OGJ Newsletter

US independents urge Congress to change

As oil prices approach $100/bbl, eight associations representing US independent oil and gas producers asked Congress to consider the consequences of passing legislation that would reduce domestic supplies further and increase prices even more.

“Increasing taxes on the industry by $16 billion to pay for renewable fuels, restricting development of federal lands (onshore and offshore), and implementing new and unnecessary environmental restrictions doesn’t produce additional American oil or natural gas. As a matter of fact, these policies would be counterproductive and increase prices to consumers,” the associations said in a Nov. 7 joint statement released Nov. 13 by the Independent Petroleum Association of America.

“The failed energy policies since the 1970s have been a major contributor to the decline in US oil production from 9 million b/d to 5 million b/d, and the rise in imported oil from 5 million b/d to 12 million b/d. If the bills being pushed by the [congressional] leadership pass, that trend will continue, and prices to consumers will rise and become even more volatile,” they indicated.

The Texas Alliance of Energy Producers, Texas Independent Producers & Royalty Owners Association, Ohio Oil & Gas Association, Kansas Independent Oil & Gas Association, Oklahoma Independent Petroleum Association, Independent Oil & Gas Association of West Virginia, and the Independent Oil & Gas Association of Pennsylvania also signed the statement, which the groups developed during IPAA’s 2007 annual meeting.

Analyst predicts oil-price decline next year

Oil prices will decline as demand for oil from the Organization of Petroleum Exporting Countries flattens or recedes in 2008, says Michael Lynch, president of Strategic Energy & Economic Research.

Lynch told the American Petroleum Institute’s Houston Chapter that current oil prices are not sustainable. He predicts growth in non-OPEC oil production over the next 5 years and believes the US has seen a peak in gasoline demand, with car buyers now choosing smaller vehicles.

Although dependent on changes in OPEC output, the oil price Saudi Arabia wants to defend, and the condition of the global economy, price weakness will likely occur as soon as the second quarter of next year, when Lynch sees an oil price of about $70/bbl. He thinks inventory pressures will lead to a sustainable long-run oil price of $40-45/bbl.

The consequences of a price collapse will be that US onshore drilling stagnates, exploration and production in the shallow Gulf of Mexico declines, and a possible pause in oil sands development, Lynch said. High-cost producers will be most affected by a drop in prices, especially those with sunk costs. Also, alternative energies such as biofuels and hydrogen will feel a pinch from lower oil prices, as will exporting nations and refiners.

The entities that thrive despite lower prices will be producers with large cash reserves and governments friendly to foreign investment. But companies spending most of their cash flow now will suffer and become takeover targets.

Lynch also sees a near-term drop in US natural gas prices. A combination of record amounts of gas in storage, a predicted warm 2007-08 winter in the US, a slower economy, and new supplies coming online will depress prices over the next few months, he said.

WEC: China, India need huge energy investment

China will need $3.7 trillion worth of investment for energy projects by 2030, of which three fourths will be dedicated to electric power alone, India’s secretary for power said Nov. 14 at the World Energy Congress in Rome. India, by contrast, will require $1.25 billion, with a similar share for power.

Anil Razdan said both countries need technology that will reduce emissions of coal used for power generation because oil and gas imports are too expensive. Market forces alone cannot develop technologies, he said. International cooperation is necessary to ensure that developing countries benefit from the best technologies if they are to meet their power requirements.

“We can’t leave market forces alone for individual profit,” he stressed, calling demand-cycle management and energy efficiency critical strategies.

Although India and China have plentiful coal reserves, Razdan warned that they might have to import coal. “India may have to import more than China whose reserves are on the coast,” he said. “India’s are in the interior, and this adds more pressure with transportation costs.”

According to Razdan, India’s coal demand is projected to grow twofold by 2030, and oil requirements are expected to increase by 2.5% and nuclear power by 5.8%.

“China’s oil needs are forecasted to rise by 2.6% and nuclear by 10.5%,” he said.

Economic growth in these countries with the world’s largest populations is fuelling the huge demand for energy. Conservative estimates place their growth in gross domestic product at 8-9%/year and energy consumption at 7-8%/year, Razdan added. Chinese and Indians aspire to own cars and consumer goods, which will have serious implications for carbon emissions if left unchecked.

Razdan said efforts are being made to increase the use of renewable energy sources, but these are not always economic options or available in sufficient amounts.

