Biofuels producers confront evolving market unknowns

With biofuels likely to become a global industry by 2012, companies that emerge as leaders will have to be nimble and develop flexible strategies to negotiate inherent market uncertainties.

Accenture reached that conclusion in a recent report entitled “Irrational Exuberance? An assessment of how the burgeoning biofuels market can enable high performance: a supply perspective.” The report examines future scenarios for biofuels production, processing, and distribution.

Diversity of transportation fuels will be a fundamental change for the oil industry in the coming decade, said Melissa Stark, Accenture senior executive in the energy practice in London. She wrote the report after an Accenture team analyzed 20 countries.

“As the global supply market emerges, it is difficult to see who will come out the winners,” Stark said. “Governments are the biggest players in the emerging biofuels market. It is the government that determines the profitability.”

Energy-consuming countries-particularly the US, China, India, and Europe-are eager to diversify fuel supply. Stark noted government politics will remain dominated by domestic priorities such as energy security, agriculture, and the environment.

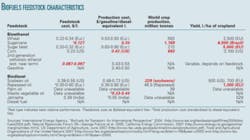

Biofuels feedstock choice will reflect local supply opportunities, said the Accenture report, which compared feedstocks worldwide. Sugarcane was the only feedstock scoring high on all Accenture’s criteria. Even if cellulosic ethanol fulfills its promises, sugarcane will remain competitive (see table).

“In order for policy-makers, farmers, agribusiness, and producers to create a global supply for biofuels, the choice of feedstock needs to be weighed against production costs, fossil energy balance, land availability for yield, and the size of the global feedstock market,” Stark said.

Accenture analyzed four categories of biofuels producers: farmer (cooperative) producers, agribusiness-agriculture supply chain and food producers, international oil companies (IOCs) and national oil companies (NOCs), and independents.

Biofuel supply growing

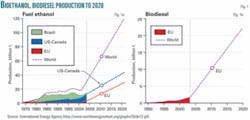

The International Energy Agency (IEA) forecasts a tripling or quadrupling of ethanol and biodiesel production by 2020 (Fig. 1).

Accenture said 2006 global crop-based ethanol production was 13.5 billion gal or 51.1 billion l. Of that, the US produced 4.8 billion gal, Brazil 4.5 billion gal, and members of the European Union 800 million gal.

The biodiesel market remains much smaller than the ethanol market. Global biodiesel consumption during 2005 was 1.1 billion gal or 4.2 billion l.

Current global oil consumption is 82.5 million b/d. Together, Japan, US, and China consume 36 million b/d of oil.

US President George W. Bush has announced a target of cutting gasoline use, now about 11 million b/d, by 20% over 10 years. To that end, he has called for consumption of renewable and other alternative road fuels of 35 billion gal/year by 2017. That would displace 15% of projected gasoline consumption in the US, up from 3.5% today.

The EU in 2003 set a target of increasing the use of biofuels in energy transportation to 5.75% by 2010. But a progress report indicates EU members likely will achieve only a 4.2% biofuels share by then. In March 2007, an EU summit proposed biofuels account for 10% of transportation fuels by 2020 in each member state.

Today, biofuels make up just over 1% of road fuel demand worldwide-85% ethanol and the rest biodiesel. Stark believes it’s unlikely that biofuels will make up more than 8% of road fuel demand by 2030 in even the most optimistic scenario (Fig. 2).

Global market requirements

Accenture defines a global biofuels industry as having price transparency and markets that connect buyers and sellers spanning multiple locations.

Such a market will be driven by policy-makers, farmers, agribusiness, and producers, Stark said. Demand hinges upon how much governments, vehicle manufacturers, product blenders, and retailers view and support biofuels as an alternative to petroleum.

Because biofuels currently cost more to produce than fossil fuels, government interventions appear crucial for now, Stark said. She believes government intervention can be reduced when the industry matures.

Different priorities for different biofuels-producing countries result “in a patchwork of targets, incentives, import tariffs, and tax structures, all aimed at growing the domestic biofuels market (albeit at different levels of commitment and aggressiveness),” she said.

The oil and transportation industries are considering their next steps in the biofuels industry based upon unfolding government policies, availability of fuels, and technology, Stark said.

“Technology will continue to improve the economics of biofuels development, but it is still uncertain which technologies will have the most impact and what the ultimate scale of the industry will be,” she said.

Accenture concluded technology has the potential to convert biofuels net importers, such as the US and China, into net exporters.

“In general, technology will continue to improve the economics of bio-fuels development, but it is still uncertain where and to what scale,” Stark said. “Cellulosic ethanol is the most obvious and anticipated, but significant advancements could be made in processing costs.”

Oil industry’s role

IOCs and NOCs own the existing fuels distribution infrastructure that the biofuels industry wants. But biofuels transportation and marketing represent “a direct cannibalization” of the oil industry’s gasoline and diesel volumes, Stark said.

“For IOCs, their big decision is whether to buy into the fast-moving and increasingly expensive and crowded first-generation market or continue with their strategies of investing in second-generation technology research,” Stark said.

First-generation biofuels are made from food crops. Second-generation biofuels are made from nonfood feedstocks, such as waste from agriculture and forestry. When commercialized, the cost of second-generation biofuels could be more comparable with gasoline and diesel than are first-generation biofuels.

“For NOCs, the key questions are around growing and integrating this new business into their downstream businesses and managing new stakeholders from the agriculture sector (including government agriculture departments),” Stark said.

IOCs and NOCs will influence how quickly and easily the biofuels market expands, Stark said.

“The IOCs, in particular, are some of the biggest investors in second-generation technology,” she said. “If any of these technologies becomes commercial, these players have the resources and capability to scale quickly, shifting the supply curve of the market.”

She forecasts an increase in mergers and acquisitions as the biofuels industry becomes more international and competitive. “We expect consolidation (independents that serve one country and that have one to two plants will not be able to stay competitive),” Stark said. “This consolidation will happen through either the merging of independents or the acquisition of independents by IOCs and NOCs or agribusiness.”

Alliances and joint ventures will help biofuels producers grow, access markets, and share risks. She foresees continuing diversity as companies refine investment strategies and their partnering skills to better access markets and financing.

So, although the potential and the costs of producing ethanol, biodiesel, and other biofuels remain uncertain, Stark said the big message to the oil industry is that energy resources will definitely be more diversified in the future.