DRILLING MARKET FOCUS: Coiled tubing market grows steadily, attracts new players

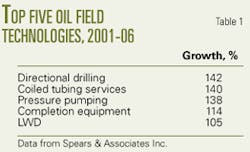

Coiled tubing is one of the fastest growing oilfield technologies. CT services expanded 140% over 2001-06, second only to directional drilling, according to Colorado-based Spears & Assoc. Inc. (Table 1).1

Spears publishes an annual oil field market report that covers 33 market segments, among which are CT services, oil country tubular goods (OCTG), and unit manufacturing (includes CT).

Operators worldwide employ versatile coiled tubing; it plays many roles in drilling, well stimulation, completion, and workovers. It’s also used for velocity and production strings, to convey logging tools, and for other special applications.

The CT market broadly includes equipment manufacturing, tubing string production, and CT services, including drilling. Coiled-tubing drilling (CTD) comprises only about 15% of the CT services industry but is growing more quickly than other areas.2

HydraRig’s Randal Graves told OGJ the global market for CT (tubing, equipment, services) is probably $500-600 million/year.

National Oilwell Varco Inc. (NOV) controls about 70% of the global coiled-tubing equipment and tubing market through its subsidiaries HydraRig, Quality Tubing Inc., and recently acquired FIDmash, according to FIDmash’s Leonid Gruzdilovich.3

Most of the world’s CT units and tubing strings are made in the US, but the supply is supplemented by a few small, regional companies.

Market-tubing

Coiled tubing is produced by seam welding long, flat strips of ductile carbon steel (occasionally stainless or chrome) or fabricated from fiber composite, then coiled on a large reel for field deployment. Tubing diameters range 0.75-4.5 in. CT can have factory-installed wireline, capillary tubes, or integral tools.

A typical, tapered CT work string will weigh 40-50,000 lb. Lead times for new tubing orders are 30-32 weeks if strip stock is in-house; 40-45 weeks if not.

According to Ronald Clarke, editor-in-chief of Moscow’s Coiled Tubing Times and past chairman of the Intervention and Coiled Tubing Assoc., worldwide annual revenue for coiled tubulars is about $200 million, split between two suppliers within 4 miles of each other in Houston (Fig. 1).

“That will change” with new market entrants, he told OGJ. CT purchases are increasing about 10-15%/year and this will continue or accelerate.

In addition to market behemoths Quality Tubing and Tenaris Coiled Tubes, smaller manufacturers of coiled tubing include Cymax Coiled Tubing (UK); Fine Tubes Ltd. (UK); and Webco Industries Inc. (Oklahoma), among others.

Calgary-based Les Tomlin provides an annual analysis of tubular shipments. In his 2007 count, published Jan. 18, 2007, on the ICoTA site (www.icota.com):

- Canada received 29%.

- US, 21%.

- Europe and North Sea, 13%.

- Alaska, 10%.

- Middle East, 9%.

- North Africa, 8%.

- Latin America, 8%.

- Far East, 2%.

So, North American operations currently consume about 60% of the world’s CT production, excluding China.

Market-equipment

ASEP’s James Goddard told OGJ the global market for new CT equipment is probably €80 million/year, based on sales of 70-80 complete units/year. HydraRig provides about 50% of all new units, Stewart & Stevenson LLC 30%, and the remainder comes from a host of smaller companies.

Coiled-tubing units include the tubing, tubing reel, injector head, control cabin, and power pack assembly. Injector heads are commonly rated 40-80,000-lb pulling capacity but can range to 200,000 lb. The largest pull, 200,000 lb, was by Baker Oil Tools in Venezuela. Graves said that only a few dozen CT units in the world are rated to 100,000 lb.

The cost of a CT unit can be broken out into five major value sections: injector head, reel, power supply, cabin-trailer-hookups, and BOP stripper, said Graves. A typical CT unit runs $1.5-1.2 million, excluding the tractor and CT string. A typical CT drilling unit runs $1.5-2 million, and a hybrid CTD unit (with mast) can cost up to $3 million.

But there are many other CT equipment designers and manufacturers in this growing market:

- ASEP Group (Netherlands; UK; US).

- C-Tech Oilwell Technologies Inc. (Edmonton).

- Fluid Design Solutions Inc. (Edmonton).

- Hydessco LLC (Kilgore, Tex.).

- Hydraco Industries (Medicine Hat, Alta.).

- Hydraulic Power Technology Inc. (Buda, Tex.).

- MXROS Inc. subsidiary Pump and Coiled Tubing (PACT; Fort Worth).

- NOV Fidmash (Minsk, Belarus).

- JSC PervoMayskHimmash (Russia).

- Stelkraft Metal Works Pte. Ltd. (Singapore).

