Energy system limits future ethanol growth

The rapid increase in ethanol consumption during 2002-06 will prove to have been a one-time event that captured two thirds of the ultimate near-term market.

Growth beyond the remaining third of ethanol’s potential will depend on ethanol’s ability to replace gasoline as a primary fuel.

Gasoline replacement by ethanol is constrained by two factors: The gasoline-ethanol distribution infrastructure does not deliver ethanol for gasoline blending everywhere in the country, and there are physical limitations on existing vehiclesall 240 million of themas to how much ethanol they can use in combination with gasoline.

Ethanol’s surge

Ethanol has been around since the internal combustion engine was invented. Used intermittently as an octane booster over the years, it received renewed interest with the Energy Tax Act of 1978, which offered a 4¢/gal blending credit for “gasohol.” That worked out to 40¢/gal of neat ethanol. The American Jobs Creation Act of 2004 streamlined the credit and expanded it to 51¢/gal for ethanol blended with gasoline.

The Energy Policy Act of 2005 (EPACT) mandates more use of ethanol, 4 billion gal in 2006 and 7.5 billion gal in 2012 and years thereafter. Current consumption, because of this boom in ethanol use in the last year, exceeds 6 billion gal/year.

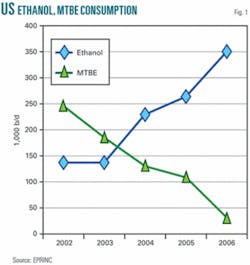

Between 2002 and 2006, ethanol consumption increased by a factor of 2.5, from 2.1 billion gal to 5.4 billion gal. While this gives the illusion of boundless consumption of ethanol in the future, it would be a mistake to translate that growth rate ad infinitum. The reason ethanol became such a hot item in 2006 was that the additive methyl tertiary butyl ether was removed from the gasoline pool because of public displeasure with leaks of the substance into water supplies and the related threat of defective-product litigation against refiners.

The MTBE phase-out had been under way since 2000, when public opposition to it began to grow. Consumption, which had peaked at about 300,000 b/d, ceased last year. About 400,000 b/d of ethanol poured into the market to replace MTBE as an oxygenate, octane booster, and supply extender.

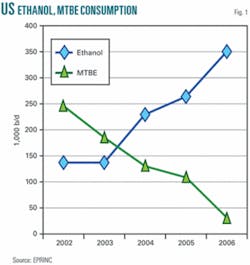

Fig. 1 shows the ramp-down of MTBE and the ramp-up of ethanol sales. Fig. 2 shows pricing phenomena that led to almost a tulip-mania style bubble for ethanol. The ethanol price peaked in the middle of summer 2006 at almost $4.50/gal, in contrast to wholesale gasoline, which also jumped last year but only to $2.25/bbl.

Ethanol’s price surge certainly spurred interest in producing ethanol, which was hugely profitable. As domestic ethanol production ramped up with the opening of more and more ethanol plants, prices of ethanol and gasoline began to converge. In recent months ethanol became cheaper than gasoline as the supply increased.

US ethanol plant capacity grew, with 131 operating plants capable of meeting all US needs right now: The capacity is 7 billion gal/year or 460,000 b/d. The 72 plants now under construction will raise capacity to about 880,000 b/d, almost 10% of US gasoline consumption and well above the EPACT 2012 mandate.

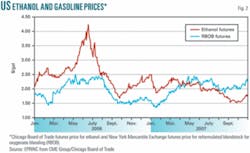

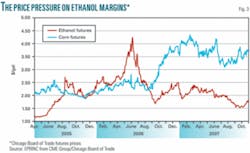

Rising demand for ethanol has of course increased demand for corn, the price of which last year doubled (Fig. 3). Now ethanol producers are buying more corn and driving corn prices up as they increase output and push ethanol prices down. An ethanol oversupply has developed while corn demand remains high.

This year US corn plantings reached their highest level since 1944. Corn acreage has increased 15% at the expense of other crops, notably cotton (acreage down 20%) and soybeans (acreage down 11%). Cotton and soybean prices will be higher because of smaller plantings. Those increases will occur with corn prices already high and likely to go higher by 2008.

Not new oil

Ethanol is not the new oil; it is new but something different. Or maybe it is the same old thing but a new fashion statement.

Ethanol’s energy content is only two-thirds that of the same amount of gasoline. Volumes of ethanol don’t hold comparable energy values, either. Wholesale prices of ethanol currently are $1.80/gal, which translates to about $2.70/gal for wholesale gasolinebefore tax, dealer mark-up, and transportation cost.

Ethanol raises widely recognized physical issues. Because it tends to separate from gasoline in the presence of water, gasoline-ethanol blends can’t be shipped by pipeline. So ethanol is transported mostly by rail at up to four times the cost of oil products moved by pipeline. Because the blend has a short shelf life, ethanol and gasoline must be mixed near the point of retail sale.

Distribution limits keep ethanol blends out of some US markets. As a result, the average ethanol content of all US gasoline is below 5%, less than half the concentration that all automobiles can use.

While there has been talk about flexible-fuel vehicles able to use fuels containing 85% ethanol (E85), only 6 million of the 237 million vehicles now on the road are FFVsand most don’t burn E85. Only 1,200 retail establishments sell the fuel.

President George W. Bush has elicited a pledge from the Big Three automakers that half their 2012 output will be FFVs. Foreign automakers have not shown much interest in doing the same; they have other ways of achieving high mileage per gallon.

