SPECIAL REPORT: US independents explore ample financing options

Robust oil and gas prices have contributed to an abundance of capital readily available to the oil and gas industry through the public equity market, the private equity market, and bank financing. An independent producer must negotiate a maze of financing options.

John Schaeffer, managing director and head of oil and gas investing at GE Energy Financial Services, sees “a plethora” of financing choices for small oil and gas companies.

“There have never been more options for the small producer to get financing, and it’s never been more confusing,” Schaeffer said. He believes independents now have the most financing options available since 1975 when he entered the energy finance business.

Any financing product introduced since the 1970s is available currently, he said, adding that this includes master limited partnerships (MLPs) for upstream companies.

James Burkhard, managing director of the Cambridge Energy Research Associates oil and gas group, said high oil and gas prices attract investors. Prices increased dramatically over the past 3 years.

Currently, $50/bbl for benchmark US light, sweet crudes on the New York Mercantile Exchange is considered low. The year-to-date price for oil as of late November was $70/bbl, he said.

“Prices in the high $90s to $100/bbl and over push both the economy and geopolitics into uncharted waters,” Burkhard said. “The unprecedented $30 surge in oil prices since Augustfrom $70 to $100reflects a sharpening mix of concerns about the value of the dollar, the adequacy of oil supplies, and economic weaknesscombined with an Iran premium.”

He said if oil prices were to average $110/bbl for 6 months, it would increase the world economy’s vulnerability to a serious downturn of the early 1980s. But he foresees some limits on oil demand.

“It’s likely that by the end of that timeframe, it would be that demand had softened. Then, the market would react to that softening, and prices could come off that $100 mark,” Burkhard said.

Another scenario is that oil supply difficulties or perceived difficulties could offset any demand weakening, he noted.

“But if the level of supply anxiety stays roughly where it is today, and there is no worsening of that anxiety, then demand could begin to pull prices down after several months,” Burkhard said.

Various investors available

Small independents must figure out how to best tap various funding sources while maximizing the value of their own companies.

“That can be rather daunting to small independents because they are not really financial guys. They are operatorsgood operators,” said Schaeffer of GE Energy Financial Services, which structures its upstream investments as limited partnerships to help small independents purchase and develop oil and gas reserves.

Traditionally, large companies access the public debt markets such as bank loans while small companies and start-ups require public equity as well. The two main types of private capital are equity and mezzanine or structured debt.

Forms of mezzanine financing include subordinated debt, project debt, preferred stock, and volumetric production payments.

“People who are willing to do mezzanine finance historically show up when the prices are good and disappear when prices aren’t so good,” Schaeffer said.

Numerous private equity options are available. Private equity providers invest in oil companies, often taking 50-80% ownership of a company. Schaeffer said the GE product does not require the small producer to dilute ownership.

It remains to be seen how long current levels of ample capital will remain available for oil and gas companies, Schaeffer said, adding that some financial providers not backed by big companies such as GE might not remain as aggressive energy investors.

“Word on the street is that some of the money available to producers for exploration and production financing is being pulled because some of the people who put that money up need liquidity due to subprime problems in other parts of their shop,” Schaeffer said. “I have no crystal ball.”

Upstream MLPs resurging

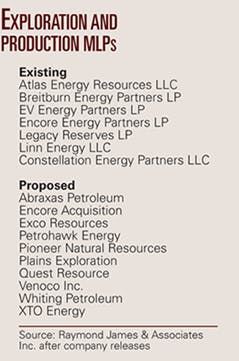

The US exploration and production industry is experiencing a resurgence of MLPs, which appeared during the 1980s. Most early upstream MLPs failed when oil prices dropped. Current MLPs appear likely to survive because of hedging, which enables producers to lock in prices for future production.

Raymond James & Associates Inc. analyst John Freeman of Houston believes upstream MLPs will be a major trend for several years. The trend is in its early stages.

As of Nov. 29, Raymond James listed seven upstream MLPs and said several other oil companies were in the process of establishing MLPs (see table). These companies are spinning off some of their producing assets into MLPs.

