OGJ Newsletter

Marathon unit to pay fine in oil-price case

Marathon Petroleum Co. LLC agreed to pay a $1 million civil fine to settle a US Commodity Futures Trading Commission charge that it tried to manipulate crude oil markets.

CFTC alleged that Marathon tried to manipulate the spot cash price for West Texas Intermediate crude delivered at Cushing, Okla, on Nov. 26, 2003, by attempting to influence downward the market assessment for the crude that day by Platts, McGraw-Hill Co.’s energy news and price-reporting service.

Platts derives its WTI market assessment, which is used as a benchmark price in some transactions, from trading activity during a particular 30-min period of the physical trading day. CFTC said Marathon priced about 7.3 million bbl/month of physical crude off the assessment at the time in question.

CFTC charged that on Nov. 26, 2003, Marathon purchased WTI contracts on the New York Mercantile Exchange with the intention of selling physical WTI during the Platts window at prices intended to drive the reporting service’s WTI spot cash assessment downward. The company also offered WTI through the prevailing bid at a price level aimed at driving the Platts WTI assessment lower, the regulator said.

WoodMac: 2007 lease sales forecast at $1 billion

Edinburgh consultant Wood Mackenzie Ltd. forecasts that proceeds from this year’s Gulf of Mexico lease sales 204 and 205, based on past total winning bids, could reach $1 billion.

The estimate represents a high not seen in the region for a decade, WoodMac said in its recent report, “GOM Lease Sales 204 and 205 exposed.”

Also in that report, WoodMac identifies 594 deepwater blocks that may be included-double the annual average number of leases offered between 1997 and 2006, the report said.

WoodMac warned, however, that the anticipated higher bid totals and more leased acreage will not necessarily lead to a proportional increase in exploration and production.

According to Matthew Jurecky, Americas upstream analyst for Wood Mackenzie, “Tightness in the deepwater oil field services market, especially in drilling rigs, is likely to limit the benefits of accumulating a mass of blocks as happened a decade ago.”

In 1997 a record 1,242 deepwater blocks were leased, representing 255% more than the 10-year average for 1997-2006. That record amount was followed by a further wave of blocks in 1998 with 878 leases, he said.

“Due to a combination of incentives such as deepwater royalty relief, robust oil and gas prices, and technological advances,” he said, “companies leased more than they were physically able to explore. A rig conundrum followed as a result of higher oil prices, increased production commitments, and frontier plays becoming more feasible; companies could not even drill potentially exciting blocks in order to get a lease term extension.”

Now 10 years later, he pointed out that these leases are “expiring and up for grabs.”

Jurecky said the WoodMac analysis identifies 594 deepwater blocks within Minerals Management Service deadlines for inclusion in the 2007 lease sales, compared with 245-the average number of newly expired blocks offered for lease in 1997-2006.

“Many of these deepwater blocks are located in plays which could lead to impressive finds,” he added.

He said the area likely to draw most attention is the Lower Tertiary, which covers areas in Alaminos Canyon, Keathley Canyon, and Walker Ridge. The report indicates that 41% of the blocks Wood Mackenzie identified are in this area, and interest is likely to be fueled by the successful flow test carried out last year at Chevron Corp.’s Jack well.

Complaints dismissed against Chevron in Ecuador

The US District Court for the Northern District of California dismissed complaints Aug. 3 against Chevron Corp. filed on behalf of three Ecuadorians.

The court said the plaintiffs had fabricated claims that they or their relative had cancer caused by the former operations of Chevron subsidiary Texaco Petroleum Co. in Ecuador.

The three plaintiffs, Gloria Chamba, Luisa Gonzales, and Gonzales’s husband, Nixon Rodriguez Crespo, were among a group of seven Ecuadorians who brought personal injury claims against the US major.

According to the lawsuits filed against Chevron, Chamba claimed her son was diagnosed with leukemia, Gonzales claimed to have been diagnosed with breast cancer, and Crespo’s claim was for “loss of consortium” related to his wife’s cancer claim.

Judge William Alsup dismissed the personal injury claims by the three plaintiffs finding that the two women had admitted during cross-examination at sworn depositions that their cancer claims were false, and thus Crespo’s claim was also without merit.

