OGJ Newsletter

UK N. Sea operators eye international markets

A growing number of UK North Sea operators are focusing on building their businesses in international markets, which could threaten future investment in the UK North Sea, according to a survey published Jan. 30 by the Aberdeen and Grampian Chamber of Commerce.

The survey found that 65% of operators are looking to invest their money elsewhere, in North and West Africa, Russia, and Australia, for example. High UK petroleum taxation, soaring technical and resource costs to develop mature areas in the UK North Sea, and a lack of long-term legislative policies are the main reasons operators give for expanding into international markets.

The UK Offshore Operators Association estimates that the oil services and goods export market in the UK is worth £6 billion. Chamber Chief Executive Geoff Runcie welcomed the opportunity for Aberdeen-based companies to grow their businesses internationally but stressed, “We need continued investment at home in exploration levels and both our offshore and onshore infrastructure to ensure the longevity of our indigenous oil and gas industry.”

About 87% of North Sea operators and contractors are working at or above optimum levels, indicating strong investment in the mature UK North Sea, the survey said. In 2005 the UK sourced 3 million boe/d from the North Sea for its energy needs. The UK produces over 90% of its own gas and nearly 100% of its oil from the UK Continental Shelf.

Companies in the supply chain are moving towards having longer and collaborative contracts and have reduced their focus in 2004-06 on cost reduction, risk sharing, and penalty clauses in their contracts. The survey said operators and contractors continue to be concerned about safety and environmental issues.

According to the survey, 44% of contractors said UKCS exploration-related activity levels rose over the last 4 months, and 39% expect this trend to continue over the next year. However, last year oil prices hit a high of $75/bbl and have now fallen to $50/bbl.

The survey looked at North Sea activities from September 2006 to January of this year.

Ortiz, head of Bolivia’s YPFB, resigns

Juan Carlos Ortiz, head of Bolivia’s state-owned Yacimientos Petroliferos Fiscales Bolivianos (YPFB), has resigned over disagreements with the government.

Ortiz said he had resigned because of differences with the government of President Evo Morales over its oil and gas nationalization policies.

Ortiz is the second head of the company to resign since Morales nationalized Bolivia’s gas industry on May 1, 2006 (OGJ Online, May 2, 2006).

The country has the second-largest natural gas reserves in South America after Venezuela.

Ortiz previously worked for foreign energy companies, including Brazil’s state-owned Petroleo Brasileiro SA (Petrobras), the biggest investor in Bolivia’s gas and oil industry, analysts said.

It is thought that Ortiz was given the task of smoothing relations with the country’s largest gas customer, Brazil, which imports 26 million cu m/day of gas from Bolivia via the 3,150-km Bolivia-Brazil gas pipeline. Morales wants to increase the cost of gas to $5/MMbtu from $4.

Petrobras officials, speaking under the condition of anonymity, told OGJ that Ortiz was trying to convince Morales to limit the price increase of gas exported to Brazil to $4.50/MMbtu.

Last year Bolivia negotiated a price hike to $5/MMbtu for the 5 million cu m/day of gas it exports to Argentina. Meanwhile, it sells gas for $1.09 to a thermoelectric plant in Cuiaba, western Brazil, delivered via a 267-km pipeline in which Royal Dutch Shell PLC holds a 38% stake.

Morales omitted, however, that gas volumes supplied to the Cuiaba plant usually average little more than 1 million cu m/day.

Morales recently said that Bolivia “can no longer continue subsidizing natural gas to Brazil.” He began nationalizing Bolivia’s energy industry in May 2006 after winning an election campaign pledging to increase state control of natural resources.

Ortiz’s resignation comes after Morales suspended key parts of the role of YPFB in the state takeover of Bolivia’s oil and gas resources in a move analysts said highlighted the company’s lack of money and technical expertise.

The implementation of the energy nationalization has been delayed, while a cash-strapped YPFB struggles to assume control of the sector.

As part of the nationalization, Bolivia also hiked taxes to as much as 82% from 18% on some multinational companies and ordered YPFB to hold a majority stake in several foreign-owned refineries. The additional revenue is expected to breathe fresh financial life into YPFB.

Georgia chooses Azerbaijan as main gas supplier

Georgian President Mikheil Saakashvili has announced that neighboring Azerbaijan will be his country’s main supplier of natural gas, but that he would still like to keep Russia as a supplier to ensure diversity.

