OGJ Newsletter

Kazakhstan may extend Kashagan suspension order

The Kazakh government has threatened to extend its suspension order of work at Kashagan oil field if the Eni SPA-led consortium does not address the operational issues hindering the project.

Kazakhstan stopped the group from continuing work at Kashagan on Aug. 27 claiming breach of environmental standards, cost overruns, and delays (OGJ Online, Aug. 28, 2007).

Analysts have interpreted the action as a move to gain higher revenues from the project.

Production, planned to start in 2005, has been postponed to 2010. Eni has suggested that operational costs could rise to $136 billion from $57 billion. The group plans to develop the field by drilling about 280 wells and building offshore platforms and artificial islands.

According to media reports, the Kazakh authorities are now pressing the consortium to propose “an adequate compensation” and reforms in the structure of the deal by Sept. 5 to drive its future implementation.

Kazakhstan has said that it is prepared to change the operator if need be, but this does not necessarily mean appointing state oil company KazMunaiGaz as the replacement. However, even if KazMunaiGaz took control, the issue is whether it has the technical experience or financial resources to manage the field efficiently.

Kashagan is an important project for future non-OPEC oil supplies to the West, which is trying to persuade Kazakhstan to direct Caspian oil away from Russia, China, or Iran.

NPRA: Keep primary ozone standard

The National Petrochemical & Refiners Association supports keeping the primary ozone standard in US clean-air regulations, NPRA environment director David Friedman testified Aug. 30 before a US Environmental Protection Agency hearing in Philadelphia.

EPA is considering lowering the National Ambient Air Quality Standard (NAAQS) for ground-level ozone to 0.07 ppm from 0.08 ppm, said Alison Davis, EPA spokeswoman for air and radiation.

Some environmentalists and medical experts support a stricter standard of 0.06 ppm. But Friedman said changing the NAAQS is unnecessary.

“Many states have not yet completed plans to attain the current standard, so EPA should focus on helping communities meet the current standard,” Friedman said. NPRA members have worked to improve air quality, and they acknowledge the efforts undertaken by the EPA, state governments, and local communities, Friedman said.

“The science behind lowering the standard is uncertain and variable, and therefore this is not the right time to change it,” he said. “There are many questions regarding the state of the science and, in particular, whether or not there have been any significant developments over the past 10 years that would warrant further revisions of the standard.”

BLM seeks comments for northeastern NPR-A

The Bureau of Land Management (BLM) is soliciting public comment on its draft supplemental environmental impact statement to address proposed oil and gas activities in the northeastern portion of the National Petroleum Reserve-Alaska (NPR-A) area.

The public comment period on the draft document is scheduled for Aug. 24-Oct. 23, a BLM release said. The northeastern NPR-A area covers 4.6 million acres.

The public comment is part of a mandatory process as outlined in the National Environmental Protection Act (NEPA). BLM anticipates a possible NPR-A lease sale in the second half of 2008, but no definite date will be set pending completion of the NEPA process, a BLM spokeswoman in Anchorage told OGJ on Aug. 29.

Tom Lonnie, BLM-Alaska state director, said the supplemental plan will allow the agency to consider the lands appropriate for leasing “and the restrictions we should place on exploration and development that will result in petroleum production while protecting the area’s important resources.”

BLM began developing the supplement in December 2006 in response to a Sept. 25, 2006, ruling from the US District Court for the District of Alaska that stated the 2005 northeastern NPR-A amended integrated activity plan-EIS failed to adequately address cumulative impacts.

Nicaragua taxes Esso, embargoes assets

Nicaragua’s vice-president has ordered Esso Standard Oil to pay $3 million in taxes on allegedly undeclared oil imports, while a judge has embargoed the company’s assets.

Vice-President Jaime Morales Carazo said transnational companies are not exempt from paying such taxes, a claim Esso denies. Esso spokesman Alfredo Fernandez said the company owes no taxes because the importation of oil into Nicaragua is tax-exempt by national law.

The Superior Council of Private Business sent a letter to Nicaraguan President Daniel Ortega saying that the tax claim and embargo “could damage the image of his government and the nation, which needs so much investment.”

The US Embassy in Nicaragua said the move has the potential to seriously damage economic relations between the US and Nicaragua.

