OGJ Newsletter

Venezuela state oil firms to pay ‘back taxes’

Venezuela’s tax authority Seniat has received or been promised payments from two state-dominated joint venture firms after imposing large back-tax bills on recently nationalized heavy oil development projects in the country’s Orinoco belt.

In a statement, Seniat said Ameriven paid some $400 million in back taxes from September 2001-December 2004, while Petrozuata agreed to pay $172 million for 1996-2006. The statement also said Cerro Negro was billed for $46 million in back taxes from 2001-04.

Petrozuata, now known as Petro Anzoategui, is 100% owned by state-run Petroleos de Venezuela (PDVSA), which also owns 70% of Ameriven, renamed Petro Piar in July. PDVSA controls 83.4% of Cerro Negro, now known as Petro Monagas.

The announcement, which comes after the state’s recent takeover of majority control of Venezuela’s energy projects, likely will be interpreted as a setback for ConocoPhillips and ExxonMobil Corp., which have been seeking compensation for the loss of their operations in the country.

When PDVSA started its takeovers, several international oil companies-among them BP PLC, Chevron Corp., Statoil ASA, and Total SA-came to terms over their continued minority involvement in the projects.

ConocoPhillips and ExxonMobil, however, failed to agree to handover terms that would have granted PDVSA at least a 60% stake in their projects. Failing any agreement, PDVSA appropriated ConocoPhillips’s 30% share and ExxonMobil’s 42%.

Nuke plant shutdown strains Asian markets

The July shutdown of Tokyo Electric Power Co.’s Kashiwazaki-Kariwa nuclear power plant will strain Asian LNG and oil markets.

Tomoko Hosoe, senior consultant at Facts Global Energy, Honolulu, said Tokyo Electric will have to buy 1.3 million tonnes more LNG than it planned in its current fiscal year and 87,900 b/d more fuel oil and crude for direct burning because of the shutdown.

The plant has been idle since June 26 because of an earthquake (OGJ, Aug. 6, 2007, p. 76).

Tokyo Electric now expects to need 18.8 million tonnes of LNG in fiscal 2007, compared with actual consumption of 16.8 million tonnes in 2006. It will need 180,900 b/d of fuel oil and crude vs. 69,600 b/d last year.

In a report, Hosoe described how Tokyo Electric’s increased fuel requirements will affect Asian markets.

“An additional 2-3 million tonnes of LNG, which need to be secured from the spot market in 2007-08 in a very tight LNG market, is a serious problem,” she said.

Tokyo Electric’s increased oil demand, she added, will have “a dramatic impact” on prices of low-sulfur heavy fuel oil, low-sulfur waxy residue, and low-sulfur crude.

The 8.2 Gw Kashiwazaki-Kariwa plant is expected to remain closed through at least next March and might require at least a further year to return to full operation.

Firm applies for nuclear plant in Alberta

A privately held Canadian power generator has taken the first step toward construction of a nuclear power plant in the heart of Alberta’s oil sands region.

Energy Alberta Corp., Calgary, filed an application for a license to prepare a site on private land adjacent to Lac Cardinal, 30 km west of Peace River.

The application is for as many as two, twin-unit Canadian deuterium uranium (CANDU) reactors. The first unit ultimately would have capacity of a net 2.2 Gw of electricity. Energy Alberta envisions a start-up date in early 2017.

Canada has seven commercial nuclear power plants, none of them in Alberta. They are in Ontario, New Brunswick, and Quebec.

Nuclear power has been examined as a way to meet the large energy needs of oil sands production, which now rely heavily on natural gas, while lowering the air emissions associated with hydrocarbon combustion.

But the nuclear option has strong environmental resistance.

Energy Alberta said its application to the Canadian Nuclear Safety Commission represents “the first of many steps in getting licenses to build the plant.”

Nigeria to launch national energy council

Nigeria is to establish a new National Council on Energy in the next few weeks to discover ways to develop sufficient electric power capacity in the country over the next decade, according to Nigeria President Umaru Yar’Adua.

The council will invite experts in electric power and natural gas to propose ideas on the future development of the power sector. Yar’Adua has promised to declare a national emergency in the power sector to focus attention on it after the council is inaugurated.

Nigeria needs adequate electric power generation to transform it into a modern economy and electricity networks are vital infrastructure, Yar’Adua said during a 3-day retreat for ministers, special advisers, and permanent secretaries in Abuja.