“E&P MLPs can significantly reduce their susceptibility to commodity price volatility by hedging a large portion of production, sometimes out 3-6 years, which is a stark contrast from the past,” Freeman said. “Also, today’s MLPs are equipped with higher-quality, longer-lived properties that are controlled for risk exposure with conservative maintenance capital budgets.”

Private equity firm Quantum Energy Partners invested $15 million in a current MLP. Linn Energy LLC was formed in March 2003 and became a public company in January 2006.

Scott Soler, Quantum Energy managing director said, “The E&P MLP concept will get much bigger, although it will go through fits and starts.”

“In the 1980s, over 100 MLPs were formed, of which 31 were upstream MLPs. We believe that E&P MLPs could again represent at least 30% of the MLPs in this era,” Soler told participants of an Independent Petroleum Association of America seminar in August.

The MLP structure will continue to attract private equity because oil and gas fundamentals remain strong, offering investors above-market rates of return, he said.

Quantum Energy reports that during 1995-98, six energy private equity firms collectively raised $2.57 billion to fund overall energy investments. During 2005-06, seven energy private equity firms raised $16 billion to finance energy investments.

International financing

Some oil and gas companies receive financial support from multilateral financial institutions. International Finance Corp. (IFC), the private sector financing arm of the World Bank Group, backed BPZ Energy Inc. with its operations in Peru.

Other US companies IFC helped are Far East Energy of Houston with its operations in China; Improving Petroleum Resources of Irving, Tex., with Egyptian operations; and Toreador Resources Corp. of Dallas with its gas fields in Turkey.

Pan American Energy LLC signed a $550 million loan agreement with IFC, for development of Cerro Dragon oil field in the Golfo San Jorge basin in the southern province of Chubut, Argentina. IFC also may support Hunt Oil of Dallas and a number of partners in financing an LNG terminal in Peru.

IFC promotes economic growth in developing countries by financing private sector investment, mobilizing capital in international financial markets, and providing advisory services to businesses and governments.

Lance Crist, IFC’s head of oil and gas investments, said IFC’s role evolves over time, and it represents a stable, long-term source of capital. The role of IFC varies on a project-by-project basis.

IFC sometimes is an equity investor and sometimes is a lender. It offers a large range of financial instruments from senior debt to quasiequity and equity investments and also works with banks worldwide to set up large syndicated loans for IFC clients.

“In times of high capital availability, we become more selective in working with more junior players who are less able to access international markets, and where we can support best practice environmental and social standards and meeting community development needs,” Crist said. “We adjust our approach according to liquidity.”

IFC is BPZ’s second-largest shareholder, owning 10% of the company’s stock. BPZ also relied upon private placements of common stock, primarily with institutional investors in the US and a few in Europe.

Recently, BPZ closed on $15.5 million convertible debt financing with IFC. This is the first tranche of a three-tranche IFC loan package worth an estimated $165 million that will enable BPZ to continue developing Corvina field.

BPZ’s gas-to-power project involves the generation and sale of electricity in Peru along with gas sales into Ecuador for third-party power generation. This project is being done parallel with developing Corvina oil field and redeveloping Albacora oil field.

Manolo Zuniga, BPZ president and chief executive officer, said IFC’s commitment and BPZ’s production revenue helped BPZ grow without accessing equity capital markets.

Zuniga said the company’s transparency and experience in monetizing gas has helped attract financing. Initially, the company was funded by a reverse merger transaction in 2004 that transformed BPZ into a publicly traded company.

BPZ has license agreements for oil and gas exploration and production covering 2.4 million acres in four properties in northwestern Peru. It also owns a minority working interest in a producing property in southwest Ecuador.

MegaWest and heavy oil

A start-up company is working to develop heavy oil in the US. MegaWest Energy USA Corp., a unit of MegaWest Energy Corp. of Calgary, used an OTC Bulletin Board company and a series of private placements for its initial funding.

“MegaWest emphasizes the redevelopment of large bypassed US heavy oil projects,” said George Stapleton, president and chief executive officer. The company plans to use the best thermal recovery technologies developed in Canada.

