The last few years have witnessed the emergence of numerous unconventional gas plays and prospects in the US.

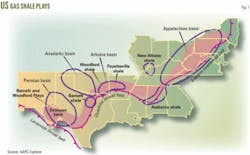

The industry continues to develop the extensive Barnett, Woodford, and Fayetteville gas shale resources and has expanded its search for new gas shale plays to West Texas, Alabama, Appalachia, and the Rocky Mountains.

Coals provide expanded opportunities for additional gas production even though the industry has delineated the easier to developed coalbed methane resources.

Aggressive development also continues in establishing new tight gas sand plays as well as revitalizing previous tight gas sand discoveries.

This article, the third in the series, describes many of these plays and prospects. The first part of this series was in OGJ, Sept. 3, 2007, p. 35, with the second part in OGJ, Sept. 17, 2007, p. 64.

Domestic gas outlook

The outlook for US natural gas production rests greatly on how successful industry is in finding and aggressively developing new and emerging unconventional gas resources. Opinions differ, however, on the likelihood of establishing new, large unconventional gas plays and prospects.

One view for future domestic natural gas production is that the outlook is perilous: “It is unlikely that a new onshore gas play, either conventional or unconventional, will be discovered in the US or Canada that will provide significant new supplies.... This is a perilous situation because the most prolific of these resources, including the Barnett shale, are already in relatively mature stages of development.”1

The contrary view, supported by numerous industry examples, is that the outlook is promising, assuming a renaissance in unconventional gas technology research, investment, and progress.

This article summarizes and provides examples of new supplies and emerging resources of unconventional gas. These resources seem substantial enough to fill a significant portion of the supply gap resulting from declining US conventional natural gas production.

Several of these new plays and prospect may not prove out, while others, with the aid of advances in unconventional gas technology, will likely emerge as sizable productive plays.

In addition, it is important to recognize that the already discovered plays provide opportunities for more intense development of these sizable unconventional gas resources.

Gas shales

Gas shales currently represent the most highly visible unconventional gas resource (Fig. 1). Such plays as the Barnett, Woodford, and Fayetteville shales are the most active, although several other shales show potential.

Combining innovative drilling and stimulation technology with a large resource potential has allowed the Barnett shale of the Fort Worth basin to produce 2 bcfd-sparking the current interest in evaluating and pursuing gas shales, a resource until recently categorized as a reservoir source rock or seal.

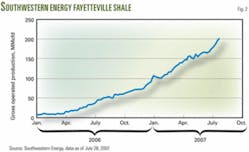

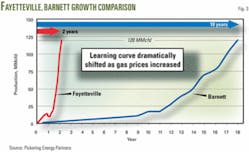

Two emerging gas-shale plays, the Fayetteville and the Woodford shales, have also reached high levels of production. For example, as of July 28, 2007, Southwestern Energy Co., the primary producer in the Fayetteville play, has increased its production from the play to 200 MMcfd from 50 MMcfd in 1 year (Fig. 2) and collapsed the initial “learning time” for this play to 2 years (Fig. 3).

Southwestern believes the Fayetteville shale has a potential 8,000 drilling locations and 11 tcf of recoverable resource.

Newfield Exploration Co., the primary producer in the Woodford shale, estimates that the play potentially has 3-6 tcf of recoverable gas. With new techniques such as long horizontal wells and advanced slick-water fracturing, producers have made plays such as the Woodford and Fayetteville shales economically productive.

Still, much remains to be learned about the favorable and less favorable geologic settings for these plays as well as the optimum drilling and completion practices.2

The search now is on for the next Barnett, Fayetteville, or Woodford shale play in places such as:

- West Texas for Barnett and Woodford shales.

- Alabama for the Conasauga shale.

- Appalachia for Marcellus and other gas shales.

- Rockies for numerous shale deposits.

The Barnett and Woodford shales in the Permian basin of West Texas are thicker and generally deeper than their Midcontinent counterparts. The Barnett shale has a 200-800 ft thickness at 5,000-15,000 ft depths, while the Woodford shale reaches a 400-ft thickness in the heart of the play. These shales have a high estimated organic content of 4-7% total organic carbon (TOC), providing gas-in-place estimates of several hundred billion cu feet per square mile in favorable areas.3

The major unresolved issues are:

- Do these shales have sufficient permeability?

- Can they be effectively stimulated?

- Will wells be sufficiently productive to cover the high drilling and completion costs of $3 million for a vertical well and $4.5 million for a horizontal well?

