Kuwaiti oil minister quits after 8-day tenure

Bader Mishari al-Humaidhi, Kuwait’s oil minister, has resigned after only 8 days in office because opposition members of parliament continuously attacked his suitability for the role.

Kuwait’s state news agency said the cabinet accepted his resignation. His departure is not expected to affect oil policy, which is set by a supreme council. Humaidhi was given the job following a cabinet reshuffle, leaving his previous role as finance minister for the past 2 years.

Several politicians strongly criticized Humaidhi’s appointment saying they felt he was escaping scrutiny in parliament over allegations of financial and administrative irregularities.

Humaidhi’s predecessor was Sheikh Ali al-Jarrah al-Sabah, who left the post in June after carrying out the duties for a year. He had little support, and opponents were about to push forward a no-confidence vote.

Kuwait wants to establish 4 million b/d of oil capacity by 2020, but this goal is being thwarted by continuous changes in leadership at the oil ministry and domestic political struggles. Presently, the country produces 2.4 million b/d of oil.

Court backs Anadarko in deepwater lease case

A federal judge in Louisiana has supported Anadarko Petroleum Corp.’s claim that the US Minerals Management Service lacked authority to collect royalty on deepwater leases issued in 1996-2000.

The leases were issued under the Deep Water Royalty Relief Act of 1995, which provides an exclusion from royalty, subject to various limits, for production from leases with specified water depths.

The law made royalty relief automatic for leases issued during 1996-2000 and gave MMS more latitude to change the program for leases issued after 2000.

To ensure collection of federal royalty during periods of elevated oil and gas prices, MMS imposed price thresholds, above which royalty relief expires, for deepwater Outer Continental Shelf leases, including those issued in 1996, 1997, and 2000.

In January 2006, the Department of the Interior, of which MMS is part, ordered Kerr-McGee Oil & Gas Corp., now part of Anadarko, to pay royalty and interest for eight deepwater leases issued in those 3 years.

Kerr-McGee challenged the agency’s authority to suspend royalty relief because of high oil and gas prices, citing statutory language about the years prior to 2000.

The US District Court for the Western District of Louisiana, Lake Charles Division, supported the Kerr-McGee-Anadarko claim, saying Interior “exceeded its congressional authority” by requiring Kerr-McGee to pay royalty based on price threshold in the years under dispute.

Deepwater leases issued during 1998 and 1999 contained no price thresholds. The omissions have been controversial.

According to press reports, the MMS might appeal the Louisiana ruling, which throws into question royalties collected on all deepwater leases with price thresholds in the 3 years covered by the Anadarko case.

Diesel spill in Veracruz sparks threat of Pemex ban

Mexico’s Petroleos Mexicanos (Pemex) has been warned it may no longer be allowed to operate in the state of Veracruz following criticism for its poor response to recent accidents and oil spills.

Veracruz State Governor Fidel Herrera Beltran launched the criticism, saying Pemex’s various accidents this year have caused losses in the state estimated at 8 billion pesos ($750 million).

His remarks followed a pipeline break on Oct. 30 that sent 420,000 gal of diesel fuel into three rivers in the Gulf Coast state, threatening the supply of drinking water for some 600,000 people in the region.

The state’s deputy secretary for civil defense, Ranulfo Marquez, said water wells and springs had been polluted by the fuel that spilled late last week into the Coatzacoalcos River and its tributaries, the Jaltepec and the Chiquito.

The rupture occurred Oct. 25 on a subterranean pipeline, but diesel rose to the surface of a creek feeding into the Jaltepec River and from there flowed into the Chiquito and the Coatzacoalcos.

Marquez said some 1,200 people were working to clean up the fuel which, he said, formed a 200 km strip down the three affected rivers. He also said some of the barriers deployed to contain the fuel broke and allowed at least 21,000 gal of diesel to flow into the gulf.

According to a statement by Mexico’s environmental enforcement office, Profepa, the spill was brought under control when Pemex stopped pumping fuel through the pipeline 30 minutes after the accident occurred.

Pemex later issued a statement saying it had recovered 80% of the fuel spilled, that the Gulf of Mexico was not contaminated, and that the fuel slick along the rivers was about 12 km long.

It said the damaged pipeline had been repaired and that it expected to complete work on the environmental damage by Nov. 2.

