Shell, Repsol may face probe over S. Pars deal

Repsol YFP SA and Royal Dutch Shell PLC may come under investigation by US authorities for an agreement the companies signed with National Iranian Oil Co.

“If there’s an investment greater than a certain amount, as specified in US law, then our lawyers take a look at it and the policymakers take a look at it, and see if there’s any further steps that we, as a government, take,” said US Department of State spokesman Sean McCormack.

On Jan. 30, Iran reported the completion of a preliminary $10 billion deal with Repsol YPF and Shell to produce 16 million tonnes/year of LNG from Iran’s South Pars field (OGJ Online, Jan. 30, 2007). Shell and Repsol YPF would each have 25% of the project, with NIOC holding 50%.

McCormack did not discuss any sanctions Repsol YPF and Shell might face if they went through with their agreement, but he suggested that a final decision on whether to proceed is expected in first quarter 2008.

Kurds say Iraq draft oil law not yet finalized

Kurdish officials have dismissed the idea that Iraq’s main political factions have overcome their differences on a draft oil law and said a final agreement could be some time away.

The Kurdistan Regional Government (KRG) issued a statement saying the draft law has not been unanimously finalized and that statements to the contrary-attributed to an oil ministry spokesman-were inaccurate and misleading.

KRG attributed the remarks to a Jan. 17 article published by Reuters news service that quoted the ministry spokesman as saying, “The committee finalized the draft of the law last night [Jan. 16]. It was approved unanimously, and it will go before the cabinet early next week.”

The Kurdish group acknowledged that the process of drafting the oil law is nearing completion but said important annexes to the law are still pending and that three associated laws must be drafted and approved before the whole package can be considered final.

KRG identified the additional laws as the revenue-sharing law, the Iraq National Oil Co. charter law, and a law to define the oil ministry’s new role.

Under the draft law, KRG would be allowed to negotiate and sign new contracts within its region and to receive its share of Iraq’s oil revenue, to be guaranteed and regulated by law.

The draft law also acknowledges that KRG is the competent authority to review its own previous contracts and make them consistent with the law.

KRG’s announcement coincided with reports that South Korea will send a joint business-government delegation to Kurdistan to discuss future oil field developments.

The South Korean Ministry of Commerce, Industry, and Energy announced the trip, saying the delegation plans to meet with KRG’s head and the minister of natural resources.

A ministry spokesman said the team is expected to review future oil field development endeavors and security conditions in the region.

Officials from the Ministry of Commerce, Industry, and Energy, the Ministry of Foreign Affairs and Trade, Korea National Oil Corp., GS-Caltex Corp., and SK Corp. will be in the 14-person delegation to Kurdistan Jan. 22-25.

Japan’s Middle East oil imports fell 1% in 2006

Japanese imports of Middle East crude fell in 2006, dropping by 1% from 2005, when they represented 90.2% of the country’s consumption.

The decline is attributed to efforts of government officials and domestic oil distributors that are eyeing new supply sources outside the Middle East, including Angola, Sudan, Russia, Azerbaijan, and Central Asia.

Nippon Oil Corp. and five other companies began sourcing supplies from the Sakhalin-1 oil and natural gas development project in Russia, while Idemitsu Kosan Co. recently signed an agreement to purchase crude oil from Azerbaijan.

In Angola, Japanese firms hold stakes in 13 different concessions, while in Sudan, reports say Japanese agencies have been negotiating for rights to oil concessions in the southern region of the country since 2005.

Last August, former Prime Minister Junichiro Koizumi took a 4-day trip to Kazakhstan and Uzbekistan with the aim of securing energy resources and boosting his country’s presence in the two oil-producing Central Asian countries.

Russia, Algeria agree to energy cooperation

State oil firm Sonatrach is interested in exploring four Russian gas fields after discussing energy cooperation with representatives from OAO Gazprom in Algeria Jan 21.

According to Russian reports, Russia’s Industry and Energy Minister Viktor Khristenko said that under an energy cooperation agreement signed last August, Gazprom had offered Sonatrach a variety of exploration rights for eight hydrocarbon fields. Khristenko said, “Gazprom has made its offer of assets exchange. Algeria has selected four fields and is working out its offers.”