About one third of Georgia’s gas is already on its way from Azerbaijan, and by February-March, about 80% will be coming from that country, Saakashvili told Russia’s Ekho Moskvy radio station.

He said, “It is not good to have just one channel, even if it is a very friendly one, as there may be many technical and other” problems. As a result, he said, “we would like to keep the Russian channel” but that it is “hard to predict, and prices there are completely crazy.”

Azerbaijan’s Azarigaz began exporting gas Jan. 11 along the Haciqabul-Qazax-Tbilisi trunkline to Georgia, which is seeking to reduce its dependence on increasingly expensive Russian supplies (OGJ Online, Jan. 11, 2007).

EPA issues state underground tank guidelines

Underground storage tank manufacturers and installers must have financial resources to clean up a site if a leak or spill occurs due to improper manufacturing or installation, the US Environmental Protection Agency said as it issued two final grant guidelines for states on Jan. 24.

The guidelines, which implement key underground storage tank provisions in the 2005 Energy Policy Act (EPACT), also require a state’s public record to include the number, sources, and causes of releases; tank compliance records; and data on equipment failures, EPA said.

The first set of guidelines describes the minimum financial responsibility and installer certification provision requirements for states to comply with EPACT. These include definitions, requirements, criteria, and options for states in implementing the provision.

By Feb. 8, states receiving federal funds under Subtitle I of the Waste Disposal Act must implement either these guidelines or the second containment grant guidelines that EPA issued in November 2006, the federal agency said.

EPA will assist states as they implement programs in appropriate cases if the states demonstrate good faith and progress toward meeting the requirements.

The public record guidelines describe minimum requirements for states meeting the public record provision under EPACT. They include developing and updating the public record, making it available, describing the minimum public record content, ensuring data quality, and demonstrating and ensuring compliance with guidelines, EPA said.

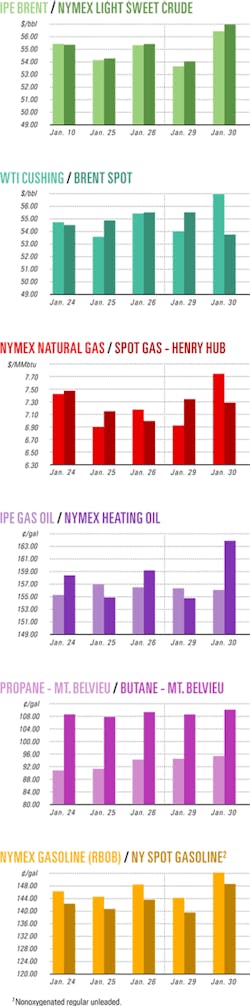

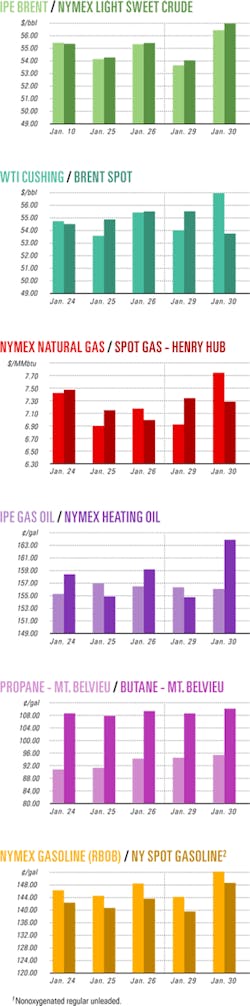

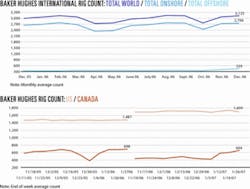

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesChevron unit finds oil on Block 14 off Angola

Chevron Corp. subsidiary Cabinda Gulf Oil Co. Ltd. (Cabgoc) and its partners reported an oil discovery on deepwater Block 14 off Angola. The well, Lucapa-1, found more than 280 net ft of oil in Miocene-age sands.

Lucapa-1 was drilled in October 2006 in 3,940 ft of water to a 10,958 ft TVD. The well, which was tested in November 2006, flowed 24° gravity oil from high-permeability sand in the main target interval.

The discovery is the 10th exploration well drilled on Block 14 since 1997.

