that she believes 2007 will hold similar potential to the 2006 discoveries. “The rate of exploration activity will stay the same.”

Sutherland said WoodMac’s own early reserves estimates for 2006 discoveries suggest 1.5 billion boe proved and probable reserves in the region. The actual reserves numbers, yet to be booked by the companies, could prove to be smaller, WoodMac noted.

Over the last 10 years, oil and gas reserves found in the deepwater gulf averaged 1.2 billion boe/year. Both 2004 and 2005 marked deepwater reserves additions of less than 1 billion boe.

During 2006, highlights included discoveries by BP PLC at Kaskida and Hess Corp. at Pony. Together these two fields account for more than half of the reserves found in the region last year.

BP E&P Inc. discovered oil with the Kaskida well on Keathley Canyon Block 292. Kaskida encountered 800 net ft of hydrocarbon pay in Lower Tertiary sands. Interests are BP 55%, Anadarko Petroleum Corp. 25%, and Devon Energy Corp. 20% (OGJ Online, Aug. 31, 2006).

Hess said wireline logs of its deepwater Pony prospect on Green Canyon Block 468 indicate 475 ft of oil-saturated sandstones in Miocene age reservoirs. Hess drilled the well to 32,448 ft TD (OGJ, July 24, 2006, Newsletter).

WoodMac noted the number of wells drilled in 2006 increased marginally compared with 2005, while the number of drilling days increased by nearly 30%. Deeper, more complex deepwater exploration led to an average drill time of more than 100 days.

Undoubtedly spurred by successful Lower Tertiary wells in remote areas of the gulf, operators extended their search for the play into waters closer to shore, WoodMac said. BP drilled its Tamara prospect in Garden Banks, north of Keathley Canyon, and Hess spudded a well at Jack Hays in Port Isabel, the most westerly test of the play so far.

Trial begins for 1999 Erika oil spill

Seven years after the Erika oil tanker spill off Brittany’s Penmarc’h point, which polluted 400 km of France’s Brittany coastline, 15 accused are facing a trial that began Feb. 12 and is due to last until June 13. It is expected to cost €600,000 (OGJ, Feb. 13, 2006, Newsletter).

There are 70 parties involved in the case ranging from local Brittany administrations and associations to Italian and Greek ship owners and environmental activists and associations clamoring for more-drastic maritime security and transparency.

Total SA is the focus of the trial because the company chartered the vessel, which was carrying 30,884 tonnes of heavy fuel oil and broke in two during a storm, releasing 20,000 tonnes of fuel. Total was indicted Nov. 7, 2001.

Total already has spent €200 million to pump out the fuel in the wreck, to treat 220,000 tonnes of polluted sand, and to clean up the coast.

Victims of the spill have obtained €118 million from the Oil Pollution Compensation Fund and should receive an additional €40 million when all claims have been dealt with. But damages claimed amount to practically €1 billion.

The trial also will bring to light the complexities and shortcomings of maritime transport embroiled in the mix of insurers, ship owners and charterers, convenience flags, negligent certification companies, and poor managers.

Although certified seaworthy, the 25-year-old tanker had changed its name and owner eight times, its classification company four times, and its flag three times, and had been poorly patched and maintained. The Erika, together with the Prestige off Spain 2 years later, was instrumental in inducing the European Union to establish stricter rules for tanker age and construction.

It is hoped that the trial will work out the responsibilities of each accused at every stage of the Erika saga.

Ecuador threatens environmental squeeze

Ecuador President Rafael Correa, who was sworn in last January and is a close ally of Venezuelan President Hugo Chavez, said he might cancel contracts of foreign oil companies that harm the environment.

Analysts see that as a threat to a Petroleo Brasileiro SA (Petrobras) block in one of the largest ecological reserves in the world, Park Yasuni.

Petrobras in 2004 won a license to explore Block 31, part of which is in a reserve considered one of the world’s most biologically diverse areas and home to primitive tribes.

Petrobras officials were not immediately available for comment, but the company has said it is using modern technology to avoid damaging the park.

The Brazilian company has insisted that the project, in which Teikoku is a partner, will affect only 100 hectares of the Yasuni reserve, which borders Peru.

The Ecuadorian economy got a $1.1 billion boost from the confiscation of Occidental Petroleum Corp.’s Block 15 in May 2006 and a new hydrocarbon tax, which together bumped up the country’s total 2006 oil revenue to about $3.8 billion, say local analysts (OGJ, May 22, 2006, Newsletter).

