OGJ Newsletter

Iraq refinery attacked by rocket

Iraq’s Doura refinery burst into flames Dec. 10 after being hit by a rocket, according to an Oil Ministry official.

Spokesman Asim Jihad said a Katyusha rocket hit a fuel storage tank at the 110,000-b/d refinery at about 6 a.m., starting a fire that sent a large plume of black smoke into the sky.

He said there were no casualties and the refinery’s firefighters expected to extinguish the fire quickly. He did not report what effect the attack had on the refinery’s output.

The facility, just outside Baghdad, refines crude oil from the north and south of the country to supply products to the Iraqi capital.

N. Sea tax rules to be revamped, not abolished

Despite strong pressure from the oil and gas industry, the UK government has rejected calls to immediately abolish the North Sea Petroleum Revenue Tax (PRT) even though it announced a proposal Dec. 6 to shake up tax rules and decommissioning rules to encourage continuous investment in the mature area (OGJ Online, Dec. 7, 2007).

Abolishing PRT immediately would create “a large number of winners and losers, damage investor confidence, and fail to secure a fair return for the UK taxpayer,” the government said. It has proposed, instead, some reforms to the PRT regime, including reducing the administrative burden of complying with PRT and providing operators with PRT relief for decommissioning costs.

Trade organization Oil and Gas UK welcomed the suggestions but said that there are inconsistencies regarding the application of PRT to decommissioning liabilities and tax relief. The government is seeking comments on the suggestions by the end of January 2008.

It also has launched another consultation on the tax burden facing operators because of the fear that this is stopping forthcoming investment. The deadline to submit comments on this and other issues is June 2008.

French companies sign gas deals with Algeria

France and Algeria have signed several natural gas deals as French President Nicolas Sarkozy sought to establish closer ties on his first state visit to the former French colony.

Sonatrach will continue to supply LNG to Gaz de France during 2013-19 under an extended contract signed in Algiers Dec. 4.

The agreement, valued at €2.5 billion/year, means that Algeria will remain a key supplier, accounting for 10 billion cu m in 2006.

Gaz de France also hopes to receive the Algerian government’s approval in early 2008 for its development plan for Touat gas field, in which it holds a 75% stake, in the Sbaa basin. Investment is expected to hit $1 billion, but discussions surrounding the construction of an 800 km gas pipeline are not yet finalized. Field production is scheduled to begin in 2011.

In 2006 Gaz de France signed up for 1 billion cu m/year of gas to be delivered through the proposed Medgaz pipeline, which is to start deliveries in 2009. The pipeline will send Algerian gas to Spain. Gaz de France has a 12% share in the project and a 20-year supply contract.

Algeria’s state-owned gas and power company Sonelgaz let a €1.3 billion turnkey contract to Alstom and Egyptian Orascom Construction Industries to build a 1,200 Mw gas-fired power plant in Terga, 600 km from Algiers. Operations are expected to start in 3 years.

Alstom will supply a full turnkey, combined-cycle power plant integrating in-house core plant components built around its advanced class GT26 gas turbine with best operational flexibility, Alstom said.

France levies high-profits tax on oil companies

France’s oil companies will pay “an exceptional tax” to help fund a heating oil reserve granted by the government to low income households. The tax will be levied on the basis of 25% of the provisions for high prices, which the companies have built up over the past years.

The companies can either pay the tax directly to the state or to the fund. They most likely will choose the second option, said Jean-Louis Schilansky, delegate general of the oil companies’ trade group UFIP. He told OGJ the fund could amount to €102 million.

