LNG TRADE-Conclusion: Spark spread trends allow analysis of LNG consumers

Spark spread trends and volatility show that opportunities for gas supply through LNG vary from market to market and require careful contracting and risk management to position LNG favorably against competing fuels and sustain a competitive position.

Despite taking more control of oil and gas resources, many gas-resource-rich nations, their governments, and their national oil companies recognize the benefits of a continued reliance on international oil companies’ technological, financial, and managerial assistance in developing their natural gas industries over the medium term.

The first part of two articles (OGJ, Oct. 1, 2007, p. 60) used analysis of natural gas statistics for production, consumption, net exports, and proved reserves to help identify and explain strategies being pursued by NOCs in producing countries where they control their national industries.

This concluding article reviews gas and LNG spark spreads in relation to electricity prices and competing fuels to provide insight into the main gas consuming countries.

Spark spreads

Volatile global gas prices create difficulty in predicting future economic returns for gas markets. As most LNG is used for power generation, however, focusing on gas prices’ effect on power prices in specific markets allows for useful economic analysis.

Spark spread, the unit electricity price minus the price of the fuel consumed to generate it, measures the profitability of power generation facilities. The amount of fuel consumed depends on the energy conversion efficiency of the power plant. Conversion efficiency for modern combined-cycle gas turbines is generally > 50%, whereas energy efficiency is < 40% in conventional coal, oil, and nuclear power plants.

A short-term increase in natural gas price usually leads to a smaller spark spread and less profitability for the electricity utility if the increase is not (or cannot) be passed on to power customers. Spark spread therefore determines the value of LNG to an electricity utility.

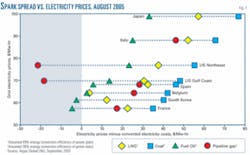

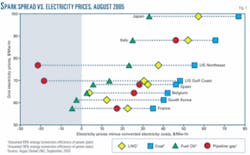

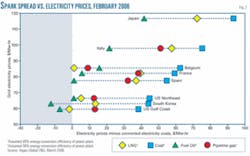

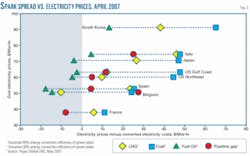

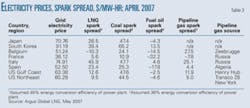

Tables 1-3 list spark spreads and power prices in selected North American, European, and Asian markets for three periods over the past 2 years: August 2005, February 2006, and April 2007. LNG and pipeline gas uses an energy conversion efficiency of 49% to provide spark spreads in a CCGT plant. Coal and oil-fired plant comparisons in Tables 1-3 use an energy conversion efficiency of 38%.

Spread trends

Figs. 1-3 compare the competitiveness of LNG vs. pipeline gas, coal, and fuel oil in each market at each specific time. These data confirm the effects of price volatility, but also highlight that some markets are more robust in the face of high gas prices than others.

Each market also shows different price trend fluctuations over the past 2 years. To some extent these trends reflect the different supply and contracting strategies adopted by the different markets.

All three figures show that coal has consistently provided a higher spark spread than gas, which in turn has provided a higher spark spread than fuel oil. LNG remains competitive with pipeline gas in most markets in all three periods. The variability of the Belgian and US markets, however, requires further explanation.

The higher spark spread of coal generation ignores expectations of the increased future price of carbon emissions, as legislation progressively addresses this issue in the power generation sector. Natural gas’ higher conversion efficiency and cleaner burning nature will limit the effects of such legislation on gas-fuelled power generation relative to coal.

The additional cost and energy consumption of clean-coal technologies, as well as carbon capture and sequestration, much talked about but not yet implemented on a commercial scale, will affect the spark spreads achievable by newbuild clean coal power plants using either CCS or integrated gasification combined-cycle systems. Such costs suggest that gas will compete aggressively with coal in the decades ahead, but also that gas and LNG’s share of the power market will continue to be limited by the effects of price volatility.