Algeria, in turn, is preparing a number of asset proposals for Gazprom to evaluate in an asset swap.

Russia and Algeria signed another energy cooperation accord Jan. 21 that will cover the entire petroleum chain from exploration to marketing. The reports added that Russia’s OAO Rosneft and the country’s pipeline firm Stroytransgaz plan to invest $1.3 billion in Algerian oil production.

Rosneft and Stroytransgaz are joint partners with a 60% stake in Block 245 South exploration project in Algeria; Sonatrach has the other 40%. The Russian companies plan to apply for a production license for two fields that have reserves of 26.8 million bbl.

The European Union has expressed concern about a closer partnership between Russia and Algeria, as they are the biggest gas suppliers to the EU. Senior officials from both countries sought to reassure the EU that there was no need for alarm. “Russia and Algeria are reliable suppliers of energy,” Khristenko said in the state-run Algerie Presse Service.

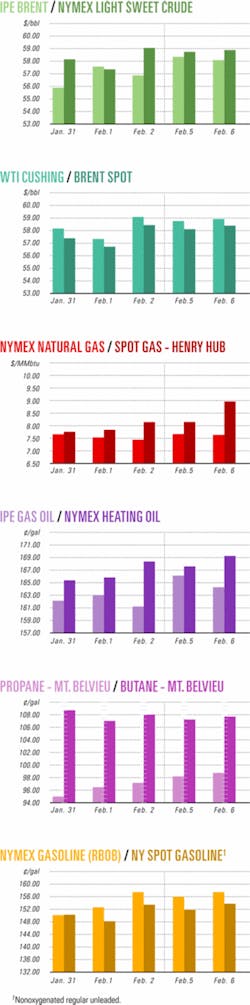

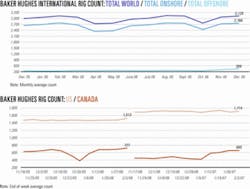

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesExxonMobil to start exploration in Sirte basin

ExxonMobil Corp., under an exploration and production-sharing agreement with Libya’s National Oil Co., will carry out exploration over four blocks in the Sirte basin, 100 miles off Libya.

The blocks are in Contract Area 20, which covers 2.5 million acres and was awarded to ExxonMobil in the third round of EPSA-IV licensing in December. The contract area lies in 4,000-6,500 ft of water.

ExxonMobil said it has completed an environmental impact assessment and has met with local stakeholders. The company also is shooting a 2D seismic survey in Contract Area 44 in the Cyrenaica basin off Libya.

Murphy has Sabah deepwater gas discovery

Murphy Oil Corp. said its Rotan-1 deepwater exploration well off Sabah, Malaysia, “encountered significant natural gas pay” in a single zone.

It is the company’s first discovery in four exploration wells on the block (OGJ, Dec. 11, 2006, p. 15).

Subsurface details were scant, but the well went to TD 7,024 ft in 3,773 ft of water 80 km from shore and 50 km from the nearest producing field to the southeast. Petronas operates that field.

The well encountered sweet, dry gas, Murphy said. It gave no specific appraisal plan or timing but said a rig could return before the end of 2007.

Block H interests are Murphy 80% and Petronas 20%.

NE British Columbia find has gas in two zones

Wyn Developments Inc., Vancouver, BC, participated in a Mississippian Debolt gas discovery at Prophet River 75 miles south of Fort Nelson, BC.

The Prophet River d-60-E/94-G-15 exploratory well, operated by EnCana Corp., flowed gas at an initial unstabilized rate of up to 7.943 MMcfd from 4,440 ft. The wellsite is 11 miles northwest of Tommy Lakes Halfway gas field.

Pressures and gas returns, coupled with known seismic and geological data, suggest likely communication with wells drilled by other operators 5 km southeast and 24 km south, Wyn Developments said. Seismic data also suggest that the gas reservoir extends to the northwest.

The d-60-E well also encountered 75 ft of prospective pay in the Triassic Halfway formation at 1,870 ft. The gas shows, log analysis, and seismic data suggest that the Halfway formation extends northwest and also 7 km southeast to the c-97-D well that tested gas. Approximate TD is 8,530 ft.