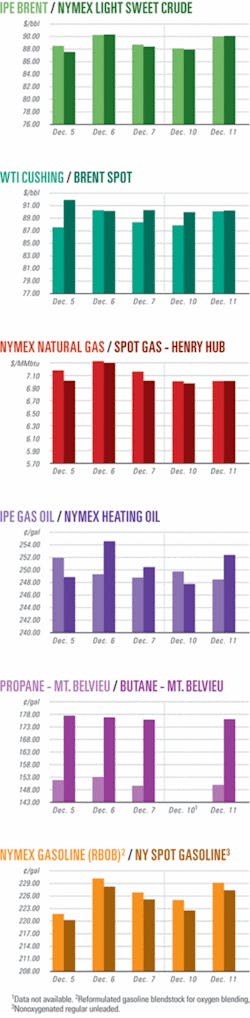

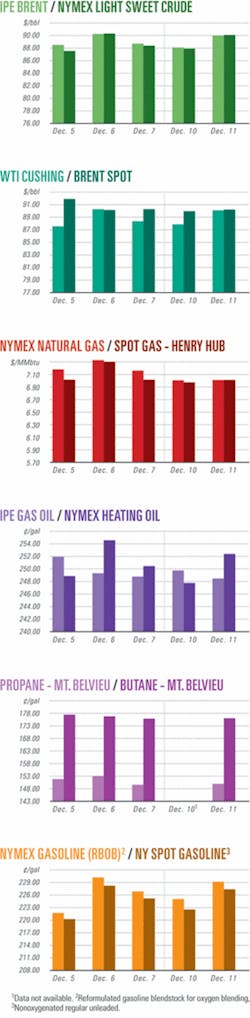

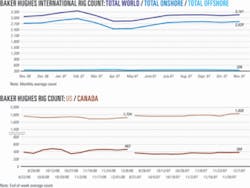

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesPetro-Canada to invest in Libyan exploration

Petro-Canada of Calgary signed an agreement Dec. 10 with Libya’s National Oil Corp. (NOC) for the two companies together to invest $7 billion in exploration and development in the Sirte basin of northern Libya.

Terms call for NOC to convert existing participation agreements and old exploration and production-sharing agreements to six new EPSA IV agreements. New agreements are to last 30 years compared with an existing 2015 expiration date.

Petro-Canada agreed to pay 50% of development costs and will receive a 12% entitlement share of production. In addition, Petro-Canada will pay a $1 billion signature bonus with the first of three payments due upon contract ratification, expected in 2008.

“Through these agreements we have achieved our long-standing objective of extending our partnership with NOC in Libya,” said Ron Brenneman, Petro-Canada’s president and chief executive officer.

Petro-Canada estimates gross resources of almost 2 billion bbl of oil associated with the redevelopment program, which includes pipeline and facility upgrades, development drilling, and waterflood expansion.

Currently, Petro-Canada’s Libyan concessions produce 100,000 b/d (gross). Under the new agreements, production from the redevelopment program is expected to double in 5-7 years.

In addition to the redevelopment costs and signature bonus, Petro-Canada also proposes to invest $460 million in exploration during 7 years in the Sirte region.

StatoilHydro finds gas in third Hassi Mouina well

Natural gas was tested and proved in Tournaisian sandstones in the third completed exploration well on the Hassi Mouina license in Algeria’s Sahara Desert, operator StatoilHydro AS said Dec. 11.

The Tinerkouk well (TNK-1) will provide “valuable information on the resource potential in the block,” said Bill Maloney, StatoilHydro senior vice-president, global exploration. Hassi Mouina, which spans four blocks within a 23,000 sq km area in the Gourara basin, is in the western Sahara, northwest of In Salah gas field.

StatoilHydro and its partner Sonatrach are now drilling the fourth exploration well, TMS 1. “Several appraisal wells will also be drilled on the earlier discoveries in order to quantify the volumes with greater certainty,” StatoilHydro said. StatoilHydro has a 75% interest in Hassi Mouina, and Sonatrach has 25%.

Libya reports gas licensing round results

OAO Gazprom, Royal Dutch Shell PLC, Polish state-owned PGNiG, and Algeria’s Sonatrach have emerged among initial winners of Libya’s first gas licensing round.

Gazprom was awarded onshore Area 64 in the Ghadames basin, and senior company officials have discussed additional areas of oil and gas cooperation in Africa with Shokri Ghanem, chairman of Libya’s National Oil Co. (NOC).

Gazprom will invest more than $100 million on its exploration program. “According to the preliminary estimations, the Block 64 oil reserves are 20 million tons,” the company said.

Shell won Blocks 1 and 3spanning 1,790 sq kmin the Sirte basin, which is adjacent to other acreage it already has, a company spokeswoman told OGJ. She added that it enables Shell to “open up a new area in the southern flank of the Sirte basin.” The new licenses will reinforce the company’s relationship with NOC.

Sonatrach will work with partners Oil India Ltd. and Indian Oil Corp. to develop four blocks comprising 6,934 sq km in the Ghadames basin. Sonatrach said the award reinforced its presence in Libya where it operates Block 65 in the same basin.

PGNiG will explore Block 113 in the Murzuq basin in western Libya, which covers 5,494 sq km. “The high prospectively of this area is confirmed both by the adjacent existing fields and the reported discoveries within this petroleum basin,” PGNiG said. It plans to sign the exploration and production-sharing agreement with NOC in the next 3 months.