- Surefire Industries Ltd. (Calgary).

- Total Equipment and Service (Granbury, Tex.).

Canadian companies ordered 78 new CT units in 2006. The top five are Savanna Energy Services Corp. (11), Technicoil Corp. (10); BJ Services; Sanjel Corp., and Trican Well Service Ltd. (6 each).

CT rig count

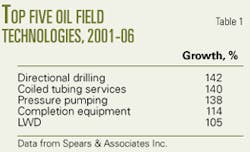

Tomlin tabulates the annual, worldwide, active CT rig count for ICoTA, most recently updated Jan. 18, 2007 (Fig. 2). The count showed 1,535 CT rigs worldwide, up 11% from the previous year. Rig fleets showed the greatest annual increase in the Middle East (23%), Canada (21%), and Russia-China (14%). The fleet size dropped in only one region, India, which lost 5 CT rigs (-17%). Tomlin notes that some international figures could not be validated.

Market-services

About 60% of the global CT services market is dominated by oil field services companies Schlumberger, BJ Services, and Halliburton.

In the Canadian market, for instance, ICoTA Canada says Schlumberger provides 27%, BJ 18%, Halliburton 15%, followed by smaller players: Savanna, Superior Energy Services Inc., Cudd Energy Services (each 5%); Trican (4%), Complete (3%), and Weatherford (2%), with the remaining 16% shared among even smaller providers.

In the US market, 26 operators provided services with 296 CT rigs in 2006, including BJ 17%; Halliburton and Schlumberger, 13% each; Cudd and Complete, 9% each; CT Services 8%; Superior 7%; Pool Well Services, a subsidiary of Nabors Industries 3%; Arctic Recoil (Cougar Pressure Control), Warrior Energy Services Corp. and Key Energy Services Inc., 2% each; with the remaining 14% provided by 15 other companies.

CT drilling

CT drilling is commonly touted as being quicker than conventional drilling, with well completions in 20-60% shorter time.2

CTD can be accomplished with traditional injector-crane assemblies (no mast) or with new, built-for-purpose hybrid CTD rigs that include hydraulic drawworks, rotary table, and top drive. The injector can slide out of the way of the mast and top drive in order to run jointed pipe.

According to Canada’s Technicoil Corp., general charges for drilling a 1,000-m well with a CTD rig in Canada are $1,500-2,500 (Can.)/day higher than use of a conventional drilling rig. The additional costs are related to the drill motor (about $500 (Can.)/day) and the cycling charges on the CT string (about $1.75/m, totaling $1-2,000 (Can.)/day, depending on CT size, well depth, etc.). Cycling charges are generally only levied on forward progress, not on round trips.

There were about 75 CTD rigs in Canada in 2006, comprising about 20% of the total fleet of CT units. This is high compared with the US, which had only about 11 CTD units, 4% of the total US CT fleet, according to ICoTA.

Made in USA, Canada

The two largest manufacturers of coiled tubing rigs are both based in Texas: HydraRig, a division of National Oilwell Varco, and Stewart & Stevenson.

HydraRig, based in Fort Worth, is the world’s leading manufacturer of coiled-tubing equipment, supplying both parts and complete units. Graves told OGJ that HydraRig has built 700 complete units and shipped the 1,000th injector head from its plant in May 2007. The National Oilwell Varco companies combined have built more than 900 units.

HydraRig has expanded to 320 staff from about 120 in 5 years. It provides CT units to all the major oil field service companies (Fig. 3). The company moved to a new Fort Worth facility in 2004, in order to expand and build more component pieces in house, gaining better control of delivery times, Graves said.

About 75% of the company’s CT units are built in Texas, 15% in Calgary and Nisku, Alta., and 10% in the UK. Complete units require about 15 months to build to order at the Fort Worth plant, but there is less of a backlog in Canada.

Most of HydraRig’s customers order trailer-mounted rigs, except for Russia and India. A typical Russian rig will run 3,500 m of 1¾-in. tubing. Customer Surgut Neftegaz has about 45 HydraRig units and recently ordered 12 units (6 CT, 6 fluid pumper) for north-central Siberia for $17.5 million.

HydraRig has sent about 30 truck-mounted units to China. A typical rig destined for China will have a reel with 15,000 ft of 1½-in. tubing.

But Graves said many of his new CT units are staying in North America, where the industry is “hot,” with about 40 units in Barnett field alone (Fig. 4).

Houston-based Stewart & Stevenson has designed and built CT equipment since 1990, with more than 300 units in the field to date. The company offers land and offshore CT units, as well as hybrid CTD units with either hydraulic or AC power; derricks up to 400,000-lb capacity; injector heads up to 200,000-lb capacity; and single or multitrailer configurations.