The company sees the potential of seven more Mississippian and seven more Triassic Halfway development wells on 21 sq miles of Prophet River lands. Potential exists to dually produce from the zones.

If a summer development program is successful, production facilities could be in place in early 2008.

UK awards 150 licenses in 24th licensing round

The UK’s Department for Trade and Industry (DTI) has named Maersk Oil North Sea UK Ltd., EnCore Oil PLC, and Ithaca Energy recipients of exploration and production licenses in the UK North Sea under the nation’s 24th licensing round.

DTI had invited 104 companies, 17 of which are new to the UK continental shelf, to develop 246 blocks-continuing the record number of licences issued last year. DTI awarded 150 exploration and production licenses to the winners.

EnCore won 7 licenses covering 12 blocks and part blocks in the Central North Sea, East Irish Sea, Northern North Sea, and Southern North Sea. It expects to operate three of the licenses.

On Blocks 28/9 and 28/10b (split), the operator, Oilexco North Sea Ltd. will drill a well within 12 months, paying a small part of EnCore’s well costs. EnCore will operate Block 14/30a and could drill a well, depending on what it learns from the nearby 14/30a-2 heavy oil discovery. On Blocks 113/29c and 113/30, Nautical Petroleum PLC and EnCore have a “drill or drop” option on a sizable offshore prospect that could be drilled from an onshore location.

Ithaca Energy secured 7 blocks, including Blocks 14/17(part) and 14/18c, which are adjacent to its Athena project in the Outer Moray Firth area. Block 14/18c contains a satellite discovery previously made by well 14/18-1, Athena East (formerly known as Bordeaux) that tested 1,250 b/d of oil in Upper Jurassic. “A water contact has not yet been established, which leads management to believe the project has upside potential. Block 14/18c may also contain upside with the extension of the Athena Lower Cretaceous discovery tested by well 14/18-15 drilled by Ithaca in 2006. Block 14/17(part) is immediately west and on trend with Athena,” Ithaca said.

Maersk Oil was granted 15 licenses and will work with Eni SPA, Noble Energy Inc., BG Group, Nippon Oil Co., Chevron Corp., and Talisman Energy UK Group in different consortiums for different blocks.

Alistair Darling, secretary of state for DTI, said, “There are potentially more than 20 billion bbl of oil and gas still available to be produced, which is good news for industry, our economy, and energy supply.”

However, DTI has delayed offering four blocks in Cardigan Bay (106/30, 107/21, and 107/22) and the Moray Firth to potential winners because it has received environmental challenges about them as habitat areas for dolphins. DTI will carry out further checks before it takes any decision on them.

Results from the 24th licensing round have been delayed by over 3 months following environmental checks against some of the applications to comply with European environmental directives.

In 2006 at least 500,000 bbl were discovered in the North Sea, which the government said was the highest number of finds since 2001. “Around 40% of exploration wells have found potentially commercial oil and gas accumulations,” it added.

Drilling & Production - Quick TakesUzbekistan, oil firms ink PSA for Aral Sea section

Uzbekistan, along with a consortium of state-owned Uzbekneftegaz, Lukoil Overseas, Petronas, China National Petroleum Corp., and Korea National Oil Co., have signed a production-sharing agreement for the Uzbek section of the Aral Sea.

In a statement Lukoil said a 35-year PSA for the project was signed in Tashkent on Aug. 30, 2006, and that all members of the consortium have equal shares in the project.

A tender was issued in January for a 2D seismic survey of Uzbekistan’s section of the Aral Sea, which covers 2,300 linear km-50% onshore and 50% offshore, including the tidelands and waters as deep as 40 m.

In addition to the seismic survey, the PSA calls for the drilling of two exploration wells over a 3-year period at a cost of $100 million.

Petrobras begins output from Cottonwood field

Petrobras America Inc. on Feb. 4 began producing from the first well in the Cottonwood gas-condensate field in the Gulf of Mexico-the first deepwater field outside of Brazil that Petrobras, as operator, has developed and put into production.

The field lies in 2,300 ft of water on Garden Banks Block 244 about 138 miles off Texas.