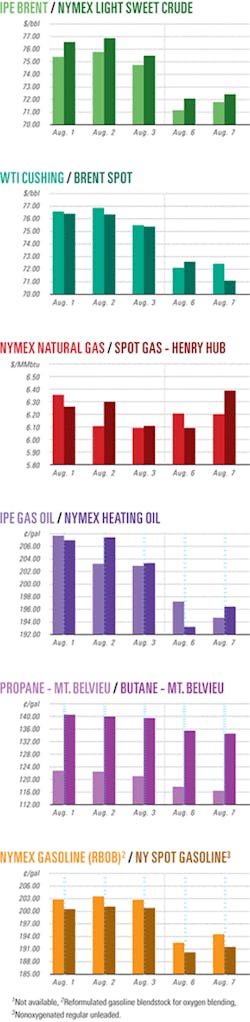

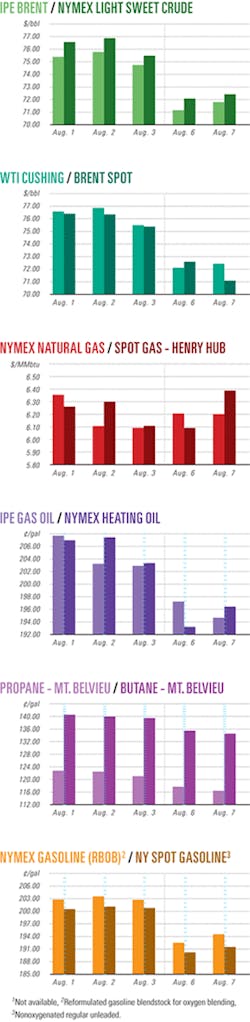

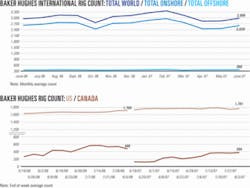

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesTotal has eleventh oil discovery off Angola

Operator Total E&P Angola and Sonangol have tested 2,130 b/d of oil through a 32/64-in. choke from the Colorau-1 exploration well on deepwater Block 32 off Angola. The find is in the northeastern part of the block, about 16 km northeast of Manjericao, a 2006 discovery, Total said.

The well, the eleventh exploration well on the block, was drilled in 1,700 m of water and hit Upper Oligocene oil-bearing reservoirs.

The partners are carrying out technical studies to fully evaluate the drilling results, and they plan to carry out extra drilling across the acreage. The consortium wants to assess the feasibility of a first development zone in the eastern part of the block. Studies will evaluate the development potential of the other 10 discoveries made on the block since 2003, all of which indicate its major potential. In May Total and its partners reported the last two oil discoveries on the block (OGJ Online, May 21, 2007).

Total holds a 30% interest in the block, and Sonangol is the concessionaire. Other partners in Block 32 are Marathon Oil Co. 30%, Sonangol EP 20%, Esso Exploration & Production Angola (Overseas) Ltd. 15%, and Petrogal 5%.

Western Desert-Nile Delta discoveries grow

Chile’s Sipetrol International SA and Oil Search Ltd., Sydney, are testing a third exploratory well after two oil discoveries in the northeastern part of Egypt’s Western Desert. They plan to start production in the third quarter of 2007. The companies’ Shahd and Ghard discoveries 80 miles west of Cairo have proven that the Western Desert petroleum system extends into the East Ras Qattara concession. The companies hope to start production before the end of 2007. Adjacent concessions have production facilities.

The Shahd-1 discovery well went to TD 3,479 m in the southwestern part of the block in late 2006 and drillstem tested 700-1,000 b/d from Cretaceous Lower Bahariya and 360-600 b/d of 39-41° gravity oil from Upper Bahariya on artificial lift.

The Ghard-ST1 discovery well, 12 km northeast of Shahd-1, flowed 2,026 b/d of 40° gravity oil and gas at the rate of 2.6 MMcfd in 2 hr on a ¾-in. choke from Lower Bahariya at 3,341-47 m and 3,350-54 m.

Rana-1, 12 km southeast of Ghard-1, was under test in early August after cased-hole log evaluation indicated several potential oil-bearing intervals in the Cretaceous Bahariya and Kharita formations. Rana-1 is one of 12 similar prospects in a chain of structures trending easterly from Shahd-1.

Oil Search also plans to start incremental production in 2007 from Area A, consisting of four development and two exploration concessions totaling 400 sq km on the Gulf of Suez west bank. The development concessions include Kareem, Shukheir, Um El Yusr, Ayun, and Kheir shallow oil fields discovered in 1958-72.

Brunei, Total unit to spud well off Borneo

The government of Brunei and Total E&P Borneo are preparing to spud the MLJ2-06 well 50 km off the island of Borneo.