The council also will look at stabilizing the Niger Delta to get Nigeria back on track in oil and gas production. Militants from the Niger Delta have damaged infrastructure to pressure the federal government into granting them greater allocations of oil and gas revenues and development of their areas.

Nigeria’s Vice-President Goodluck Jonathan has been in talks with leaders of militant groups from the Niger Delta and Yar’Adua has said the federal government will begin to implement the Niger Delta master plan drawn up by Niger Delta Development Commission in partnership with the states in the region.

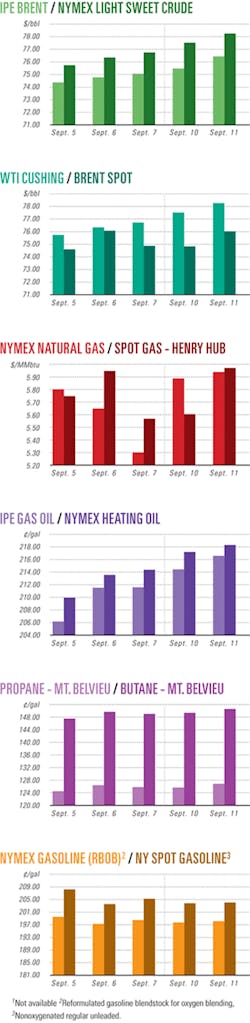

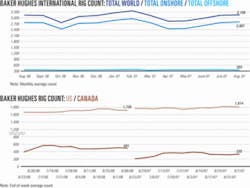

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesWyoming Baxter shale gas flows without frac

Questar Corp., Salt Lake City, said it still has much to learn about the Cretaceous Baxter shale in the Vermillion subbasin in southwestern Wyoming after it began gas sales from a second horizontal well without treatment.

The Trail 14D-10H well in Sweetwater County, averaged 7 MMcfd of gas on 12/64-in. to 20/64-in. chokes in the first 24 hr with 7,100 psig initial flowing wellhead pressure. The well flowed from a 2,900-ft lateral in Middle Baxter after encountering multiple indications of natural fractures.

Questar set 4½-in. liner across the horizontal interval, perforated 850 ft of interval, and opened the well to sales. TD is 14,500 ft. Bottomhole location is in 9-13n-100w with surface location in Sec. 10.

The well, which produced at rates up to 9.1 MMcfd in the first 4 days on line, was making 2.7 MMcfd on a 12/64-in. choke on Sept. 4 with 3,300 psig flowing wellhead pressure. Questar’s working interest is 100%.

The early results are encouraging, said Charles Stanley, president and chief executive officer of Questar E&P.

“We mapped, targeted, and drilled into multiple natural fractures. We perforated less than one third of the 2,900-foot horizontal section, and we produced gas at good initial rates without fracture stimulation,” he said. “We believe natural fractures are the key to this play, and we think that the best way to tap the natural fracture network is with horizontal wells, but we still have much to learn about how to drill and complete these Baxter shale wells to optimize rate and recovery.

“We intend to produce the naturally completed 850-ft interval for a few weeks before making a decision to either fracture-stimulate the currently perforated section, or simply perforate the remaining 2,000 ft of lateral section.”

Questar’s first horizontal well in the play, Trail 13-15J, flowed 65 MMcf of gas in its first 11 days on production (OGJ Online, Feb. 27, 2007).

Iraq Taq Taq well tested at high oil rates

The fourth appraisal-development well in Taq Taq field in northern Iraq’s Kurdistan area flowed 48º gravity oil at a combined rate of 37,560 b/d from three reservoirs, said Addax Petroleum Corp., Calgary.

The TT-7 well made 10,240 b/d from a 232-m barefoot interval in Shiranish, 10,250 b/d from a 111-m interval in Kometan, and 17,070 b/d from a 53-m interval in Qamchuqa, said Taq Taq Operating Co., a joint venture of Addax and Genel Enerji AS of Turkey. The flows were on 128/64-in., 76/64-in., and 128/64-in. chokes, respectively.

TT-7 is 2.9 km southeast of TT-4, which was on the crest of the structure. TD is 2,187 m. The companies are drilling the fifth and sixth wells in the program and have started shooting 290 sq km of 3D seismic over the field.

This is the highest rate of any Taq Taq well to date and will contribute to the Kurdistan regional government’s goal of producing 1 million b/d of oil within 5 years, said Ashti Hawrami, minister of natural resources.