During December 2006, the founders of what is now MegaWest bought Brockton Capital Corp. to establish a means to raise capital and acquire properties. Brocktonan inactive company that once sold keyboards for personal digital assistantsbecame a heavy oil company.

Brockton Capital entered into a series of letters of intent for property acquisitions. In February, the company changed its name to MegaWest.

Through December 2006 to March 2007, MegaWest organizers raised $34 million through three private placements and issued a number of share purchase warrants. If the warrants are exercised, Megawest has potential additional proceeds of nearly $23 million.

As of late November, the company had acquired four US heavy oil project areas with operatorship and ownership or the right to earn an interest in over 100,000 acres in Texas, Kentucky, Montana, Missouri, and Kansas. The property acquisition strategy continues.

MegaWest produces 100-150 b/d of 18-20º gravity oil through the Chetopa pilot project in Labette County in southeastern Kansas. MegaWest has 100% interest in Chetopa field where producing sands are analogous to Bluejacket and Warner sands in Missouri.

In October, MegaWest Energy USA closed a deal for over 33,000 acres in Montana for an estimated $2.25 million, including cash, shares, a carried work interest, and warrants.

Stapleton believes MegaWest can acquire heavy oil assets cheaper in the US than in Canada.

“The last 2-3 years, there has been tremendous interest in the oil sands of Canada,” he said. Operators in Canada generally obtain leases at auction from the Canadian government, which maintains a database on all drilled wells.

Historical information about potential US leases is “spread out all over the place,” Stapleton said, adding, “It’s much harder to assemble the land position here. You negotiate with each land owner as to what you pay.”

Bank loans in demand

Oil companies continue showing strong demand for bank loans, said Mark Fuqua, senior vice-president and manager of energy lending for Comerica Bank in Dallas.

The credit crunch, triggered by problems with subprime lending, probably prompted banks and brokerage houses to become “a little more reluctant” to take underwriting risks worth billions of dollars, he said.

“What happened was the subprime lending [problems across all types of business] hit a lot of the hedge funds and institutional players pumping a lot of capital into the market,” Fuqua said. “Some financial institutions have seen a number of write-downs already.... Some of that probably bled over into the energy sector. I don’t think there is any bank holding much in the way of losses in energy paper.”

The availability of private equity drives growth for new companies, which translates into demand for bank loans, Fuqua said. For many start-ups, debt is still cheaper than private equity.

He said many start-ups are oriented toward exploration or development and don’t have much of a reserve base yet with which to approach banks for reserve-based loans. “The market has been so super hot, particularly for anybody that can show some proved or probable reserves, that a lot of times these new companies sell quickly,” Fuqua said. “They can sell out sometimes before there ever is any bank debt.”

Cimarex Energy Co. has relied upon conventional bank financing to expand its oil and gas exploration and production operations in the Midcontinent, Permian basin, and Gulf Coast.

Tom Jorden, executive vice-president of exploration, said the company funds its drilling program from its operating cash flow. Yearend 2006 proved reserves totaled 1.45 tcf of gas equivalent.

“Most of our properties are cash-flow machines. We reinvest that and are self funding,” Jorden said. Third-quarter average production was 325.2 MMcfd of gas and 20,537 b/d of oil, Cimarex reported.

The Denver independent constantly is expanding its drilling program and optimizing production rates, he added. If a significant drilling opportunity for which Cimarex needed financing were to suddenly materialize, Jorden said the company would use bank debt.

He said the company is fiscally conservative and will continue to be so regardless of prices.

“Everybody looks good during good times, but a few of us remember when partners didn’t pay their bills,” Jorden said. “We are building a company that will weather the storm. We keep an eye on downside sensitivity.”

Meanwhile, Comerica’s Fuqua believes independents for the most part remain fiscally conservative despite high commodity prices and ample financing options. “They are using a lot of hedging,” Fuqua said of producers. “I think overall most of these guys have been around the block a few times, and they don’t want to overleverage their companies.”