As of the beginning of 2006, companies had leased more than 1.3 million acres in these two shale plays. Leased acreage is concentrated in Reeves and Culberson counties, with the deeper and thicker shales occurring in the central and western parts of Reeves County.

Conoco-Phillips, Chesapeake Energy Corp., and Encana Corp. currently hold large portions of the leased acreage, although it was the small independent, Alpine Inc. (operating as K2X in Texas), that took the risk to establish the productivity of these West Texas shales.4

But more test well results still are needed to verify that the industry can exploit economically the large gas-in-place in the West Texas Barnett and Woodford shales.

Leasing and drilling for the middle Cambrian-age Conasauga shale is underway in St. Clair and Etowah counties in northeastern Alabama. The Conasauga shale is several thousand feet thick (gross) due to the highly folded and faulted productive play area, potentially making it difficult to develop.

In February 2007, the Alabama State Oil and Gas Board established 25,000 acres in northern St. Clair County as a new gas-shale field named Big Canoe Creek. Dominion Black Warrior Inc. with 13 wells (each with relatively modest test rates) is the primary developer in this field.

Energen Resources Corp. has drilled three wells just outside the field boundary. It is still too early to determine whether this play will be a major gas shale play or an economic disappointment.5 6

The Devonian-age Marcellus shale in eastern Pennsylvania and New York typically lies at 5,000-8,000 ft and has 75-200 ft of net pay. The shales are organically rich and thermally mature with nearly 5% TOC and average vitrinite reflectance values (Ro) of 1-2%.

Range Resources Ltd. has drilled 27 wells in the Marcellus shale and expects 0.8 bcf/well estimated ultimate recoveries (EURs) from its initial wells. Range is experimenting with Barnett-like horizontal wells and slick-water fractures that, while more expensive, are expected to increase productivity greatly.

Within its 500,000-acres of Marcellus shale leases, Range projects an unrisked 2.5-5 tcf resource potential.7-9

The gas basins in the Rockies have numerous Cretaceous and late Carboniferous-age shales. With the growing interest in gas shales, it seems that exploration is taking place in every basin with a feasible shale resource. In line with its “early-mover” reputation, Bill Barrett Corp. has initiated its Yellow Jacket shale-gas project in southern Colorado and Utah, targeting the Pennsylvanian Gothic shale between 5,500 and 7,500 ft. Barrett estimates 800 bcfe of unrisked potential on its 63,000 (net) acre lease, expecting 1-3 bcf/well EURs.

Numerous producers also are exploring the potential of the Cretaceous-age Baxter shales in the Green River basin. Questar Corp. has drilled or recompleted 18 wells in the Baxter and plans to drill 10 more in 2007, at depths ranging from 10,000 to 13,500 ft. One planned well includes a horizontal completion.

Kodiak Oil and Gas Corp.’s NT Federal No. 1-33 Baxter shale well tested 2 MMcfd of gas plus considerable water. The company completed this $4.5 million well with a nine-stage frac. Kodiak has plans to drill five more wells near the NT Federal well.

Coalbed methane

Much of the higher quality, easier to produce coalbed methane resource plays has been found. What remains are the deeper coals, the lower rank coals and the opportunity to develop existing plays more intensively. Notable potential plays are:

- Deep coals of the Greater Green River and Piceance basins, estimated to hold hundreds of tcf of gas in-place.

- Lower rank, Tertiary-age coals along the Gulf Coast.

- Additional development of the already discovered Raton, San Juan, and Uinta basin coals with infill wells, restimulation, and enhanced coalbed methane (ECBM).

The coalbed methane in the Green River and Piceance basins has long been noted for two things: the vast in-place resource and their considerable depth. Estimates put the in-place coalbed methane resource of the Green River basin at 314 tcf10 and of the Piceance basin at 84 tcf.11

In the Piceance basin, the Cameo coal in the Paludal zone below the Williams Fork (Mesaverde) tight gas sands contains about 80% of the basin’s CBM resource.

During the 1980s and early 1990s, producers experimented with commingling production from these deep tight gas sands and coals, motivated, in part, by Section 29 tax credits. The high reservoir pressure, however, and the increase in water production from completing the coals eventually discouraged this practice.

More recently, Encana has reported completing the entire Williams Fork (Mesaverde) interval, including the lower Paludal coal zone, with vertical wells and multiple fracs.

In the Green River basin, 85% of the 314-tcf coalbed methane resource occurs below 6,000 ft. Since the early 1990s, operators have attempted to tap into these deep coals through completions into multiple seams or through commingled completions of coals and overlying Mesaverde tight gas sands, all with limited success. Today, drilling for these coals is under way in the Atlantic and Pacific Rim projects, along the shallower flanks of the Washakie basin.