Addax said recent constructive efforts of the Kurdistan region and Iraq could result in a legal framework that will enable the corporation to begin full field development in 2008.

Gas-condensate find tested west of Shetland

Total SA gauged a gas-condensate discovery on Block 205/5a 100 km northwest of Sullom Voe west of the Shetland Islands.

The Tormore discovery well flowed 32 MMcfd of gas with 75 bbl of condensate per million cubic feet. TD is 3,936 m. The well is in 610 m of water 15 km southwest of the Total-operated Laggan discovery, successfully appraised in 2004 (see map, OGJ, Aug. 20, 2007, p. 38).

Total plans to evaluate the discovery’s reserves in coming months.

Total operates Tormore with 47.5% interest. Partners are Eni UK Ltd. 22.5%, DONG E&P (UK) Ltd. 20%, and Chevron North Sea Ltd. 10%.

The Total group’s proved and probable reserves in the UK exceeded 1 billion bbl of oil equivalent at the end of 2006. Total UK E&P’s equity production on the UK Continental Shelf is 280,000 boe/d.

Imperial has two discoveries at Tomsk, Siberia

Imperial Energy Corp. reported two discoveries on its interests at Tomsk in Western Siberia.

Imperial said its North Chertalinskoye 403 exploration well identified potentially large oil deposits.

“The reservoirs are in the Bajenov, Jurassic, and Tyumen sections, with net oil pay in aggregate estimated at 68 m identified through logs and cores,” Imperial said. The firm expects to flow-test the Tyumen section “by fraccing later this month, with the other sections to be tested during the winter period.”

Imperial also said its Nyulginskoye-2 exploration well, which was spud in July, has identified “promising intervals of oil” in the Cretaceous and Tyumen sections.

“Net oil pay is estimated in aggregate to be 7 m through logs and cores,” Imperial said. This well also is expected to be flow-tested later this month.

Meanwhile, Imperial said, its Tamratskoye-3 exploration well that was spud Aug. 27 is deeper than 1,000 m of its targeted depth of 3,000 m, while the Buranovskoye-2 exploration well on Block 74 was spud on Aug. 30 and is at 800 m of a targeted depth of 3,000 m.

The British firm said it expects to spud its South Maiskoye 395 exploration well on Block 70 later this month.

Drilling & Production - Quick TakesProduction starts from North Sea’s Blane field

Talisman Energy (UK) Ltd. has begun production from Blane oil field, which straddles the UK and Norwegian sectors of the North Sea.

Blane is about 160 miles east of Aberdeen on UKCS Block 30/3a and NCS Block N1/2. The field has been unitized at 82% and 18% respectively across the median line.

Production from two horizontal development wells drilled in 2006 is expected to peak at 17,000 b/d of oil equivalent.

The Blane development wells in the UK sector are tied back by pipeline to the Ula platform in the Norwegian sector.

Oil will be transported via the Ula Tambar system and Norpipe pipeline network to Teeside, UK.

Talisman said an injection well will be drilled in the fourth quarter.

Blane field was discovered in 1989 by well N1/2-1, which encountered oil in Paleocene Upper Forties sandstone. The structure was appraised via the 30/3a-1 well in the UK sector (OGJ Online, July 6, 2005).

Talisman Energy operates Blane field and holds a 43% interest. Partners include Eni UK Ltd. 13.9%, Eni ULX Ltd. 4.1%, Nippon Oil Corp. subsidiary MOC Exploration (UK) Ltd. 14%, Bow Valley Petroleum (UK) Ltd. 12.5%, and Roc Oil (GB) Ltd. 12.5%.

Whiting begins CO2 flood at North Ward Estes

Whiting Petroleum Corp., Denver, has begun a field-wide carbon dioxide flood project in its North Ward Estes field covering 58,000 net acres in Ward and Winkler counties in Texas.

This represents the initial phase of a five-phase development project being carried out in the field through 2012 at an estimated cost of $639 million. The project’s Phase 5, which would begin in 2013, has not been finalized, a company spokesman told OGJ.

The company began injecting 1 MMcfd of CO2 in North Ward Estes field in May. Its current rate of injection is about 16 MMcfd.

By first quarter 2008, the company expects the injection rate to reach 100 MMcfd of CO2.

Whiting has increased the field’s injection wells to 440 from 180 and its producing wells to 935 from 580. These additions are the result of more drilling and converting inactive wells to producers, the spokesman said.

