Robust pricing for oil and gas continue to drive North American fleet growth in the drilling market, and the number of land and marine drilling rigs continues to increase worldwide, according to Grant Prideco’s 54th annual ReedHycalog rig census.

The census data represent activity during 45 days, May 2- June 15, 2007. A rig is counted as being active if it has “turned to the right” at any time during the 45-day period.

North American rig fleet utilization has decreased over the past year.

The US fleet rose to 2,817 rigs, up 23% from 2006, but utilization dropped to 85%, down 11% from a year earlier. The increase in the fleet resulted from 614 additional rigs, of which 349 were newly constructed; the remainder reactivated or refurbished (189), built from components (71), or moved in from another country (5). Rigs were also taken from the US fleet; 77 were removed from service (cold-stacked), 14 were moved out of the country, and 4 were destroyed.

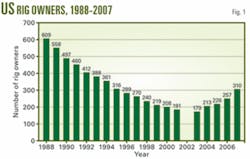

The total number of US rig owners increased to 310, up 53 from 2006, as more companies entered the drilling market (Fig. 1). This number is building back up from a low in 2002 and has reached about the same level as 1995.

The Canadian fleet reached a record high of 871 rigs, up 9% (net 73 rigs) from 2006, but utilization fell to 43%, down from 84% utilization in 2006. All the rigs added to the Canadian fleet were either newly constructed (86) or assembled from components (2). Sixteen rigs left the fleet; 10 were moved out of Canada and 6 were retired or used for parts.

This is the third year that the census has tracked international land rig activity, with coverage increasing each year. Overall international utilization was 94% for 2007, down from 95% in 2006. Rig utilization in Africa showed the largest drop, to 86% in 2007 from 99% in 2006, attributed to a drop in shallow barge drilling in Nigeria.

ODS Petrodata provides data on mobile offshore drilling units to the census. The global MODU fleet remained about the same, with a net drop of 4 units, but utilization rose to 88%, up from 85% in 2006. Fleet additions include 11 newbuilds and 11 reactivated rigs. Another 26 rigs were reclassified as retired, having not worked in more than 5 years.

ReedHycalog Pres. John Deane presented the results of the rig census and drilling contractor survey on Nov. 2 at the International Assoc. of Drilling Contractors’ 2007 annual meeting, in Galveston, Tex. A summary of the data is available at www.grantprideco.com/rhrigcensus/2007censushistory.xls.