Libya invited companies to bid for 41 onshore and offshore blocks earlier this year to improve gas production to 3 bcfd by 2010 from 2.7 bcfd currently. Ghanem said more winners could be announced in a week.

Total farms into Yemen blocks with Sinopec

Total SA gained a 40% interest in two onshore exploration blocks in Yemen under a farmin agreement signed with Sinopec.

An exploration well is being drilled on Block 69 following the acquisition of 2D seismic. The block spans 1,333 sq km and is in central Yemen’s Marib basin, from which gas is directed to the Yemen LNG plant. Block 71, which is 1,800 sq km, is in eastern Yemen’s Masilah basin, near Block 10, which Total has operated for 20 years. The partners have acquired 2D seismic for Block 71 as well.

Total will work with operator Sinopec (45.5%), state-owned Yemen General Corp. for Oil & Gas (10%), and the Arabian Group of Cos. (4.5%). Workers have shot 2D seismic on both blocks, and a well is being drilled on Block 69.

Murphy, PTTEP farm in to Australia Block AC/P36

Murphy Oil Corp. and Thailand’s PTT Exploration & Production PCL (PTTEP) together have acquired a 60% stake in Block AC/P36 off northwestern Australia.

The farmin reduced the ownership of the 4,000 sq km tract in the Browse basin held by privately-owned Australian concern, Finder Exploration Pty., to 40%.

Under the partnership accord, Murphy Oil, through its local subsidiary Murphy Australia Oil Pty. Ltd., become operator with a 40% share in the acreage.

The Thai majority-state-owned firm, which received an offer to acquire the AC/P36 interest from Murphy Oil, holds 20% through subsidiary PTTEP Australia Offshore Pty. Ltd. It is the first venture into Australia for both Murphy Oil and PTTEP. The consortium plans to drill an exploration well by the end of 2008 or the first quarter of 2009, according to PTTEP Pres. Maroot Mrigadat.

Chitrapongse Kwangsukstith, senior executive vice-president of the parent firm PTT, said PTTEP’s initial capital expenditure in the Aussie block would be about $60 million.

Both will provide capital for advance exploration to prove gas reserves in the permit, which lies in water 1,200-1,600 ft deep, according to PTTEP executives.

Drilling & Production - Quick TakesBP to increase King oil field production by 20%

Oil production from King field in the Gulf of Mexico is expected to increase by 20% with the application of multiphase pump equipment that BP PLC has installed (OGJ, Oct. 8, 2007, p. 49).

King produces 27,000 boe/d, and BP expects to improve recovery by 7% and extend the economic life of the field by 5 years. The pump, which BP described as the world’s deepest in 5,500 ft below the sea’s surface also sets a world record, for distance because the pumps are 15 miles from the Marlin tension leg platform. King is tied back to Marlin.

Andy Inglis, BP’s chief executive of exploration and production, said: “In line with our strategy to maximize reserves from our existing fields, the application of this cutting edge technology across BP’s large deepwater portfolio has the potential to unlock significant resources that would otherwise remain unrecoverable.”

BP is 100% owner and operator of King, which is 75 miles off Louisiana in Mississippi Canyon Blocks 84, 85, 128, and 129. The pumps will be powered by an umbilical from the Marlin tension leg platform in Viosca Knoll Block 915.

Norway’s Njord field starts gas production

After a 2-month delay, StatoilHydro AS produced first gas from the Njord field in the Norwegian Sea, providing a new gas supply for Europe along with oil production.

The field, which will produce 6 million cu m/d of gas, required an investment of 1.2 billion kroner to ensure that Njord will supply gas up to 2020.

A new 40 km pipeline ties Njord gas into the Asgard Transport line, which in turn connects with the Karstø processing complex, north of Stavanger, and the trunklines to continental Europe.

Some 20,000 b/d of oil is being produced through 11 wells from Njord, while four injection wells sent the gas back into the reservoir as pressure support under the initial phase. Several new production wells help continue production by phasing in additional resources near the existing infrastructure under the second phase.

“The new process facility, which has been in operation since Oct. 1, is functioning very well. Regularity was as high as 99.7% for the first month,” StatoilHydro said.

It attributed the gas production delay to a faulty weld. The repair on board the Far Saga vessel took “a long time due to bad weather,” officials said.

Anadarko makes oil find with West Tonga well

Anadarko Petroleum Corp. has made an oil discovery in its West Tonga prospect on Green Canyon Block 726 in deepwater Gulf of Mexico.

