LEAN ENERGY MANAGEMENT-12: Gas-to-electricity real options can provide deepwater strategic, operational flexibility

Computer Aided Lean Management (CALM) uses software for the optimization of profitability under uncertainty.

CALM technologies add two kinds of flexibility to traditional economic analyses in order to better deal with uncertainties common to the oil industry today.

The first is strategic flexibility, used to dynamically manage portfolios of potential investments to take advantage of volatility in the marketplace, changes in exogenous forces, and the long-term uncertainties of reservoir performance.

The second is operational flexibility, used to manage the shape and mix of the production within fields in order to maximize value extraction.

We present below scenario and real options analyses that demonstrate the value of the flexibility that CALM brings to strategic and operational decision-making in ultradeepwater development.

Our analyses suggest that additional enterprise value going forward can be created through the addition of a gas-to-electricity option using a new kind of offshore hub centered around floating generation, sequestration, and offloading (FGSO) vessels and undersea high voltage DC (HVDC) power cables to shore.

Strategic flexibility

Most businesses decide future changes in strategy based on past decisions on investments, resources, systems, and operational capabilities. These decisions have created core competencies within each firm that define who they are in their industry.

The evaluation of future investment options based on potential changes in exogenous forces (supply/demand, geopolitical, climatic) through scenario and real options analyses can provide rich alternative investment strategies to consider in today’s volatile business climate.

The dynamics of geopolitical uncertainty, always a risk in the oil and gas industry, are compounded by uncertainties arising from potential consequences of global climate change and supply/demand shortages and excesses.

We have evaluated scenarios concerning how to maintain profitability in ultradeepwater production with the world moving towards a “green” economy in which there are significant new penalties for carbon emissions and most end-use is via electricity and heating. In such scenarios, a modern oil and gas company must consider its real options for remaining profitable in the face of potential new carbon taxes, sequestration requirements, and competition from coal gasification.

Climate change, combined with governmental action (at the state if not the federal level), creates opportunities to transform how energy is economically delivered to customers, particularly from ultradeepwater areas, where capital costs are already the largest faced by exploration and production companies today.

The maintenance of a real option for conversion of gas-to-electricity at FGSO hubs can allow future transport of electricity using undersea HVDC cables to electricity markets. Such an option can be exercised when a positive “spark spread” exists between the price of electricity vs. natural gas from ultradeepwater production (Fig. 1).

Given the uncertainty of future geopolitics, technology development, and international competition, we show that making significant investments based purely on the existing paradigm of oil and gas market dynamics can easily result in lost opportunity at best or bankruptcy at worst.

An alternative approach is to use CALM real options and scenario analyses to create alternative investment options to capture “out-of-the-box” opportunities without making significant commitments of capital investment until absolutely necessary (Fig. 2).

Maintenance of a real option to produce gas-to-electricity offshore provides a compelling argument to make potential investments in a new generation of production technologies that we call “FGSO” vessels. Our analysis shows that the opportunity is at least as large as that realized in the last 15 years from the invention and widespread deployment of floating production, storage, and offloading (FPSO) vessels.

Commitment of capital in a resource-constrained business such as oil and gas without immediate increases in enterprise value is similar to storage of products in a warehouse. There is great risk that the products stored will lose value or become obsolete (c.f., the current US automobile business).

The imperative to delaying capital commitments as long as possible as dynamic forces change, while anchoring in the real options to enable entry into emerging markets, is a major component of CALM theory (Fig. 2).

Operational flexibility

Once capital investments have been made, CALM controllers provide the mechanism for computing the real option value of added capabilities that arise from swapping delivery of variable product-mixes to multiple, asynchronous markets.

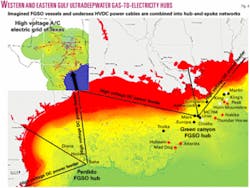

Price signals that vary by geography, such as those in the energy markets for natural gas and electricity in the southern US, qualify for such real options considerations for ultradeepwater production from the Gulf of Mexico.

In order to take full advantage of dynamic differences in commodity prices, producers in the gulf would need to add additional real options of selling electricity generated offshore from produced gas, paired with potential trading in carbon dioxide credits from sequestration at the source of the production.

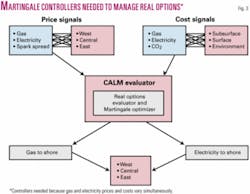

If price and cost signals are both received in real time, and if sufficiently diverse product and sequestration options exist, then CALM’s martingale controller concept (described in past articles in this series) could produce the added value required to justify the large additional capital investment. Such smart controllers are especially useful in out-of-sync quadrants of our scenario analysis when either positive or negative spark spreads exist.

In 2005-07, regional spark spread premiums of ±$20/Mw-hr equivalent between the electricity and natural gas prices have been common. These variations were caused by electricity congestion in the summers and gas shortages in the winters.

