Size distribution of Middle East fields and reserves growth issues draw focus

The Middle East has been estimated to contain approximately 65% of the world’s oil.1-3 Ultimate recoverable “reserves” growth through time has been observed both in the aggregate and for individual oil fields in many parts of the world.

One common average “multiplier factor” for ultimate field recoverable volume as a function of “earliest known reserves estimate” is 7.1.

The 2005 book “Twilight in the Desert,” which exposed questionable oil reserves figures in the Middle East, created a great honking and flapping of wings not only among oil companies and economists but also among political leaders and ordinary citizens.

In the June 2, 2007, issue of Oil & Gas Journal, Sadad Al-Husseini and Moujahed Al-Husseini further detailed the huge discrepancies between different analysts’ oil reserves calculations for Iraq in particular (whether proved reserves or proved plus geologically probable reserves).4

Further discussion of reserves estimates, which can sometimes vary by two orders of magnitude, seems warranted. The following article will discuss distribution patterns of Middle East oil reserves of giant oil fields, geographically, stratigraphically, and with respect to reservoir type.

Historical trends in oil and gas reserves and examples of growth factors for individual field reserves require us to be more optimistic than “Twilight in the Desert” but skeptical about some of the more sensational reserves claimed by IHS Inc. in Iraq, for instance, where insufficient attention was paid to certain geological factors (overmaturity of Silurian source rock and poorer Jurassic reservoir quality than in neighboring Saudi Arabia).

Introduction

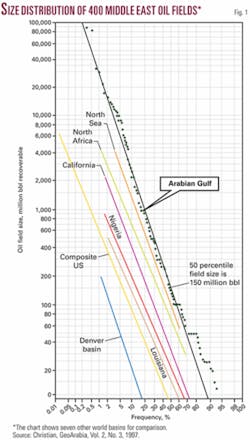

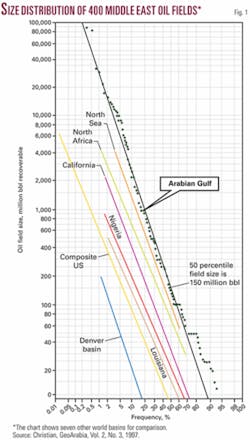

Plotted on probability paper, about 400 significant Middle East oil fields had a 50 percentile (median) reserve size 10 years ago of 150 million bbl5 (Fig. 1).

The median reserve sizes for seven other producing basins, also plotted on Fig. 1 for comparison, average about 20 million bbl. Some 40 years ago this 150 million bbl median figure would have been an estimated 250 million bbl, and for Saudi Arabia, Iraq, and Iran separately, median reserve sizes of about 500 million bbl were estimated by the writer at that time. Of course median reserve sizes tend to decline with time as exploration in any given area reaches a more mature stage.

Presently at least 80 to 90 Middle East oil fields have ultimately recoverable “reserves” greater than 1 billion bbl each. Of these 80 or more giant fields, the top 33 supergiants exceed about 5 billion bbl each (Table 1).

Ghawar, the world’s largest oil field, has at least 90 billion bbl recoverable from Upper Jurassic limestone reservoirs. Even without access to Saudi Aramco proprietary data, one can imagine recent stratigraphic trap gas-condensate discoveries on Ghawar’s east flank could increase the final total at Ghawar to perhaps 92 billion to 95 billion bbl of oil or barrels of oil equivalent (BOE) on a btu basis.

Supergiant oil fields

The 33 supergiant oil fields listed on Table 1 are distributed geographically as follows: 11 are in Saudi Arabia, 6 are in the United Arab Emirates, 5 are in Iraq, 5 are in Iran, 4 are in Kuwait, and 2 are in Qatar.

These same supergiant oil fields are distributed according to main reservoir rock as follows: 28% in Lower Cretaceous carbonate, 20% in Tertiary carbonate and clastics, 18% in Lower Cretaceous sandstones, 17% in Upper Jurassic carbonates, 11% in Upper Cretaceous carbonates, and 6% in Paleozoic sandstones and limestones.

Barrels of reserves are distributed in a different way: 32% in Lower Cretaceous sandstones, 31% in Upper Jurassic carbonates, 15% in Lower Cretaceous carbonates, 11% in Tertiary carbonates, 6% in Paleozoic sandstone and carbonates, and 5% in Upper Cretaceous carbonates.

Looked at in different ways, one can note that of the top seven ranked fields, 3 are in Iraq, 2 are in Saudi Arabia, 1 is in Kuwait, and 1 is in Abu Dhabi.

And finally, it can be observed that of the top seven fields, 1 (the largest) produces from Upper Jurassic limestones and dolomites, 3 (including the second largest) produce from Lower Cretaceous sandstones, 2 produce from Cretaceous limestones, and 1 produces from an Oligocene limestone/sandstone reservoir.

