Petro-Canada updates Fort Hills oil sands costs

Petro-Canada expects the first phase of the Fort Hills oil sands project in Alberta to have a capital cost of $14.1 billion (Can.) and produce through mining 160,000 b/d of bitumen, which then the venture would upgrade to 140,000 b/d of syncrude.

In a June 2007 presentation, the company said the first bitumen production from Fort Hills should start in late 2011, pending final project approval, with the upgrader ready to process bitumen in second-quarter 2012.

The Fort Hills partners also plan a second phase in the venture that would double production and upgrading to 320,000 b/d of bitumen and 280,000 b/d of syncrude.

The present plans for the upgrader call for producing a single 36° gravity syncrude with less than 0.1% sulfur.

Both phases together have an estimated capital cost of $26 billion (Can.).

Working interest owners of the Fort Hills Energy LP project are Petro-Canada, 55%, UTS Energy Corp., 30%, and Teck Cominco Ltd., 15%.

Petro-Canada Oil Sands Inc., a unit of Petro-Canada, operates the project.

Fort Hills

Fort Hills is an integrated oil sands project that includes a mine and a bitumen extraction plant 56 miles north of Fort McMurray, as well as a bitumen upgrader about 300 miles south in Sturgeon County east of Edmonton. Fig. 1 shows the Fort Hills lease and future extraction-plant site.

Petro-Canada said the project currently is in the front-end engineering and design (FEED) stage that will take about 12 months to conclude. The company expects the FEED process to provide a definitive cost estimate and the basis upon which the Fort Hills partners will make the final go-ahead decision.

Regarding the FEED process, Ron Brenneman, Petro-Canada’s CEO and president said “The size, staging, and technology chosen should provide solid financial returns while minimizing execution risk. This step puts us on a path for a final go-ahead project decision in the third quarter of 2008, following the anticipated regulatory approval of the Sturgeon Upgrader.”

The Fort Hills mine received regulatory approval in 2002 from Alberta Environment and the Alberta Energy and Utilities Board. The partners filed the commercial application and environmental impact assessment for the Sturgeon Upgrader with provincial regulators in December 2006.

Table 1 summarizes the capital cost of both Phases 1 and 2.

The $14.1 billion (Can.) cost for Phase 1 includes a $1.7 billion (Can.) estimate for inflation during the next 4-5 years, while the FEED phase before sanctioning will cost another $1.1 billion (Can.).

In addition, the project also will need investments from third parties such as for the pipeline and return diluent line between Fort Hills and the Sturgeon upgrader, estimated to cost about $1.5 billion (Can.).

In Phase 1, other third-party investment includes hydrogen plants, co-gen plants, camps, and sulfur and coke handling. These additional investments increase the cost of Phase 1 to $18.8 billion (Can.).

Petro-Canada said Phase 2 will cost less because it will leverage investment made during Phase 1. Phase 2 capital cost for the partners is $12.1 billion (Can.). This includes an estimated $2.1 billion (Can.) for inflation. Expected start of production for Phase 2 is 2014.

Both phases include two trains for the mine but the upgrader investment for Phase 2 is less than for Phase 1. Phase 1 will have four coke drums, while Phase 2 calls for adding to the upgrader two coke drums, a vacuum column, another crude unit, and some additional hydrotreating.

Petro-Canada said that it staggered the mine and upgrader start-ups to avoid an overlap in manpower peaks during the construction. The mine starts up in 2011 and the upgrader starts 6-9 months later in 2012. Also, the partners plan to start Phase 2 at the tail end of Phase 1 and keep the same construction force, if the economics remain favorable.

The project includes a paraffinic froth treatment at the extraction plant that Petro-Canada said would allow the venture to sell marketable bitumen during the time between mine start up and upgrader completion.

Petro-Canada said the process involves removing paraffin at the mine site and then blending in a condensate to the bitumen for transporting the blend to Edmonton.

The project will include a diluent pipeline for returning condensate from the upgrader to the extraction plant.

Some of the engineering contracts in the FEED include:

- Technip Canada Ltd.-upgrader coker.

- SNC Lavalin Inc.-upgrader hydrotreating and tank farm, and mine froth treatment.

- CH2M Hill-upgrader water treatment.

- Washington Group International Inc.-upgrader utilities and offsites.

- Fluor Corp.-mine extraction plant.

- Jacobs Engineering Group Inc.-mine utilities, offsites, utility corridor, and tank farm.

- Hatch Energy-ore operations plant.

Fort Hills will design the tailings area and plans to award design of the upgrader sulfur plant in third-quarter 2007. During the winter of 2007, the project schedule includes drilling 300-400 wells to delineate additional resources on the lease.

Economics

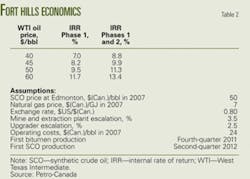

Petro-Canada in the project base-case economics assumed a $45/bbl West Texas Intermediate (WTI) oil price. With this price, Phase 1 has an internal rate of return (IRR) of 8.2% (Table 2). Because of lower capital cost for Phase 2, the second phase has a higher 12.5% IRR at $45/bbl, which increases to 13.8% IRR at $50/bbl and an IRR greater than 16% at $60/bbl.

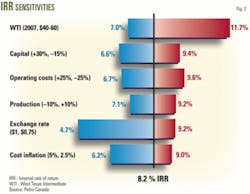

The tornado diagram (Fig. 2) shows that the IRR for Phase 1 ranges between 7-11.7% for oil prices between $40-60/bbl. Other sensitivities shown are for capital, operating cost, production, exchange rate, and cost inflation.

The operating cost central point assumes $24 (Can.)/bbl operating cost for both the mine and upgrader.

The exchange rate sensitivity is from $1.00 to $0.75 and shows that a strong Canadian dollar hurts the project economics.

The current exchange rate is about $0.93 US/$1 (Can.) while current oil prices are about $70/bbl.

Petro-Canada did not include the FEED costs in the economics.

Fig. 3 shows the substantial cash flow Petro-Canada expects the project to generate for three different WTI oil price scenarios.