EU discusses new European gas sources

Representatives from the European Union, Africa, and the Middle East discussed new sources of natural gas for European consumers at a Nov. 1 energy conference at Sharm El Sheikh, Egypt.

Europe wants to reduce its dependence on Russia, Norway, and Algeria by developing other supplies in the Middle East and West Africa. The meeting also was intended to highlight Egypt’s potential role as a transregional “bridge” between the Middle East and Africa.

Benita Ferrero-Waldner of Austria, EU commissioner for external relations and neighborhood policy, co-chaired the meeting with Ahmed Aboul Gheit, Egypt’s foreign affairs minister. In her opening speech, Ferrero-Waldner said, “We are working to promote the access of Middle East and West African natural gas to the EU market via pipelines such as the Arab Gas Pipeline originating in Egypt and the planned connection in Iraq, as well as the important Trans-Saharan pipeline from Nigeria to the EU via Algeria”

EU Energy Commissioner Andris Piebalgs of Latvia said a comprehensive Africa-Europe energy partnership is one of the priorities for a “real European foreign policy.”

High-level representatives from all three regions discussed cooperation to enhance regional energy security, address climate change, and improve access to energy sources.

Results of the conference will be considered by the EU-Africa Energy Partnership to be launched at the EU-Africa Summit in Lisbon in December.

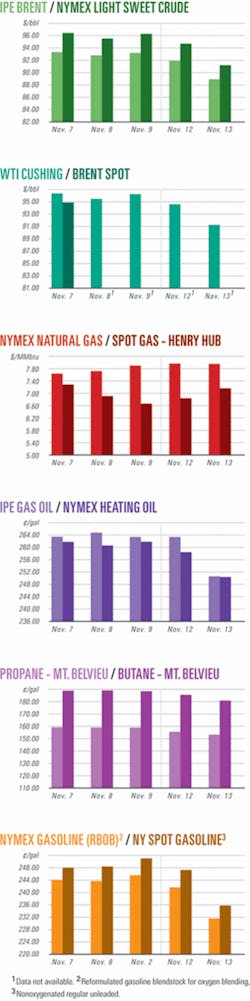

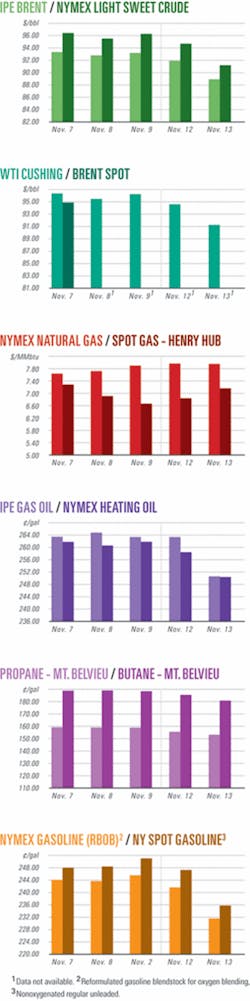

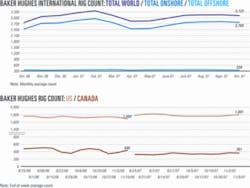

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesGulf Lower Tertiary deep wildcats drilling

Anadarko Petroleum Corp. said it expects to spud two Miocene tests and one Lower Tertiary test in the Gulf of Mexico between November 2007 and January 2008.

Green Bay is a proposed 32,000 ft Lower Tertiary test in Walker Ridge Block 372. Anadarko is operator with 35% working interest.

The Chevron Corp.-operated Sturgis North prospect is a planned 31,500-ft Miocene test in Atwater Valley Block 138 in which Anadarko has 25% working interest. Woodside Energy (USA) Inc. will operate a proposed 26,000-ft Miocene test on the Terrebonne prospect in Green Canyon Block 452 in which Anadarko has 33% working interest.

An Anadarko-operated well to test Middle Miocene objectives on the West Tonga prospect in Green Canyon is drilling toward 27,400 ft in 4,700 ft of water and is expected to reach TD in the fourth quarter. Interests are Anadarko 38%, Statoil 25%, Chevron 20%, and Shell 17%.

Anadarko spud the Atlas Deep-1 prospect at Walker Ridge 155 as a Middle to Lower Miocene test. The well, in 5,740 ft of water, is to reach TD of 32,000 ft in the fourth quarter. Interests are Anadarko 68%, Repsol E&P USA Inc. 20%, and Ridgewood Energy Corp. 12%.