The MLJ2-06 well is about 25 km from Champion oil field, where Brunei Shell Petroleum Co. Sdn. Bhd. (BSP) last year reported the start of a third phase of oil production (OGJ, Jan. 16, 2007, Newsletter).

Brunei Energy Minister Pehin Dato Awang Haji Yahya said the MLJ2-06 well could be “one of the most challenging” ever drilled in Southeast Asia because of high temperatures and pressures and environmental controls.

Total’s drilling manager, Yannick Marcillat, said the MLJ2-06 is one of Total’s most challenging wells in the region because it is deeper and has greater pressure than the firm’s other wells.

“This particular well has a very high pressure with 17,000 psi, and we have to be very careful when the pressure comes to the surface,” Marcillat said. “Besides, it is hotter at 170° C. so it is a bit complicated when we run electronic equipment as the temperature is very high for the equipment.”

The Maersk Completer jack up rig, built in Singapore and towed to Brunei, will drill the well. It has been prepared for high-pressure, high-temperature drilling.

According to Marcillat, the rig is under a 1-year contract, with 170 days scheduled for the MLJ2-06 well and the remainder of the time for other projects in the region. The MLJ2-06 is to be drilled to 22,000 ft.

Drilling & Production - Quick TakesTui area fields start flow off New Zealand

The Tui Area Development in the offshore Taranaki basin of New Zealand has come on stream 19 months after the final investment decision and some 3 years after discovery.

The development encompasses three adjacent oil fields about 50 km offshore. It includes production from four subsea wells incorporating extended horizontal sections in the reservoirs and connected to the Umuroa floating production, storage, and offloading vessel.

Project operator Australian Worldwide Exploration Ltd. (AWE), Sydney, says the production will be ramped up to a peak rate of 50,000 b/d during August and is expected to total around 10 million bbl in the first year.

Proved and probable reserves are estimated at 28 million bbl.

When fully commissioned, Tui will be New Zealand’s largest oil producing operation.

The final cost stands at $269 million, 10% more than the previous estimate. Much of the overrun has been due to bad weather affecting the offshore construction activities.

Participants are AWE 42.5%, Mitsui E&P New Zealand Ltd. 35%, New Zealand Oil & Gas Ltd. 12.5%, and Pan Pacific Petroleum NL 10%.

TNK-BP launches $2 billion rig tender

TNK-BP is looking for up to 60 dedicated drilling rigs in tenders worth more than $2 billion to maintain output from mature oil and gas fields and prepare for new production in 2008 from eastern Siberia.

TNK-BP wants to lease rigs for up to 5 years with options to extend.

“Contractors will be requested to tender advanced rig designs which utilize upgraded, efficient, and environmentally friendlier operating systems and equipment,” TNK-BP said.

It wants rigs that have triplex pumps, variable speed drives, and environmentally advanced mud systems. Those tendered should have a reduced environmental footprint, mechanical pipe-handling, reduced discharges, energy efficiency, and reduced personnel exposure to safety risks.

More than 20 companies have prequalified to participate in the tender, two thirds of them is Russian. The winners will be informed in October, and rigs are to be in place in January 2008.

TNK-BP described the long-term rig tender as the largest in the Russian industry.

ADMOC lets contract to lift Zakum flow

Abu Dhabi Marine Operating Co. has let a contract to Technip of Paris and National Petroleum Construction Co. of Abu Dhabi for work that will raise production capacity of giant offshore Zakum oil field.

Under the engineering, procurement, and construction contract, the firms will install gas processing and compression facilities on a new gas compression platform bridge-linked to the existing lower Zakum complex. The new platform will have two gas turbine-driven centrifugal compression trains, a triethylene glycol dehydration unit, an air cooling unit, and a vapor recovery system.

The facilities are to be operational in January 2010. No production increment has been disclosed.

Zakum field, discovered in 1963, has been producing since 1967.

Processing - Quick TakesShell agrees to sell three French refineries

Royal Dutch Shell has signed deals to sell three French refineries with a combined capacity of more than 300,000 b/d to Basell Polyolefins, Hoofddorp, the Netherlands, and Petroplus Holdings AG, Zug, Switzerland.

The refineries are among Shell’s smallest and oldest. Shell said earlier this year that it was carrying out a review of nonstrategic assets (OGJ Online, Jan. 15, 2007).

Basell has agreed to pay $700 million to Societe des Petroles Shell to buy the 80,000 b/d Berre-l’Etang refinery site complex and associated infrastructure in France. The deal should be completed in early 2008.