At the Atlantic Rim project, Double Eagle Petroleum Co. has been the most active producer with about 165 wells drilled and with 120 wells planned for 2007. Estimated recoveries are 1.0-1.2 bcf/well, with drilling and completion costs of $1 million/well.

Pending final approval of an environmental impact study (EIS) filed for the Atlantic Rim, operators estimate that 1,800 wells may be drilled in the next 5 years. While the active drilling in the shallow Green River coals is encouraging, the ultimate fate of the CBM potential in the Green River basin lies in the still to be explored deep coals.

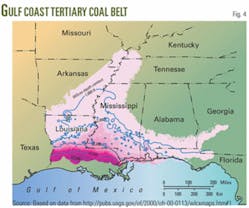

A large in-place coalbed methane resource also exists in Gulf Coast Tertiary coals, stretching from the Florida panhandle to the Texas Gulf Coast (Fig. 4). One study12 sets the in-place resource at 4-8 tcf, while an independent mapping and resource assessment puts the size of the in-place resource much higher, with 3.4 tcf possibly recoverable.13

Prospective coals occur at 1,500-5,000 ft depths with more mature, gas-rich coals below 3,000 ft. Drilling has been limited to individual test pilots and significant production has yet to be established. Leasing, however, has been active, with more than 400,000 acres leased to date.

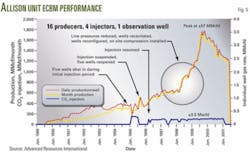

BP PLC’s Tiffany (N2) and Burlington Resources Inc.’s Allison (CO2) San Juan basin ECBM pilots, conducted in the early 2000s, demonstrated the potential for ECBM to boost production. At the Allison test, involving 16 production wells and 4 CO2 injection wells, gas production increased five-fold to a peak of about 3.5 MMcfd/well after CO2 injection from about 700 Mcfd/well before CO2 injection (Fig. 5). The pilot, however, had numerous other well enhancements and ECBM may only account for about one-third of the increase.

Consistent with laboratory work, the ECBM test also experienced a loss in CO2 injection capacity. The loss of injection capacity, however, was modest at 50% and appeared to improve over time. The authors believe that ECBM will likely remain a lower priority until the US enacts carbon credits for storing anthropogenic CO2. Work by ARI indicates that US coalbeds could ultimately sequester 90 gigatons of CO2.14

To understand this resource better, the US Department of Energy is sponsoring a series of field tests involving CO2-ECBM and CO2 sequestration.

Tight gas sand

With the benefits of expanding geological knowledge, improved well-completion technology, and a willingness to take risks, industry continues to find and establish new tight gas sand plays as well as revitalize previously discovered plays.

Notable growing tight gas sand plays are:

- Lance at Pinedale in southwestern Wyoming.

- Deep Bossier in East Texas.

- Mesaverde in the Piceance and Uinta basins.

All three of these unconventional-gas plays offer promise for intensive resource development.15

Gas production has climbed rapidly for the Lance-Mesaverde tight-gas play, now approaching 1 bcfd. The Lance-Mesaverde reservoirs contain stacks of channel-fill sandstones, involving 20-70 individual sand packages and providing net pay of 300 to more than 1,000 ft.

Three-dimensional seismic is helping identify fairways in these complex stacked reservoirs and advanced core and log analysis is providing a more complete geologic model of the productive sands in the field.

Operators have determined that a greater number, a dozen or more, of smaller-size (about 100,000 lb of proppant) stimulations help a well achieve contact with more sands than the previous smaller number of larger-size stimulations (Table 1).

The low-permeability of the Lance-Mesaverde sands and their lenticular nature allow considerable downspacing for wells without significant loss in well productivity. For example, Ultra Petroleum Corp. conducted a study on 170 Pinedale wells spaced at 10 acres. The study noted little to no well interference and opened up the potential for closer, more optimal well spacing for this tight gas sand play.

Estimated well EURs continue to increase, rising to nearly 9 bcf/well for more recent completions from less than 5 bcf/well in the late 1990s (Table 2).

Ultra, the largest leaseholder on the Pinedale anticline, has drilled and placed on production 168 wells. With more than 5,000 drilling locations, Ultra believes its holding may contain 23 tcf of ultimate gas recovery (gross).