Range Fuels to build cellulosic ethanol plant

Range Fuels Inc. broke ground on what the Broomfield, Colo., company is calling the nation’s first commercial cellulosic ethanol plant, which is being constructed in Treutlen County, Ga., near the town of Soperton.

Range Fuels will use wood and wood waste as its feedstock. First phase construction-a 20 million gal/year plant-is scheduled for completion in 2008. Plans call for the plant to produce more than 100 million gal/year in about 2011.

US Sec. of Energy Samuel W. Bodman and Georgia Gov. Sonny Perdue attended the groundbreaking. Range Fuels was one of six companies selected by the US Department of Energy for financial support in building a commercial cellulosic ethanol plant.

As part of its $76 million technology investment agreement with DOE, Range Fuels will receive $50 million based upon first-phase construction. The other $26 million will be provided for construction in the project’s next phase.

Range Fuels uses a two-step, thermochemical conversion process to turn wood chips, municipal waste, paper pulp, olive pits, and other waste materials into ethanol.

The company is privately held and funded by Khosla Ventures LLC.

Mitch Mandich, Range Fuels chief executive officer, said the company’s process for producing cellulosic ethanol will use 25% of the average amount of water required by corn-based ethanol plants.

Grain-based ethanol is produced through fermentation of sugars, distillation, and drying. Corn is low in sugar, but high in carbohydrate cellulose that must be turned into fermentable sugar (OGJ, Aug. 6, 2007, p. 20).

Researchers are working on methods to more efficiently convert cellulose to sugar. Many chemists see biobutanol as a potential game changer for biofuels because of its potential to integrate better than ethanol into the refining and gasoline distribution infrastructure.

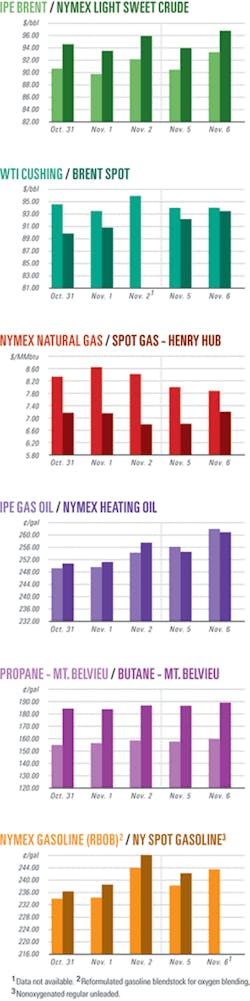

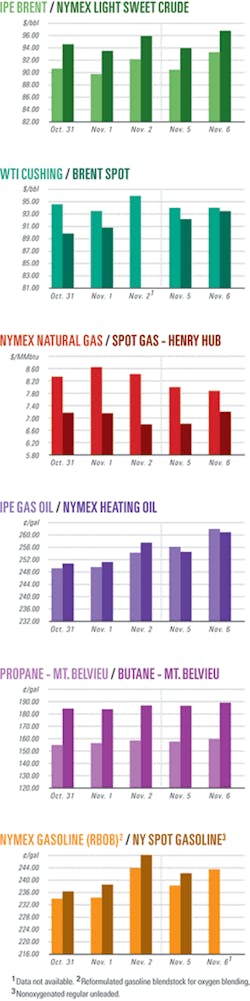

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesDevon’s Paktoa a giant Beaufort oil find

Devon Canada Corp. discovered 240 million bbl of recoverable oil at the Paktoa C-60 wildcat while exploring for natural gas in the Canadian Beaufort Sea in 2006, the company has revealed.

The well, the Canadian Beaufort’s first wildcat in 20 years, won the company a 37,000-acre Significant Discovery License designation from the National Energy Board.

Paktoa C-60 is in EL 411 in 40 ft of water west of Beluga Bay (see map, OGJ, Nov. 3, 2003, p. 42). Devon’s interest is 100%.

Devon, with more than 1.3 million net acres, is the largest exploratory leaseholder in the Beaufort Sea-Mackenzie Delta. Affiliates of ExxonMobil Corp. made a work bid earlier this year of $585 million for 507,000-acre EL 446 just north of Paktoa, and Chevron Canada Ltd. bid $1 million in work commitments for 267,000-acre EL 448 just west of Paktoa (OGJ Online, July 19, 2007).