Ortega has been negotiating with Venezuela President Hugo Chavez to import and refine Venezuelan crude oil. Last month, Chavez and Ortega launched construction of a 150,000 b/d refinery in Piedras Blancas, near Nicaragua’s Pacific coast (OGJ Online, July 23, 2007).

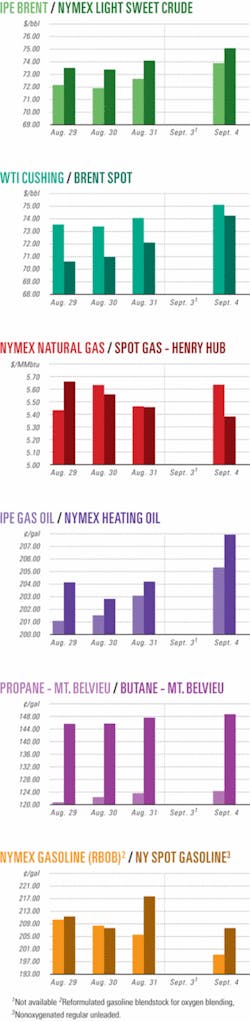

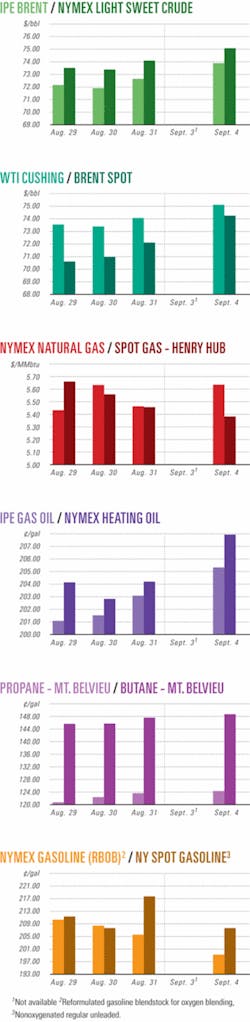

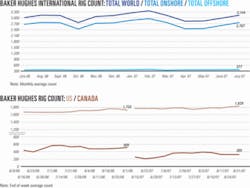

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesConocoPhillips makes gas find with Harrison well

Operator ConocoPhillips has discovered a 16-m gas column in the lower Ketch formation of its Harrison exploration well (44/19b-6) in the UK southern North Sea.

The well reached a TD of 4,289 m and will be flow tested with results expected later this month. Harrison is 20 km to the northeast of the Murdoch platform. All of the drilling was completed ahead of schedule and under budget.

Aidan Heavey, chief executive of Tullow Oil PLC, a partner in the well, said early assessment of the well’s data show that it is in line with the company’s predrill expectations.

Petrobras to boost Amazon gas exploration

Brazil’s state-owned Petroleo Brasileiro (Petrobras) plans to step up exploration for natural gas in the Amazon rainforest, according to a senior company official.

Petrobras plans to launch gas production in 2008 from its Urucu field in northern Amazonas state, where it produces 50,000 b/d of oil, said director of exploration and production Guilherme Estrella on Sept. 3.

Estrella said Urucu field will help meet gas demand growth by 2012 and that Petrobras has a 20-year agreement to supply 5.5 million cu m/day of gas to Amazonas state.

Petrobras plans to drill 23 wells in the Solimoes basin by 2012, he said. Major projects will include Jurua, Jaraqui, and Sao Mateus fields.

Meanwhile, Estrella forecast lower production for Petrobras than earlier predicted. Petrobras’s average oil output will stand at about 1.85 million b/d in 2007, down from the earlier target of 1.919 million b/d, Estrella said.

The reduced output resulted from operational problems with platforms P-34, P-50, P-43, and P-48. According to Estrella, however, most problems have been resolved.

Final notice issued for central gulf sale

The US Minerals Management Service issued a final notice for central Gulf of Mexico Outer Continental Shelf Lease Sale 205, which covers 28.5 million acres of submerged land in federal waters off Louisiana, Mississippi, and Alabama. The sale will be held Oct. 3 in New Orleans.

Sale 205 offers about 5,000 blocks 3-224 miles offshore in 12-11,200 ft of water in what is the newly configured central Gulf of Mexico OCS Planning Area.

Sale 205 is the first central gulf lease sale in the agency’s 2007-12 OCS leasing program.

MMS estimates the sale could result in the production of 0.776-1.292 billion bbl of oil and 3.236-5.229 tcf of natural gas.