The refinery produces naphtha, LPG, fuels, bitumen, and heating oil. Basell has a steam cracker, a butadiene extraction unit, and polypropylene and polyethylene plants adjacent to the refinery and a polyethylene plant at nearby Fos sur Mer.

Petroplus Holdings has signed separate letters of intent with Shell International Petroleum Co. Ltd. to acquire the Petit Couronne and Reichstett Vendenheim refineries in France. Petroplus will pay $875 million, including working capital of $400 million.

The parties hope to reach agreement on a sale in 2008.

The 164,000-b/cd Petit Couronne refinery, 130 km northwest of Paris on the River Seine, produces 40% middle distillates and 20% gasoline. Its major units include crude and vacuum distillation, fluid catalytic cracking, visbreaking, hydrotreating, reforming, lubricant production, and bitumen production. It receives crude via a 70-km pipeline from the port at Le Havre. The crude slate is about 70% high-sulfur.

The 80,000-b/cd Reichstett Vendenheim refinery is in Alsace, France, near Strasbourg, about 5 km from the River Rhine. It produces 45% middle distillates and 20% gasoline. Major units are crude and vacuum distillation, fluid catalytic cracking, visbreaking, hydrotreating, reforming, and bitumen production. Crude arrives via a pipeline from Fos. The crude slate is about 45% high-sulfur.

Shell approved for ProJet acquisition in Malaysia

Royal Dutch Shell PLC has received Malaysia’s approval to acquire 100% of ConocoPhillips’s wholly owned subsidiary Conoco Jet (Malaysia) Sdn. Bhd., which operates the ProJet retail marketing assets in Malaysia.

The deal comprises 44 ProJet-branded retail outlets and 14 vacant land sites primarily in Kuala Lumpur, Selangor, and Johor.

The sites will be rebranded as Shell over the next 3 months, but all ProJet retail outlets will immediately begin to carry Shell fuels, said Mohzani Wahab, managing director of Shell Malaysia Trading Sdn. Bhd.

In addition to the ProJet retail stations, Shell is looking to add another 30 new stations by yearend.

With its existing stations, Shell expects to have about 900 Shell retail sites throughout Malaysia by yearend, said Mohzani.

Woodside gives formal nod to Pluto LNG project

Perth-based Woodside Petroleum Ltd. has agreed to spend $11.2 billion (Aus.) to develop an LNG project using gas from its wholly owned Pluto and Xena fields in Western Australia’s Carnarvon basin, 190 km off Karratha.

The timetable calls for first gas to be delivered by yearend 2010.

The initial phase will involve a single LNG production train having a 4.3 million tonne/year capacity on the Burrup Peninsula and a 180 km, 36-in. subsea pipeline from the fields.

A field platform at Pluto, moored in 85 m of water, will be connected to five subsea wells. A second phase, which will require additional funding approval, will include compression on the platform and a tie-in to the smaller Xena field. Onshore facilities will also include storage tanks and a marine loading terminal.

The company said that reservoir studies indicate the combined dry gas content for Pluto and Xena has increased to 5 tcf from 4.5 tcf.

Woodside has spent about $800 million (Aus.) on preliminary studies at the field and preparatory work at the LNG site. The additional funding just approved is higher than Woodside’s earlier estimates of $6-10 billion.

Funding will be provided by cash flow from the company’s Australian operations along with a fully underwritten dividend reinvestment plan and the issuance of corporate debt.

The company had already preapproved $1.4 billion for long-lead items and LNG plant site preparation. Earthworks began in January.

Woodside received provisional environmental approval in June despite its earlier having failed marine standards set by the Western Australian Environment Protection Authority. The EPA said the project could proceed if Woodside agreed to a range of conditions for the pipeline access route. Sales contracts have been signed with Japanese companies Kansai Electric and Tokyo Gas.

CPC taps ABB Lummus for petrochemical work

CPC Corp., Taiwan, has let a contract to ABB Lummus Global for a petrochemical complex to be built in Lin Yuan, Kaohsiung, Taiwan.

The complex will use Lummus SRT VI cracking furnaces and recovery technology to produce 600,000 tonnes/year of ethylene. It will use proprietary Lummus olefins conversion technology based on metathesis to produce 432,000 tonnes/year of propylene.

Lummus, through a partnership with BASF AG, also will supply a 130,000 tonne/year butadiene extraction unit.

The complex is scheduled to begin operations in late 2013.