In 2017, when the president wants gasoline use to have been cut by 20%, there will be 280 million vehicles on the road in the US, not many of which will be FFVs. Even if Detroit meets its pledge to Bush, only 25% of the new vehicles sold in any given year will be FFVs.

Easy amount blended

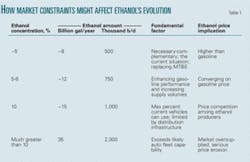

What does all this mean? There is an easy amount of ethanol that can be absorbed in the gasoline pool (Table 1). That is about 5%, and that is where the market is now: about 8 billion gal/year, or 500,000 b/d.

At that level, ethanol is a necessary and complementary component of the gasoline pool. It is the current situation. It represents the replacement of MTBE in an economic environment that accommodates ethanol prices higher than gasoline prices.

But a lot of production capability is under construction and soon will be available. The additional ethanol will be hard to absorb into the gasoline pool, given the 10% effective cap and the lack of distribution facilities.

Certainly increasing volumes can be supplied, and gasoline performance can be enhanced, but at the same time, with all this capacity coming on line, ethanol prices will converge on gasoline prices on a btu-adjusted basis. If the market is oversupplied, adjusted ethanol prices will be lower than gasoline. The 10% theoretical maximum that can be used in current vehicles would be hard to achieve because of the distribution conflicts. With ethanol production capacity soon to about double, reaching 15 billion gal/year, the potential for an ethanol price slump is high, and it would result in stranded ethanol plant investment and pressure by ethanol producers for new subsidies.

For years beyond 2012, there are proposals for ethanol sales mandates that assume concentrations in gasoline above the current 10% cap. How that might be achieved is an unanswered question, given that only US automakers espouse the plan, and they account for only about half of US vehicle sales.

Proposals for sharply increased ethanol sales simply assume that auto manufacturers will warranty existing cars for fuel blends containing far more than the current 10% maximum.

Cellulosic ethanol

The role of cellulosic ethanol in the gasoline pool remains in question. Ethanol from plant wastes must transition from lab to commercial activity. That hasn’t happened.

Cellulosic ethanol would be a good supplement for the corn ethanol now prevalent in and essential to the gasoline pool. It would minimize crop-cycle risk and alleviate the conflict between food and energy consumers. Additionally, it would mitigate the inflationary impact of ethanol on agricultural commodities, which is often unmeasured because most price indexes exclude food and energy, sweeping under the rug some very real price pressures in the economy.

Assuming away vehicle compatibility issues, even if cellulosic sources become commercially viable on the most optimistic schedule, consumption of ethanol still won’t exceed 10% of gasoline supply without substantial changes in the stock of capital: pipeline transport and terminal facilities; retail facilities able to dispense E85; universal distribution across the country; and a change in the automobile stock to facilitate the use of higher concentrations of ethanol in gasoline.

Investors have been quick to back ethanol production, but infrastructure has attracted little interest. Financing such infrastructure as pipelines is challenging. There are special vehicles for raising capital in the pipeline and midstream segments of the industrythe master limited partnership is onebut raising capital for projects requires special efforts.

Refining vs. ethanol

Investment in refining has lagged at the same time that ethanol plant investment has been robust. Refining capacity grew by only 600,000 b/d in the past few years, while imports of oil products grew by 1 million b/d. A new energy-security issue is emerging: The US depends not only on other nations’ crude oil but increasingly on other countries’ refining capacity.

US refining capacity now operates at very high utilization rates; as a consequence, it has diminished ability to deal with outages and scheduled maintenance. Largely because of refinery outages, pump prices rose from $2.15/gal last January to $3.25/gal in June. Strain on refinery capacity has become its own energy security issue.

Ethanol and oil now compete for capital. They also compete for materials and services in facility construction. Ethanol may be crowding out investment in refining.

The threat of additional ethanol mandates has chilled refining and transportation investment even though the US needs new refining capacitya need highlighted by the jump in gasoline prices that occurs each time gasoline imports drop below 1 million b/d.

Policy aims

The policy aims driving ethanol expansion are sound: controlled growth and perhaps a reduction in petroleum imports; protection of the economy against oil price shocks; domestic fuel supply capacity more in line with consumption than it is now and less vulnerable to mishap.

Depending on an agricultural commodity to accomplish these goals, however, just adds the risk of the crop cycle to present instabilities. That dependency will be a concern until ethanol from cellulose becomes economic and available in large amounts.

More immediately, the ethanol industry faces the stresses of consistently high corn prices, weakening product prices, the consequent compression of margins, and the possibility of producer consolidation.

How the immediate stresses affect the ultimate shape of an industry still in its formative stages remains uncertain.

What is certain is that the modern energy economy has constraints on how much ethanol it can absorb.

The author

Larry Kumins became vice-president of research and analysis at the Energy Policy Research Foundation Inc. in February 2007. Before that he was a research specialist in energy policy at the Congressional Research Service (CRS) in the US Library of Congress. He has over 30 years of research experience in a wide range of oil and natural gas policy and economic issues with special expertise in fuel supply, trends in petroleum supply and demand, natural gas regulatory policy, oil imports and exports, the Organization of Petroleum Exporting Countries, and world oil market developments. His recent work at CRS included detailed assessments of the price and supply effects of Hurricanes Rita and Katrina.