The government’s threat fits a pattern that some observers fear will spread following the Russian government’s success in taking majority control of the Sakhalin-2 project after challenging the project on environmental grounds (OGJ, Jan. 15, 2007, p. 34).

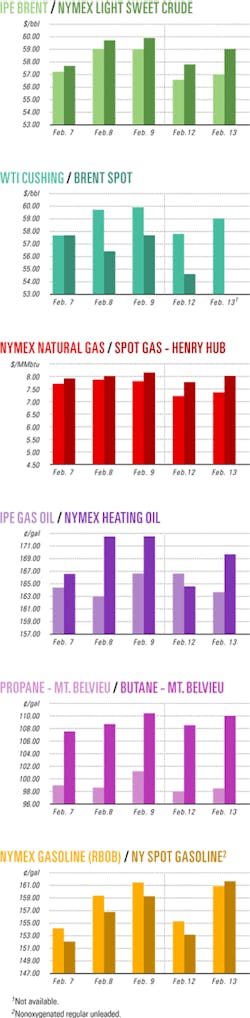

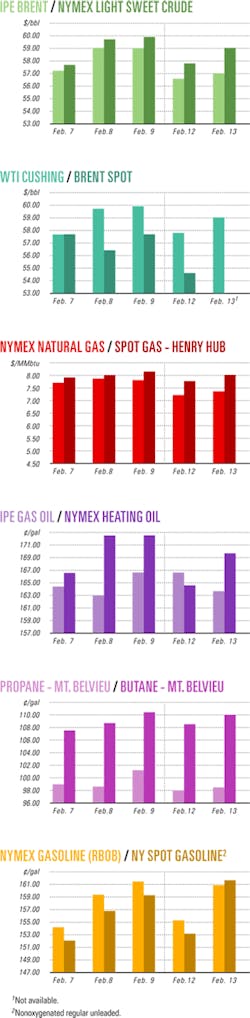

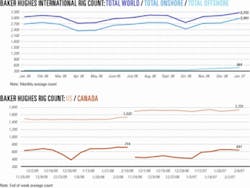

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesTotal makes two oil finds on Angola’s Block 32

Total SA reported making two oil discoveries on deepwater Block 32 off Angola.

The Manjericão-1 well tested more than 5,000 b/d of oil from Oligocene oil-bearing reservoirs. This discovery is 38 km northwest of the Gengibre-1 discovery made in 2004. Total said the discovery shows “there is additional resource potential in the previously unexplored central area” of the block. The well was drilled in 1,977 m of water in the central part of Block 32.

The second well, Caril-1, produced 6,300 b/d of light oil from a selected interval in Oligocene oil-bearing reservoirs. It was drilled in 1,673 m of water in the northeastern part of Block 32, about 18 km north-northwest of the Gindungo-1, and 7 km west-southwest of Cola-1, discoveries that were made in 2003 and 2004, respectively.

Total said technical studies are being carried out to fully evaluate these drilling results, and further exploration drilling is under way across the block.

Total holds a 30% interest in Block 32 and serves as operator. Other partners in Block 32 are Marathon Oil Co. 30%, Sonangol EP 20%, Esso E&P Angola (Overseas) Ltd. 15%, and Petrogal 5%.

Appraisal well extends Syrah field in Egypt

Apache Corp., Houston, said its Syrah 5X appraisal well in Egypt’s Western Desert tested 47.6 MMcfd of gas from the Jurassic Lower Safa sand, extending Syrah field to the northwest.

The Syrah 5X well targeted the lower 50 ft of Lower Safa pay. The well flowed from perforations at 14,210-60 ft through a 1-in. choke with 2,599 psi flowing wellhead pressure.

Syrah field, which lies on the Khalda Concession, is slated to begin production in third quarter 2008, following completion of continuing infrastructure expansion in the greater Khalda area.

The field lies 4 miles north of Qasr field, Apache’s largest discovery, which is currently producing 340 MMcfd of gas and 15,800 b/d of condensate from the Lower Safa sand.

Qasr was discovered in 2003 and contains proved reserves of 2.1 tcf of gas and 64.5 million bbl of condensate. This field also is producing 11,800 b/d of oil from the Cretaceous Alem el Bueib (AEB), a shallower formation overlying the deeper Lower Safa.

In March 2005, the Syrah 1X discovery well tested 46.5 MMcfd from a correlative zone. The success of Syrah field, along with newly acquired 3D seismic data, create the potential for further exploration on Apache’s acreage to the north in the Matruh Concession, where five Jurassic-AEB exploratory tests are planned this year.