Shell Exploration & Production Co., with 82 bcf of Pinedale production last year, has participated in drilling more than 260 wells. Shell is pursuing increased efficiency in well completions, with up to 8 frac stages/day/well reported recently. Shell has also undertaken individual reservoir sand-unit pressure tests to determine sand continuity and optimal well spacing.

Questar Corp., with 195 producing wells, believes that, with down-spacing, it still has more than 900 undrilled locations within its core acreage.

The Lance-Mesaverde tight gas sands at Pinedale field have already produced more than 1 tcf of gas to date. With all three major operators reporting increased drilling in 2007, Pinedale is poised to become Wyoming’s largest producing natural gas field and one of the largest in the US.

The Deep Bossier is a high pressure, high-temperature tight gas sand reservoir, occurring at depths generally greater than 15,000 ft. It is a Jurassic-age continental slope depositional system on the western flank of the East Texas basin. The resource is characterized as containing thin, overpressurized, low-water saturation, low-permeability sands within a thick package of marine shales.

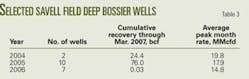

The overall shale-sand package ranges in thickness from 1,000 to 2,500 ft, with 25 to 100 ft of net sand. Pressure gradients range from 0.6 to 0.8 psi/ft and matrix permeabilities are on the order of 5 μd. Wells in this difficult, deep play currently cost between $8 million at 15,000 ft and $12 million at 18,500 ft to drill and complete. It is anticipated, however, that well costs will come down as drilling practices evolve. While operators typically report EURs from 5 to 7 bcf/well, a handful of wells have EURs in excess of 20 bcf.

Three main operators are developing this emerging tight gas sand play. Gastar Exploration Ltd.’s primary asset is the Hilltop Resort field in which it holds 16,350 net acres. Gastar has drilled 16 Deep Bossier wells in the field and estimates a recoverable resource of 350 bcfe within its lease acreage.

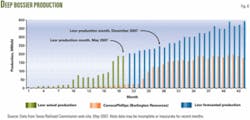

EnCana and Leor Energy LP have joint working interest in the 190,000-acre Amoruso field. The companies estimate that their acreage holds multiple tcf of recoverable gas. The field currently produces about 200 MMcfd and may reach 350 MMcfd by yearend 2008 (Fig. 6). Encana and Leor have drilled some exceptional wells in the Amoruso field, including three that produced more than 1 bcf in their first 30 days.

ConocoPhillips is active in the Savell and Rainbolt Ranch fields where the company holds about 200,000 acres, produces about 200 MMcfd, and has plans to increase drilling this year. Gas production rates from the wells in these two fields are impressive (Table 3).

The Deep Bossier play is still in early exploitation. If the Savell, Hilltop Resort, Amorusa, and Rainbolt Ranch fields continue their success, the Deep Bossier has the potential to become one of the larger domestic tight gas sand plays with production of 1 bcfd or more.

The Williams Fork-Mesaverde play in the Piceance basin is a growing Rockies tight gas sand play that produced 145 bcf of gas in 2006. A geologically analogous tight gas play in the Uinta basin, the Wasatch-Mesaverde, is still in early development. These are stacked, lenticular sand plays deposited in fluvial and coastal environments. The reservoirs consist of a 3,000-4,000 ft thick package of sands, shales, and coals, with a series of 20-40 ft thick point bar sand deposits that terminate abruptly at low-permeability boundaries.

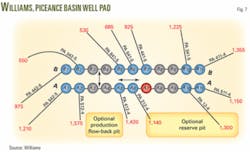

The Piceance basin Williams Fork (Mesaverde) play has seen significant innovations during its development. For example, Williams Co., the dominant producer in the play, is using FlexRigs that are capable of drilling up to 22 wells from a single pad (Fig. 7). It reports drilling times of fewer than 10 days/well with this rig, compared with 20 days to drill a well 5 years ago.

The company also has centralized well-fracturing operations, with up to 65 wells on 6 pads fractured from a single location.

Williams also is actively pursuing the largely undeveloped Piceance Highlands properties holding 3,700 undeveloped drilling locations and 3 tcf of potential resource.

The Uinta basin portion of the Wasatch-Mesaverde tight gas sand play is still in the process of being defined. EOG Resources Inc. has conducted coring studies that point to more than 200 ft of pay in a 900 ft interval vs. only 40 ft previously identified by openhole logs.

EOG now estimates that the play contains up to 250 bcf/section of gas in-place, five times higher than estimated from logs (Fig. 8).

