US gasoline supply deficit to more than halve by 2010

The US gasoline supply deficit has grown considerably in recent years because demand growth has outpaced refinery output. The recent flurry of refinery expansion and upgrade projects, however, in addition to regulations that will increase ethanol consumption, will reverse this trend before the end of the decade.

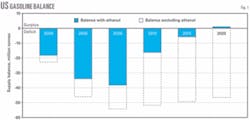

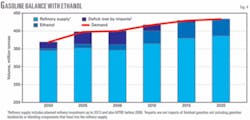

We expect the refinery supply deficit of gasoline to remain broadly constant in the short term at just more than 50 million tonnes; however, the addition of ethanol significantly reduces the balance. In 2006, ethanol use of 16 million tonnes reduced the total gasoline deficit to about 40 million tonnes.

We forecast ethanol’s contribution to grow rapidly during 2006-10, increasing about 20 million tonnes. This additional supply more than halves the 2010 gasoline deficit to only 16 million tonnes. This means that less than 4% of gasoline demand must be met with imports by 2010 vs. almost 10% currently.

Beyond 2010, because of slower demand growth and continually increasing crude processing due to refinery capacity expansions, capacity creep, and slightly higher utilization rates, the deficit reduces further. Our forecast shows the US moving to balanced gasoline by 2020 (Fig. 1).

Slower gasoline growth

Gasoline is the single most important oil product in the US, accounting for more than 40% of total demand. Demand has grown at 1.6%/year during the past decade due to increased car ownership and travel, whereas vehicle fleet efficiency has changed very little.

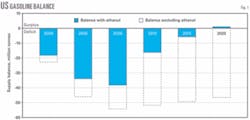

Growth has fluctuated, depending on the state of the economy and changes in pump prices; in 2002, demand grew nearly 3%, whereas in 2005, the increase was as little as 0.6%. Demand will grow at 1%/year through 2010, with growth subsequently slowing and eventually stagnating by yearend 2020.

The amount of ethanol blended into the US gasoline pool has risen sharply during the last 5 years, particularly since the phaseout of methyl tertiary butyl ether in 2006. The amount of ethanol blended will likely reach 18.5 million tonnes (6.1 billion gal) in 2007, almost three times the amount used in 2002. This is beyond the level dictated by the Renewable Fuels Standard (RFS) passed in 2005, which requires 4.7 billion gal of renewable fuels by this 2007.

Ethanol demand should continue to expand quickly through 2010. Although the rate of growth should slow next decade, ethanol demand will reach 47 million tonnes (close to 16 billion gal) by 2020. This will represent roughly 10% of gasoline demand by then (Fig. 2).

Total gasoline demand growth will continue to be a result of ownership levels and efficiency improvements in the long-term and, in the shorter-term, pump prices. US car ownership will grow to nearly 820 cars/1,000 people in 2020 from 786 cars/1,000 people in 2006. With a growing US population, the total number of cars will increase to 275 million in 2020 from 235 million today.

Much of the incremental growth during the past 20 years has been in sales of light trucks (sport utility vehicles, multipurpose vehicles, and pick-ups), which have more relaxed mandatory fuel-efficiency standards than cars. Recent high pump prices, however, have brought fuel economy into focus once more and sales of these larger vehicles have faltered.

Nevertheless, the light-truck sector will continue to account for higher growth in the vehicle fleet-although the fuel economy of the fleet will improve. Some of this improvement will be mandated; the light truck fuel-efficiency standard, which remained unchanged at 20.7 mpg for model years 1996-2004, has been progressively increased and will average 24 mpg by model year 2011 based on the National Highway Traffic Safety Administration’s new rulemaking from 2006.

Hybrid sales will also account for some of the efficiency gains because sales are increasing, despite disappointing efficiency gains outside of city use.

Continuing growth in vehicle miles traveled, however, will offset much of the improvement in vehicle efficiency. Travel by all vehicles in the US has increased at about 2.25%/year during the past 15 years. Although the rate will slow in the long term, it will still rise at 1.3%/year through 2020.

We therefore forecast total gasoline demand to grow to 432 million tonnes by 2020 from 400 million tonnes in 2006. Due to increased ethanol consumption, however, demand for refinery gasoline will remain static at around today’s level of 385 million tonnes during the next 15 years.

Higher gasoline production

Refinery production of gasoline will grow by 40 million tonnes 2006-20 due to the combined effects of slightly increased refinery utilization rates, additional crude and upgrading capacity from planned projects, and the effect of capacity creep.

