DRILLING MARKET FOCUS: Operators build-to-own in tight DW rig market

Operators are building their own deepwater rigs to ensure availability for their drilling commitments.

Flush with capital, international oil companies are looking for core business investments to augment their stock buy-back programs. National oil companies are also profiting handsomely from rising crude prices and have ambitious program goals at home and abroad. Faced with a tight market for deepwater rigs and ever-increasing day rates, IOCs and NOCs are opting to build their own.

Project demand

The Tenth Biennial Simmons & Co. International Offshore Europe Energy Conference, held in Gleneagles, Scotland, in September, featured six energy industry panel discussions; four touched on the rig market.1

Growth in Latin America was described as “explosively strong” in the international oil service panel, with an “extraordinary revival” in Mexico’s drilling activity, following 2 years of “stagnation.”

The panel estimated that Petroleos Mexicanos E&P’s onshore Chicontepec initiative would require 15,000 new wells to generate a production output of 1 million bo/d. In August, Pemex granted a 4-year contract to ICA Fluor, jointly owned by Fluor Corp. and Empresas ICA, to manage engineering, procurement, and construction of surface facilities at Chicontepec (OGJ Online, Aug. 14, 2007). Schlumberger has already signed a 4-year contract to oversee drilling and oil services for 500 new wells in Chicontepec II.

Bids for Chicontepec III, another 500-well project, were due in October.

Brazil’s 5-year E&P budget increased 30-35%, based on recent revisions by Petrobras.

Saudi Arabia’s offshore Manifa heavy oil project will require about 40 offshore rigs capable of horizontal and extended reach drilling, the panelists noted. Saudi Aramco expects the Persian Gulf field to produce 900,000 b/d of Arabian Heavy crude and 120 MMscfd of gas by 2011 (OGJ Online, Feb. 8, 2007).

The company let a front-end engineering and design (FEED) and Manifa project management services contract to two units of Foster Wheeler Ltd. (OGJ, Nov. 6, 2006, p. 8); signed a contract with Belgium dredging contractor Jan De Nul for work at Manifa (OGJ Online, Feb. 8, 2007); and let a lump-sum turnkey contract to J. Ray McDermott Inc. to design, procure, fabricate, transport, install, and connect offshore platforms for Manifa (OGJ, June 11, 2007, p. 9).

India offers a “very big exploration market” and the panel described it as “ramping [up] very hard.”

Newbuilds

As of mid-November, there were 43 semisubmersibles and 24 drillships under construction, including 5 new ship orders since September (OGJ, Sept. 24, 2007, p. 41).

Representatives from Cameron International, FMC Technologies Inc., Grant Prideco Inc., and National Oilwell Varco Inc. formed the Capital Equipment panel at the September Simmons conference. They noted 83 jack ups under construction with newbuild costs for a conventional high-end jack up running about $220 million, up from $150 million in 2004.

Additionally, the panelists said 73 deepwater rigs were under construction or being upgraded, with newbuild costs for a high-end semisubmersible running $600-650 million, up from $300-400 million in 2004. High-end drillships are being built for $650-700 million, with the recent GlobalSantaFe drillship estimated at $740 million (OGJ, Sept. 24, 2007, p. 41), up from $450 million in 2004. Shipyard space is limited, with 2010 delivery slots nearly gone.

The chairman of Awilco Offshore ASA, Sigurd Thorvildsen, and the chief financial officer of Seadrill Ltd., Trond Brandsrud, anchored the Simmons panel of Norwegian Offshore Drillers. Their outlook on day rates and long-term contract opportunities was essentially the same as that of the US offshore contract drillers. The Norwegians said there were good possibilities for long-term (3-5 year) contracts at $500,000/day or higher. Brandsrud said the all-in leading edge costs for a new semisub were $600-650 million, and $650-700 million for a drillship, less than GlobalSantaFe’s leading edge estimates of $750-800 million for a sixth-generation semisub.

The Norwegian drillers thought operating expenses in the drilling industry would continue to increase about 10%/year, although Simmons & Co. models predict 15% annual inflation for 2007-10. Deepwater rig commissioning will be the “biggest execution hurdle” faced by the owners of new rigs.

IOC fleets

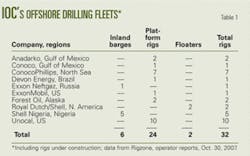

IOCs own only a handful of inland barges, platform rigs, and floaters, and no jack ups. The 32 rigs represent only 3% of the worldwide fleet of 1,089 offshore drilling rigs (Table 1). Many other rigs are on long-term contract to IOCs but out of their direct control. There seems to be a slowly growing trend among IOCs to put capital into newbuilds. This is a financial step up from their capital investments in substantial upgrades of floaters locked into long-term contracts.

With a great number of new jack ups coming into the competitive contract market, operators recognize they are better off investing in semisubs and shipsin shorter supplythat can be used in deepwater drilling programs.