The discovery well, drilled to a TD of 25,680 ft in 4,700 ft of water, encountered more than 350 ft of net oil pay in three high-quality subsalt Miocene sands.

The West Tonga discovery potentially could be tied back to the Constitution spar, Anadarko said.

Anadarko operates West Tonga with 37.5% working interest. Partners in the discovery include StatoilHydro AS 25%, Chevron Corp. 20.5%, and Royal Dutch Shell PLC 17%.

Petrobank to step up Bakken drilling in 2008

Petrobank Energy & Resources Ltd., Calgary, plans to drill 110 horizontal wells next year in the Bakken play in southeast Saskatchewan.

Petrobank expects to operate seven rigs within the Bakken playan area in which it is expected to have a drilling inventory of 600 (565 net) well locations, based on a future well density of four wells per prospective section.

Drilling will take place after its acquisition of Peerless Energy Inc. for $334 million, including debt. As part of the deal, Petrobank is expected to issue about 4 million common shares. The transaction could lead to combined production from the Bakken play to as much as 7,900 b/d of oil.

Peerless currently is producing about 4,250 boe/d of light oilprimarily from the Bakken playand natural gas from Alberta and British Columbia.

Peerless also has more than 100,000 net acres (156 sections) of undeveloped land.

Reserves for the acquired properties will be evaluated by Petrobank’s independent reserves evaluator at yearend.

The deal is subject to approvals, including that of Peerless shareholders.

Processing - Quick TakesProposed Canadian refinery first in 23 years

Newfoundland & Labrador Refining Corp. has selected Honeywell International Inc. subsidiary UOP LLC, Des Plaines, Ill., to supply technology, basic engineering services, and equipment for a refinery to be built in the Placentia Bay area of Newfoundland and Labrador.

NLRC’s facility will be the first refinery built in North America since 1984. UOP is under way with basic engineering design for the complex, which is scheduled for start-up in 2011. It is projected to process 300,000 b/d of Middle Eastern crudes into transportation fuels for North American and European markets.

The facility also will feature a wide range of trademarked UOP technologies and processes to remove sulfur and upgrade distillate materials to produce clean fuels. A continuous catalytic reforming process will be used to produce aromatics and hydrogen from naphthenes and paraffins. Other procedures will absorb chlorides from regenerated catalyst to enhance efficiency of chloride management and reduce emissions.

NLRC is backed by St. John’s-based mining company Altius Resources Inc. and private investors.

California to report GHG emissions in 2009

California’s refineries, power plants, cement kilns, and manufacturing plants will be required to report annual greenhouse gas emissions (GHG) starting in 2009, the California Air Resources Board agreed Dec. 6.

The mandatory reporting rule, approved unanimously, is expected to affect about 800 industrial sites accounting for 95% of California’s industrial emissions.

The rule covers emissions of carbon dioxide, nitrous oxide, and methane. Initial reports will not have to be audited by a third party, but future reports will have to be verified. Schools and hospitals are exempt from the new rule.

Carbon emissions reports will be made to the California Climate Action Registry, a nonprofit agency created in 2000 to encourage companies to voluntarily track and report GHG emissions.

Contract let for Colombia refinery expansion

Refinería de Cartagena SA has awarded to Chicago Bridge & Iron Co. a contract for a refinery expansion project in Cartagena, Colombia.

CB&I will perform the engineering, procurement, and construction for the expansion, including adding 14 processing units.

The $80 million expansion project is designed to increase processing capacity at the facility to 150,000 b/d from 80,000 b/d.

The upgraded facility will produce ultralow-sulfur gasoline and diesel from a heavy crude oil slate.

Refinería de Cartagena is owned by Glencore International AG 51% and Ecopetrol, Colombia’s national oil company 49%.

Neste Oil to build Singapore biodiesel plant

Neste Oil of Finland said it will invest €550 million to construct the world’s largest biodiesel plant in Singapore.

The plant, to have a capacity of 800,000 tonnes/year, will primarily use palm oil as feedstock, Neste Oil said, adding that it will use only palm oil certified by the Roundtable on Sustainable Palm Oil as soon as sufficient quantities are availableprobably in early 2008. Singapore was chosen because it is the world’s third-largest center of refining and occupies a central location in terms of product and feedstock flows and logistics.

Construction of the plant will begin in first half 2008, and operations at the facility are expected to begin by yearend 2010.

