OGJ Newsletter

Venezuela officials take issue with OPEC figures

Venezuelan Oil Minister Rafael Ramirez as well as other country officials have taken issue with the latest oil production quota figures published by the Organization of Petroleum Exporting Countries.

On its web site, OPEC’s figures reduce Venezuela’s quota ceiling to 2.47 million b/d in November, some 750,000 b/d lower than the 3.22 million b/d allotted earlier in September.

Ramirez said there is confusion and manipulation in the figures because, under OPEC’s quota system, Venezuela is allocated 11.5% of the organization’s total output. He said any change in the system of quotas would require a resolution by OPEC’s ministers.

Venezuela’s new production limit represents 9% of OPEC’s 27.25 million b/d in total production-a figure that is in line with estimates by independent analysts and oil organizations concerning the level of Venezuela’s actual output.

Paris-based International Energy Agency, among other secondary sources of information, pegs Venezuela’s output at 2.4 million b/d. In his criticism of OPEC’s figures, Ramirez said they reflect information based on such secondary sources.

Carlos Ramones, Venezuela’s vice-minister of finance, also expressed surprise about the OPEC decision, saying the ministry will review the change for the 2008 budget. “You can’t reduce that many barrels to the quota [ceiling.] This will be reviewed because we have to set an oil production level for the [2008] budget,” he said. The OPEC figures also might come as an embarrassment to Venezuelan President Hugo Chavez, who as recently as Sept. 16 announced plans to increase his country’s oil production to 5 million b/d in 2012 from the current 3.2 million b/d (OGJ Online, Sept. 19, 2007).

Kashagan issues not to be politicized, leaders say

Kazakh President Nursultan Nazarbayev and Italian Prime Minister Romano Prodi, meeting on the sidelines of a recent United Nations meeting, said the situation regarding the Kashagan oil project should not be politicized.

The informal agreement came even as Kazakhstan’s lower house of parliament unanimously passed legislation allowing the government to break oil contracts in the name of “national security.”

“Prodi and Nazarbayev believe that politics should not be involved in this,” said Yerlan Bayzhanov, Nazarbayev’s press secretary. “This is a matter of business and cooperation between specific business circles.”

Bayzhanov said, “Prodi expressed a wish that his forthcoming visit to Kazakhstan in October would not be linked with this issue,” referring to the disagreement between his country’s government and a consortium led by Italy’s Eni SPA.

The legislation passed by the Kazakh lower house of parliament will increase the government’s leverage in ongoing talks with Eni over the future of the stalled Kashagan oil project.

In a unanimous vote, lawmakers in the lower house passed amendments to the country’s subsoil law that allow the government to force retrospective changes to any existing oil contracts or even break the contracts altogether if they are deemed “a threat” to the country’s national security.

With the upper house of parliament also stacked with loyal members of the president’s party, according to analyst Global Insight, the new legislation is likely to sail through that house shortly and quickly be signed into law by the Kazakh president ahead of his October meeting with Prodi.

Kazakh official eases Kashagan demands

Meanwhile, Kazakhstan reported it could drop its demand that state-run KazMunaiGas become joint operator of Kashagan field, according to a senior official who added that the government has no plans to revise contracts of other international oil companies.

Kazakh Energy Minister Sauat Mynbayev Oct. 2 said, “The question of Kazakhstan’s role in the project as a co-operator is part and parcel of the negotiating process.” He said Kazakhstan would not approve the development plan and budget of the consortium led by Eni SPA in their present forms (OGJ Online, Oct. 1, 2007).

As for environmental complaints lodged by the Kazakh Environmental Protection Ministry and the Kazakh Emergency Situations Ministry against the Eni group, Mynbayev said he saw no reason in them to suspend work on the project as a whole.

“The consortium accepted a part of the complaints, and it is currently in the process of rectifying them. We do not see any reasons to suspend the project because of the environment. The Environmental Protection Ministry and the consortium are reaching an agreement,” he said. He also said the government of Kazakhstan has no intention of revising contracts with foreign producers that honor the country’s laws.