Ignored here is the gas supergiant North field, in offshore Qatar, which may have reserves higher than 1 quadrillion cubic feet, and perhaps 10 to 20 billion bbl of condensate.6 7

Reserves trends

In 1988, the late Z.R. Beydoun of Beirut and London published a collection of oil and gas reserves estimates for the entire Middle East. Field by field tabulations of proved published reserves available at that time totaled 408 billion bbl of oil and 926 tscf of gas.

Saudi Aramco’s 1988 annual report assessed remaining proved reserves in Saudi Arabia alone at 252.4 billion bbl and implied total “possible” geological reserves could have been as high as 315 billion bbl of oil and 253 tcf of gas.

Reserves growth since 1988 in proved as well as geologically probable categories (from OGJ, US Geological Survey, and similar sources) have increased enormously.

Up to Jan.1, 2005, or thereabouts, cumulative historical oil production from the Middle East is estimated to have been 320 billion bbl. Remaining proved Middle East oil reserves are reportedly about 700 billion bbl.8 9

No attempt to forecast yet to be discovered oil is included here, and for that matter, numerous oil and gas “discoveries” of small or undetermined size scattered throughout the Middle East are not included. More than a dozen such unevaluated or subcommercial discoveries (mostly gas) are known to exist in Syria alone.10

Worldwide oil discoveries (especially of giant sized oil fields) reached an annual peak no later than 1962. That year an inflection point in the rate of change in the growth of world oil reserves (ultimate recovery) took place, and annual reserves additions have been declining ever since.

Worldwide annual oil production, on the other hand, has continued to increase for at least 40 years (minor exceptions being caused by economic recessions, oil embargoes, or wars).

If two Gaussian or near-Gaussian curves are constructed which plot (a) annual additions to oil reserves, and (b) annual oil production worldwide (the King Hubbert-L.F. Ivanhoe approach), the two curves cross in 1979 or 1980, and so net remaining worldwide oil reserves have been declining steadily since 1980.9

Integrating the areas under the two curves, it is evident that eventually the two areas must be equal: that is, total ultimate production obviously cannot exceed total discovered reserves; and since there has already been a 42-year period of producing history since the peak discovery year and a 25-year period of producing history under conditions of declining net remaining reserves worldwide, reasonable mathematical projections are able to suggest more or less permanent producibility shortfalls beginning about the year 2010, or perhaps 2020.

After that an inevitable world decline in oil production has been forecast. Of course this does not take into account the mining of large tar sands deposits in Venezuela and Canada or oil use conversions to gas use, both of which are already beginning to take place.

Within a decade or so natural gas use on a BTU basis may rival or exceed crude oil use worldwide.11

Growth in single fields

The growth through time of oil and gas reserves in single fields deserves to be considered separately.

The most dramatic example at hand is supergiant North field (“North Dome”), off Qatar.5 Fig. 2 indicates more or less “official” (published) gas reserves (excluding condensate) increasing hugely from early times at or soon after discovery to perhaps more than 1 quadrillion cu ft now. It is estimated that 10 to 20 billion bbl of condensate are potentially recoverable also. This could be considered an extreme case in historical reserves growth.

Yet a former Mobil Oil petroleum engineer, Chet Doyle, in an unpublished study in the western states of the US more than 40 years ago, documented the increases in reserves estimates for a considerable number of oil fields in California basins, as also shown here graphically on Fig. 2. Averaging his results for the group of fields results in a 7.1 multiplier factor which had to be applied to the earliest calculated reserves in order to arrive at ultimate recoverable reserves calculations at or near full field development and decline. Less radical multiplier factors are cited by Verma et al.3 On the other hand, multipliers as high as 9 or 10 are claimed by Attanasi et al.12

Reasons for such a large ratio (a 7.1 multiplier, or thereabouts) may be assumed to be partly technological (more wells, more information, better knowledge of the reservoir, better control of geological or geophysical mapping), and partly a matter of economic or political conditions or policy.

In the latter categories can be included the timidity or conservatism of economists, planners, and bankers potentially involved in underwriting development schemes (as opposed to sometimes overly exuberant exploration geologists and geophysicists intent on drilling and developing favorite prospects).

National and international income tax, royalty, and depreciation terms, and even Wall Street attitudes or oil company bonus policies may also create conscious or subconscious motives on the part of oil company management (and host government authorities) to either inflate or minimize early geological reserves estimates.

The sudden doubling of stated reserves by countries at war, or at times when World Bank loan applications are pending (or for reasons of national pride), may also be mentioned.

Hussain13 ascribes the huge increases in stated oil reserves by gulf members of OPEC in about 1985 to the fact that OPEC production quotas were at the time determined in part by individual country oil reserves.

Similar circumstances of inflated reserves statements by the former Superior Oil Co. led Mobil Oil Corp. to outbid competitors in a hurried buyout ordered by top management without adequate auditing of Superior’s stated reserves.14 Superior’s top executives had been receiving annual bonuses based on additions to reserves.

