Iraqi oil minister defends stance on oil contracts

Iraqi Oil Minister Husayn Al Shahristani has defended his country’s efforts to prevent international oil companies from signing exploration and production contracts with the Kurdish Regional Government.

In an interview televised via Dubai’s Al-Arabiyah satellite channel, Al Shahristani said current Iraqi law does not allow any governorate or ministry other than the oil ministry to conclude oil contracts until the new oil and gas law is enacted.

When the law is enacted, he said, a Federal Oil and Gas Council will be established, and it will be the authority to which oil contracts are submitted for approval.

Until then, he said, the constitution is clear: “Iraqi oil is for Iraq. The only side that represents all Iraq is the federal government, and it is not permissible for any part of Iraqi oil to be extracted and taken by whatever quarter without the Iraqi government’s agreement.”

Al Shahristani denied that any intimidation was behind Baghdad’s decision to exclude companies that have concluded agreements with the KRG from signing contracts in other areas of Iraq. “It is not a policy of arm-twisting,” he said, “It is a purely legal position.”

He said dealings with the KRG and companies have not shifted from diplomacy to threats to dissuade them from concluding contracts: “I do not call what is happening a threat to anyone. All I said is that they should considerand we are advising those companiesthat when they violate Iraqi laws that are in force, they must bear the consequences.”

Asked about his statement that foreign companies that produce oil on the basis of agreements concluded with the KRG will not be able to export the oil without the federal authorities’ agreement, Al Shahristani said that is clear, and the companies know it.

He repeated that revenues from the export of Iraqi oil must be paid into a single federal fund and distributed among all Iraqis in their various areas according to the density of population.

Earlier this month, Al Shahristani said India’s Reliance Industries Ltd. may find the going tough in acquiring future oil blocks in Iraq (OGJ Online, Nov. 20, 2007).

His remarks followed earlier reports that the KRG had signed five production-sharing contracts previously approved by its Regional Oil and Gas Council (OGJ Online, Nov. 13, 2007).

Kazakhstan, Eni JV near Kashagan tax agreement

Kazakhstan’s Deputy Finance Minister Daulet Yergozhin said the ministry is moving forward with tax checks into the Eni SPA-led Agip KCO consortium just days ahead of a Nov. 30 deadline for a deal between the consortium and the government on the Kashagan oil field.

“We have questions,” Yergozhin said. “We will expect answers to our inquiries over the next few days.” He said the ministry will be ready to present a tax claim against Agip-KCO before yearend.

Yergozhin’s statement followed recent reports of progress in talks between the government and the Agip-KCO consortium.

The Interfax-Kazakhstan news agency, citing an unnamed government source, said there is progress on the standpoints set forth in a memorandum to the effect that KazMunayGaz’s share in the project should be raised, that the amount of profit oil should be increased, and that spending should be cut.

“Now a proposal agreed by all contractors remains to be received in order for the government to consider it and take the appropriate decision,” said the official, adding that members of the consortium must submit their ideas to the Kazakh government by Nov. 30.

Court drops Ecuadorian suits against Chevron

The US District Court for the Northern District of California has dismissed the remaining two claims against Chevron Corp. alleging health impacts to Ecuadorian citizens resulting from a subsidiary’s oil operations that ended in 1992.

“The ruling, based on California’s 2-year statute of limitations, effectively brings the matter to an end,” Chevron said in a statement. It said the lawsuit was the third in a series of suits that had been launched by Cristobal Bonifaz, a Massachusetts-based trial attorney claiming to represent Ecuadorian plaintiffs.

The suits claimed chemicals and wastewater dumped by Chevron subsidiary Texaco Petroleum in the years it operated in Ecuador caused several inhabitants to develop cancer. In October, however, the judge imposed sanctions and a $45,000 fine against Bonifaz after the plaintiffs admitted they did not have cancer.

Chevron is still fighting a major lawsuit in Ecuador over claims of environmental damage. In October, the firm filed a petition with the Ecuador Superior Court seeking dismissal of that suit.