Transportation - Quick TakesMetgasco to extend Casino-Ipswitch gas pipeline

Sydney-based coal seam methane explorer Metgasco Ltd. is planning to extend its proposed 140 km Casino-Ipswitch gas pipeline further north to BP Australia’s refinery on the Brisbane River. The pipeline previously was designed to deliver gas from the Casino area in northern New South Wales to CS Energy’s Swanbank power station near Ipswitch, Queensland.

The extension results from a tentative 15 petajoules/year (about 14 bcf/year) gas supply deal with BP to supply the latter’s Brisbane refinery. This contract follows an 18 petajoules/year (16.7 bcf/year) contract signed last year with Queensland-owned CS Energy.

Metgasco says the higher volume through the line will improve the economics of the entire project.

The new schedule allows for another 30 months to complete environmental approvals and an additional 8 months for construction of the pipeline. If the timetable holds true, first gas would flow north towards the end of 2010. Metgasco (formerly Methane Gas Co., formed as a private syndicate of geologists in 1997) is working in the Clarence-Moreton basin coal fields near Casino.

Metgasco’s immediate priority is to increase its 2P gas reserves from the 194 petajoules (180.4 bcf) announced in September to 660 petajoules (614 bcf) by mid-2008. The company’s drilling contractor, Vectra, is working on ways to improve horizontal drilling techniques in the coal seams and speed up completion times with the aim of bringing on stream as many as 40 wells each year.

Part of the earlier agreement with CS Energy includes CS Energy’s paying some of Metgasco’s exploration and development costs in return for interests in some of the company’s fields. The BP deal includes BP’s aid in feasibility studies for the pipeline extension. At the moment BP is supplied with gas via the Roma-Brisbane pipeline, which transports gas mostly derived from conventional fields owned by Santos and Origin Energy in the Surat basin. BP uses the gas for power generation at the refinery, but has been seeking a second source of supply to maintain its energy security.

Angola LNG receives final investment decision

Angola LNG Ltd. will become the latest African export project as the partners have taken the final investment decision to start deliveries in early 2012 to the Gulf LNG’s Clean Energy regasification terminal in Mississippi.

The 5.2 million tonne/year onshore liquefaction plant in the Soyo region in Zaire province will commercialize gas from Blocks 0, 14, 31, 15, and 18; gas from nonassociated fields; and gas that is otherwise flared. Related gas liquids products will also be produced from the 1 bcfd of gas that will be sent to the plant. Angola LNG is expected to supply as much as 125 MMcfd of gas to state-owned Sonangol for domestic use.

Cabinda Gulf Oil Co. Ltd., a wholly owned subsidiary of Chevron Corp., has a 36.4% interest in Angola LNG, which has entered into an investment contract with the Angolan government and Sonangol to develop the project. Italy’s Eni SPA also joined the consortium on Dec. 10 by taking a 13.6% from Sonangol. “The involvement of Eni in the Angola LNG consortium is part of the strategic cooperation established between Sonangol and Eni, signed in December 2006, and aiming at the development of gas resources,” Eni said.

This new development means the Angola LNG shareholders are Sonagas 22.8%, Chevron Corp. 36.4%, Eni 13.6%, Total SA 13.6%, and BP PLC 13.6%. Regasified LNG will be sold to the US affiliates of the partners. Total Gas & Power North America will buy and market Total’s 13.6% share, around 100 MMcfd.

Marathon signs deal for Piceance production

Marathon Oil Co. is the latest in a slew of major oil and gas producers that have entered into long-term agreements with Enterprise Gas Processing LLC for the gathering, compression, treating, and processing of natural gas produced in the Piceance basin of northwest Colorado. Enterprise will construct 50 miles of gathering lines to connect Marathon’s multiwell drilling sites to the partnership’s 48-mile, 36-in. Piceance Creek Gathering System (PCGS) for delivery to Enterprise’s Meeker processing complex. Gas production is expected to peak at 180 MMcfd.

The Meeker complex, which was placed into service in October, is designed to process up to 750 MMcfd of gas and has the capability to extract as much as 35,000 b/d of natural gas liquids (NGL). Phase II of the Meeker complex, which will double the facility’s capacity to 1.5 bcfd of gas and 70,000 b/d of NGL, is expected to begin operations in summer 2008 (OGJ Online, Nov. 15, 2007).

In addition to gathering pipelines, Enterprise also will build a compressor station to deliver gas into the PCGS. The station, 25 miles south of the Meeker complex in Rio Blanco County, Colo., will provide 22,000 hp of compression, as well as condensate handling and natural gas dehydration facilities.