GLOBAL OIL RESERVES-2: Recovery factors leave EOR plenty of room for growth

Within a broad context, the applicability of the assortment of improved oil recovery and enhanced oil recovery technologies depends by and large on two factors: the API gravity of the oils and the depth of the reservoirs.

This second of two parts summarizes the reserves classifications and discusses EOR’s potential production growth.

In reality, the proper technical selection parameters are the oil viscosity and the reservoir pressure. These, however, are related empirically to oil gravity and reservoir depth, respectively.

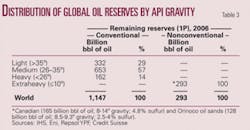

World oil reserves were sorted by API gravity and depth. The gravity classifications are: light (>35°), medium (26-35°), heavy (10°-<26°) and extraheavy (≤10°). The upper tiers for heavy and medium gravity oils were changed slightly from the official definitions to better reflect limits of successful field EOR projects.

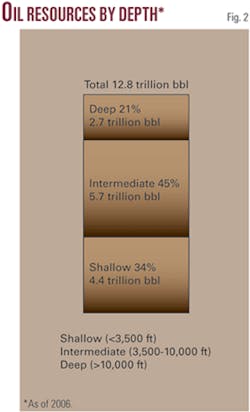

The same is true for the depth classifications selected: shallow (<3,500 ft), intermediate (3,500-10,000 ft), and deep (>10,000 ft). Tables 3 and 4 summarize the results of both sorts. These groupings provide a convenient core for classifying the coupled resource base.

Fig. 1 illustrates the gravity distribution of the world’s total oil resources of 12.8 trillion bbl. Light and medium gravity oils make up two thirds of the total resources while heavy and extraheavy oils make up the other third.

Fig. 2 shows the depth distribution of the oil resources. Roughly one third of the total resources are located at shallow depths, which as expected matches the volumes of heavy and extraheavy oils. A similar correspondence is observed between medium gravity oils (44%) and reservoirs at intermediate depths (45%), also between light oils (22%) and deep reservoirs (21%).

Shallow reservoirs with heavy and extraheavy oils are the best disposed to steam injection processes. Intermediate and deep reservoirs with oils above 30° are the ones best adapted to miscible CO2 injection.

Other miscible processes with N2, HC gases, and flue gases require reservoirs deeper than 5,000 ft. Polymer and other chemical processes are limited mostly by temperatures, usually intermediate depth reservoirs with oils in the range of 15-30° gravity. In situ combustion has no depth restriction, but oils below 30° gravity are preferable.

EOR and future production

According to the Oil & Gas Journal’s Worldwide EOR Surveys, the volume of oil produced by EOR methods doubled from 1982 to 1990 (1.2 million b/d) and doubled again to 2.5 million b/d in 2006.

US EOR production is 649,000 b/d, roughly 14% of total US production. Worldwide, OGJ found 303 active EOR projects,16 and the single largest project, the Duri field steamflood in Indonesia, produces 220,000 b/d.

Four countries-the US (153), Canada (45), Venezuela (41), and China (39)-account for 92% of the total number of projects. Table 5 gives an overview of the general characteristics of these field projects: number of projects by type, minimum and maximum EOR production rates, depth, and API gravity ranges. Twenty-nine new projects (CO2, 16; steam, 6; polymer, 4; and combustion, 4) were planned for 2006-07.

A 1% increase in global recovery efficiency would bring forth 88 billion bbl of expanded conventional oil reserves, sufficient to replace 3 years of world production at the current rate of 27 billion bbl/year.

The contribution of unconventional resources is not included because these are new-so far less than 7 billion bbl (~0.2%) have been produced.

Large-scale application of conventional EOR will impact the production profile of the world very much in the same way it has been until now, adding more production and easing the decline of mature fields. It would throw in roughly 1 million b/d for every 10 billion bbl of added reserves.

The EOR capex required to develop 88 billion bbl of added reserves is estimated to be about $190 billion, roughly 80% of the global E&P capex for 2006. A well-timed disposition to make outlays of this magnitude will eventually determine the impact of EOR on future global supplies. The oil potential is there.