The field currently produces a net 5,300 b/d of oil. Peak production of 13,000 b/d of oil is expected in 2014. The field holds about 127 million boe in proved reserves as of Dec. 12, 2006.

Whiting acquired the field in 2005 from Celero Energy LP, Midland, for $459 million (OGJ Online, Oct. 7, 2005).

Aker completes Blind Faith semisubmersible hull

Aker Kvaerner ASA has completed the Froya deep-draft semisubmersible (DDS) hull for Chevron Corp.’s Blind Faith platform, which will use steel catenary risers for more-efficient exploration in ultradeepwater Gulf of Mexico.

The semisub is in a gulf integration yard to be outfitted with topsides. Once complete, the Blind Faith platform will be installed on Mississippi Canyon Block 650, about 162 miles southeast of New Orleans, in 6,500 ft of water.

The platform will produce 45,000-60,000 b/d of oil and 45-150 million cu m/day of gas from the high-temperature, high-pressure field that will start producing in first-quarter 2008. Initial production will be through three wells at rates of 30,000 b/d of oil and 30 MMcfd of gas (OGJ, Oct. 17, 2005, Newsletter).

Aker Kvaerner’s DDS concept will enable the Blind Faith platform to reduce Chevron’s operating costs, as operators will not have to continually change the flexible risers, and the platform will not move as much in the water, compared with others.

Chevron, with partner Anadarko Petroleum Corp., awarded the original engineering, procurement, and construction contract to Aker Kvaerner in October 2005.

GSF orders newbuild ultradeepwater rig

GlobalSantaFe Corp. is adding to its deepwater drilling fleet and has signed a turnkey contract with Hyundai Heavy Industries Ltd. for a newbuild ultradeepwater drillship.

The vessel, to be built in Ulsan, South Korea, at an estimated cost of $740 million, is scheduled for delivery in September 2010.

It is a next-generation drillship that combines the best features of GSF’s drillships and semisubmersibles in a single unit, said GSF Pres. and Chief Executive Jon Marshall.

The vessel is an enhanced version of company’s GSF C.R. Luigs and GSF Jack Ryan drillships, which entered service in 2000. Like those rigs, it will be capable of drilling in as much as 10,000 ft of water and upgradeable to 12,000 ft.

Also, the rig will feature advanced dynamic-positioning capabilities, triple activity load paths, a derrick rated for 4 million lb, dual liquid-storage systems, larger quarters, and an efficient deck design that provides more space than previous-generation drillships.

Processing - Quick TakesExxonMobil plans Singapore steam cracker

ExxonMobil Chemical Co. plans to build a second world-scale steam cracker complex at its existing site in Jurong, Singapore (OGJ Online, Nov. 29, 1999).

The multibillion plant will be fully integrated with the company’s 605,000 b/cd refinery and chemical plant, providing feedstock, operating, and investment synergies. The initial chemical plant began operating in 2001.

The new plant, expected to start up in early 2011, will include a 1 million tonne/year ethylene steam cracker, two 650,000 tpy polyethylene units, a 450,000 tpy polypropylene unit, a 300,000 tpy specialty elastomers unit, an aromatics extraction unit to produce 340,000 tpy of benzene, and an oxo-alcohol expansion of 125,000 tpy. A 220-Mw electric power cogeneration unit also will be built.

ExxonMobil Asia Pacific Pte. Ltd. has awarded the design, engineering, procurement, and construction contract for the steam cracker recovery unit to Shaw Group.

Mitsui Engineering & Shipbuilding and Heurtey Petrochem Group have been selected as EPC contractors for the steam cracker furnaces. Mitsui also received EPC contracts for the polypropylene and specialty elastomers units.

Mitsubishi Heavy Industries has been awarded the EPC for the two polyethylene units.

SP Chemicals plans petrochemical complex in Vietnam

SP Chemicals Ltd., Singapore, has signed a tentative agreement with Vietnam to build a $5 billion petrochemical complex at Phu Yen, about 560 km northeast of Ho Chi Minh City.

SP plans to submit its proposal to Vietnam’s prime minister next year, according to Vo Dinh Tien, an official with central Phu Yen province’s planning and investment department.

If the prime minister approves the project, construction would begin in 2009 on 1,300 ha, Tien said. The aim of the project is to supply domestic as well as export markets.