Apache said it is evaluating the Jurassic-AEB potential in the 4 miles between Syrah and Qasr fields.

Apache operates Khalda with a 100% contractor interest.

Colombia gets two-zone Upper Magdalena find

The Hocol subsidiary of Maurel & Prom, Paris, reported a two-zone oil discovery at its La Canada Norte-1 ST well on the San Jacinto/Rio Paez Permit in Colombia’s Upper Magdalena basin.

The well, 250 km southwest of Bogota, stopped at TD 1,006 m after encountering six zones that contained oil in the Cretaceous Monserrate and Caballos formations. Combined output of the three Caballos intervals was 700 b/d of 33-34° gravity oil. Monserrate flowed 200 b/d of 17-18° gravity oil after frac.

The LCN-1 well, near La Hocha (Monserrate) oil field 100 km southwest of Neiva, identified proved and probable reserves of 41 million bbl, Maurel & Prom said.

Permit holders are Hocol, operator with 36.67% interest, Cepsa of Spain 33.33%, and Petrobras 30%.

Maurel & Prom produced 5.2 million b/d in Colombia in 2006. It acquired the Hocol assets from Knightsbridge Petroleum in mid-2005 (OGJ Online, Nov. 4, 2004).

La Hocha field, discovered in 2001, went on production in January 2003 and is still being developed.

Lukoil makes find on Condor block in Colombia

OAO Lukoil affiliate Lukoil Overseas Colombia Ltd. made an oil discovery at the Medina structure on the Condor exploration block in Colombia. The block covers 3,089 sq km in the western Llanos oil basin and is one of Colombia’s largest exploration blocks.

The find marks Lukoil’s first hydrocarbon discovery in the Western Hemisphere, the company said. There was no report from the company regarding flow rates or the oil’s properties.

Lukoil Overseas operates the project with 70% interest, while Colombia’s Ecopetrol National Oil Co. holds 30%.

Anadarko chases Garden Banks subsalt Miocene

Having drilled three noncommercial ultradeep wildcats in the eastern Garden Banks area of the Gulf of Mexico, Anadarko Petroleum Corp. said it will continue to pursue its Trade Winds play.

The company said it remains encouraged with the geological concepts the wells were designed to test and that the area is still underexplored for subsalt Miocene-age objectives.

Anadarko drilled to measured total depth of 32,500 ft at the Grand Cayman prospect on Garden Banks Block 561, the program’s first prospect. The company plugged the well, two blocks east of Oregano oil field. Anadarko had 35% working interest. Participants were Plains Exploration & Production Co. 30%, Statoil ASA 25%, and Newfield Exploration Co. 10%.

The Andros Deep well on Block 342 north of Llano oil field went to MTD 31,800 ft and was plugged. Anadarko and Hess Corp. each held 50%.

The Norman well on Block 434 east-southeast of Llano field went to MTD 27,700 ft and was plugged. Anadarko operated with 41.25% interest. Participating were Norsk Hydro AS with 22.5%, Plains E&P 15%, Hess 16.25%, and Callon Petroleum Co. 5%.

Anadarko said it is incorporating data from the wells into its seismic modeling and is using the latest seismic imaging technology to identify potential targets below and next to complex salt bodies.

Key farms in to Nyuni East Songo Songo license

Aminex PLC has farmed out a 20% interest in its Nyuni East Songo Songo license off Tanzania to Key Petroleum Ltd.

In exchange Key will fund 30% of the costs for the two exploration wells on Nyuni, one will be spudded in the second quarter and the other will be drilled later in the year. Key also will contribute 10% of all license costs, which are estimated at $2.5 million and have been backdated to Nov. 1, 2006.

If the combined cost of the two proposed wells at Nyuni should exceed $15.4 million, then Key will only be obliged to pay 20% of the excess cost over this amount, the company said.

Aminex and its partners have shot extensive new seismic surveys over shallow reefs and islands and are close to finalizing the location for the first Nyuni well in the current program.

Partners in Nyuni are Aminex 84%, Bounty Oil 6%, and East Africa Exploration Ltd. 10%. Discussions are continuing with Pan-African Tanzania Ltd., a subsidiary of East Coast Energy Ltd., to participate in Nyuni.