Volatile gas prices and growing dependence on imported gas in the main energy consuming markets affect the future uncertainty of spark spreads for power generators. These trends, combined with the uncertainty of future geopolitics, technological developments, and international competition, increase power generators’ interest in spreading fuel price risks by building a portfolio of power plants that includes nuclear, coal, and biomass plants, which are less affected by price volatility and supply geopolitics than gas.

A spark spread of zero or less means that it is unprofitable for power generators to burn a specific fuel. This situation has occurred in some markets over the past 2 years; particularly in fuel oil as a consequence of higher crude prices (Figs. 1-3), but also in LNG and pipeline gas for lower-price electricity markets (France and Belgium in April 2007).

In markets where the price of electricity has historically remained >$80/Mw-hr (e.g., Japan and Italy), all fuels generate attractive spark spreads. These markets are less sensitive to gas price fluctuations, and LNG remains attractive even at high prices as a source of supply security. This situation undoubtedly pushes the long-term strategy of such countries toward gas-fired power plants.

Markets with volatile electricity prices, including periods of low prices below $65/Mw-hr (e.g., South Korea, Belgium, and the US), place greater importance on gas and LNG prices. LNG price indexing can play a critical role in such markets.

Belgian LNG, linked to crude and fuel oil prices, has been expensive and unprofitable for power generation for much of the past 2 years. Countries with long-term high volume LNG contracts linked to electricity prices (e.g., Spain and France), however, have been able to achieve better spark spreads from LNG than from competing pipeline gas. Japan’s S-curve price formulas for long-term LNG supplies (using both ceiling and floor prices) linked to the Japanese crude cocktail oil price, have also managed to achieve price stability for LNG while providing power generators with enviable spark spreads.

Contrasting the trends in spark spreads (and electricity prices) in Japan and South Korea for the past 2 years shows some of the forces at work. Neither country has pipeline gas supplies, and both have historically had to pay premium prices to secure large-volume LNG supplies.

South Korea manages greater seasonal demand variations and more volatile LNG and electricity prices than Japan. Both have successfully diversified their LNG supply sources, using long-term and medium-term contracts (both ex-ship and FOB) and pricing against competing fuels in their specific markets.

South Korea’s market seasonality makes short-term LNG price fluctuations more problematic there because it needs to buy additional short-term cargoes in cold winters. It recently, however, has committed to building additional LNG storage capacity, and increasing its number of LNG receiving terminals to five, to ease such seasonal vulnerability.

LNG has generally provided a comparable spark spread to pipeline gas in the US markets, but both are subject to volatility in both short-term gas and electricity prices. Most LNG cargoes are indexed to Henry Hub spot or short-term futures prices with a time lag involved. The time lag, in times of price volatility, can result in either pipeline or LNG providing a more attractive spark spread for generators at any given time.

Spark spreads frequently lie close to the margins (<$20/Mw-hr) for gas and LNG in the US, combining with geopolitical concerns about growing dependence on gas imports to make power generators reluctant to commit to substantial newbuild gas-fired power plants.

Short-term gas pricing strategies of US buyers can also make it difficult to secure LNG cargoes at competitive prices because they can at certain times be sold at more attractive prices into European (and sometimes Asian) markets. Using an LNG strategy with long-term contracts linked to a basket of competing fuels (or with floor and ceiling prices) might help power generators overcome such problems moving forward.

Gas-producing nations find it difficult to sustain the risks of supplying LNG to markets with volatile spark spreads without the involvement of international oil companies in the supply chain to absorb a substantial amount of the price and demand risk. Term contracts that provide financial upside in times of high demand, frequently expose gas suppliers to over capacity and low prices during periods of demand downturn.

IOCs, with diverse downstream gas portfolios, are better equipped to handle market volatility by mixing and matching supply to several markets on a short-term basis than more resource-oriented NOCs.