Gas production from the well is being increased initially to 40 MMscfd.

Petrobras has plans to put a second well on stream this month. This well is expected to raise the field’s gas production to 70 MMscfd, combined with oil-condensate production that will boost field production to 20,000 boe/d.

OMV raises flow from Pakistan’s Sawan gas field

OMV AG has increased gas production from its Sawan field in Pakistan to 400 MMscfd from 340 MMscfd under a $350 million investment plan. Pakistan’s Sui Northern Pipelines Ltd. and Sui Southern Gas Co. intend to take the additional gas.

OMV, which operates the field, drilled additional wells in Sawan and modified the gas processing plant to boost production. OMV’s share of output from Sawan and nearby Miano field is now 120 MMscfd of its previous 110 MMscfd.

Sawan is in Sindh Province in the central Indus basin, about 500 km from the port city of Karachi.

OMV is the largest international gas operator in Pakistan and supplies 16% of the country’s gas.

Partners in Sawan field are OMV 19.74%, Pakistan Petroleum Ltd. 26.18%, Eni AEP Ltd. 23.68%, Government Holdings Private Ltd. 22.5%, and Moravske Naftove Doly AS 7.9%.

S. Texas gas productivity declining, report says

South Texas natural gas wells examined in a recent study are losing productivity, and rising costs of materials and labor are driving up operating costs, according to Ziff Energy Group.

The average well productivity of the fields studied fell by 25% during 2000-05. The 2005 average operating expense was 98¢/Mcf equivalent vs. 59¢/Mcf in 2000.

Ziff’s South Texas benchmarking study included production primarily in Texas Railroad Commission Districts 2 and 4. Seven operating companies provided data on 25 fields in the study.

The fields analyzed produced 1 bcfd from more than 2,400 wells. Total annual operating costs of the fields came to $250 million.

AGR, Helix Energy awarded FPSO conversion job

AGR Group and Helix Energy Solutions Group Inc. will convert the 34,000 dwt Westralia fuel-supply ship into a floating production, storage, and offloading vessel. The partners bought the ship from the Australian government; its new name will be Shiraz.

The FPSO will be used in Southeast Asia as an early-production system or as an extended-production test vessel.

The partners have carried out an extensive feasibility study and front-end engineering design for the conversion will start immediately.

Processing - Quick TakesUS petrochem production up, inventories down

US production of 15 petrochemicals in fourth quarter 2006 increased 14% to 48.2 billion lb, compared with production in fourth quarter 2005 of 42.4 billion lb of the same petrochemicals, said the National Petrochemical & Refiners Association in a recent report.

The fourth quarter 2006 production figure also represents a 3% decrease over third quarter 2006 production of 49.7 billion lb of the same 15 petrochemicals, said NPRA in its “Survey of Production and Inventory Report for Fourth Quarter 2006.” The petrochemicals surveyed include olefins and aromatics.

From third quarter 2006 to fourth quarter 2006, production of two of the 15 petrochemicals increased.

Concerning petrochemical inventories, total fourth quarter 2006 inventories of seven petrochemicals was 5.7 billion lb, a 3% decrease compared with same quarter 2005 inventories of 5.9 billion lb, yet was an increase of 6% over third quarter 2006 inventories of 5.4 billion lb of the same petrochemicals.

Contracts let for Al-Jubail petrochemical complex

Saudi Kayan Petrochemical Co. (Saudi Kayan) on Jan. 24 let separate contracts to two companies for the construction of a polypropylene (PP) and a low-density polyethylene (LDPE) plant at its petrochemical complex, for which construction is slated to begin this month in Al-Jubail Industrial City, Saudi Arabia (OGJ Online, Dec. 11, 2006, Newsletter).

Samsung Engineering was awarded the contract to build the 350,000-tonne/year PP plant, and Simon Carves Ltd., UK, received the contract to build a 300,000-tonne/year LDPE plant.

The $2.2 billion complex, expected to be operational in December 2009, will have a capacity exceeding 4 million tonnes/year.

Saudi Kayan is a joint venture of Saudi Basic Industries Corp. 35% and Kayan Petrochemical Co. 20%. The remaining 45% will be offered for public subscription.