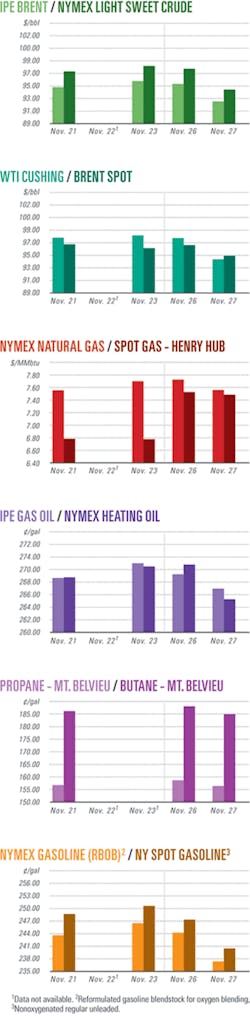

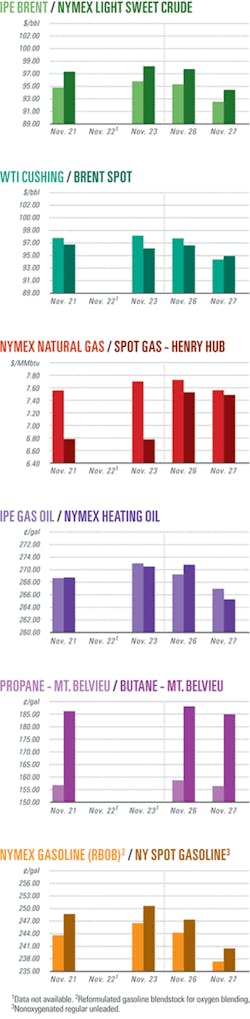

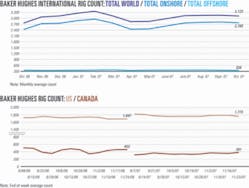

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesBrunei Shell makes Bubut offshore gas discovery

Brunei Shell Petroleum Co. Sdn. Bhd. has reported a natural gas discovery in the Bubut structure 7 km off Brunei and some 15 km from the Brunei LNG plant.

The Deep Driller 2 jack up drilled the exploration well in deep, high-pressure sand reservoirs. Shell said well logs and hydrocarbon samples confirmed the finding, but it did not release details.

Reports said that as a result of the Bubut discovery, Shell will reevaluate the nearby Danau structure, which was drilled in the 1970s. Additional appraisal work will be conducted in both fields to define their full potential.

Both fields would be developed in a single, integrated program, the company said.

“You can see the BLNG plant from the exploration rig. The discovery is in shallow waters and close to existing infrastructure and, as such, we are confident of bringing production on stream in the shorter term,” said Grahaeme Henderson, Brunei Shell managing director, in making the announcement to local media.

CNPC, PDVSA reach deal for Orinoco exploration

China National Petroleum Corp. said Venezuela has granted oil exploration rights in Sumano oil field to its joint venture with state-owned Petroleos de Venezuela SA (PDVSA).

CNPC said it will take a 40% interest in any commercial production in the block, with the balance reserved for PDVSA. The two firms will set up a joint venture to develop two additional blocks in Venezuela’s Orinoco heavy oil belt, but CNPC did not name the blocks.

China and Venezuela signed a series of oil development deals during Venezuelan President Hugo Chavez’s visit to China in August 2006, including one for CNPC and PDVSA to jointly develop a block in the Junin area of the Orinoco belt.

Afren to acquire block interests in Ghana, Angola

Afren PLC has agreed to acquire Devon Energy Corp.’s interests in two exploration blocks in Ghana and Angola. Afren will acquire a 95% working interest in and operatorship of the Keta Block off eastern Ghana and a 15% working interest in Angola’s Block 16.

The acquisition, which is subject to certain conditions, preferential rights, and governmental approvals, is in line with Devon’s strategy to sell off its West African assets, the company said. The Keta Block lies in the Volta River basin and covers 5,500 sq km. Devon, which had carried out extensive technical work in the area, identified primary targets as Upper Cretaceous deepwater sandstone reservoirs that have not yet been drilled. The play type is similar to the Mahogany and Hyedua discoveries to the west.

Further evaluation of reprocessed seismic data is ongoing, and the expected mean potential reserves are about 250-500 MMboe.

The current license on the block expires at the end of 2008 and includes one commitment well. The license can be extended for an additional 6 years, which is divided into three 2-year periods, each with a firm well commitment.

Ghana National Petroleum Corp. has a 5% carried interest in the block.

Block 16 off Angola lies within the Lower Congo basin and covers an area of 4,936 sq km. AP Maersk Co. Ltd. holds a 50% interest and operates the block. Other partners include Brazilian firm Odebrecht SA (15%) and Angola’s Sonangol EP (20%).