Aurelian discovers gas in Romanian well

Aurelian Oil & Gas PLC, London, has discovered gas in thin Sarmatian (Middle to Upper Miocene) sands in its Boistea 1 well on the Cuejdiu Block in Romania.

Boistea reached a TD of 2,295 m on the eastern part of the block and encountered the gas in an interval of 1,700-1,800 m.

“After electric logging and a series of pressure measurements, it has been decided to complete the well to allow a long term flow test of the interval 1,783-85 m,” Aurelian said.

This was the first well drilled on the block.

Aurelian plans to drill deeper targets on the western part of the block following a seismic survey to be shot in 2008.

Partners in the Cuejdiu joint venture are Aurelian 40%, SNGN Romgaz SA 37.5%, Europa Oil & Gas SRL 17.5%, and Millennium International Resources Corp., wholly owned by Aurelian, 5%.

Pacific tests gas in Lower Magdalena basin

The La Creciente-3 well in the Lower Magdalena basin tested gas at extrapolated rates as high as 25 MMcfd and indicated a production potential similar to that measured at the La Creciente-1 discovery well, said Pacific Stratus Energy Ltd., Toronto.

The LCA-3 well, deviated southwest from the discovery well pad on Prospect A of the La Creciente Block, went to TD 12,950 ft MD (10,977 ft TVD subsea). The maximum rate was obtained on a 32/64-in. choke with 4,453 psi wellhead flowing pressure.

The company cemented production liner and plans to run a vertical seismic profile log and a second drillstem test. It will also compare production results between the two wells.

The Cienaga de Oro reservoir consists of 630 ft (true thickness) of well-sorted coarse to fine-grain sandstones, of which the upper zone consists of 257 ft of gas-bearing sandstones. The interval has 219 ft of net reservoir sandstones, 15.5% average porosity, and 27.3% average water saturation.

The rig moved to Prospect D to spud the LCD-1 well 5.5 km north of the discovery well on Oct. 26.

Drilling & Production - Quick TakesPemex resumes production as gulf storms end

Mexico’s state-owned Petroleos Mexicanos said it has restored all but about 300,000 bbl of oil production halted last weekend when storms hit the Gulf of Mexico.

Pemex had suspended as much as 1.1 million b/d of output on Oct. 30 after oil completely filled storage tanks at three ports-Dos Bocas, Cayo Arcas, and Pajaritos-where inclement weather prevented ships from loading.

Dos Bocas and Cayo Arcas have since reopened, allowing ships to begin loading oil, and more will move as weather clears, said Pemex director Jesus Reyes Heroles.

Meanwhile, Pemex expected to reopen wells Oct. 31 and resume normal production of about 3.1 million b/d, including 1.7 million b/d for export, according to Pemex E&P Director Carlos Morales.

A week of heavy rains caused widespread flooding in southeastern Mexico, killing at least one person and forcing tens of thousands to flee rising waters in Tabasco and Chiapas states.

The flooding was thought to have caused a leak in a 10-in. natural gas pipeline after soil support was washed away, according to Pemex officials. Tabasco officials said the pipeline had exploded.

Rowan adding nine super class jack ups to fleet

Under a contract worth $700 million, Rowan Cos. Inc. has ordered from Keppel AmFELS Inc. four Super 116E class jack up rigs having the ability to drill to 35,000 ft. Deliveries will begin in the second quarter of 2010 in 4 month intervals.

In addition, Rowan expects to deliver three 240-C rigs, currently under construction, in the third quarters of 2008 and 2009 and will build two additional 240-C class jack ups at its own Vicksburg, Miss., shipyard for delivery in the third quarters of 2010 and 2011 for $400 million. These rigs will be able to drill to 35,000 ft.

“The 240-C was designed to be a significant upgrade of the original 116-C class, which has been the ‘workhorse’ of the global drilling industry since its introduction in the late 1970s,” a Rowan spokesperson said.

A company spokesman told OGJ that it would have 30 rigs in total for its clients by 2011. He said Keppel received the contract because Rowan does not have sufficient capacity in its own shipyards to construct the rigs. “We have started conversations about getting contracts for them and we try to line these up 6 months to 1 year before delivery of the rigs,” he added.

Danny McNease, chairman and chief executive of Rowan, said: “Each of these new rigs will employ the latest technology to be able to efficiently drill high-pressure, high-temperature, and extended-reach wells in just about every prominent jack up market throughout the world.”

