SPECIAL REPORT: OGJ200 expands as 2006 earnings, spending surge

The OGJ200 group of companies posted a 16% gain in earnings for 2006, as capital expenditures surged and production and reserves increased. The number of companies qualifying for the group climbed for the first time since 1999, when the list was limited to the largest 200 firms.

OGJ began publishing its list of US-based, publicly traded oil and gas producing firms in 1983 as the OGJ400. This year’s compilation contains 144 companies, up from last year’s all-time low of 138.

Collectively, the current group of companies posted $110 billion in earnings during 2006. At $117 billion, the companies’ capital and exploration expenditures were up sharply from a year earlier, and their combined revenues increased 5%.

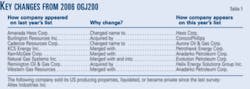

List changes

Eleven companies appear in the OGJ200 for the first time this year, and another firm, Atlas America Inc., returns to the list.

Atlas America ranks No. 71 by assets and was previously included in the results of Resource America Inc., which last appeared in the report 2 years ago. In June 2005, Resource America spun off its oil and gas operations to Atlas America, with which Resource America formerly consolidated.

Six firms from the previous edition of the OGJ200 no longer appear in the compilation because of mergers and acquisitions (OGJ, Sept. 4, 2006, p. 20). They are Burlington Resources Inc., KCS Energy Inc., Kerr-McGee Corp., Natural Gas Systems Inc., Remington Oil & Gas Corp., and Western Gas Resources.

Altex Industries Inc., which last year ranked No. 134, is no longer listed. This Breckenridge, Colo., company sold its oil and gas assets last year.

Unavailable as of press time, the 2006 results of three of the companies that qualified for the compilation are not detailed in this report and are excluded from the group totals. These companies are Capco Energy Inc., Empiric Energy Inc., and Petrol Industries Inc.

Market drivers

The OGJ200 companies benefited from higher oil prices last year than during 2005, but natural gas prices declined, and earnings were tempered by rising operating costs.

Worldwide economic growth and ensuing growth in oil demand combined with little spare production capacity and refinery glitches to put a floor under oil prices last year. The futures and wellhead prices of crude peaked in July amid tight refining conditions and strong product demand in the US.

At $66.31/bbl, the average closing futures price for crude oil on the New York Mercantile Exchange in 2006 was 17% higher than during the prior year.

Meanwhile, gas futures prices were down 21%, averaging $7.03/MMbtu for 2006. Gas prices peaked during the fourth quarter of 2005, following Gulf of Mexico production declines in the wake of a damaging hurricane season. From the start of 2006, gas prices weakened from those highs.

The OGJ200 firms with refining operations on the US West Coast and in the Midwest enjoyed higher cash refining margins last year than during 2005, according to Muse, Stancil & Co. Strong demand in these markets limited product supply and buoyed prices, especially during April-August of 2006.

Although they were strong in the second quarter of 2006, average margins for US Gulf Coast and East Coast refiners dipped last year from their full-year 2005 averages.

Exploration and production operating costs climbed as greater upstream activity increased demand for the inputs necessary to produce oil and gas. Companies paid more for labor, supplies, and services as a result.

Annual results

In addition to improved financial results, the OGJ200 companies reported a collective increase in worldwide oil and gas production and reserves during 2006.

Last year, growth in the OGJ200 companies’ spending and drilling programs surpassed 2005 growth rates. The group’s capital spending last year increased 40%.

The 2006 capital spending surge resulted in a 27% increase in the number of US wells that the group drilled. The OGJ200 companies drilled 21,394 net wells in the US last year.

In 2005, the group’s spending climbed 34%, and the number of US net wells that these companies drilled increased 24%.

The OGJ200 details each company’s liquids and gas production and reserves worldwide and breaks out the results for the US. The group reported collective gains in nearly all categories for 2006. Results for natural gas were stronger than for oil.

The group’s liquids production last year climbed 6% worldwide, but in the US liquids output was up just 1.8% from a year earlier. The group’s liquids reserves increased 2% worldwide last year, but US liquids reserves declined 0.4%.

The OGJ200 firms reported a 10% gain in worldwide natural gas production and a 7% increase in US gas production for 2006. And while the group’s combined gas reserves in the US climbed 11% last year, the total was up 23% worldwide.

Financial performance

Growth in not only earnings but also stockholders’ equity and total assets during 2006 outpaced revenue growth for the OGJ200 companies.

The group reported a 20% surge in yearend assets, totaling $942.4 billion at the end of 2006. Combined stockholders’ equity climbed 21% to $431 billion.

Revenues increased to $993.5 billion last year on higher oil and gas production, but lower gas prices held growth in check. In 2005, this group of companies reported $942.7 billion in revenues.

In spite of higher operating costs, earnings climbed at a rate three times that of revenues. The OGJ200 firms posted collective earnings of $110 billion last year, up from $94.5 billion in 2005.

Thirty-eight of the companies in the current OGJ200 group reported net losses for 2006, though, while 37 members of this group posted losses for 2005. There are 44 firms in the group that recorded net income in excess of $100 million for 2006, while two companies’ losses were greater than that amount.

Fast growers

Ranked at No. 23 by assets, Helix Energy Solutions Group Inc. is the fastest growing OGJ200 company based on 2006 results.

