Oil and gas companies in growing numbers are issuing sustainability reports in response to demand for information on corporate governance and risk-mitigation.

Shareholders and industry observers expect companies to disclose business risks involving the environment, labor, human rights, other social issues, and anticorruption measures. Nonfinancial sustainability reports sometimes accompany annual reports and financial statements.

Accountants told OGJ that corporate social responsibility initiatives are responsible for generating sustainability reports, which disclose a wide range of information that varies widely between companies and also between countries.

Xavier Houot, a partner with Ernst & Young India in sustainability advisory services, said corporate disclosure of past financial performance isn’t enough anymore. “Today, with increased emphasis on corporate governance across the world, with the appearance of new risks, the multiple forms of transparency and mitigating activities required have become a part of life,” Houot said. “The world expects a proactive approach to sustainability from the corporate community and is concerned about environmental, climatic, labor, social, and other developmental challenges.”

Statistics compiled by CorporateRegister.com Ltd., an online directory of corporate social responsibility and sustainability reports, indicate 99 oil and gas companies reported in 2006 compared with 26 in 1996.

In a 2006 joint report, KPMG and the United Nations Environment Programme (UNEP) said more than half of the top 250 companies in the Fortune 500 list produce sustainability reports, with 75% of them citing economic reasons for the reports.

A separate study from CorporateRegister.com in 2007 shows 234 of the world’s largest 300 companies produce a corporate nonfinancial report.

France is among the countries calling for mandatory sustainability reports from publicly traded companies. The practice remains self-regulating by the companies in many countries, including India. KPMG annual surveys on sustainability reporting trends indicate South Africa is one of only a few developing countries that have considered sustainability reporting.

In the US, the Securities and Exchange Commission has some disclosure requirements that pertain to reporting sustainability issues. “As early as 1971, the SEC demanded disclosure of environmental data in SEC filings,” the KPMG-UNEP report said.

Although the US Sarbanes-Oxley Act does not explicitly regulate the disclosure of environmental or social information, KPMG-UNEP said the act could enhance corporate transparency, encouraging sustainability information.

Evolving guidelines

The KPMG-UNEP report said ethics-oriented investment funds in the UK and US first screened companies during the 1980s based on corporate social and ethical performance. That focus increased after the Exxon Valdez oil tanker ran aground off Alaska.

“Following the 1989 Exxon Valdez disaster, the US-based Coalition for Environmentally Responsible Economies (CERES) developed the CERES-Valdez Principles on behalf of the Social Investment Forum,” KPMG-UNEP said. “These principles introduced a tough set of environmental reporting guidelines.”

Mandatory disclosure on environmental issues through local or site-level reporting was introduced with environmental legislation during the mid-1990s in the Netherlands, Sweden, Denmark, and Belgium.

Since then, sustainability reporting has increased with more comprehensive coverage. In 1997, CERES and UNEP launched the Global Reporting Initiative (GRI) to develop reporting guidelines for what GRI calls “the triple bottom line: economic, environmental, and social performance.”

The first GRI guidelines were launched in 2002 with the latest incarnation, the G3 guidelines, launched in October 2006.

The guidelines seek to elevate sustainability reporting to the same rigor as annual financial reporting, the KMPG-UNEP report said.

CorporateRegister.com said 30% of all nonfinancial reports produced in 2006 followed the GRI guidelines. The number of corporate nonfinancial reports for all industries grew from fewer than 50 in 1992 to 2,265 in 2006.

The oil and gas sector is the third most prolific reporting industry, said Iain McGhee of CorporateRegister.com, based in London.

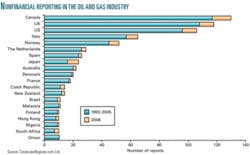

The most active reporting oil companies are based in Canada, UK, and US, he said (see figure).

France is the most commonly cited example of a mandatory approach because of its New Economic Regulations law, operative in 2003, which requires publicly traded companies to issue social and environmental information with their annual reports.

The UK also authorized mandatory reporting of nonfinancial performance factors. Businesses have until October 2008 to comply with provisions in the Companies Act of 2006, which formally outlines duties for corporate directors beyond financial reporting such as environmental concerns, employee matters, and social issues.

The KPMG-UNEP report said its research found more than 100 reporting requirements and standards in selected countries that addressed sustainability issues. About 50 of the 100 were mandatory requirements. Most of the selected countries were Organization for Economic Cooperation and Development members.

“However, these requirements remain largely fragmented and in most cases do not fit an integrated strategy to regulate sustainability reporting,” KPMG-UNEP said. “Quite often laws were promulgated without any reference to sustainability reporting, yet-after the fact-such laws can be classified as a legal requirement for sustainability reporting because of the nature of the issues addressed.”

Sustainability reporting varies considerably between companies and also between countries.

Reporting incentives

Speaking before the Sustainability Summit Asia 2006 in New Delhi, Ernst & Young’s Houot said India has no mandatory sustainability reporting requirements, but he believes corporations benefit from reporting social and environmental performance.

Sustainability reporting builds stakeholders’ confidence for Indian companies operating abroad that want to be perceived as meeting the same standards as their global peers, he said, adding that the practice also attracts socially responsible investors.

“It is the right time for Indian companies to seize the opportunity and adopt reporting practices,” Houot said. “And why? What does not get reported does not get improved. What gets measured can be benchmarked, compared, improved, verified, and audited.”

McGhee said the reporting history in the oil and gas industry has been characterized by a rapid evolution from single issue reporting, such as environmental issues only, to comprehensive multiple-issue reports covering social, environmental, and ethical issues in one document.

CorporateRegister.com reports that over 90% of the oil and gas company reports produced so far this year are multiple-issue reports.

Last year, Jantzi Research Inc. of Toronto released a report entitled “Oil and Gas in a Bull Market: The Shifting Sands of Responsibility.” The report examined 23 oil companies worldwide on environmental issues, human rights, and other social issues.

That report ranked companies on their social and environmental performance, saying the top performers were dominated by European and Canadian companies. BP PLC received the highest score.

Jantzi rated companies on four categories: environment, community and society, human rights, and health and safety. The environment category was broken down into subcategories. Emphasis was given to corporate reductions in greenhouse gas emissions.

“Many US oil and gas companies are only in the beginning stages of acknowledging climate change as a corporate concern and business issue,” the Jantzi report said.