BP PLC abandoned due to mechanical problems a planned 33,000-ft well in 5,562 ft of water on the Cortez Bank Lower Tertiary prospect in Keathley Canyon 244, 12 miles west of the Kaskida discovery. The well had not reached its target. Interests are BP 55%, Anadarko 25%, and Devon Energy Corp. 20%.

KRG signs five more PSCs for northern Iraq

Iraq’s Kurdistan Regional Government (KRG) has signed five production-sharing contracts (PSC) previously approved by its Regional Oil and Gas Council.

The PSCs cover areas near Irbil, Al-Sulaymaniyah, and Dahuk in northern Iraq. They are with TNK-BP affiliate Norbest Ltd.; subsidiaries of Sterling Energy LLC and Aspect Energy LLC of Denver; a Korean consortium headed by Korea National Oil Co.; and HKN Energy, an affiliate of Hillwood International Energy, Dallas.

PSCs the KRG signed earlier have come under question from US and Iraqi authorities (OGJ, Oct. 1, 2007, p. 36; Oct. 22, p. 30). Most recently, KRG signed a PSC with OMV Petroleum Exploration (OGJ Online, Nov. 7, 2007).

In conjunction with the five new contracts, KRG Minister for Natural Resources Ashti Hawrami said, “In Kurdistan, we are setting an example: This is the first post-Saddam framework for oil investment in Iraq which follows the democratic, federal, and free market principles mandated by the Iraq constitution.”

He said he hopes for a similar framework for all of Iraq.

“Without such a framework, investors cannot have confidence in contracts issued by authorities in other parts of Iraq,” he said.

Northeastern Spain’s Ebro basin due search

Beach Petroleum Ltd., Adelaide, plans to spend $3 million to fund a seismic survey to earn 25% interest in four gas-prospective permits held 75% by Serica Energy PLC in the Ebro basin between Madrid and Barcelona.

A 15-km test line was shot in July, and a 330 line-km 2D seismic program is under way. Three large targets, Torres, Fabregas, and Casillas, have been identified.

The basin has large structures and seeps. The Abiego, Barbastro, Binefar, and Peraltilla permits total 275,000 acres 40 km southeast of Serrablo gas field. Gas demand is strong and the price is above $8/gigajoule in northeastern Spain, Beach noted, and a gas trunkline crosses the permits.

Beach decided a year ago to expand exploration outside Australia and New Zealand and expects to announce more international transactions soon.

Drilling & Production - Quick TakesStorm shuts in production in Norwegian North Sea

Major operators in the Norwegian North Sea shut in production of 540,000 boe/d on their platforms in early November because of a major storm.

A BP PLC spokesman told OGJ it shut in 80,000 boe/d of gross production from its Valhall oil field on Nov. 6 as the storm was looming, saying, “We hope to come back on stream tomorrow afternoon [Nov. 7], but there is always a degree of uncertainty.” BP began evacuating the platform, because the storm was expected to be in full force at 9 p.m. GMT time that evening.

ConocoPhillips shut down 5 of the 16 platforms in Ekofisk oil field, which produce 140,000 boe/d. The field is between Norway and the UK in the North Sea, about 360 km from the UK coast.

StatoilHydro halted production of 320,000 boe/d from Grane, Visund, Oseberg South, and Heimdal fields.

Production from Veslefrikk, Huldra, and Troll C fields were not affected, although StatoilHydro also reduced staff by 114 people on the Veslefrikk platform and by 11 workers on the Huldra platform. Staffing at the Troll C platform also was reduced by about 20 people.

Nexen Inc. temporarily shut down the Buzzard platform after the storms damaged the upper section of one of the three power generation turbine exhaust stacks. The company said it did not expect production to be down for an extended period of time since the platform can operate at full rates with two turbines.

Gas plant boosting East Texas field flow

Madisonville Gas Processing LP started up a gas treatment plant expansion at Madisonville field in Madison County 100 miles north of Houston to handle sour gas from the Cretaceous Rodessa formation at 12,000 ft.

The expansion is accepting 20 MMcfd of gas and is expected to reach its 50 MMcfd capacity by the end of November, said GeoPetro Resources Co., San Francisco. MGP purchased the field’s existing 18 MMcfd treatment plant from Hanover Compression LP in July 2005.