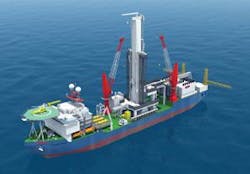

In October, Shell EP Offshore Ventures Ltd. and Frontier Drillships Ltd. signed a joint-venture agreement to build a new drillship for deepwater and arctic work (Fig. 1). The “Bully 1” rig is a customized version of GustoMSC’s pressure-riser drilling PRD 12,000 MPT-DP design drillship. The ship will have an ice-class hull and a Huisman-Itrec multipurpose tower (MPT) drilling system. The MPT is a box-like structure, instead of a lattice-derrick, containing two sets of drawworks for dual-activity work.2

(A month before the Shell and Frontier contract, GustoMSC announced that GlobalSantaFe Corp. selected the P10,000 drillship design, with dual lattice-type derricks, to be built by Hyundai Heavy Industries in Korea.)

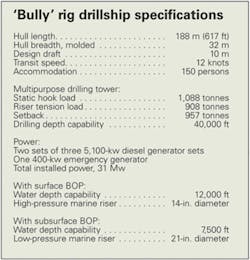

The new “Bully” ship will be able to drill in 12,000 ft water with a surface BOP and 14-in. diameter, high-pressure marine riser or drill in water as deep as 7,500 ft with a traditional subsurface BOP and a 21-in. diameter, low-pressure riser (see rig spec box on p. 42). The hull length, at 188 m, is slightly longer than the 166 m of the original PRD 12,000 design.2

Shell E&P Executive Vice-Pres. Matthias Bichsel said the company needs drillships in the short to medium term for its drilling programs, and the Bully rig will meet requirements “at a lower cost and with improved environmental performance.”

GustoMSC designed modifications to the new drillship with assistance from Frontier Drilling and Shell. The compact design requires less steel and will operate with lower emissions due to reduced fuel use from efficient engines.

Frontier will operate the ship, which has yet to be named, after its delivery from Singapore in early 2010. It will initially work under a 5-year contract for Shell beginning in the Gulf of Mexico. Shell expects to be able to deploy it rapidly to other projects in Brazil, Nigeria, Northwest Europe, and the Far East. Bichsel said control over deployment “brings tremendous advantages for managing...drilling prospects and their sequencing.”

Shell International E&P’s Peter J. Sharpe, vice-president technical for wells, told OGJ that it was time for an innovative rig concept, rather than assuming that bigger is better. The “bully” rig name was coined by Shell’s Mike Humphries. Sharpe said the rig’s strong points are the low center of gravity, better use of space, and anticipated environmental performance, along with a “great power-to-weight ratio.”

Sharpe said the new ship design, use of surface BOPs and expandable tubulars, and seabed pumping will allow Shell to exploit many different opportunities worldwide.

NOC fleets

National oil companies own 16% of the world’s offshore rigs, including 22 drilling barges, 40 platform rigs, 68 jack ups, and 17 floaters (Table 2). In addition to the 147 rigs they own directly, they may indirectly control others through long-term contracts.

Many NOCs are building additional land and marine rigs, and their fleets will remain more heavily capitalized than the tiny IOC fleets for the foreseeable future.

CNOOC, Gazprom, and the National Iranian Oil Co. have semisubmersibles under construction. Three of these semisubs were announced after OGJ’s recent tabulation of offshore rig construction projects (OGJ, Sept. 24, 2007, p. 41). After years of delays, OAO Gazprom is building two Arctic semisubs. NOV recently signed a letter of intent to provide drilling equipment for about $250 million/rig.1

China National Offshore Oil Corp. (CNOOC) is building its first deepwater rig, a Friede & Goldman design that will be delivered in 2011. The $599 million semisub project is part of $2 billion plans to invest in deepwater exploration and development equipment.

According to China Daily, more than 200,000 sq km of the country’s coastal waters are deeper than 300 m. The semisubmersible is under construction at Shanghai Waigaoqiao Shipbuilding Co., a subsidiary of the China State Shipbuilding Corp.3

Petrobras Netherlands BV (PNBV), a full subsidiary of Petrobras, has two dynamically positioned drillships under construction in Korea, to be delivered in 2009 and 2010.

SCORE

GlobalSantaFe Corp.’s Summary of Offshore Rig Economics increased 2.4% worldwide to 139 in September, up from 135.8 in August. The SCORE compares the profitability of current mobile offshore drilling rig day rates to the profitability of day rates at the 1980-81 drilling peak, when SCORE averaged 100. The 2.4%/month increase was driven by a 5.3% increase in jack up profitability; semisub activity was flat month-over-month. Worldwide SCORE is up 8.5% from a year earlier.

Regionally, the SCORE increased substantially in Southeast Asia (9.8%) and in the Gulf of Mexico (3.4%) from the previous month but increased only 0.2% in West Africa and decreased 0.5% in North Sea. Southeast Asia has also shown the highest year-over-year increase, up 41% from September 2006.

References

- “Simmons & Co. International Tenth Biennial Offshore Europe Conference 2007,” Energy Industry Research Report, Sept. 17, 2007, 15 pp.

- Hendricks, Sjoerd, Westhuis, Jaap-Harm, and Ooijen, Martijn “GustoMSC drill ship designs increasing efficiency in deepwater operations,” presented at 2007 Deep Offshore Technology Conf., Stavanger, Oct. 10-12, 2007.

- “CNOOC building deepsea drilling rig,” Oct. 23, 2007, www.MarineLink.com.