Also under development on Block 14 is the $2.3 billion Benguela Belize-Lobito Tomboco (BBLT) project, which started up in January 2006. Once fully developed, BBLT will produce an estimated 200,000 b/d of oil in 2008.

Also, in June 2006, Chevron began production from the Landana North reservoir in the Tombua-Landana development area of Block 14 by producing through the BBLT facility. When developed, Tombua-Landana is expected to achieve peak production of 100,000 b/d of oil by 2010 through its own facility.

Cabgoc, with 31% interest, serves as operator of the Block 14 contractor group, which includes Total E&P Angola 20%, Sonangol 20%, Eni Angola Exploration BV 20%, and GALP 9%.

BP makes 12th oil find on Angola’s Block 31

BP PLC and its partners made a 12th oil discovery, Terra, on Angola deepwater Block 31. BP, the operator, drilled the well using GlobalSantaFe’s Jack Ryan ultradeepwater drillship to 6,118 m TVD. The well flowed more than 5,000 b/d of oil on test.

This is the third discovery on Block 31 where the exploration well was drilled through salt to access the oil-bearing reservoir beneath.

Block 31 covers 5,349 sq km and is 411 km northwest of Luanda in 1,500-2,500 m of water. The Terra discovery is 30 km northwest of the recently announced Titania discovery (OGJ, Nov. 6, 2006, Newsletter).

BP Exploration (Angola) Ltd. holds 26.67% and its partners are Esso E&P Angola (Block 31) Ltd. 25%, Sonangol EP 20%, Statoil Angola AS 13.33%, Marathon International Petroleum Angola Block 31 Ltd. 10%, and Tepa (Block 31) Ltd., a subsidiary of Total SA, 5%.

BP discovers gas with Egypt’s Giza North-1 well

BP has found an estimated 1 tcf of natural gas with its Giza North-1 exploratory well in the North Alexandria concession off Egypt in the Mediterranean Sea. The well encountered a significant gas accumulation as part of a large channel complex, BP said.

The partners, BP, RWE Dae AG, and EGPC/EGAS, will drill an appraisal well to evaluate the large complex in April.

Sameh Fahmi, the Egyptian petroleum minister, said that the well penetrated an 80 m gas-bearing layer that was a Pliocene formation. BP has made three previous discoveries in that formation: Taurus, Libra, and Fayoum. The company also drilled the Raven discovery well in the deeper pre-Pliocene formation.

The group will move the rig to the next appraisal well site in the Taurus field as part of a planned four-well appraisal program in the North Alexandria concession.

Giza North-1, 56 km north of Alexandria City, was drilled to 2,040 m in 668 m of water.

BP is operator of the North Alexandria concession, holding a 60% shareholder interest. RWE Dea holds the remaining interest. EGPC/EGAS has an entitlement under the concession’s production-sharing arrangements.

Bongkot partners make gas finds off Thailand

Total SA reported three gas discoveries at exploration wells Ton Chan-1X, Ton Chan-2X, and Ton Rang-2X drilled on Blocks 15 and 16 in the Gulf of Thailand.

The two Ton Chan area wells are on Block 16 in the Bongkot concession, 5 km from each other and 15 km southeast of the Bongkot Central Complex (BCC).

Ton Chan-1X found gas-bearing reservoirs with a total of 143 m net pay thickness, while Ton Chan-2X found gas with a total of 44 m net pay thickness.

Ton Rang-2X is on Block 15 of the Bongkot concession, 5 km south of the Ton Rang-1X discovery and 20 km northwest of the BCC. Ton Rang-2X found gas-bearing sand of 72 m.

Total said a development plan for the three discoveries is under study and that production could start in 2009. Bongkot produces 600 MMcfd of gas and 18,000 b/d of condensate. Member companies of the Bongkot joint venture are Total 33.33%, Thailand’s PTT E&P (operator) 44.45%, and BG Group 22.22%.

Ecopetrol sets $2 billion E&P budget for 2007

Colombia’s state-owned Ecopetrol plans to invest $2 billion this year to explore for and produce oil and gas. Ecopetrol spent $1.3 billion in 2006, the company reported.

Colombia will produce 520,000 b/d of oil in 2007. Ecopetrol and other companies must invest to sustain that level of production in the future, said Ecopetrol Finance Minister Alberto Carrasquilla.