About half of the company’s CT units stay in North America; others are sent to South America, Russia, Middle East, China, and North Africa.

Stewart & Stevenson acquired privately-held Crown Energy Technologies in February 2007. The Calgary-based company, with 1,100 employees in Canada and the US, builds CT masted units for hydraulic fracture (frac) work.

Stewart & Stevenson’s Chad Joost told OGJ the Crown acquisition brought complimentary business in stimulation and workover equipment, as well as an entry to the Canadian market.

About half of the company’s CT units stay in North America; others are sent to South America, Russia, Middle East, China, and North Africa.

Stewart & Stevenson acquired privately-held Crown Energy Technologies in February 2007. The Calgary-based company, with 1,100 employees in the Canada and the US, builds CT masted units for hydraulic fracture (frac) work.

Stewart & Stevenson’s Chad Joost told OGJ the Crown acquisition brought complimentary business in stimulation and workover equipment, as well as an entry to the Canadian market.

Stewart & Stevenson is currently a privately held company but filed for an initial public stock offering in November 2006.

Texas also hosts the two main manufacturers of CT tubulars, which equally share the global market: Quality Tubing Inc., a division of NOV, and Tenaris Coiled Tubes, which acquired Precision Tubes as part of its $3.2 billion purchase of Missouri-based Maverick Tube Corp. in October 2006. Maverick had acquired Precision in 2005 for $55 million and spent $12 million in 2005-06 expanding manufacturing capacity at Precision’s Houston CT plant.

Quality Tubing (QT) was founded in 1976 and purchased by Varco International in 2001. It increased its production capacity by 60% in 2006, including a new tube mill line and two new tube-mill entry lines.

QT says it can produce coiled tubing strings up to 26,000 ft long without a single girth (butt) weld. The company has four basic tubing grades: QT-700, QT-800, QT-1,000, and QT-1,200, ranging from 70,000-120,000 psi minimum yield strength, as well as QT-900 for sour service; QT-16Cr for wet CO2 work; and H0-70 for permanent tubing installations.

Global steelmaker Tenaris SA, through subsidiary Tenaris Coiled Tubes, has two coiled-tubing manufacturing facilities in Houston, for downhole (drilling and well service) and subsea (pipelines and umbilicals associated with deepwater trees). Tenaris has four downhole-tubing grades (70, 80, 90, 110), with 1 to 5-in. OD, and 0.08-0.30-in. WT. (OGJ, June 25, 2007, p. 45). Dennis Dunlap, managing director of Tenaris Coiled Tubes, said the company uses coiled strip stock from France.

A new player is about to enter CT manufacturing. Global Tubing LLC announced last month that it would build a coiled-tubing manufacturing plant in Dayton, Tex.4 Global Tubing President and owner Jon Dubois, who founded Quality Tubing 31 years ago, said the new company would export “to China, to Russia, and to the rest of the world.”

Made in Europe

Established in 1981, the private ASEP Group has manufactured K-CTU truck-mounted (land) and containerized (offshore) coiled-tubing units and CT reels for the European market since 2000 at ASEP NL BV’s plant in Groot-Ammers, Netherlands.

About 65% of the wireline and CT equipment ASEP manufactured in 2006 went to seven clients: Halliburton, Schlumberger, Baker Atlas, PSL, Seadrill, Aker Kvaerner, Qserv, and Weatherford. CT units are sold primarily to PSL Energy Services Ltd.

ASEP has two new developments: an 8 by 8 all-wheel-drive coil truck, and a four-chain CT injector head. The “QuadHead” has 80,000-lb pull capacity, stands about half as tall as a standard, two-chain injector head, and is potentially stackable, ASEP’s Keith Henderson told OGJ. The grippers can accommodate tubulars to 4½-in. diameter, and two stacked units could potentially be used for jointed pipe. The new injector sells for about 30% premium over standard heads, and the first unit was just purchased by PSL.

Made in Russia

According to Steve Robertson, oil and gas manager at Douglas-Westwood Ltd., the Russian oil field services industry is set to double in value over the next 5 years.5 Russian companies are looking to the West and beginning to adopt western business models.

One example is the reactivation and planned upgrade of a coiled-tubing manufacturing plant in Chelyabinsk, Russia. Sergey A. Gouskov is the principal at JSC UralTrubMash (UTBM), which has made CT in the past and is currently retooling for a push into the market. UTBM produces CT with 20-57 mm ID, in strings as long as 4,500 m.6

Earlier this year, Leonid Gruzdilovich, president of the FID Group, said FIDmash has produced four generations of coiled tubing equipment, 1999-2007, with primarily Russian-made components.3 He said 50% of this year’s deliveries will be made to international servicing companies (up from 24% in 2006), 30% to companies in the CIS (same in 2006), and 20% to Russian oil and gas production and servicing companies (down from 46%).