Upon completion of the plant expansion, GeoPetro plans to produce the Fannin and Magness wells at rates higher than when plant capacity was 18 MMcfd. It also plans to produce the Mitchell well, shut-in awaiting a workover and the plant expansion, and in early 2008 the Wilson well if a frac job is successful.

Madisonville oil and gas field was discovered in 1945 and was developed with 125 wells in shallow zones, but the Rodessa was left undeveloped because the gas contained hydrogen sulfide.

The Magness well, drilled n 1994, had 139 ft of net pay in Rodessa and flowed sour gas with 28% of impurities. It flowed 12 MMcfd from 10 ft of perforations on a 22/64-in. choke with 3,915-19 psi flowing wellhead pressure. It flowed at 20.8 MMcfd on recompletion in October 2001, and CAOF was 176 MMcfd. Deliveries began in May 2003.

The Fannin well has 146 ft of Rodessa pay and went on line in early 2006, after which GeoPetro drilled the Wilson and Mitchell wells.

Processing - Quick TakesShell to design Mariisky refinery upgrades

Under a two-phase, $1.3 billion investment program, Mariisky NPZ LLC, Mari El, Russia, will upgrade its Mariisky refinery with the support of Shell Global Solutions International BV to increase refining capacity and meet stricter European specifications.

The 1.3-million-tonne/year Mariisky refinery produces naphtha, vacuum gas oil, diesel fuels, and kerosine from crude delivered via the strategic Surgut-Polozk pipeline, which is 150 m from the refinery. The refinery’s capacity will be increased to more than 4 million tonnes/year following the expansion.

Under the Phase 1 expansion, expected to cost about $1billion, Mariisky plans to expand crude distillation capacity by adding a crude distillation unit (CDU), a high vacuum unit (HVU), a solvent deasphalting unit (SDA), and a hydrocracker (HCU), which will maximize kerosene and diesel production.

A Mariisky spokesman told OGJ that Shell’s feasibility study for the proposal indicates that capacities of the new units would be: CDU, 7,060 tonnes/stream day; HVU, 4,670 t/sd; HCU, 7,560 t/sd; and SDA, 1,750 t/sd. “Some changes may be introduced during [the front-end engineering and design] phase,” he added.

The parties agreed that Shell will supply the basic design packages and licenses for the CDU, HVU, and HCU units. Design work is expected to be finished in September 2008.

Shell said the diesel produced at Mariisky would meet Euro V specifications, while the kerosine would comply with Russian fuels specifications and, if required, international kerosine A1 specifications, with minor modifications.

Once the first phase is finished, Mariisky plans to invest another $300 million in upgrading light-end fuels via aromatics production of benzene, toluene, and mixed xylene. The refinery is expected to become a fuel-oil-free refinery, manufacturing light, high-value products.

The Mariisky spokesman said major unit capacities would be: continuous catalyst regeneration unit (platformer), 2,360 t/sd; naphtha hydrotreating unit, 3,660 t/sd; and sulfolane extraction unit, 2,020 t/sd.

The company will evaluate laying another pipeline to the refinery from the large-volume Surgut-Polozk pipeline.

Work proceeds on Khalifa Point refinery

A survey and geotechnical investigation have been completed for the $5 billion Khalifa Coastal Refinery project planned by International Petroleum Investment Co. (IPIC) of Abu Dhabi and Pakistan’s Pak-Arab Refinery Ltd. (Parco) near Hub in Baluchistan Province (OGJ, Oct. 15, 2007, Newsletter).

A detailed feasibility study for the 300,000 b/d refinery will be completed by January 2008, with the front-end engineering and design expected by November 2008.

A construction contract is expected to be awarded by March 2009, with completion of the facility due by December 2012.

IPIC will hold 74% of the project, with Parco holding the remaining 26%.

Shell, Codexis to advance next-generation biofuels

Royal Dutch Shell PLC and Codexis Inc., a specialist in clean biocatalytic process technologies, have teamed to find ways of converting biomass to clean, renewable liquid transportation fuels through “super enzymes” in the next generation of biofuels. This partnership builds on earlier collaboration that began in November 2006.

The companies will conduct research together over the next 5 years, with Shell making an equity investment in Codexis and becoming a member of the company’s board. “Research will focus on adapting enzymes to improve the conversion of a range of raw materials into high-performance fuels. It will assist Shell in developing the next generation of biofuels as it explores a number of nonfood bio materials, new conversion processes, and alternative fuel products,” Shell said.