Final remarks

Now that oil prices are soaring and have the long-term prospect of staying much higher than historical levels, cash flow is at a high which is good for EOR.

EOR can unlock already discovered, remaining buried resources in existing fields which are estimated at 11.8 trillion bbl worldwide. All resource holders should consider the benefits of this new and growing opportunity.

The recovery factor for the bulk of the world’s conventional reserves is around 22%, so there is plenty of room for growth. For nonconventional extraheavy oils, the current recovery factor is 10%; an additional 10-15% is possible for both the Canadian and Orinoco sands. Cumulative production to date is still insignificant, barely 2% of reserves.

The North Sea fields have the best overall record of recovery, averaging 46%. The US follows with 39%. Oil fields with top recovery factors are Statfjord (North Sea) and Prudhoe Bay (US) with 66% and 47%, respectively.

Worldwide, a 1% increase in the global recovery factor represents 88 billion bbl of added conventional reserves, equivalent to the replacement of 3 years of global production. The estimated capex required to develop these reserves is roughly $190 billion, corresponding to 80% of the global E&P capex outlays ($236 billion) in 2006. The impact of EOR on future global oil supplies depends on the disposition to make significant investments over the long term.

Successful IOR/EOR projects are long-lived, manpower intensive, may need long lead times to do the R&D vital to the tailoring of the processes, and require constant sophisticated engineering monitoring. Two thirds of the world’s resource base is located in countries that have strong NOCs and-or policies with restrictive access to IOCs which have some of the best EOR technologies.

Offshore, with a resource base of 2.7 trillion bbl, has its own complexities that make difficult the application of EOR techniques. Reservoirs can be deep (wellbores as long as 40,000 ft), drilling infill wells is costly, and the number of wells per platform is usually fixed. In other words, EOR should be incorporated early in the master plan of offshore fields for maximum results.

EOR’s role is primarily one of realizing the last technically extractable drop of oil from the reservoir while extending the economic life of the abundant mature oil fields. Its contribution will be crucial for the continued expansion of world oil production. EOR is quite a challenge, both technologically and economically, but it is worth pursuing.

References

- “Facing the Hard Truths about Energy,” NPC Report, July 18, 2007.

- “World Oil Outlook through 2030,” OPEC Report, June 26, 2007.

- Moritis, Guntis, “Upstream Production Capacities to Advance in many Countries,” OGJ, July 23, 2007, p. 43.

- Sandrea, Ivan, and Sandrea, Rafael, “Global Offshore Oil-Growth expected in global offshore crude oil supplies,” OGJ, Mar. 5 & 12, 2007.

- Dittrick, Paula, “Worldwide E&P spending reaches record,” OGJ, Sept. 3, 2007.

- Goldman Sachs Global Energy Report, Feb. 20, 2007.

- Editorial, Oil & Gas Financial Journal, April 2007.

- Lake, Larry W., Schmidt, Raymond L., and Venuto, Paul B., “A Niche for Enhanced Oil Recovery in the 1990s,” Schlumberger Oilfield Review, January 1992.

- “China Nanpu Oil Find Shows Pitfalls of Estimating Reserves,” Rigzone News, Aug. 17, 2007.

- Verma, M.K., “The Significance of Field Growth and the Role of Enhanced Oil Recovery,” USGS Report, 2000 (www.pubs.usgs.gov).

- Technical Updates, US DOE, March, 2006.

- Saleri, N.G., OGJ, Oct. 4, 2004, p. 25.

- Sandrea, R., “What About Deffeyes’ Prediction that Oil will Peak in 2005?,” Middle East Economic Survey, Vol. 48, No. 37, Sept. 12, 2005.

- “Highlighting Heavy Oil,” Schlumberger Oilfield Review, Summer, 2006.

- AAPG Hedberg Conference,” Nov. 12-17, 2006, Colorado Springs, Colo.

- “Worldwide EOR Survey,” OGJ, Apr. 17, 2006.