PetroChina refineries to get Axens units

PetroChina Co. Ltd. will use Axens technology for deep hydrodesulfurization of FCC gasoline in new units at two refineries.

It will install a 32,800-b/d unit using Axens Prime-G+ technology at its Jinxi Petrochemical Complex and an 18,200-b/d unit at its Dagang Petrochemical Complex in Tianjin Municipality. When the units are on stream, gasoline pool sulfur content will be less than 50 ppm at Jinxi and 25 ppm at Daqang, Axens said.

Transportation - Quick TakesGreece, Turkey, Italy sign pact on gas pipelines

After months of negotiations, Greek, Turkish, and Italian officials have signed an agreement to build a pipeline system to transport natural gas from the Caucasus to Western Europe through Turkey and Greece by 2011.

Turkish Energy and Natural Resources Minister Hilmi Guler said the agreement will allow Turkey to buy at a cheaper price 15% of the gas passing through the Turkish sector of the proposed pipeline. Greece’s Minister of Development Dimitris Sioufas described the project as “a work of strategic importance.”

The project is a system of three pipelines: one linking Greece and Turkey that is already nearing completion, a 217-km underwater pipeline from Greece to Italy, estimated to cost €300 million; and a 590-km pipeline connecting the western terminus of the Greece-Turkey pipeline, in Komotini, Greece, to the eastern terminus of the Greece-Italy pipeline near the Greek port of Igoumenitsa at a cost of more than €600 million. Total investment earlier was estimated to exceed €1 billion and will be partly funded through the European Union’s Fourth Community Support Framework (2007-13).

The Turkey-Greece pipeline will have a transport capacity of 11.5 billion cu m/year of natural gas. The Greece-Italy subsea pipeline is to have a capacity of 8-8.8 billion cu m/year. The difference is to be channeled into the Greek gas market, as well as Albania and the former Yugoslavian Republic of Macedonia, officials said. Bulgaria also has expressed interest in obtaining natural gas from Greece.

The Turkey-Greece link initially was scheduled to be completed in June but is now expected to begin operations in late August. Construction of the subsea Interconnector Greece-Italy (IGI) link is to start next June with completion slated for 2011.

WestPac plans Texada Island LNG terminal

WestPac LNG Corp., Calgary, plans to invest $2 billion to build an LNG terminal combined with a natural gas-fired electric power generation plant on Texada Island, 120 km northwest of Vancouver, BC. The project is expected to be operational in 2013.

Facilities will include a marine jetty and berthing facility capable of unloading and loading ships of 20,000 cu m to 165,000 cu m; possibly two onshore LNG storage tanks, each with a capacity of 165,000 cu m; a gas-fired power generation facility with a capacity of 1,200 Mw from two trains; and an on-site interconnection with the existing Terasen gas pipeline from the mainland to Vancouver Island.

Project design is still being finalized and could entail only one storage tank with capacity of 200 million cu m, a WestPac spokesman told OGJ.

The company intends to file a project description with regulatory agencies later this year. Construction is scheduled to start in 2009 and continue for 3 years.

WestPac has acquired a long-term lease at Kiddie Point at the north end of Texada Island. This proposed Texada LNG site is in an industrial area and the site is a secure source for natural gas with minimal environmental impact, WestPac said.

WestPac said the Texada Island project also could enhance air quality in the Fraser Valley by allowing BC Hydro to decommission its Burrard thermal power generator, which it currently depends on for peak-demand power supply.

Separately, WestPac has been conducting environmental assessment work for a proposed LNG receipt and transshipment terminal at Ridley Island near Prince Rupert. The Ridley facility will not proceed immediately, but the location could play a future role as a second terminus to serve the north coast when gas demand reaches new levels, WestPac said.

Sonatrach, EDP partner for Iberian gas supply

EDP Energias de Portugal SA in a public filing said a natural gas and power generation partnership with Algeria’s state-run Sonatrach will be in place by Oct. 31. The partnership will jointly supply and market gas in Portugal and Spain and partner in combined-cycle gas turbine plants.

Sonatrach, keen to increase natural gas sales to Europe, will provide as much as 2 billion cu m/year of gas to EDP while taking a 25% minimum stake in the gas supply projects. It also will have one representative on EDP’s board when the deal is formalized, EDP said.

Other talks are said to include EDP’s possible participation in gas plants in Algeria. Earlier this year Algeria announced a tender of about €2.5 billion for five natural gas plants and an underwater cable to Spain. EDP, Iberdrola SA, Enel SPA, and Endesa SA are interested in the bidding.