This exploratory block has nine wells and two discoveries of Miocene and Oligocene age. The discoveries, prospects, leads, and play types mapped in Block 16 are analogous to adjacent fields in Blocks 15, 17, 31, and 32. The plays are considered to be highly prospective with several leads and prospects identified. The expected mean potential reserves are about 1,000 MMboe. The discoveries on Block 16 are under appraisal with the potential for early development.

Trinidad and Tobago to award Block 2 PSC soon

Trinidad and Tobago’s Ministry of Energy and Energy Resources reported it will reach an agreement within the next 6 weeks with Tullow Oil PLC and Centrica Resources, enabling them to explore Block 2 (ab) off the eastern coast of Trinidad and Tobago.

The Caribbean island’s Director of Resource Management Helena Innis-King said she also expects a production-sharing contract (PSC) to be signed with Tullow Oil for the Guayaguayare shallow and Guayaguayare deep Blocks.

The three blocks are near BP PLC’s 163,000 b/d oil fields, which were discovered in the early 1970s, and not far from most of the country’s gas reserves.

Innis-King said failure to sign the PSCs more than 2 years after the blocks were first put out for bids was due to several factors, including the creation of new terms for PSCs and the fact that some bids did not meet the ministry’s expectations.

She explained, “I know it has taken longer than it should have, but the reality is that we were kept back because we were dealing with many issues, including local content, but I expect we will agree to production-sharing contracts by the end of the year.”

Innis-King also revealed that the merger of Statoil and Norsk Hydro ASA delayed negotiations with then-Statoil for a PSC in Trinidad’s ultradeep water.

Drilling & Production - Quick TakesBHP brings Stybarrow project on stream

BHP Billiton Ltd. has begun production, ahead of schedule, from the Stybarrow development on Block WA-32-L in the Exmouth subbasin 65 km off Western Australia’s North West Shelf. The $760 million development initially was expected to start up in early 2008.

Stybarrow lies in some 825 m of water, making it Australia’s deepest offshore development. It contains nine subsea wells that are connected to the 80,000 b/d Stybarrow Venture floating production, storage, and offloading vessel. Oil is produced from Eskdale field via a single well tie-back to Stybarrow field. This will be followed by production from adjacent wells in the field. Production is expected to ramp up to full flow during the next few months.

Eskdale and Stybarrow fields were discovered in February 2003 and have estimated to have total recoverable reserves of 60-90 million bbl, with a field life of 10 years.

Corvina oil field starts producing off Peru

BPZ Energy has begun oil production through the CX11 platform in Corvina field on Block Z-1 off northwestern Peru (OGJ, Nov. 5, 2007, Newsletter).

First production came from the CX11-21XD well, which reached a stabilized rate of 2,500 b/d of oil. The 21XD well was shut in after the first of two leased tankers was filled with 5,000 bbl of oil to allow the company to finish the dual completion of the CX11-14D well.

The 14D well, which has an expected maximum design throughput of 28 MMcfd of gas, flowed at a stabilized rate of 1,900 b/d through its oil tubing, producing 5,000 bbl into the second tanker. No formation water was detected in either well.

The two Navy tankers will deliver this first 10,000 bbl of Corvina oil to a recently refurbished 40,000 bbl transport barge moored adjacent to Petroperu’s 62,000 b/d Talara refinery 70 miles south of the field. Once the transport barge is filled to near capacity, the oil will be off-loaded into the refinery.

The company expects to achieve average oil production rates of up to 2,500 b/d.

Production is expected to increase to 4,000 b/d by yearend or early next year when a 40,000 bbl floating production, storage, and offloading vessel is in service.

BPZ plans to bring the next well, CX11-18D, on line in the first quarter of 2008.

Juanambu discovery on stream in Colombia

Gran Tierra Energy has placed the Juanambu-1 discovery well on production on the Guayuyaco Block in the Putumayo basin of southern Colombia, said partner Solana Resources Ltd. Both companies are based in Calgary.

Juanambu was discovered and tested in the first half of this year (OGJ Online, Aug. 28, 2007). It is currently producing about 1,400 b/d of oil, 450 b/d net to Solana.

State-owned Ecopetrol recently approved Juanambu field commercial and exercised an option to back in for a 30% interest. Gran Tierra and Solana each will retain a 35% interest in the field.

Meanwhile, on the Catguas Block in northeastern Colombia, operator and 100% interest holder Solana on Nov. 16 spudded the Cocodrilo-1 well, which is expected to take 3 weeks to drill.