With a 143% gain in stockholders’ equity, Houston-based Helix Energy Solutions Group posted a 128% increase in earnings from a year earlier. During 2006, the company acquired Remington Oil & Gas Corp. and divested 27% of its offshore contracting business, Cal Dive, in a public offering.

The 20 fastest-growing companies are ranked by growth in stockholders’ equity. For a firm to qualify for the list of fast growers, it must have recorded positive net income for both 2006 and 2005, and it must have recorded an increase in earnings from 2005. Limited partnerships, newly public companies, and subsidiaries are excluded from this list.

No. 78 by assets, GMX Resources Inc. is the second-fastest grower. The company, based in Oklahoma City, posted a 25% increase in earnings as its stockholders’ equity climbed 115%.

Arena Resources Inc. is third on the list of fast growers and is ranked at No. 82 by assets. Arena Resources was the fifth-fastest grower in the previous edition of the OGJ200.

Other companies on the fast-growers list for at least the second consecutive year are Chesapeake Energy Corp., Aspen Exploration Corp., Basic Earth Science Systems Inc., Gulfport Energy Corp., and XTO Energy Inc.

Top 20 firms

Many of the 20 companies leading the current OGJ200 assets ranking were also in the top 20 of the previous edition of this annual report.

Removal of Burlington Resources and Kerr-McGee from this year’s list made way for No. 19 Pogo Producing Co. and No. 20 Newfield Exploration Co., which previously were ranked 21 and 22 respectively.

Anadarko Petroleum Corp. moved to No. 4 from No. 8 a year ago. During 2006, Anadarko acquired Kerr-McGee and Western Gas Resources.

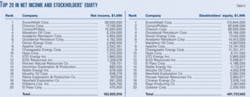

The top 20 firms’ annual results grew almost as much as those of the entire group. The top 20 companies’ combined earnings were $103.7 billion last year, up from $89.6 billion in 2005.

These 20 companies’ total revenues last year were $965 billion, and their capital spending during 2006 grew 38% to $96.4 billion.

The total assets of the top 20 firms climbed 19% to $853.2 billion and account for almost 91% of the total group’s assets.

The market capitalization of the top 20 firms as of Dec. 31, 2006, was $1 trillion. In the previous OGJ200, the top 20 firms had a combined market cap of $853 billion as of yearend 2005.

Earnings, spending leaders

The OGJ200 ranks the companies not only by assets but also by revenues, earnings, capital spending, and other gauges. ExxonMobil Corp. tops most of these lists.

The top four companies as ranked by 2006 revenues are ExxonMobil, Chevron, ConocoPhillips, and Marathon Oil Corp.

Up 24% from a year earlier, Hess Corp. reported 2006 revenue of $28.7 billion. This puts Hess at No. 5 in terms of revenue. Ranked by assets, Hess is No. 11.

And ranked at No. 17 by assets, Murphy Oil Corp. reported the seventh-highest revenue for 2006: $14.3 billion, up from $11.9 billion in 2005.

With $39.5 billion in annual earnings, ExxonMobil tops the rankings by 2006 net income. Chevron, ConocoPhillips, Marathon, and Anadarko round out the top five firms by earnings.

Ranked No. 30 by assets, Plains Exploration & Production Co. is No. 17 ranked by 2006 earnings. Plains reported net income of $598 million, compared to a net loss of $214 million for 2005.

Plains reported that its net income for 2006 includes a gain on the sale of oil and gas properties, losses on mark-to-market accounting for derivatives contracts, a charge for extinguishment of debt, and other items. Sales volumes for the year were down 5% from 2005 as a result of the company’s third-quarter 2006 producing property sale.

Ranked by capital and exploratory expenditures, Apache Corp. is sixth, with $3.9 billion in 2006 spending. Apache is ranked at No. 10 by assets.

Chesapeake Energy is the leading OGJ200 company in terms of net wells drilled in the US during 2006. Chesapeake’s count of US net wells drilled is 1,449.2, followed by Dominion Exploration & Production with 1,081 wells. Chevron is third on this list with 986 US net wells drilled last year.

Reserves, production

While ExxonMobil is the highest ranking company in terms of worldwide liquids production, Chevron leads the OGJ200 firms in US liquids production during 2006. ConocoPhillips is second as ranked by US liquids production, and ExxonMobil is third.

But ExxonMobil leads the OGJ200 group in both US liquids reserves and worldwide liquids reserves. On each of these lists, ExxonMobil is followed by Chevron, ConocoPhillips, Occidental Petroleum Corp., Anadarko, and Apache.

With 900 bcf produced last year, ConocoPhillips is the leading OGJ200 company in terms of US gas production. ExxonMobil is second on this list with 706 bcf and is first as ranked by worldwide gas production for 2006.

ExxonMobil produced 2.77 tcf of gas worldwide last year, followed by ConocoPhillips with 2.07 tcf, and Chevron with 1.8 tcf. Devon Energy Corp. is fourth as ranked by worldwide gas production, with 815 bcf produced last year.

At the end of 2006, ConocoPhillips was the leading OGJ200 company in US gas reserves, with 12.44 tcf. And ExxonMobil held the largest gas reserves worldwide, totaling 32.48 tcf.