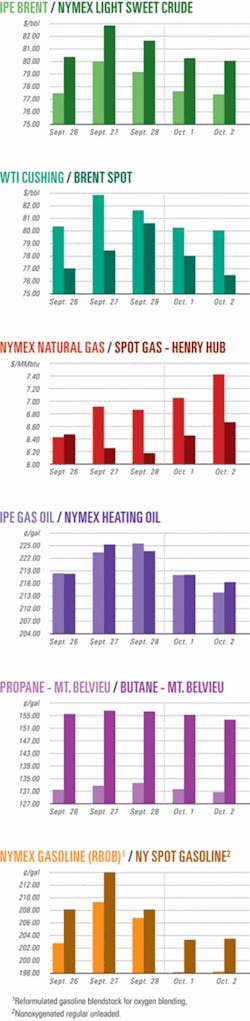

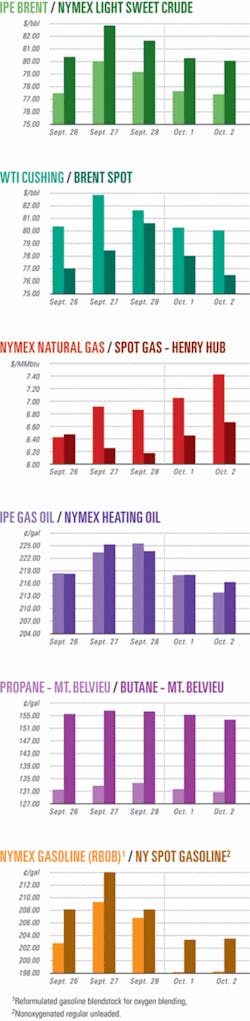

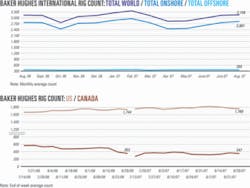

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesBrazil’s ANP to auction 312 blocks

Brazil’s National Petroleum Agency (ANP) said it plans to auction 312 offshore oil and gas blocks on Nov. 27-28. Of these, 221 are offshore and 91 on land.

Several blocks have an “elevated potential to hit oil or gas,” the agency said Sept.18, adding that they are adjacent to promising finds in Brazil’s Santos basin.

Petroleo Brasileiro SA and BG Group recently announced that they found oil in Carioca field in Santos basin, while late last year they discovered oil in nearby Tupi field (OGJ Online, Sept. 12, 2007 and Oct. 6, 2006).

Several of the blocks to be auctioned lie between those two finds, ANP said, adding that it also will auction promising blocks in the oil-rich Campos and Espirito Santo basins in November.

Tullow logs third Kaiso-Tonya well in Uganda

Tullow Oil PLC, operator and 100% interest owner of Uganda’s Block 2, has drilled and logged the final well in its three-well appraisal program in the Kaiso-Tonya area. The Mputa-4 appraisal well, drilled 1 km east of the Mputa-1 discovery, was to test an adjacent fault block. The well reached 1,073 m TD and encountered three oil-bearing zones with a total net pay of 15.4 m.

The company’s Mputa-3 well also intersected three oil-bearing zones, with a total net pay of 19.5 m, the best result to date in the appraisal area, Tullow said. Well data indicate that all three zones in Mputa-3 could flow at a combined rate of more than 4,000 b/d of oil. The well was being suspended as a future producer (OGJ Online, Aug. 23, 2007). Downhole pressure testing and sampling of Mputa-4 indicated moveable light, sweet crude with very good permeability, as seen in the other Mputa wells.

The Mputa-4 appraisal well has proved the lateral extent of oil-bearing reservoirs across the region. And the data from this program, which includes 3D seismic surveys and possible further production testing on existing wells, will help to determine the ultimate potential of the area and provide critical information for the early production system development, Tullow said.

Pearsall gas flow to evoke Maverick drilling

Drilling may increase in the next 3 years in the Maverick basin in Southwest Texas after a vertical exploratory well flowed 10 MMcfd of gas from Cretaceous Pearsall on a short drillstem test.

TXCO Resources Inc., San Antonio, intends to deepen the Glass Ranch B 1-77 well, in which it holds 100% working interest, through the Pearsall after gauging the 4-hr flow from an interval defined as the top of Pearsall under its joint exploration agreement with EnCana Oil & Gas (USA) Inc.

Meanwhile, TXCO and EnCana forged a new exploration agreement to examine the Pearsall and exploit other formations.

TXCO acquired 100% of EnCana’s interests in formations above the Pearsall in 250,000 gross acres in the southern part of EnCana’s acreage position that are subject to lease maintenance obligations.

TXCO agreed to drill three horizontal Pearsall wells by July 31, 2008, carrying EnCana for a 50% working interest in each well. TXCO will acquire a 50% interest in the Pearsall and deeper formations in 1,280 acres around each well.