Cocodrilo-1 targets the Eocene Barco and Paleocene Catatumbo formations, which are oil-bearing in the Solana’s nearby Tres Curvas-1 new field discovery (OGJ Online, Sept. 17, 2007).

Sakhalin Energy shuts in oil at Vityaz complex

Production of 80,000 b/d of oil has been suspended from the Vityaz complex off northeastern Sakhalin Island because of turbulent weather, Sakhalin Energy Investment Co. (SEIC) said Nov. 26. It also has stopped using the Okha floating storage and offtake vessel.

“While preparing to reconnect the Okha over this weekend it became apparent that the single-anchor leg mooring (SALM) buoy at the Vityaz complex has suffered damage. The cause of the damage is being investigated,” SEIC added. “Oil spill response and other vessels are at the scene to avoid the chance of further release of oil.”

A company spokesman told OGJ it would be impossible to predict when the weather would become calm. He added that SEIC estimates that less than 10 l. of oil had escaped into the sea because of damage to the SALM. “Before [the investigation] is concluded, it is hard to say when it will be repaired.”

Oil production from Vityaz is usually shut in from mid-December until early May or June because of ice.

Processing - Quick TakesArgentina to hike taxes on oil, products exports

Argentina plans to increase taxes on exported oil and refined products to keep domestic prices at below-market levels, according to a statement issued by the ministry of planning.

In the statement, Minister of the Economy Miguel Peirano said that when prices rise on international markets, taxes are an instrument the government can use to guarantee prices on the internal market. The government did not issue specific details of the planned tax increases.

Foreign-owned refinery licensed in Vietnam

Vietnam’s central Phu Yen Province has licensed a joint venture of the UK’s Techno Star Management (51%) and Russia’s Telloil (49%) to build a 4 million tonne/year refinery.

Capitalized at more than 27,480 billion Vietnamese dong ($1.7 billion), the Vung Ro refinery in the province’s Dong Hoa district will be the country’s first wholly foreign-owned refinery.

An official from the Phu Yen Planning and Investment Department said the Vung Ro refinery should become operational in 2012, when Vietnam’s demand for petroleum products will surge to an estimated 20 million tonnes/year from 12.5 million tonnes in 2006.

Meanwhile, a $3.7 billion project to build the Long Son refinery complex in southern Ba Ria Vung Tau Province is awaiting an investment license, according to the Vietnam Oil & Gas Group (Petrovietnam).

Nguyen Viet Son, director of Petrovietnam’s Oil Processing Department, said his group and the Vietnam Chemical Corp. will contribute 29% of the total investment. The remaining 71% will be provided by two Thai partners, Siam Cement Group and Thailand Plastic Co. If licensed, the first phase of the project is scheduled for completion in 2011 and the whole project in 2013.

Petrovietnam plans to build three refineries with combined capacities of 20 million tonnes/year, two in central Thanh Hoa and Quang Ngai Provinces and one in southern Ba Ria Vung Tau Province. Vietnam imported nearly 10.4 million tonnes of petroleum products in the first 10 months of 2007, 12.1% over the comparable 2006 period, according to the General Statistics Office.

Suncor’s Sarnia plant upgrade nears completion

Suncor Energy Inc. said the final phase of a 3-year upgrade project at its 70,000 b/cd refinery in Sarnia, Ont., is almost complete.

The final phase involved a 3-month shutdown of certain units to facilitate tie-in of new facilities. The company said the refinery currently is ramping up to full production.

The tie-ins are a part of a $1 billion investment to increase the refinery’s ability to process sour crude from the company’s oil sands operations in Northern Alberta, as well as to improve the facility’s environmental performance by reducing sulfur dioxide emissions, and to enable the production of ultralow-sulfur diesel.

The upgrades to enable production of ultralow-sulfur diesel were completed in 2006.

Transportation - Quick TakesSteady flow may be near for Colombia’s Rubiales

Petro Rubiales Energy Corp., Vancouver, BC, said it plans to truck Rubiales field crude to Guaduas field in Colombia for export via the OCENSA pipeline, gradually ending local sales of the heavy oil and as much as doubling netbacks eventually.

Once it reaches Guaduas, the 12.5° gravity Rubiales crude will be blended with crude as light as 18° gravity and the diluted blend will be shipped via the pipeline to the Covenas terminal on the Caribbean Sea as part of the Vasconia stream.