Drilling & Production - Quick TakesStatoil starts Gullfaks fields oil production

Statoil ASA has begun oil production from its Skinfaks field and has implemented improved recovery techniques to boost oil output from Rimfaks field. Both lie in the Gullfaks license in the Tampen area of the Norwegian North Sea.

The fields are expected to make up 12% of Gullfaks license production when all wells go on production this fall. Gullfaks produced 130,000 b/d during third quarter 2006.

A Statoil spokesman told OGJ that four of the horizontal wells were completed using the downhole instrumentation and control system (DIACS) to enhance oil recovery at Rimfaks. Rimfaks production before the IOR project was about 17,000 b/d of oil and condensate, he said. DIACS increases oil production from existing wells by monitoring downhole physical properties and correcting them remotely if the conditions are unfavorable.

Rimfaks production was improved by tying back several wells to the Gullfaks C platform. The field was developed in June 2000 as a satellite, with the wellstream tied back to the Gullfaks A platform.

Skinfaks, which was proved in 2002, comprises several smaller structures from the Brent group geological formation. It was developed with a subsea production system tied in to existing christmas trees on Gullfaks South satellite field. Both projects cost $535.8 million to develop, and recoverable reserves are estimated at 62 million boe for Skinfaks and the IOR part of Rimfaks. The recovery ratio for Rimfaks will increase by 36-47% with Skinfaks-Rimfaks IOR.

ADGAS taps Technip for turnkey job

Abu Dhabi Gas Liquefaction Ltd. has awarded a $610 million lump sum turnkey contract to Technip, Paris, to engineer and install gas compressor stations and associated facilities at Das Island in the UAE. Technip’s operations and engineering center in Abu Dhabi will execute the contract. Completion is scheduled for fourth quarter 2009.

The plant’s facilities, which include compressor and booster stations and fuel gas treatment and gas dehydration units, will treat 211 MMscfd of associated gas produced by fields off Abu Dhabi.

Technip said the project would be configured predominately in large-scale process system modules and interconnecting racks that will be manufactured and assembled at construction yards before being transported and erected at Das Island.

Norne FPSO to be upgraded for Alve gas project

Aker Kvaerner will modify the topsides of the Norne floating production, storage, and offloading unit under a $62.3 million contract so that additional fields can be tied back to Statoil’s Alve gas-condensate field in the Norwegian Sea (OGJ, Jan. 22, 2007, Newsletter).

Design and procurement work has started, subject to a letter of intent received Jan. 5, and prefabrication of steel and piping will start in August. The engineering, procurement, construction, and installation contract will be completed in March 2009.

Alve gas field will be phased in with existing infrastructure on the Statoil-operated Norne field. Alve will produce 4 million cu m/day of gas when it begins production in December 2008.

During the first quarter, Statoil plans to award Alve contracts for subsea production equipment, flexible risers, cables for pipeline heating, marine installations, and pipeline laying. “All contracts are pending Norwegian Ministry of Petroleum and Energy approval of the Alve plan for development and operation,” Statoil said.

Alve field was proved in 1990 and is a smaller-scale gas and condensate find in production license 159B, around 15 km southwest of Norne field. The find comprises the Garn, Not, Ile, and Tilje formations. Proved gas reserves of 6.8 billion cu m and 8.3 million bbl of condensate lie in the Garn and Not formations.

Processing - Quick TakesPetrovietnam gets funding for Dung Quat refinery

The Vietnam Development Bank has awarded a credit of $1 billion to Vietnam’s state-owned Petrovietnam to finance construction of the country’s first oil refinery at Dung Quat.

Petrovietnam General Director Tran Ngoc Canh said the loan would be used mainly to pay the consortium carrying out the refinery’s engineering, procurement, and construction (EPC) work. In 2005, Petrovietnam reported that major work contracts were in place for constructing the 140,000 b/d refinery (OGJ Online, Aug 25, 2005).

It was reported that Technip engineering centers in Paris and Kuala Lumpur would carry out the EPC contract, while Japan’s JGC and Spain’s Tecnicas Reunidas would build the crude oil and product tanks, oil pipelines, and an offshore oil delivery system. The Dung Quat refinery, scheduled for completion in 2009, is under construction in the Binh Son District of the central province of Quang Ngai.

On completion, it will process 6.5 million tonnes/year of crude oil to meet about one third of the country’s requirements for gasoline, diesel fuel, fuel oil, liquefied petroleum gas, and kerosine.

China approves second Ningbo refinery complex

China has agreed in principal to the construction of a $10 billion refinery and ethylene complex in the port city of Ningbo by a joint venture of Formosa Plastics Group, Taipei, and China Petroleum & Chemical Corp.