TXCO will have the option to drill four more horizontal Pearsall wells by July 31, 2009, carrying EnCana for 50% interest, and TXCO will earn a 50% working interest in the deep rights on 5,760 acres around each well. TXCO will have a further option to carry EnCana for 25% interest in 16-20 horizontal Pearsall wells, depending on well costs, giving it the option to earn 50% of the deep rights in the remaining 250,000 acres in the block.

The vertical Glass Ranch well is the first effort by either company to drill the Pearsall in the southern part of the Maverick basin. TXCO said it believes that “horizontal wells will ultimately make the Pearsall a major producing interval in the Maverick basin.”

Acquisition of the shallow rights gives TXCO the means to recomplete the 90-plus Glen Rose porosity wells drilled to date in other zones as they deplete.

US official warns of Kurdistan deal risks

Hunt Oil Co. has come under pressure from the US government for its recent signing of an exploration and production agreement with the Kurdistan Regional Government (KRG) in northern Iraq.

In Baghdad, a US Embassy spokesman warned that Hunt and a handful of small “wildcat” companies that have signed similar deals could find themselves in a legal battle between the Iraqi federal government and the northern, semi-independent Kurdistan region. “We think that these contracts have needlessly elevated tensions between the KRG and the government of Iraq, who both share a common interest in the passage of national legislation,” the official said.

He added that the US is “pushing all sides to negotiate in good faith and knock off the things that undermine national unity.” Meanwhile, he said, “We advise companies that they could incur significant political and legal risk by signing contracts with any party before the national law is passed.” Analysts interpreted the spokesman’s statements as signaling that the US government may be unwilling to support Hunt Oil should there be a future dispute about the legality of its contract with the KRG.

KRG, Hunt Oil Co. of the Kurdistan Region, and Impulse Energy Corp. on Sept. 8 announced the signing of a production-sharing contract covering the Dihok area of the Kurdistan region (OGJ, Oct. 1, 2007, p. 36).

Japex to expand operations in Libya

Japan Petroleum Exploration Co. (Japex) plans to expand its operations in Libya by launching test drilling on Blocks 176-4 and 40-3/4 and by training more Libyan engineers in Japan.

Test drilling on Block 176-4 will start in May 2008 following recent seismic surveys that encouraged Japex to believe that a commercial production prospect was viable. Japex will begin drilling on Block 40-3/4 later in the 2008 fiscal year.

Japex also has invited Libya’s National Oil Corp. to send more engineers to the firm’s machinery maintenance factory in Niigata Prefecture for welding training starting next month through March 2008. Earlier this year, Japex invited six NOC employees for exploration technology training in Japan.

Drilling & Production - Quick TakesOil flow starts from Greater Plutonio area

Oil production has started Oct. 1 from the Greater Plutonio development area on Block 18 off Angola, reported block operator BP Angola (Block 18) BV. Production, which flowed at 45,000 b/d of oil, is expected to ramp up to a plateau of 200,000 b/d by next year.

The offshore development, the first BP-operated asset in Angola, is comprised of five fields: Galio, Cromio, Paladio, Plutonio, and Cobalto. BP made its first discovery on the block in 1999-2001 in 1,200-1,450 m of water. The area’s final development plan calls for 43 wells-20 producers, 20 water injectors, and 3 gas injectors-which will be connected by a large subsea system to a floating production, storage, and offloading vessel.

The FPSO has a storage capacity of 1.77 million bbl of oil, a processing capacity of 240,000 b/d of oil, and gas handling of as much as 400 MMscfd of gas. The vessel, which has a treated water injection rate of 450,000 b/d, is held in position by 12 mooring lines connected to anchor piles on the seabed.

The subsea system includes the longest single riser tower system of its kind in the world, BP said. At 1,258 m, it connects the FPSO to a network of subsea flowline and control systems that include 150 km of flowlines, 9 manifolds, and 110 km of instrument and control umbilicals. Many components of the subsea systems, as well as the riser tower, were made in Angola, including six of the subsea manifolds along with the worlds largest CALM (Catenary Anchor Leg Mooring) offloading buoy and the first ever Angolan assembled and tested subsea trees.

Several Angolan technicians and engineers are being trained to operate and support the Greater Plutonio development area in an ongoing 5 year development program, BP said.

BP and Sonangol Sinopec International Ltd. each hold equal interest in Block 18.

Aramco lets oil production contract to Saipem

Saudi Aramco has let a contract to Saipem SPA and its Saudi partners TAQA and Al Rushaid to construct, transport, and install oil production facilities in the kingdom.

The 7-year contract will help Saudi Arabia maintain its oil production capacity. Saudi Aramco has two 3-year options to renew the deal.