Drilling & Production - Quick TakesAlabama strat trap oil field still growing

A southern Alabama oil field with a unique trapping mechanism is still under development after having become the state’s largest producing field in 2005.

Midroc Operating Co., private Dallas independent, has drilled more than 40 wells into the Little Cedar Creek field Jurassic Smackover limestone reservoir since becoming operator of the field in May 2000. Hunt Oil Co., Dallas, discovered the field in Conecuh County in 1994.

The field is near the updip limit of the Smackover formation, and the trapping mechanism is interpreted as stratigraphic, the Alabama Oil & Gas Board reports. There is no faulting or structural closure based on current well control, and the Smackover displays monoclinal dip to the southwest at a rate of 200 ft/mile.

“This trapping mechanism is unique among Jurassic reservoirs throughout the entire Gulf Coast region,” the board said.

The discovery well, Cedar Creek Land & Timber Co. 30-1, in 30-4n-12e, 10 miles southeast of Evergreen, Ala., went to a TD of 12,100 ft. It flowed 108 b/d of oil and 49 Mcfd of gas on a 12/64-in. choke with 248 psi flowing tubing pressure from the Smackover.

Subsequent drilling by Midroc on 160-acre spacing has expanded the field limits to include more than 10,000 acres in 4n-12e and 4n-13e. Development continues mainly to the northeast.

Little Cedar Creek field produced 1.17 million bbl of oil in 2005 and 1.64 million bbl in 2006, helping reverse the state’s declining oil production trend, the board noted.

The Smackover pool “consists of two main porosity zones separated by a dense nonproductive zone.” The pool is officially defined as Smackover strata between 11,490 ft and 11,580 ft in the Pugh 22-2 well in 22-4n-12e.

Amerisur moves rig to Colombia’s Putumayo basin

Colombia’s state-owned Ecopetrol SA has authorized mobilization of the Pride-17 drilling rig to the Platanillo block in Colombia’s Putumayo basin, reported partner Amerisur Resources PLC.

Platanillo is an “advanced project with near-term production potential,” said Amerisur chief executive officer John Wardle. The firm said rig mobilization will take about 3 weeks and that it expects the well to spud in early to mid-September, followed by testing and results in October.

The rig will drill a second well, Platanillo-2, immediately following the drilling of Platanillo-1, Amerisur said. The location of Platanillo-2 will depend on results obtained in Platanillo-1. Subject to the possibility of additional civil works, it is expected that Platanillo-2 will be spudded in October.

The firm said negotiations are continuing regarding the acquisition of an increased working interest in the Platanillo contract. The current stakeholders are operator Ecopetrol 40%, Repsol YPF SA 35%, and Amerisur 25%.

Delays raise Long Lake oil sands project costs

Nexen Inc. said labor problems have delayed construction and start-up at the Long Lake oil sands development 200 miles north of Edmonton, Alta. and increased the project’s capital cost by 10-15% above the previous forecast of $5.3 billion.

Nexen said the sulfur recovery unit is slated for completion in first quarter 2008 because of lower than expected labor productivity and difficulties securing sufficient labor, particularly pipefitters, to work on the sulfur recovery unit, said Charlie Fischer, Nexen’s president and chief executive. The pace of commissioning activities also is slower than expected, he added.

However he said the work is almost complete, and the company expects to have sufficient laborers for all remaining activities.

Progress on other units of the upgrader also has been slower than expected. Completion of the hydrocracker, the OrCrude unit, and all main plant utilities are expected in the third quarter of this year and the gasifier and air separation units, in the fourth quarter.

Commissioning has commenced on the utility steam boilers, with start-up expected during the third quarter.

Full start-up of the upgrader is now expected to begin in the first and second quarters of 2008.

Commissioning and start up of the steam-assisted gravity drainage (SAGD) plant and wells is under way. The company currently is injecting steam into 4 of the 10 well pads and expects to be steaming all well pads by the end of September.

“SAGD performance at Long Lake is as expected or slightly better, and we expect bitumen production to ramp up to full rates over the next 12-24 months” Fischer said.

Production of synthetic crude oil is expected late in second-quarter 2008. The company expects the upgrader to reach full production capacity 12-18 months after start-up.