For the last 7 years, FIDmash has dominated the Russian market of CT equipment,” Gruzdilovich said, with “70% produced by us, about 13% by Hydra Rig, and about 4% by Stewart & Stevenson.” Another 13% of the purchased units were produced elsewhere in Russia.

The coiled-tubing equipment market in Russia is small, he noted. The average Russian company has 2-5 units at most. Larger companies have more; for example, Gazprom owns 30 units and Surgutneftegaz owns 27.

CJSC FIDmash was established in 2001 in Minsk, Belarus, and was acquired by National Oilwell Varco in December 2005.7

NOV Fidmash says its strategic aim is to provide equipment to Russia, CIS countries, Eastern Europe, Central Asia, and the Middle East. The company has supplied CT equipment to Schlumberger, BJ Services, Gazprom, Rosneft, SurgutNeftegas, Tatneft, Bashneft, Ukrneft, Ukrgazodobicha, and others.

Graves told OGJ that FIDmash had built about 50 CT units for the Russian market. Some NOV Fidmash CT units include HydraRig injectors and Texas Oil Tool BOPs. Unit output doubled in 2006 from the previous year and he expects it to double again in 2007.

A smaller Russian company, PervoMayskHimmash, produces light-duty CT units. Two Russian operators mentioned purchases. Vladimir Dmitruk, of gas producer Nadymgazprom, said his company uses CT for 37% of its well repairs (about 18/year). It bought a CT unit built by Rebound Rig Co. Ltd. in 1994, a Belarus-made M10 from FIDmash in 2005, and plans to buy a URAN-20.1 from PervoMayskHimmash this year.8

Nikolai Rakhimov, chief engineer at Urengoigazprom, said the company uses CT equipment for about half of the 90-120 well repairs it performs each year in the Urengoi oil-gas-condensate field. The company has purchased CT units from FIDmash and PervoMayskHimmash.8

Tatneft has CT units built by HydraRig, Stewart & Stevenson, and FIDmash.8 Orenburggazprom bought a single M-20 unit built by FIDmash in 2002, for work in Orenburg oil-gas-condensate field.

Russian expertise

In a recent interview, Aleksandr G. Molchanov, professor and department head at I.M. Gubkin Russian State University of Oil & Gas, discussed the primacy of Russia’s SurgutNeftegaz in coiled-tubing expertise. It’s the “best-equipped Russian company in...CT and CT tools [and] can broadly apply CT technologies,” he said.9

Molchanov acknowledged that “CT drilling is still considered in this country a rather exotic process” but that SurgutNeftegaz is drilling with CT beyond 2,000 m.

Independent Russian oilfield service companies offering CT include: Eurasia (CTD only); CJSC Uralmash-Burovoye Oborudovaniye, purchased by Integra Group in 2005; RITEK, a subsidiary of Lukoil, and others.

Weatherford International will open the first coiled tubing-conveyed tool rental workshop in Russia in Nizhnevartovsk in second-half 2007. The equipment will target well repairs and will include small motors, mills, impact hammers, fishing tools, and packer systems.9

Future

Coiled tubing is nearly recession-proof, Ronald Clarke said. When drilling is down, workover activity increases; when drilling is up, CT units are either engaged in drilling or well completions. Upside: CT companies often show EBIDTA (earnings before interest, taxes, depreciation, and amortization) of 40% or more. Downside: coiled tubing is becoming a commoditized product.

Regardless, the market seems likely to continue to expand at least 10-15%/year for the foreseeable future.

References

- CIBC World Markets Inc., Schlumberger Coiled Tubing Discussion, Sept. 6, 2006.

- “Coiled tubing: State of the Industry and Role for NETL,” US Deptartment of Energy, National Energy Technology Laboratory Topical Report, June 2005, www.netl.doe.gov.

- Balashov, Sergai, “FIDmash Founder Leonid Gruzdilovich Talks CT and His Deal with NOV,” Mar. 5, 2007, Oil & Gas Eurasia, www.oilandgaseurasia.com.

- George, Mike, “Dayton welcomes Global Tubing to town,” Dayton News, June 6, 2007, www.hcnonline.com.

- Robertson, Steve, and Westwood, Rod, “The Russian Oil Field Services Market Report 2007-2011,” Douglas-Westwood Ltd., 2007.

- http://www.utbm.ru/rus/production/dtb.

- NOV FIDmash; www.fidmashnov.com/gb/about

- Balashov, Sergai, “The Customers’ Opinion on Coiled Tubing,” Mar. 5, 2007, Oil & Gas Eurasia, www.oilandgaseurasia.com.

- Coiled Tubing Times magazine, March 2007, pp. 12-16.