Utilization rates will increase by 2010 from the low rates seen in 2005 and 2006 (due to refinery shutdowns and maintenance caused by Hurricanes Katrina and Rita, and one-time events such as the BP Texas refinery explosion) but will not be at their maximum due to a number of project tie-ins that year. From 2010 onwards, we expect that utilization rates may increase further but we do not believe that they will exceed the levels in 2004, which were 93%. An increased safety and reliability focus in refinery processing, in addition to the processing to tighter-quality specifications, is unlikely to allow rates to rise higher than this.

We forecast total additional crude capacity (currently planned and we believe to be realistic) to be about 0.94 million b/d by 2013, of which around 500,000 b/d will be on stream by 2010. Some small expansions will add about 435,000 b/d of crude capacity to existing sites. Two major crude expansion projects are the 180,000-b/d expansion at Marathon Oil Corp.’s Garyville, Ind., refinery, expected to start up in 2010 and the 325,000-b/d expansion of Motiva’s Port Arthur, Tex., refinery, which we have assumed will be completed in 2011.

Due to the large number of expansion projects, we do not believe creep will have much effect in the short to medium term; therefore, the majority of creep will increase capacity in the 2012-20 period in which projects have not yet been planned.

Refinery supply growth

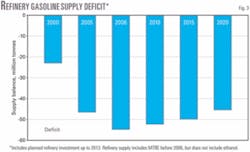

The deficit in the refinery supply of gasoline has grown considerably in recent years, increasing to 55 million tonnes in 2006 from 23 million tonnes in 2000. We expect the deficit, however, to start to decline gradually because increases in crude and upgrading capacity will grow refinery supply at a slightly faster rate than demand growth.

The deficit will fall to 45 million tonnes by 2020 (Fig. 3). This is before accounting for the effects of ethanol.

Although Fig. 3 highlights the total US (including the US territories) as deficit gasoline, there are regional differences. Petroleum Administration for Defense District (PADD) I has the largest deficit (refinery supply vs. demand of more than 80 million tonnes in 2006) and PADD III is 80 million tonnes in surplus. PADD II’s deficit is currently around 40 million tonnes, and PADD IV is balanced. PADD V is slightly in deficit. PADD III is therefore a major supplier of gasoline to PADD I, and also sends product to PADDs II and V.

Although the total US refinery supply deficit gradually declines, the deficit in PADD I will increase to 90 million tonnes by 2020. PADD III’s surplus will grow to more than 100 million tonnes. The remaining PADDs stay similar to current levels. This is due to significant investment being planned in PADD III, vs. very little planned in PADD I.

More ethanol on the way?

RFS currently requires 6.8 billion gal of renewable fuels by 2010 and 7.5 billion gal by 2012 (Table 1). There appears to be strong political support for increasing the RFS. A bill passed the Senate on June 21, 2007, which contained a substantially increased RFS.

Due to recent growth in ethanol consumption more than the required levels and additional ethanol capacity coming on stream in the US, we forecast that ethanol consumption will more than double during the next 4 years to 36 million tonnes (12 billion gal) in 2010. Although the rate of growth will slow in the next decade, ethanol demand will still reach 47 million tonnes (close to 16 billion gal) by 2020 (Fig. 4).

Adding ethanol to the refinery supply of gasoline reduces significantly the gasoline deficit. Currently there is a total supply deficit of 39 million tonnes; ethanol use of 16 million tonnes partially offsets the refinery supply deficit of 55 million tonnes.

We forecast ethanol consumption to grow rapidly between 2006 and 2010, increasing by about 20 million tonnes. In addition, slower overall gasoline demand growth and increased crude processing from refinery capacity expansions means that the refinery supply deficit reduces slightly. The overall supply deficit will therefore fall to 16 million tonnes by 2010.

Our forecast shows the US moving to balanced gasoline by 2020 if ethanol consumption matches the expected growth.

The authors

Aileen Jamieson ([email protected]) is research manager-global products outlook for Wood Mackenzie, Edinburgh. She joined Wood Mackenzie’s downstream consulting team in 2001, specializing in crude quality, refining, and oil product supply. Jamieson has been involved in detailed analyses of refining and forecasts oil product supply-demand balances for Europe, US, and Asia-Pacific. Before joining Wood Mackenzie, she worked for ExxonMobil Corp. for 5 years in both technical and commercial roles. Jamieson holds a BEng (1996) in chemical engineering from Edinburgh University.

Linda Giesecke is a senior analyst for oils research at Wood Mackenzie, Boston. She joined Wood Mackenzie in May 2007 and focuses on oil product demand in the Americas. Before joining Wood Mackenzie, she worked for Energy Security Analysis Inc. for 6 years, where she was involved in analyzing the oil product markets of the Atlantic basin. She has also worked in economic consulting, primarily for antitrust matters and damages estimation. Giesecke holds a BA from Lafayette College, Pa., and an economics degree (Diplom) from the University of Mannheim, Germany.