CALM’s martingale controllers incorporate dynamic real options to compute optimal decision paths that are “always-in-the-money.” When controlling ultradeepwater production, they would simultaneously balance price signals against production costs to distribute gas vs. electricity into different regional markets in real time (Fig. 3).

Gas-to-electricity offshore

The value of investment in real options comes not from the addition of new kinds of power delivery systems to the market mix but from the modest initial investments needed to enable the possible selection of options such as FGSO hubs at a later date. The timing and volume of gas and oil streams piped to shore are the only current options available to ultradeepwater operators.

What would be required to generate such additional options of selling electricity generated by burning gas at new offshore power hubs while sequestering CO2 back into reservoirs to enhance production?

A similar paradigm change in offshore production methodology has been executed by the industry in the recent past. When the need for more diverse production and storage facilities was required in ultradeep water off Brazil and West Africa, FPSO vessels were invented. Today, more than 100 FPSOs have been built to exploit this need for additional flexibility at a cost of well over $75 billion.1

Would it be profitable to build FGSO vessels that use natural gas for power generation onsite and offload electricity instead via undersea (HVDC) cables connected to diverse electricity markets?

The vessels could also sequester CO2 and use it for enhanced oil recovery (EOR) in the same reservoirs being used to fuel the floating power plants. The components exist to modify supertankers to contain modern, 1,200-Mw gas turbine power plants, along with AC/DC converters, and CO2 sequestration capabilities.

We estimate that the cost would be about the same as FPSO vessels. One thousand miles of HVDC cable to carry the electricity to multiple shore locations could be laid with a traditional marine cable-laying ship for an estimated capital investment of about $1 billion.

Fuel-efficient, aeroderivative gas turbines with proven reliability in marine environments can be used to provide a high-density power plant.

Modularization would be used to provide enough mobility that components requiring overhaul could be offloaded for repair onshore. This modularity, combined with a modest amount of redundancy, has been demonstrated to deliver close to 100% availability in onshore gas turbine power plants.

Redundancy in AC/DC converters and HVDC cables can produce similar percentages of availability offshore while providing real options for redeployment amongst newly emergent markets, given the rerouting and splicing potential of flexible HVDC cable laid onto the sea floor. A hub-and-spoke design is envisaged for collecting the gas for powering the FGSO generators. CO2 would be captured and returned to the gas fields for EOR sequestration (Fig. 4).

Ultradeepwater economics

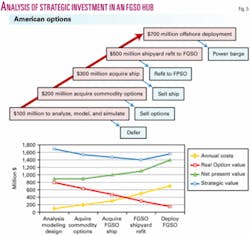

We have used an American Options model to estimate the value of maintaining real options for construction and deployment of FGSO hubs in the ultradeep water (Fig. 5, top).

We then compared capital expenditures, real options, and strategic value with the more traditional net present value method of evaluating a five-step investment in the construction and deployment of an FGSO power production hub in the northern Gulf of Mexico (Fig. 5, bottom).

NPV-based investment decisions create biased and uncertain forecast-dependent valuations, especially for forecasts that are many years out. There are additional tradeoffs from the exercising of real options along the path to construction and deployment that can enable larger capabilities to profit when uncertainties solidify in the future. In other words, incremental investment in building the capacity to profit from the real options creates a dynamic plan with decision gates that force ongoing evaluation of capital investments.

There is always more certainty of the payback at a later date from any plan assembled today, and that advantage can be used to create a valuable, real options framework for any company. True, real options for those investments must exist, of course.

We conducted our evaluation of gas-to-electricity investment using the real options analysis tool kit in a common strategic planning tool used in the oil industry called “Crystal Ball.”

Such real options are valid when management has the ability to decide if each successive stage can be implemented after the results from the previous stage are final. In such options, only the previous sunk cost is at risk at any stage.

The strategic value of being able to defer investments in order to wait and see until more information becomes available is the sum of the real option value and the NPV of the asset with cash discounted at the hurdle rate and volatility estimated. If, over time, the volatility decreases, then uncertainty and risk are lowered and the real option value decreases.

The cost-of-waiting is evaluated by computing the dividend rate as a percentage of the asset value. The balance between collecting more information and the cost of waiting is continuously recalculated so that the optimal strategic value can be maintained all along the way. The ability to wait, while simultaneously preparing all that is necessary to execute, is worth several hundred million dollars in the ultradeepwater FGSO hub case study (Fig. 5).

Scenario analysis

Real options combine naturally with scenario analysis.

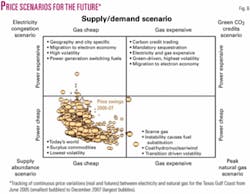

Below, we demonstrate this capability by evaluating the profitability from the execution of the FGSO real options described above in a world in which gas and electricity prices are independently fluctuating at the same time that “green CO2 credits” are being contemplated and congestion makes delivery even of abundantly supplied gas and electricity difficult. The value in these scenarios ultimately arises from the differences between natural gas and electricity prices (Fig. 6).