“We expect to produce synthetic crude oil at Long Lake for several decades and benefit from a significant operating cost advantage,” Fischer said. Despite the increase in capital costs, “project returns from Long Lake at current commodity prices are higher than [was] expected at the time of sanctioning.”

Processing - Quick TakesNPRA: US refining capacity climbed 0.6% in 2006

US refining capacity grew 0.6% during 2006 to 17.4 million b/cd of distillation capacity and 18.4 million b/sd as of Jan. 1, reported the National Petrochemical & Refiners Association Aug. 22 in its annual refining and storage capacity report. The figures exclude capacity in Puerto Rico and the US Virgin Islands.

The trend of adding capacity to existing refineries has continued, said NPRA Executive Vice-Pres. Charles T. Drevna. “While it’s true that a brand new refinery hasn’t been built since 1976, we’ve actually, on the aggregate, built the equivalent of one new world-class refinery each year for the past 14 years,” he said.

Capacity at 149 operable US refineries at the beginning of this year was 3.9% higher than 5 years earlier and 12.9% higher than at the beginning of 1997, according to NPRA, which used figures compiled by the US Energy Information Administration in its 2007 Petroleum Supply Annual.

However Drevna said expanding domestic capacity has become more challenging because of more-stringent regulations, and the permitting process remains complex and uncertain.

Policymakers also send conflicting signals when they call for more capacity on one hand and 20% cuts in gasoline consumption over 10 years on the other, he observed.

“Refiners make their reinvestments today based on where they see demand headed. If policymakers take actions that significantly decrease consumption, domestic refiners will naturally consider the wisdom of investing in new capacity or facilities only to have those investments stranded in a decade or less,” Drevna said.

Sinopec, CNPC plan 30 refineries in China

China Petrochemical Corp. (Sinopec) and China National Petroleum Corp. (CNPC) are expanding their refining facilities to ease the country’s tight oil supply, according to media reports.

China’s eobserver.com said Sinopec is scheduled to add and enlarge some 20 refineries with 10 million ton/year production capacity in the next 2-3 years, while CNPC plans to set up 10 refineries, each also having a production capacity of 10 million tons/year.

The financial daily said with completion of the 30 plants, China will have to import more oil because the country’s current output of 200 million tons of crude has reached its peak. Now, it said, 50% of China’s domestic crude oil consumption relies on imports.

Eobserver.com said Sinopec Group’s planned refineries will be built in South and East China, especially in the relatively developed southern areas, where “the strong economic engines are in urgent need of more energy.”

It said CNPC will mainly set up its new plants in West China and Northeast China, with plans calling for facilities in Daqing, Fushun, Jinzhou, Huludao, Dalian, Lanzhou, and Xinjiang.

Brazil starts work on Abreu e Lima refinery

Brazilian President Luiz Inacio Lula da Silva on Sept. 4 officially launched construction on the $4.05 billion Abreu e Lima refinery outside Recife, the largest city in northeastern Brazil and the capital of Pernambuco state.

Noticeably absent from the proceedings were any representatives of Venezuela’s state-run Petroleos de Venezuela SA (PDVSA), formerly identified as a 40% partner in the refinery project, with Brazil state-owned Petroleo Brasileiro SA (Petrobras) holding the remaining 60%.

Under a memorandum of understanding between the two state oil companies, the new refinery is expected to process oil from Venezuela’s Orinoco Belt and from Marlim field in the Campos basin off Brazil, with each country supplying 50% of the crude oil.

The agreement, however, appears to have hit an impasse over the terms of Petrobras’s proposed participation in a project to develop Venezuela’s Carabobo field, which was to provide Caracas’ share of the oil to be processed at the refinery.

With negotiations over the field continuing, Petrobras said that by second half 2010 the refinery will begin to refine about 200,000 b/d of heavy oil to annually produce 814,000 cu m of petrochemical naphtha, 322,000 tons of LPG, 8.8 million tons of diesel fuel, and 1.4 million tons of oil coke. The products will be marketed locally and in northern-northeastern Brazil.

Petrobras said the refinery’s main production focus is on diesel fuel, particularly aimed at supplying the increased demand for derivatives in the northeastern region, which currently is fuel-deficient. The unit will be the first in Brazil to process 100% heavy oil.

In addition, the Abreu e Lima refinery will be capable of producing low-sulfur content derivatives and will be able to comply even with the strict European standards, which specify maximum emission limits of 10 ppm of sulfur.