Codexis scientists say they have developed super enzymes that can outperform naturally occurring varieties. This pioneering technology has been used to improve manufacturing processes for leading pharmaceutical companies, including Pfizer and Merck.

Transportation - Quick TakesCrew detained after oil spill off San Francisco

US authorities have detained the all-Chinese crew of the Cosco Busan, a containership that spilled some 58,000 gal of heavy bunker oil into San Francisco Bay after it rammed a section of the San Francisco-Oakland Bay Bridge.

The Cosco Busan’s entire crew is being detained aboard the ship for questioning, according to Capt. William Uberti, head of the US Coast Guard for Northern California. The ship was departing from the Port of Oakland for South Korea when the accident occurred.

The crew’s detention came after Uberti notified the US attorney’s office on Nov. 10 about issues involving management and communication among members of the bridge crew: the helmsman, the watch officer, the ship’s master, and the pilot.

After ruling out mechanical failures as a cause of the accident, investigators were reportedly focusing on possible communication problems between the ship’s crew, the pilot guiding the vessel, and the Vessel Traffic Service, the USCG station that monitors the bay’s shipping traffic.

The accident left a gash nearly 100 ft long on the side of the 926-ft vessel and ruptured two of its fuel tanks. Spillage from the ship’s oil tanks has killed dozens of sea birds and spurred the closure of nearly two dozen beaches and piers.

Tangguh field on schedule to export LNG

Indonesia’s Tangguh gas field will begin exporting LNG to South Korea or China by early 2009 as scheduled, according to a senior government official.

Kardaya Warnika, chairman of government oil and gas agency BP Migas, said preparations at the Tangguh gas field are 80% complete, and production of LNG is expected to start in late 2008.

“The first delivery will go to either South Korea or China,” he said, adding that, “South Korea is more prepared because it already has a gas storing terminal.”

Current buyers for Tangguh’s output include China’s Fujian (2.6 million tonnes/year), South Korean K-Power and Posco (1.11 million tpy), and Sempra Energy on the western coast of Mexico (3.6 million tpy).

However, the Indonesian announcement coincided with reports that Mexico’s gas regulator Comision Reguladora de Energia approved the modification of the permit for the Costa Azul LNG regasification terminal and storage facility to allow its expansion.

According to the statement, the regasification capacity of the Costa Azul project will be expanded to 2.6 bcfd from 1 bcfd, and its storage capacity will be increased to 320,000 cu m through the construction of two additional tanks.

Owned by Sempra LNG, the Costa Azul plant in Ensenada, Baja California, is due to start operations in 2008. Sempra LNG and Royal Dutch Shell PLC equally split the terminal’s capacity under a 20-year agreement.

Last month, BP Berau Ltd., operator of the Tangguh LNG project, announced it is considering construction of as many as eight additional LNG trains at the company’s existing site in Papua (OGJ Online, Oct. 26, 2007).

TransCanada to start Keystone line construction

TransCanada Corp. is preparing to begin construction in spring 2008 on the 1,845-mile US portion of its Keystone oil pipeline project, which will transport oil from Canada to the US Midwest.

Keystone will total 3,456-km, including additions to existing Canadian pipelines and mainline flow reversals. It is expected to start up in late 2009 with the capacity to deliver 435,000 b/d of crude oil from Hardisty, Alta., to the US at Wood River and Patoka, Ill.

The company has entered into contracts or conditionally awarded about $3 billion for major materials and pipeline construction contractors and is continuing to secure land access agreements.

TransCanada intends to apply to Canada’s National Energy Board in November for additional pumping facilities to expand Keystone’s capacity to 590,000 b/d and extend the line to Cushing, Okla., starting in 2010.

Based on the increased size and scope of the project and the executed material and service construction contracts, the Keystone project cost is now estimated at $5.2 billion.

Plans to expand Keystone were announced earlier this year following the successful completion of an open season that secured an additional 155,000 b/d of firm contracts for oil delivery from Hardisty to Cushing (OGJ, July 16, 2007, p. 10).

The project has secured firm long-term contracts totaling 495,000 b/d for an average of 18 years. And producers and refiners continue to express interest in contracting for additional volumes. In response, Keystone intends to hold another binding open season by yearend.

Keystone received NEB approval this year for two major applications to construct and operate the Canadian portion of the project. Applications for US regulatory approvals at federal and state levels are proceeding.