Most recently, Sadad and Moujahed Al-Husseini4 have highlighted enormous discrepancies (by two orders of magnitude) in so-called “proved” and “potential” oil reserves for Iraq in particular by different analysts.

Precision in terms

The kinds of discrepancies in reserve estimates mentioned here are most severe when there is a failure to discriminate between “proved” reserves and “probable or possible” reserves.

Proved reserves are those that have been blessed by engineers, planners, bankers, and historians, for instance following complete infill drilling and production to a point approaching the time of field abandonment, while “geologically probable or possible” reserves are calculated much earlier on the basis of a single discovery well (or two or three) plus the planimetered area of a seismically mapped structural trap.

The trouble with such big differences in calculated or estimated reserves is that economic decisions (to develop, to build a pipeline, to abandon) cannot rationally be reached taking into account either extreme, but rather require economic evaluation of risk factors of various kinds as well as the extremes between early “reserve” estimates by engineering and economic managers on one hand vs. the early estimates of explorationists on the other hand.

The legendary petroleum engineer John Arps pointed out during a 1967 AAPG Lecture Tour that “management’s interest in estimates is maximal when information is minimal and vice-versa,” making for lots of arguments between optimistical geologists and pessimistical engineers!15

The need for management decisions to look at both sides of such disagreements at an early stage and to introduce probability and risk analysis into the decision equation is obvious. The significance of early understatement of proved and potential oil reserves was clearly appreciated by the Saudi Petroleum Mininster, Ali Al-Naimi, in an address to the World Affairs Council in Dallas in May 2004.

Acknowledgments

The writer thanks GeoArabia’s editor-in-chief Moujahed Al-Husseini, Jeorg Mattner, and the graphics and production staff of Gulf PetroLink for their past assistance from time to time in the preparation of this article. The late John Forman provided data relating to California reserves used in Fig. 2.

References

- Yergin, D., “The Prize: the Epic Quest for Oil, Money and Power,” Simon and Schuster, New York, 1991, 877 p.

- Ahlbrandt, T., Pollastro, R., Klett, T., Schenk, C., Lindquist, S., and Fox, J., US Geological Survey World Petroleum Assessment, Chapter R2, 2000, 46 pp.

- Verma, M., Ahlbrandt, T., and Al-Gailani, M., “Petroleum reserves and undiscovered resources in the total petroleum systems of Iraq, reserve growth and production implications,” GeoArabia, Vol. 9, No. 3, 2004, pp. 51-74.

- Al-Husseini, Sadad, and Al-Husseini, Moujahed, “Magnitude of undiscovered resource in Iraq’s western desert in dispute,” OGJ, July 2, 2007, pp. 40-42.

- Christian, L., “Cretaceous Subsurface Geology of the Middle East Region,” GeoArabia, Vol. 2, No. 3, 1997, pp. 239-256.

- Christian, L., “Subsurface Geologic Atlas of the Middle East Region,” with explanatory notes and analyses, spread sheets and bibliography, Dallas, 2005, 346 pp.

- Economist Magazine, National Geographic Magazine, US Geological Survey, New York Times, Oil & Gas Journal, and other unofficial or semiofficial press releases of oil production and oil reserve estimates by Qatar government, Iraqi, Iranian, and Saudi Arabian officials.

- Beydoun, Z.R., “The Middle East: Regional Geology and Petroleum Resources,” Sci. Press, U.K., 1988, 292 pp.

- Wells, R., “Oil Supply Challenges,” OGJ, Feb. 21, 2005, pp. 20-38.

- Khulqi, N., “Gas Development in Syria,” Oil and Arab Cooperation (OAPEC) Vol. 22, Issue 77, 1996, pp. 56-68 (in Arabic).

- Tippee, B., “Worldwide Gas, LNG Demand Poised to Surpass Oil,” OGJ, Sept. 22, 2003, pp. 28-30.

- Attanasi, E., Mast, R., and Root, D., “Oil, Gasfield Growth Projections,” OGJ, Apr. 5, 1999, pp. 79-81.

- Hussain, A., “Market Gives OPEC Opportunity to Improve Oil Reserves Data,” OGJ, June 27, 2005, pp. 20-22.

- Forman, J., Doyle, C., and other former Mobil Oil geologists and engineers, 1985-2005, verbal communications and miscellaneous information regarding reserves calculations and other misadventures.

- Arps, J., AAPG Lecture Series on Reserve Estimates, Probability and Economics, Nov. 27-30, 1967, Tripoli, Libya.

- Al-Naimi, A., speech by the Petroleum Minister of Saudi Arabia before the World Affairs Council, Dallas, May 2004.

The author

Louis Christian is an international petroleum consultant having retired from Mobil Oil International with Middle East/Far East experience. After retiring he was a consultant to Bunker Hunt, Anschutz, and Tur-Kan and wrote numerous published papers on Middle Eastern geology and issues. He self-published a 346-page subsurface geologic atlas of the Middle East in 2005. A geologist, he has BS and MS degrees from Stanford University.