SP is expected initially to invest $1.5 billion to build several petrochemical facilities in that area from 2009-14. SP then will invest $3.5 billion to enlarge the complex.

A refinery and a port that can accommodate ships as large as 250,000 dwt also will be built as part of the project, Tien said. The completed complex is expected to attract further investment of $6 billion from foreign and domestic companies, he said.

Total to build desulfurization unit at German refinery

Total SA will invest $163.6 million to construct a 1 million tonne/year desulfurization unit at its Leuna refinery in Germany by fall 2009. Total will supply the domestic market with ultralow-sulfur heating oil.

Leuna, which Total described as one of the most efficient refineries in Europe, has a capacity of 227,000 b/cd and is able to process sour crude without producing heavy fuel oil.

Total said the project is part of its strategy to upgrade its refining base. It follows the commissioning of a distillate hydrocracker at the 140,600 b/d Normandy refinery in late 2006, the construction of a desulfurization unit and steam methane reformer at the 221,280 b/d Lindsey Oil refinery in the UK, and desulfurization capacity extensions carried out or under way at the Flandres, Provence, and 115,600 b/d Feyzin refineries in France.

Petrobras awards expansion of Cubatao refinery

Brazil’s state-owned oil company Petroleo Brasileiro SA (Petrobras) has awarded a contract to Swedish construction group Skanska AB and its Brazilian partner Engevix Engenharia for an $84 million expansion of a refinery in Brazil, reported Skanska.

The contract covers construction of a sulfur recuperation unit and a residual gas treatment unit at the 162,800 b/d Presidente Bernardes refinery in Cubatao.

Skanska’s share of the project comprises detailed engineering, procurement, construction and assembly, commissioning, and start-up assistance, and is valued at $55 million.

The project is to start immediately and is scheduled to be completed in 29 months, Skanska said.

Transportation - Quick TakesKonys-Kumkol oil pipeline opens in Kazakhstan

KuatAmlonMunai, a Chinese-Kazakh joint venture, has commissioned a 73-km crude oil pipeline from Konys field in Kazakhstan to Kumkol. It will deliver as much as 2,000 cu m/day of oil from Konys field to the Atasu-Alashankou export pipeline.

Built at a cost of 1.7 billion tenge, the Konys-Kumkol pipeline and pumping station will upgrade oil transportation in southern Kazakhstan, which earlier relied on deliveries by tanker truck from Konys to Kyzylorda and then by rail to eastern Kazakhstan.

KuatAmlonMunai, a 50:50 joint venture of China National Petroleum Corp. Ltd. and Kuat Holding Co., plans to produce 721,300 tonnes of oil this year, up more than 50% from the 417,500 tonnes produced in 2006. Officials said the new pipeline will speed deliveries of oil to China and will greatly reduce transport costs.

Gazprom seeks Japan Bank funding for Sakhalin-2

Russia’s OAO Gazprom, said to be faced with financial constraints over the Sakhalin-2 LNG energy project, has resumed negotiations with the Japan Bank for International Cooperation (JBIC) to secure needed funding.

The European Bank for Reconstruction and Development, which had been central to Sakhalin-2’s initially planned lending syndicate, withdrew in August due to concerns over Gazprom’s efforts, perceived as illegitimate, to gain control of the development.

In April Gazprom acquired a 50%-plus-one share in the Sakhalin Energy Investment Co. for $7.45 billion under an agreement with SEIC shareholders (OGJ Online, Apr. 24, 2007).

SEIC stakeholders-Royal Dutch Shell PLC, Mitsui & Co., and Mitsubishi Corp.-were forced to sell their majority stake to Gazprom following Russia’s halting construction on the project for alleged environmental infractions.

Absent EBRD, Gazprom is seeking new backers to meet the project’s 2-trillion-yen cost. Gazprom Deputy Chairman Alexander Medvedev said his firm and the three minority partners have reached a memorandum of understanding for JBIC financing.

Medvedev also said JBIC would consider financing other oil and gas development projects in such areas as East Siberia, a region of key concern to Japan.

Russia has long insisted that development of hydrocarbon resources in East Siberia would be essential to the development of the East Siberia Pacific Ocean oil pipeline that Japan has long sought.

In February, Russian Minister of Industry and Energy Viktor Khristenko made clear that his country would like Japanese investment in the development of East Siberian crude and gas reserves as part of the ESPO pipeline project (OGJ Online, Feb. 26, 2007).