The investment is needed to recover the country’s proved reserves that topped 3 billion bbl in years’ past, dropped to 1.5 billion bbl in 2004, remained at that level in 2005, and increased a bit in 2006, Carrasquilla said.

Ecopetrol target is to invest $12.5 billion over the next 5 years to sustain the country’s output levels. Oil is currently Colombia’s leading export and source of foreign income, constituting one third of the country’s foreign revenues.

All oil production is undertaken by Ecopetrol in contracts of association with foreign companies.

Most of the Colombian oil industry runs through joint ventures between Ecopetrol and international companies, some of which have heavily financed the construction of pipelines. Investment from these multinational corporations has led to the creation of the oil infrastructure that exists in Colombia today. BP PLC and Occidental Petroleum Corp. are among the largest international companies in the Colombian oil sector.

Colombia has become a hot spot for oil and gas exploration in Latin America as energy multinationals face increasing hostile business conditions elsewhere in the region, industry experts say. Key attractions include a steep, sustained fall in guerrilla attacks under President Alvaro Uribe-now in his second 4-year term-and a reduction of taxes.

The government has drawn up incentives to attract oil companies, including cutting Ecopetrol’s mandatory stake to 50-55% in any exploration contract with a private-sector company. This compares with the 70% required over the past 30 years.

Drilling & Production - Quick TakesShell inks deal with NIOC, Repsol YPF for LNG

Royal Dutch Shell PLC has signed an upstream services agreement with National Iranian Oil Co. (NIOC), the Iranian state-owned oil company, and Repsol YPF SA to further investigate the feasibility of the upstream element of their proposed Persian LNG project.

A Shell spokesman told OGJ that Shell would look at constructing gas production facilities, hand them over to NIOC, and recoup its expenditure once gas production has started under a buyback contract.

The consortium hopes to build an 8.1 million-tonne/year liquefaction plant that could be expanded with a second train to target markets in India, the Far East, and Europe.

Shell emphasized that this was not a final investment decision to go ahead with Persian LNG and that Shell is about a year or so away from taking that step. Persian LNG covers Phases 13 and 14 of South Pars gas field.

The services agreement will help to inform the final investment on Persian LNG. According to Iranian reports, the deal is worth $10 billion for both upstream work and the LNG infrastructure.

Shell’s move defies pressure from Washington, DC, on non-US companies to stop investment in Iran because of its uranium enriching activities, which Washington fears is the basis for nuclear weapon development.

Iran only offers buyback contracts to attract energy investment in the country, but many western companies have found the terms limiting and have not invested.

Eni: Kashagan field more ‘generous’ than thought

Kashagan oil field in Kazakhstan is more “generous” than expected, said Eni SPA’s Chief Executive Paolo Scaroni Jan. 25, indicating that Kashagan may have higher production rates than originally anticipated.

The Eni-led project in the North Caspian Sea has been delayed by environmental problems and technical challenges. Production, planned to start in 2005, has been postponed to 2009.

Kazakh state-owned energy company KazMunaiGaz is investigating the project to determine why higher costs and delays have occurred. Scaroni said audits are normal, and Eni is not worried by the checks. Within coming weeks, it will publish a schedule and cost structure for starting commercial oil extraction at Kashagan, he added.

Eni in 2004 estimated field development at $29 billion over 15 years. Last March, Eni increased costs for Kashagan by $4-5 billion because of a weakened dollar and higher equipment costs.

The Caspian Sea is shallow and freezes from November-February, posing access problems for the consortium. Meeting stringent environmental standards is proving costly and time-consuming, and the field’s high pressures and levels of hydrogen sulfide are complicating field development.

Kashagan has recoverable reserves of 13 billion bbl. It will be developed in multiple phases: Under Phase I, production will reach 75,000 b/d and gradually increase to 450,000 b/d. Production will increase during the following stages at an expected plateau of 1.2 million b/d.

Processing - Quick TakesIrving starts filings for second St. John refinery

Irving Oil Ltd., St. John, NB, started the permitting process with provincial and federal authorities to build a second refinery at St. John.

A filing was made to initiate the necessary environmental impact assessments, Irving said Jan. 25.

The proposed $5-7 billion facility, to be built near the Irving Canaport deepwater crude receiving terminal, would have a designed capacity of as much as 300,000 b/d.