Volumes of as much as 4,000 b/d are to be trucked shortly. New Guaduas unloading facilities expected to be available at the end of first quarter 2008 are to be able to handle 20,000 b/d.

Shipments are expected to grow later to 200,000 b/d with construction of a pipeline to eliminate the trucking. The line is expected to begin service in third quarter 2009.

Petro Rubiales, which said it plans to expand production capacity at Rubiales field to 126,000 b/d from 24,000 b/d, has announced a plan to merge with Pacific Stratus Energy Ltd., Toronto, which owns the tank farm at Guaduas field on the Caguan Block (OGJ Online, Nov. 13, 2007).

Sinopec, Iran gas supply dispute halts LNG plant

Sinopec has stopped work on an LNG receiving terminal in the coastal city of Qingdao, in China’s Shandong Province, because it has been unable to secure sufficient gas supplies following the collapse of a planned agreement with Iran.

The $607 million regasification projecta joint venture of Sinopec and power firm China Huaneng Groupwas to have an initial capacity of 3 million tonnes/year of LNG, rising to 5 million tonnes/year during a second phase. Construction was originally scheduled to start in 2006 and complete in 2007.

China and Iran signed a memorandum of understanding in 2004 for Sinopec to buy 10 million tonnes/year of LNG from Iran for 25 years, but reports suggest that the two sides have failed to agree on contract terms. The Iranians reportedly think Sinopec’s price offer is too low, while Sinopec is said to be concerned that Iran’s political instability poses investment risks to the project.

Sinopec reportedly is seeking new supply sources in Australia and is considering changing the location of the proposed plant. Reports did not say where.

Two Japanese partnerships order LNG carriers

Nippon Yusen Kaisha (NYK) Line has signed partnership agreements with two other Japanese firms for joint ownership of LNG carriers.

In the first, NYK and Tokyo Gas Co. subsidiary Tokyo LNG Tanker Co., Ltd., both of Tokyo, signed a joint ownership contract with Kawasaki Shipbuilding Corp. for construction of a 177,000 cu m capacity LNG carrier. The companies also signed a heads of agreement for joint ownership and a long-term charter for the carrier.

NYK Line will hold a 90% stake in the ship, while Tokyo LNG will hold the remaining 10%. NYK Line also was appointed ship manager under the 20 year-term time charter that will start from 2011, when the vessel will be completed.

Construction of the tanker will start in fiscal 2009. The Moss-type carrier will be equipped with four spherical tanks and will be equipped with a Kawasaki advanced reheat turbine plant for propulsion, enabling 15% higher fuel efficiency.

After its completion, the ship will transport LNG from the Northwest Shelf Expansion, Malaysia I and III, the Darwin Project, Sakhalin-2, Pluto, and Gorgon among others.

The agreement marks the second new carrier that NYK will co-own solely with Tokyo LNG Tanker, following a 153,000 cu m capacity carrier planned to be completed in 2009. After completion, this newbuild carrier will be used in an LNG transportation project for Tokyo Gas Co. Ltd., said NYK Line.

In another joint ownership deal, NYK and Mitsui raised $700 million through a syndicated loan to cover some 70-80% of the construction costs for four 145,000 cu m LNG carriers.

Mitsui and NYK will jointly own the four vessels, which are being built by Mitsubishi Heavy Industries and Kawasaki Heavy Industries. The first ship will be delivered in 2009, with the others being delivered in 2010-11.

NYK and Mitsui have already chartered these ships to Taiwan’s Chinese Petroleum Corp. for 25 years. CPC will use the vessels to transport 3 million tonnes/year of LNG to Taiwan from Qatar.

TransCanada applies for pipeline expansion

TransCanada Corp. has requested approval from Alberta regulators to construct a 300-km, 42-in. natural gas pipeline on the northern Alberta system to deliver more gas to oil sands producers.

The Calgary company filed an application Nov. 21 with the Alberta Energy and Utilities Board for a construction permit for the 800 MMcfd capacity line. The estimated capital cost of this expansion is $983 million (Can.). The expansion, called the North Central Corridor pipeline project, is intended to address anticipated increased gas demand, resulting largely from increased oil sands development, TransCanada said.

The proposed pipeline would connect the northwestern Alberta system at the existing Meikle River compressor station to the northeast portion of the system at the existing Woodenhouse compressor station.

Construction is anticipated to begin in late 2008.

The first segment of the pipeline is expected to be completed in April 2009. TransCanada anticipates completing the second segment and putting it in service in April 2010, the company said.