Described as the largest-ever foreign investment project on the Chinese mainland, the proposed facility, subject to approval by China’s State Council, will have a capacity of 1.2 million tonnes/year of ethylene and 10 million tonnes/year of oil.

Chinese government officials earlier had blocked the proposed facility, saying it could conflict with another refinery project in nearby Zhenhai (OGJ Online, July 19, 2006). However, the officials approved the Ningbo project after learning it will target sales in Taiwan.

Mitsui, Sipchem plan Jubail petchem plant

Mitsui & Co. is considering a joint venture with Saudi International Petrochemical Co. (Sipchem) to construct a petrochemicals plant in Jubail, on the east coast of Saudi Arabia.

With an estimated cost of $7-8 billion, the 1-1.3 million tonne/year plant would use natural gas produced by Saudi Aramco to manufacture ethylene and basic materials for plastics in 2011.

Reports say the Saudi facility is designed to produce 18 types of petrochemicals, including commodity plastics polyethylene and polypropylene and methyl methacrylate.

Sipchem also is said to have called on several other corporations, including DuPont and Lucite International Ltd., to participate in the project, and negotiations are now in the final stages.

The entire project will likely be split into several parts, with Mitsui assisting in the production of PE and PP. Reports say the Japanese firm is expected to sign a general agreement as early as this month.

KBR technology chosen for China propylene plant

Kellogg Brown & Root has been awarded a basic design engineering package for a 200,000 tonne/year nominal capacity propylene plant, to be built at an existing industrial site in Jilin City, China. Jilin Chemical (JiHua) Group Corp., a subsidiary of China National Petroleum Corp., will own and operate the production facility, for which detailed engineering has been awarded to China Petroleum Engineering Co., Northeast Branch Co.

The plant will use KBR’s Sperflex technology, a fluidized catalytic cracking process that converts low-value refinery and ethylene plant streams with a high degree of selectivity to propylene, ethylene, and high-octane gasoline.

The unit will be the second of its kind in the world and the first commercial Superflex unit in the Asia-Pacific region, KBR said. The first commercial unit is currently in the start-up phase for Sasol Ltd. in South Africa.

Transportation - Quick TakesESPO phase 2 on track to complete in 2012

Russia may be able to complete construction of the second phase of the Eastern Siberia-Pacific Ocean (ESPO) pipeline to coincide with plans of the Asia-Pacific Economic Cooperation organization for a summit to be held in Vladivostok in 2012.

Russian oil pipeline operator OAO Transneft is building the 4,000-km ESPO line with the aim of exporting Russian crude to countries in the Asia-Pacific region.

“We may be able to meet the APEC forum with the ESPO fully completed,” said Russia’s Industry and Energy Minister Victor Khristenko, who praised the speed at which the project is being implemented.

“The first phase of the ESPO [project] will be completed before the end of 2008,” said Khristenko, saying the pipeline will reach Skovorodino by then and that there will be an export terminal on the Pacific coast at Kazmino. If necessary, he said, a rail line could be constructed to transport the crude to Kazmino from Skovorodino while the second phase of pipeline construction takes place.

In the first phase, the pipeline system will have capacity to carry 30 million tonnes/year of oil from Taishet to Skovorodino, with the proposed rail system to link Skovorodino with the port terminal at Kozmino.

Khristenko said progress made by Rosneft and Surgutneftegas in constructing the line warrants optimism and that there is no doubt that the first section of the pipe will be filled.

Trinidad and Tobago studying fifth LNG train

Trinidad and Tobago reported it is to begin a prefeasibility study into the construction of a fifth LNG train at its liquefaction plant at Point Fortin, Trinidad.

The Caribbean island’s Minister of Energy Lenny Saith told the South Trinidad Petroleum Conference that the study would be concluded by yearend.

“We have already signaled our intention to consider another LNG train. Train X,” Saith said. “Now that we have satisfied the domestic demand, we are about to undertake the first concrete steps towards the realization of that objective with a prefeasibility study which we expect to conclude by December 2007.”

Trinidad and Tobago has four LNG trains and is the largest exporter of LNG to the US, accounting for almost 70% of US imports.

Saith said if the plant is constructed, the government would be taking a larger share in it and had agreed to work with its partners, BP PLC, BG Group, and Repsol YPF SA towards getting equity in regasification facilities in the US as well as shipping and marketing.