ONGC signs with Ocean Rig for deepwater rigs

Oil & Natural Gas Corp. (ONGC) signed a memorandum of understanding with Ocean Rig ASA to contract two fifth-generation semisubmersible deepwater rigs for 5 years each for $2.07 billion total.

The Leiv Eiriksson was completed in 2001 while the Eirik Raude was completed in 2002, both built to the Bingo 9000 design. The Eirik Raude is under contract with ExxonMobil Corp. in Canada and would be available around August 2008. The Leiv Eriksson is under contract with Royal Dutch Shell PLC in the North Sea and would become available in October 2009.

“Except Ocean Rig, none of the other bidders were in a position to supply rigs within the stipulated time frame,” said a senior ONGC official. “In fact, we are anxious to get all the formalities of the signing completed as soon as possible, in the face of the continuing shortage of deepwater drilling rigs.”

Processing - Quick TakesMarathon to upgrade, expand Detroit refinery

Marathon Oil Corp. has approved a projected $1.9 billion expansion and heavy oil upgrade project at its 100,000 b/cd refinery in Detroit.

The project will increase the refinery’s heavy oil processing capacity, including Canadian bitumen blends, by about 80,000 b/d and will increase its total refining capacity by about 15%, to 115,000 b/d.

When completed in late 2010, the project will add more than 400,000 gpd of clean transportation fuels to the market. Construction is expected to begin in late 2007 or early 2008, subject to regulatory approvals.

The Detroit heavy oil upgrade project will include a 28,000 b/d delayed coker, a 280 tonne/day sulfur recovery complex, and a 33,000 b/d distillate hydrotreater.

In addition, an associated pipeline will be built. Construction on the 29-mile pipeline segment is expected to begin in mid-2009 with completion in 2010.

Marathon completed an expansion at the Detroit refinery in late 2005 that increased crude capacity to its current capacity from 74,000 b/d (OGJ, Online, Sept. 30, 2005).

Gas plants to aid Utah Natural Buttes growth

Anadarko Petroleum Corp.’s midstream unit plans to start up around Dec. 1 the 250 MMcfd Chapita gas processing plant west of Bonanza in giant Natural Buttes gas field in Uintah County in northeastern Utah.

A lateral under construction will transport liquids that the new refrigeration plant extracts from the field’s gas to the Mapco natural gas liquids pipeline in western Colorado for shipment to Mont Belvieu, Tex., for fractionation.

Anadarko currently delivers 300 MMcfd from the Uinta basin into various dew point control facilities and plants operated by others. Most of this will be diverted to Chapita when the new plant starts up.

A second 250 MMcfd plant has been ordered. It is in early stages of fabrication and scheduled for delivery in mid-2008 and start-up in first quarter 2009. A third train with a capacity of 250 MMcfd or larger is being considered. The second and third trains will be cryogenic units.

Processed gas from the Chapita plant will move through the 400 MMcfd Kanda lateral, operated by El Paso Western Pipelines and owned by Wyoming Interstate Co., to the Colorado Interstate Gas mainline for transport out of the Rockies, Anadarko said.

Anadarko also is optimizing its Natural Buttes gas gathering system, which consists of 750 miles of pipe with 40 compressors totaling 47,000 hp at 23 sites. More than 1,400 wells are connected, and more than 200/year are being hooked up.

Anadarko’s 2007 drilling program alone called for the drilling of 280 development wells in Natural Buttes field, where the company holds 225,000 net acres, has eight operated and three nonoperated rigs running, and has identified nearly 5,000 drillsites. Drilling exploits Cretaceous Mesaverde zones and explores deeper potential.

The Natural Buttes gathering system handled 280 MMcfd of Anadarko gas and 20 MMcfd of third party gas in 2006, and its expansion will allow Anadarko Midstream to aggressively pursue adding third party volumes.

CNPC plans to build refinery in Costa Rica

China National Petroleum Corp. plans to build a refinery in Costa Rica to supply Central American markets, according to Chinese state media.

The official Shanghai Securities News, citing CNPC sources, said the agreement was concluded during a visit of Costa Rica President Oscar Arias Sanchez to China.

Before his trip, Arias told Costa Rica’s La Nacion newspaper that one of the most important goals of his visit would be to reach an agreement to a refinery.