Transportation - Quick TakesFluxys doubling Zeebrugge LNG terminal capacity

Fluxys LNG has received an €85 million loan from the European Investment Bank toward its program to double the capacity of the Zeebrugge LNG regasification terminal to 6.6 million tonnes/year. The increased capacity is fully booked on a long-term basis, the company said.

Fluxys is adding extra regasification infrastructure and a fourth LNG storage tank under a €165 million investment plan. “Construction works for the capacity increase are nearing completion,” Fluxys said. Commissioning is expected to start at yearend.

The loan means that parent company Fluxys can optimize its resources for other infrastructure projects in gas transport and storage.

EIB said it granted the loan because it considers the expansion a priority for Europe in securing competitive and sustainable energy supplies.

“The investment will contribute to increase, secure, and diversify gas supplies to the EU, as imported gas from Zeebrugge can easily be moved to the UK, the Netherlands, Germany, Luxemburg, and France. Environmental benefits will be felt from the completion of this project as well, since it will allow the use of larger volumes of natural gas to replace less environmentally sound fuels,” Fluxys said.

Fluxys LNG, with a 93.20% stake, is owner and operator of the Zeebrugge terminal.

Lukoil completes section of Khauzak pipeline

Lukoil Uzbekistan, a subsidiary of Lukoil Overseas, has completed a 45-km section of 711-mm (28-in.) gas pipeline on the Khauzak block in southwestern Uzbekistan. The line will enable sour gas to be delivered to a tie-in point on the Dengizkul-Mubarek main pipeline.

The line is part of the Kandym-Khauzak-Shady-Kungrad project, which involves the drilling of more than 180 development wells and construction of more than 1,500 km of pipeline and two compressor stations (OGJ Online, July 10, 2007).

The project also involves construction of an 8 billion cu m/year gas processing plant in the Kandym area.

The main gas pipeline for Khauzak gas field will be commissioned at yearend, Lukoil said.

Work starts on Turkmenistan-China gas line

Construction has started on a 7,000-km pipeline that will deliver 30 billion cu m/year of gas from Turkmenistan to China starting in 2009.

Turkmen President Gurbanguly Berdimuhamedov attended a ceremony at which he made a symbolic weld on the pipeline, which will cross Uzbekistan and Kazakhstan.

About 188 km of the pipeline will be laid in Turkmenistan, 530 km in Uzbekistan, 1,300 km in Kazakhstan, and over 4,500 km in China.

China plans to import 30 billion cu m/year of Turkmen gas for 30 years through the pipeline but has not given the value of the deal.

China National Petroleum Corp. has received exploration rights for Bagtiyarlik territory.

“Turkmenistan is granting a foreign country the right to produce gas on the mainland for the first time,” Berdimuhamedov said.

The president, who came to power last December following the death of his predecessor, has welcomed foreign investment in his country’s oil and gas industry (OGJ Online, June 15, 2007).

DNV proposes study for Arctic pipeline standards

Det Norske Veritas is proposing a joint industry project (JIP) to evaluate design methods and recommendations for installation, operation, and maintenance of offshore pipelines in Arctic regions. It also would establish a common practice for addressing the challenges of such operations, which includes ice interaction with surface and subsea offshore installations.

The final results of the JIP will be published as the Recommended Practice (RP) for ‘Arctic Offshore Pipelines,’ DNV said.

The project could begin by yearend 2007 or early 2008 and is expected to take 18-24 months to complete.

The estimated costs are 400 kroner ($68,000)/operator and 200 kroner ($34,000)/contractor.

“Operators, regulators, designers, pipeline contractors, specialists, research institutions, and universities are invited to participate in the JIP, both through funding and through work-in-kind contributions,” said Catherine Jahre-Nilsen, DNV’s project manager.

The areas tentatively identified for the RP to address include design philosophy and design principles; design concepts; routing; line pipe; ice interaction loads (simple and advanced approaches; pipeline protection; fabrication and installation; and operation, inspection, and repair.

The RP will be an official code for use by pipeline operators and designers, and will present a common and documented approach that supplements the requirements of DNV-OS-F101 (offshore standards for submarine pipeline systems) and other internationally recognized pipeline codes.

It will be subsequently updated and maintained to reflect ongoing research and development, future JIPs, and project experience.