“A minimum workload is guaranteed during the first 4 years of the agreement,” Saipem said. “[Work will consist of] 16 platforms and 80 km of sea lines, in addition to the lay of the cables, ancillary to the platforms.”

Aramco periodically will confirm the scope of subsequent work to be executed, valued on the base of a “price-per-unit” agreed scheme. Fabrication will be carried out in a yard under construction in Dammam, 400 km east of Riyadh, Saudi Arabia. The Castoro II vessel will carry out offshore activities.

Aramco plans to allocate budget in the fourth quarter.

GDF, Vattenfall plan CO2 pilot in Germany

In a move it claims is consistent with its sustainable development policy, Gaz de France has signed a cooperation agreement with Germany’s Vattenfall Group for a carbon dioxide pilot project in Germany.

Erdgas Erdol GMBH Berlin, GDF’s wholly owned exploration and production affiliate, will use CO2 to enhance gas recovery from its nearly depleted Altmark gas field-the second largest onshore field in Europe.

The project will take 15 months to implement and will contribute to GDF’s research program on CO2 capture, injection, and storage. The partners are involved in a number of European CO2 storage projects such as the CO2 injection experiments on K-12-B field in the Dutch North Sea that Gaz de France has carried out the past few years.

Processing - Quick TakesKNPC eyes 615,000 b/d Kuwaiti refinery for 2012

Kuwait National Petroleum Co.’s (KNPC) board has allocated a budget of 4 billion (KWD) for a 615,000 b/d refinery it intends to construct, according to state media.

Official KUNA news agency quoted KNPC Chairman and Managing Director Sami Al-Rushaid as saying that the budget allocated for its construction was based on “accurate estimates.”

KNPC initially tendered the giant refinery with a budget of $6.3 billion, but was forced to withdraw the tender in February 2006 after the lowest bid came in at $15 billion.

Al-Rushaid said the new contract will be based on a cost-plus profit margin, which means Kuwait will pay the cost of the project to the successful bidder plus an agreed profit.

KNPC recently selected 17 international companies to bid for construction of the facility. The companies include Snamprogetti, Technip, GS Engineering & Construction Corp., SK Engineering & Construction Co., Hyundai Engineering & Construction Co., Hyundai Heavy Industries, JGC Corp., Petrofac International Ltd., and Saipem SA.

Also included are Foster Wheeler Energy, WGI Middle East, Daelim Industrial Co., Daewoo Engineering & Construction, CB&I, Archirodon Construction, and Gulf Leighton LLC. Fluor Corp. also was reported still in talks for parts of a tender.

The project will be divided into four major parts: two manufacturing units, utilities and services, storage tanks, and a pier.

Construction is due to start in 12-18 months, with the refinery to come on stream by the end of first quarter 2012. Completion was originally planned for 2010. KNPC also plans to modernize two of its three existing refineries, one at Al-Ahmadi and the other at Mina Abdullah, taking their combined capacity to 800,000 b/d from their current 700,000 b/d.

When those two projects are finished, KNPC will close down the country’s third refinery, at Shuaiba, which has a capacity of 200,000 b/d. The net result will give Kuwait a refining capacity of 1.4 million b/d by 2012.

Japan, Angola discuss refining, oil supply

Japan’s Ministry of Economy, Trade, and Industry (METI) has entered talks with Angola to build refining facilities in the African country in exchange for oil supplies in times of emergencies.

A METI delegation in early September met with the country’s industry minister, Joaquim David, and senior officials at state-owned Sonangol.

No agreements have been reached, according to one Japanese official who explained that METI hopes to stabilize Japan’s imports of oil and natural gas by diversifying its suppliers.

Angola’s only refinery is a 39,000 b/d hydroskimming facility operated by Fina Petroleos de Angola at Luanda.

Angola has become a supplier of interest to a number of countries, including the US, according to a recent report.

“Few African countries are more important to US interests than Angola,” said the report by the Center for Preventative Action, an arm of the Council on Foreign Relations, New York.

“Angola’s success or failure in transitioning from nearly 30 years of war toward peace and democracy has implications for the stability of the US oil supply as well as the stability of central and southern Africa,” the report said.

Angola on Jan. 1 became a member of the Organization of Petroleum Exporting Countries and is expected to have a production quota on Jan. 1, 2008. Reports say the amount of the quota will be decided on Dec. 5 at an OPEC meeting in Abu Dhabi.

In August, Roc Oil Co. Ltd., Sydney, confirmed a significant heavy oil find with its Massambala-1CH2 sidetrack well on Cabinda South Block in Angola (OGJ Online, Aug. 30, 2007).