Arias said the refinery proposal would allow Costa Rica to meet its own fuel needs and to export products.

The Shanghai Securities News report said the proposed refinery will process heavy oil from Venezuela.

In August 2006, CNPC agreed with Petroleos de Venezuela SA to establish a joint venture to develop a block in the Junin area of the Orinoco heavy oil belt.

Jurong Aromatics lets contract for Singapore plant

Jurong Aromatics Corp. Pte. Ltd. has let a contract to UOP LLC, Des Plaines, Ill., for the technology and basic engineering services and equipment for an aromatics plant to be built on Jurong Island in Singapore.

UOP already is performing basic engineering design, and commissioning of the complex is slated for 2011. When completed, the plant will be one of the largest privately owned petrochemical facilities in Singapore.

Plans call for the plant to produce 800,000 tonnes/year of paraxylene, 200,000 tonnes/year of orthoxylene, and 450,000 tonnes/year of benzene.

The new facility will feature various UOP technologies for removing sulfur and for upgrading distillate materials for the production of clean fuels.

Transportation - Quick TakesSEIC to boost Sakhalin-2 liquefaction capacity

The annual capacity of the Sakhalin-2 liquefaction plant under construction on Sakhalin Island will be increased by 7 million tonnes, said a state official Oct. 18.

Regional Gov. Alexander Khoroshavin said the working group of project operator Sakhalin Energy Investment Co. has begun to draft a plan for the plant’s third stage.

The plant currently has two units with a total capacity of 9.6 million tonnes/year of LNG. It is due to be commissioned in 2008 after completion of start-up operations now under way.

SEIC said it received a second shipment of LNG for use in testing and start-up operations at the plant (OGJ Online, Oct. 17, 2007).

Sakhalin-2 is designed to produce LNG at two fields in southern Sakhalin, and the bulk of the LNG has been purchased in advance by US, Japanese, and South Korean companies.

Russia’s OAO Gazprom bought a 50% stake plus one share in the project for $7.45 billion in late 2006, leaving Royal Dutch Shell PLC, Mitsui, and Mitsubishi respective stakes of 27.5%, 12.5%, and 10% in the project.

China to start second phase of West-East pipeline

China is likely to start the second phase of the West-East natural gas pipeline project around yearend or early 2008, according to a senior government official.

Chen Deming, vice-chairman of the State Development and Reform Commission, said gas from Xinjiang, the Inner Mongolia Autonomous Region and Shaanxi Province will be transported to the Pearl River Delta through the country’s pipeline network after completion of the West-East project.

Chen said more than 12 billion cu m of gas will be supplied to the Yangtze River Delta in 2 years’ time, due to increased imports of gas and large-scale gas exploitation in Chongqing Municipality and Sichuan Province.

By then, he said, the urban gas and transportation systems in half the regions of China will gradually have access to clean gas.

Over the last 4 years, China has seen a 62% increase in the growth of its oil and gas pipeline networks, which now extend a total of 48,000 km, according to official figures (OGJ Online, Oct. 10, 2007).

BG Group to submit EIA for Brindisi terminal

BG Group PLC will prepare an environmental impact assessment for its proposed Brindisi regasification terminal to meet the Italian government’s new requirements.

Earlier this month the government suspended its decree allowing BG to construct the $720.6 million terminal until the EIA was completed. BG said it was committed to developing the 8 billion cu m/year Brindisi terminal and the authorization given in 2003 was full and valid and did not require an EIA at the time. BG described its change in stance as “a gesture of good faith.” It has already invested €200 million in the project.

BG said it was committed to completing the project. “We have reached our decision quickly and have already begun work on the EIA,” the company said.

The terminal is expected to begin operating by 2010.

Spectra to build Bronco gas pipeline from Rockies

Spectra Energy is proposing to build a 650-mile natural gas pipeline to connect Rocky Mountain natural gas supplies to Western US markets.

The proposed Bronco Pipeline, with estimated construction costs exceeding $3 billion, will have an initial capacity of more than 1 bcfd.

The pipeline will access existing and growing supply basins in Wyoming, Utah, and Colorado and extend westward, interconnecting with several pipelines en route to its terminus near Malin, Ore.

Based on preliminary market need and assessments, the project is currently planned to be in-service as early as 2011, with completion in 2012.

Spectra said it will hold an open season in the next 3 months to determine final project parameters including route, market, and timing.