Completion and treatment of as much of the sand in the Wasatch-Mesaverde interval as possible is a key technology step. For example, Bill Barrett Corp. has been stimulating an average of 10 multipay zones across an interval of about 2,900 ft in their Peters Point field wells. Its average well has produced 0.9 bcf in the first 12 months.

Within their Uinta acreage, Bill Barrett has identified 250-300 drilling sweet spots where it expects the multiple-pay-zone stimulation practices to provide EURs of 2-3 bcf/well, much higher than achieved by earlier wells in this area.

Next steps

Space constrains this review and discussion of new and emerging unconventional gas plays. Numerous other potential opportunities exist, such as the tight gas sands of the Columbia basin, the coalbeds of the Midcontinent, and the gas shales of Alberta and British Columbia.

An important next step is a renewed emphasis on rigorously establishing the resource-in-place for unconventional gas.

Early visionary steps to quantify the gas in-place in tight gas sand plays were taken by USGS scientists (Law, Spencer, Fouch, and Johnson, among others) using the best of limited and difficult-to-interpret data. The database is now considerably larger and today’s log-and-core interpretation methods are superior.

ARI’s decades of work on unconventional gas resources convinces us that large volumes of unconventional gas resource remain. With technology, vision, and persistence, these could be converted to recoverable reserves, but much still remains to be learned about the true size and nature of the unconventional gas resource and its economically prospective plays.

Acknowledgment

The authors thank Peggy Williams for her personal correspondence regarding the shale section of this article.

References

- Berman, A., “What’s New in Exploration: The Impending US Gas Supply Crisis: Why Prices Will Increase,” World Oil, Vol. 228, No. 6, June 2007, p. 23.

- Toal, B.A., “Fayetteville and Woodford Shales,” Oil and Gas Investor, June 2007.

- Riestenberg, D., “Woodford Shale” assessment for Model for Unconventional Gas Systems, US DOE/EIA Task Order No. 40241.

- Williams, P., “Far West Texas,” Oil and Gas Investor, January 2006.

- “Conasauga shale gas play grows in Alabama Valley and Ridge” OGJ, Feb. 19, 2007, p. 37.

- An Overview of the Conasauga Shale Gas Play in Alabama, Alabama State Oil and Gas Board, June 2007.

- Williams, P., “Take a Look at These Shales,” Oil and Gas Investor, July 11, 2007

- Brown, D., “If It’s Shale, It’s Probably in Play,” AAPG Explorer, April 2007.

- Milici, R., and Swezey, C., “Assessment of Appalachian basin Oil and Gas Resources: Devonian Shale-Middle and Upper Paleozoic Total Petroleum System,” USGS Open-File Report 2006-1237.

- Tyler, R., et al., Geologic and Hydrologic Assessment of Natural Gas from Coal: Greater Green River, Piceance, Powder River, and Raton basins, Western United States, RI0228, Texas Bureau of Economic Geology, 1995.

- McFall, K.S., et al., A Geologic Assessment of Natural Gas from Coal Seams in the Piceance basin, Colorado,” GRI 87/0060, Gas Research Institute, 1986.

- Warwick, P.D., et al., “Coal gas resource potential of Cretaceous and Paleogene coals of the Gulf of Mexico Coastal Plain (including a review of the activity in the Appalachian and Warrior basins),” USGS Open-File Report 2004-1273, pp. 1-25.

- Potential Gas Supply of Natural Gas in the United States, Potential Gas Committee Report, 2005.

- Reeves, S.R., Assessment of CO2 Sequestration and ECBM Potential of US Coalbeds, Topical Report, DOE Contract No. DE-FC26-00NT40924, February 2003.

- Kuuskraa, V.A., and Ammer, J., “Tight Gas Sands Development-How to Dramatically Improve Recovery Efficiency,” Unconventional Resources, GasTIPS, Winter 2004.

The authors

David Riestenberg is a senior geologist with Advanced Resources International. He specializes in unconventional resources, CO2 enhanced oil recovery, and CO2 sequestration. Riestenberg holds a BS in biology from the College of Mount St. Joseph, Cincinnati, Ohio, and an MS in geology from the University of Tennessee, Knoxville.

Robert Ferguson is a research assistant with Advanced Resources International. He has worked on many unconventional resource projects, including the model for unconventional gas systems (MUGS), which was developed for EIA to forecast economic feasibility of tight gas, coalbed methane, and shale plays. Ferguson holds a BA in economics from Washington and Lee University, Lexington, Va.

Vello A. Kuuskraa’s photo and biographical information appeared in Part 1 of this series (OGJ, Sept. 3, 2007, p. 35).