It would be the first major refinery built in North America in nearly a quarter century (OGJ, Oct. 23, 2006, Newsletter).

A review by authorities under the New Brunswick Environmental Impact Assessment Regulation and the Canadian Environmental Assessment Act could take as long as 24 months.

Irving continues to invest in its existing, 250,000 b/d refinery at St. John. That refinery, Canada’s largest, supplies more than 75% of Canada’s gasoline exports to the US and 19% of all US gasoline imports.

Oryx plant produces GTL products for first time

The Oryx GTL plant in Qatar has produced its first gas-to-liquids products under its start-up plan, and its products will be ready for international markets by the end of March.

Sasol Ltd., a major partner in the $950 million project, said in January that the plant was producing waxy synthetic crude, the intermediate result of the Fischer-Tropsch (F-T) process in creating GTL products, and it would move on to testing the product workup unit. This is the world’s first GTL plant on a commercial scale using the proprietary, low-temperature Sasol slurry phase distillate process based on F-T technology (OGJ, Mar. 14, 2005, p. 18).

The plant will convert 330 MMcfd of lean gas from Qatar’s vast North gas field into 34,000 b/d of ultralow-sulfur diesel: 24,000 b/d of diesel, 9,000 b/d of naphtha, and 1,000 b/d of liquid petroleum gas. Diesels will be sent to Europe and naphtha to the Far East. LPG will be used for local consumption.

The plant was officially inaugurated in June last year and has undergone a sequential plan to test the processes. The partners have proposed expanding capacity at Oryx to 100,000 b/d in the future.

Oryx GTL is a joint venture of state-owned Qatar Petroleum Co. 51%, and Sasol 49%.

Contract let for Songo Songo plant expansion

Globeleq, an operating power company and operator of the Songas gas-to-electricity project, has let an engineering and project management consultancy contract to Foster Wheeler South Africa (Pty.) Ltd. for the expansion of the Songo Songo Island gas processing facility in Tanzania. The value of the contract was not disclosed.

The Songo Songo Island gas processing facility is part of the Songas integrated gas-to-electricity facility. With the planned expansion of the gas processing plant, capacity will double to 140 MMscfd.

The processing plant processes gas from Songo Songo Island gas fields. The gas is then transported via a 225-km subsea and onshore pipeline to the Ubungo electric power station in Dar es Salaam and to other industrial users (OGJ Online, July 26, 2004, Newsletter).

Transportation - Quick TakesGassco plans Nordic gas pipeline

Norwegian gas pipeline operator Gassco AS has submitted a plan to the Norwegian energy ministry to develop a 3 billion cu m/year gas pipeline from Kårstø in western Norway to eastern Norway, western Sweden, and Denmark.

Plans call for 463 km of 24-in. pipeline to be laid from Kårstø to the Grenland industrial region in eastern Norway and a 270-km, 18-in. section to be laid from Grenland to Sweden. From Sweden to Denmark an existing pipeline operated by Nova Naturgas will be used.

After carrying out a feasibility study for the past 2 years, Gassco has received interests from seven companies to own 70% of the proposed pipeline, while another nine have committed to pay for the right to use it.

A Gassco spokesman told OGJ that 14 companies-from Norwegian, Swedish, and Danish industry and energy sectors-will spend $23.6 million on the preengineering phase that will continue until 2009.

For the project to continue, Gassco needs to secure binding purchase contracts before June 30. “The investing companies can renounce their transport undertakings if such contracts are not in place by then,” Gassco said.

Norwegian Minister of Petroleum and Energy Odd Roger Enoksen said the government will discuss how it can contribute to the project. “I will shortly have meetings with my Scandinavian colleagues to discuss the gas pipeline project,” he said.

Gassco plans to make a final development decision in 2009 and start operations in 2012.

Lukoil lets pipelay contract for Yuri Korchagin field

OAO Lukoil unit Lukoil-Nizhnevolzhskneft LLC has let a subsea pipeline installation contract to a unit of J. Ray McDermott SA for the Yuri Korchagin oil field pipeline project, 180 km off Russia in the Caspian Sea.

Under the contract J. Ray will install 58 km of 12-in. pipe connecting the ice-resistant fixed platform No. 1 (LSP-1) to a single-point mooring buoy south of Yuri Korchagin field.

J. Ray also will provide design engineering, procurement, installation, and testing of the line.