We assume price volatility is driven in the future by annual variations from summer to winter and occasional natural disasters like those from hurricanes Katrina and Rita.

Our scenarios were then compared with recent variations in commodity prices over the last 3 years. These mostly fall within the cheap electricity and gas scenario (lower left quadrant of Fig. 6). The upper right quadrant represents the green scenario that will likely result in a surcharge on current prices for both gas and electricity.

We foresee significant opportunities for carbon credits and an “electron economy” developing as energy use for transportation and heating migrates over to electricity. New technologies like plug-in hybrid vehicles and ultraefficient electric heat pumps will drive this conversion.

Harvesting of arbitrage between gas and electricity prices with positive or negative spark spreads, the other two quadrants of our scenario analysis, can be assured via the use of CALM martingale controllers. Significant profits can be assured by marketing a flexible mix over selling either gas or electricity in these highly variable price quadrants.

CO2 sequestration

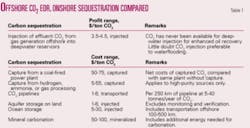

CO2 removal offers additional real options of sequestration right at the source of ultradeepwater production to both enhance production through CO2 flooding and profit from trading in carbon credits.

There is significant environmental upside from such real options. Given the assumption that the value of CO2 sequestration would be high for the green scenario, returns from this investment are far above expected costs of capital to make this option real.

Consider the value of carbon sequestration at the site of ultradeepwater production should a carbon tax come into existence.

In Table 1, we compare offshore EOR using the CO2 captured by the FGSO hubs with estimated costs for onshore carbon sequestration from the International Panel for Climate Change, United Nations, 2007. Injection at the source of ultradeepwater production could add a premium of $10-20/Mw-hr equivalent in our scenario, assuming that the profit range is $3.50-4.50/ton of CO2 injected (current cost in West Texas).

Investment ‘hockey stick’

The real options valuation must be combined with estimated revenues and operational and capex costs into a profit/loss model in order to determine the investment quality of the venture (Fig. 7).

We compute a payback period of five years for capital investment in the FGSO hub, assuming an ultradeepwater production facility is connected to both a gas pipeline and an FGSO electricity/sequestration hub. Without the $20/Mw-hr carbon credit, the payback time would be 7 years.

Summary

Given long-term forecasts that are guaranteed to be wrong, a CALM methodology that utilizes real options, paired with scenario analyses, can provide a powerful means of exploring alternative investment options under uncertainties in dynamic and market forces.

The scenario analysis provides investment stages for real options evaluation so that alternatives for deployment of capital can be identified into the future. The economic model for evaluation of the ROI for ultradeepwater electricity production hubs using FGSO vessels and undersea HVDC power cables to shore requires recovery of capital costs and sufficient future market flexibility onshore to sustain profitability for the life of the hub.

Our evaluation suggests that additional real options for producing gas-to-electricity make an attractive alternative to the more traditional options of oil and gas delivery by pipelines. Our evaluation of a green scenario, whereby fear of climatic change produces a hefty new CO2 tax, illustrates the need for strategic flexibility with real alternative investment options in order to assure profitability for ultradeepwater production.

Reference

- Maritime Reporter, August 2003.

Installments in this series:

- OGJ, Mar. 17, 2003, p. 47.

- OGJ, May 19, 2003, p. 42.

- OGJ, June 30, 2003, p. 36.

- OGJ, Aug. 25, 2003, p. 56.

- OGJ, Nov. 24, 2003, p. 48.

- OGJ, June 28, 2004, p. 35.

- OGJ, Nov. 22, 2004, p. 36.

- OGJ, Mar. 7, 2005, p. 34.

- OGJ, May 9, 2005, p. 41.

- OGJ, Sept. 19, 2005, p. 56.

- OGJ, May 15, 2006, p. 29.

- OGJ, July 23, 2007, p. 36.

The authors

Roger Anderson ([email protected]) is Doherty Senior Scholar at the Center for Computational Learning Systems at Columbia University. He has a joint appointment at the School of Engineering and Applied Sciences and the Lamont-Doherty Earth Observatory. A cofounder of Bell Geospace, an exploration company specializing in gravity gradiometry, and CALM Energy Inc., he has a PhD from Scripps Institution of Oceanography.

Albert Boulanger is senior scientist at the Center for Computational Learning Systems of Columbia University. Before that, he was at the Lamont-Doherty Earth Observatory. He was CTO of vPatch Technologies and a research developer at BBN. He specializes in complex systems integration and intelligent reasoning components that interact with humans in large-scale systems. He developed the active notebook and other web technology contained in the Lamont 4D SeisRes software system.

John A. Johnson is cofounder and president of CALM Energy Inc., which provides computer-aided lean management solutions to the energy industry. He has over 20 years’ experience in the energy industry primarily in energy management, operations, strategic planning, and business development. He is a professional engineer and has an MBA in finance from the NYU Stern School of Business.