ConocoPhillips, ADM to produce renewable fuel

ConocoPhillips has formed an alliance with agricultural processing firm Archer Daniels Midland Co. to develop technology to convert biomass into renewable transportation fuels.

The alliance reportedly will spend $10 million/year on the collaborative research of a next-generation biofuel production process that involves the conversion of biomass from crops, wood, or switchgrass into biocrude, as well as the refining of biocrude to produce transportation fuel.

ConocoPhillips last April teamed with meat producer Tyson Foods Inc. to produce diesel from animal fat. For this project, the major said it would spend $100 million over the next few years to upgrade several US refineries to enable production of the new diesel (OGJ Online, Apr. 18, 2007).

Transportation - Quick TakesPetrobras to spend $7.5 billion on gas transport

Petroleo Brasileiro SA (Petrobras) plans to spend more than $7.5 billion in natural gas transportation-related projects between now and 2012. Projects include more than 4,560 km of pipelines, 10 compressions stations, 31 city gates, and 2 LNG terminals.

Speaking at the Rio Pipeline 2007 Conference & Exhibition, Celso Luiz Silva Pereira de Souza, Petrobras’s manager of natural gas planning, implementation, and logistics, said the Campinas-Rio gas pipeline and the Cacimbas-Vitória section of the Gasene gas pipeline would both enter operation before yearend, improving gas integration between the southeast and northeast sections of Brazil.

The Atalaia-Itaporanga and Itaporanga-Pilar gas lines in Brazil’s northeast will also come on line this year, according to Souza.

Souza said Brazil’s gas market has grown 15%/year since 2001, driven primarily by industrial and automotive demand. Total 2006 demand stood at 46.3 million cu m/day, expected to increase to 134 million cu m/day by 2012.

Brazil’s gas transportation infrastructure must grow to meet this demand, but Carlos Felipe Guimaraes Lodi, Petrobras’s general manager of operational supply planning, sees problems in achieving this growth, including: lack of skilled project managers, delays in environmental permitting, and difficulty in acquiring storage spheres and compressors, the delivery lead time of which he currently places at 450 days.

Russia plans Sakhalin Island oil, gas port

The Russian government plans to build a port to export oil and gas from fields off Sakhalin Island.

Transportation Minister Igor Levitin said the port, planned for the village of Ilyinsky on Sakhalin Island, will be linked to two trunk pipelines, one for crude oil and the other for gas. He said the arrangement will cut the number of pipelines crossing the island.

As a result, there will be lower transportation costs as well as fewer environmental impacts, he said, adding that the total cost of the Ilyinsky port will be 10-15% less than the transportation infrastructure for the Sakhalin-1 and Sakhalin-2 projects. Ilyinsky port will be open year-round to shipping, without the need for icebreakers, unlike the port of De-Kastri, which in the ice season requires two icebreakers for every 100,000-tonne tanker shipment.

The project will require investment of 82 billion rubles, according to expert estimates. The figure includes roughly 37 billion rubles in state investment and 45 billion rubles from other sources.

Russian official assures China on spur line

Russia will abide by its understandings to build a crude oil pipeline spur from Skovorodino in the Russian Far East to the border with China, according to Russia’s Deputy Prime Minister Alexander Zhukov.

At a Sept. 28 meeting of a Russian-Chinese commission, Zhukov noted that Russian and Chinese companies have signed several energy agreements over the past few years.

“It is pleasant to note that all these understandings are implemented on time,” he said. “This also applies to the Skovorodino-Chinese border oil pipeline project.”

The statement followed remarks by Rosneft Deputy Pres. Dmitry Bogdanchikov that Russia should restrict the amount of oil it plans to transport to China via the projected Eastern Siberia Pacific Ocean line (OGJ Online, Sept. 18, 2007).

Construction starts on California LNG plant

Construction has begun on California’s first large-scale LNG production plant in the Mojave Desert about 75 miles northeast of Los Angeles, said Clean Energy Fuels Corp., Seal Beach, Calif.

The plant will have an initial production capacity of 160,000 gpd, which will be expanded to 240,000 gpd. The plant’s LNG storage capacity will be 1.5 million gal. Commercial shipments are scheduled to begin in the second half of 2008.

Tanker trailers will deliver the LNG, which will be used as fuel for vehicles, to customers throughout California and the US Southwest. Natural gas vehicles emit significantly less greenhouse gas and pollution than vehicles fueled by diesel or gasoline.