Transportation - Quick TakesIGI gas line to become operational in 2011

Italy and Greece are planning to build a 220-km pipeline that will transport 8 billion cu m/year of gas from the Caspian Sea to Europe via Turkey from 2011.

The protocol of intent was signed Jan. 31 in Athens by Greek Development Minister Dimitris Sioufas and his Italian counterpart, Pierluigi Bersani.

Next year both countries will start building the subsea underwater pipeline between Greece’s west coast and southern Italy. Italy’s Edison SPA and Greece’s Depa will have a respective 80-20 transmission capacity in the pipeline, which has been dubbed the Italy Greece Interconnector (IGI). IGI will be linked to an existing pipeline connecting Turkey and Greece, which is to start operations later this year.

Third parties also will gain access to some incremental IGI capacity. The companies agreed to swap larger amounts of gas at the virtual Italian Swap Point, contributing to the establishment of a gas exchange.

Edison and Depa have already started negotiations for gas supplies from some producing countries in the Caspian Sea basin and with those that will cross the pipeline.

Edison said that the commitment from the governments would fast-track construction of the pipeline because of its strategic importance to the European Union in diversifying its gas supplies. Russia supplies about 25% of western Europe’s gas needs.

RWE proposes Czech Republic-Belgium pipeline

RWE Energy AG plans to construct a 5 billion cu m/year gas pipeline that will extend from the Czech Republic to Belgium. It would start operations in 2011 and reduce Germany’s reliance on Russian gas imports.

Plans call for a 560-km line to originate in Sayda on the Czech border and cross through Werne in Germany and a 200-km section extending to the Belgian system in the Aachen area.

“The pipeline would form a direct link between the Czech and the German gas transport grids of RWE Energy,” RWE said. Germany, Great Britain, and the BeNeLux countries are the proposed customers for gas supplies from the Caspian Sea area, the Middle East, and Egypt.

The $1.3 billion project is another European route intended to diversify its significant reliance on Russia, however RWE did not rule out sourcing Russian gas supplies.

An RWE spokeswoman told OGJ the pipeline would bring in regasified LNG from its proposed 7.3 million tonne/year Adriatic terminal in Croatia, which will start operations in 2011. She said the Czech pipeline could link to other pipelines that could connect to OMV AG’s proposed 8 billion cu m/year Nabucco pipeline through southeastern Europe (see map, OGJ, June 13, 2005, p. 60). She emphasized that the project was in the early stages and that nothing has been finalized.

RWE has invited third parties to take up capacity on a nondiscriminatory basis in the Czech pipeline to determine if it should increase its capacity of 5 billion cu m.

To more quickly launch the project, RWE is seeking an exemption from the German Federal Grid Agency and the European Commission’s rules on grid regulation, stressing that the infrastructure improves supply security and increases competition.

Berthold Bonekamp, CEO of RWE Energy AG, said, “We want to invest in new capacities. Additional gas procurement options in Europe promote competition.”

CenterPoint, Spectra pull plug on gas pipeline

CenterPoint Energy Gas Transmission Co. and Spectra Energy have agreed to call off development of a joint Midcontinent Crossing (MCX) pipeline, which proposed to move natural gas from basins in the Midcontinent to interconnects serving the US Northeast and Southeast (OGJ Online, June 12, 2006, Newsletter).

“Market and economic analyses do not support the construction of the proposed pipeline at this time,” the companies said in a joint statement.

CenterPoint and Spectra plan to continue to “independently evaluate opportunities for building infrastructure to transport Midcontinent natural gas supplies including projects in the vicinity of the proposed MCX pipeline,” adding, “Should the appropriate project present itself, we would be willing to look at it jointly.”

BP reports 600,000 b/d throughput for BTC line

BP PLC reported that throughput at the Baku-Tbilisi-Ceyhan crude pipeline has reached 600,000 b/d, but it plans eventually to increase that to 1 million b/d.

Initially the line transported oil only from the Azeri-Chirag-Gunashli fields, but in January BP added production from the offshore Shah Deniz gas-condensate field.

BP said it expects future increased volumes will “include those from across the Caspian, possibly commencing by the end of 2007.”