Texas officials order abandoned rig removed

Texas Land Commissioner Jerry Patterson ordered the immediate removal of a derelict jack up, Zeus, that authorities say has long threatened to topple into the Freeport Ship Channel and spill toxic sludge.

The emergency order was the first under new authority to remove derelict structures from state waters. State lawmakers also authorized $2 million to enable immediate rig removal.

Zeus owner Sanship Inc. of Brownsville, Tex., remains liable for the rig’s removal costs and any cleanup costs. Sanship also could be subject to fines, penalties, and fees, state officials said.

“We’re getting on this right now-the courts can decide ultimately who foots the bill,” Patterson said. “But the quicker this work is done, the better.”

Already Zeus has begun leaking an oily mix into coastal waters, he said. But the greatest threat poised by the abandoned rig is its potential to collapse into the ship channel.

The US Coast Guard inspected the jack up and determined a hurricane or tornado could cause its collapse, consequently interrupting Brazosport, Tex., shipping activities. The Texas General Land Office is working with Port Freeport management, which will hire a contractor for the jack up removal and cleanup by using state funding.

Citgo found guilty of environmental charges

A federal jury in Corpus Christi, Tex., found Citgo Petroleum Corp. guilty of two felony criminal violations of the Clean Air Act but acquitted the Houston refiner-marketer on two other counts, the US Department of Justice and Citgo said in separate announcements June 27.

Citgo, a subsidiary of Petroleos de Venezuela SA (PDVSA), was found guilty of operating two large, open-air tanks without proper emissions controls at Citgo Refining & Chemicals Co.’s Corpus Christi East refinery. DOJ said Citgo used the tanks to separate oil from water without either a fixed roof, vented to a control device, or a floating roof. Separators upstream from the tanks never worked to remove oil from the waste water before oil entered the tanks, it said.

Citgo learned within months after the two tanks went into operation that the upstream oil-water separators did not work, and it used vacuum trucks to remove oil from the surface of water in the tanks for nearly 10 years instead of installing the proper control equipment to prevent emissions of benzene and other volatile organic compounds, DOJ said.

Citgo noted that it was acquitted of two other counts relating to the reporting of benzene in waste water streams during 2001-02 and said it plans to appeal the guilty verdicts.

US Environmental Protection Agency regulations do not require roofs on waste water equalization tanks and explicitly excluded such tanks from the requirement, the company said. It voluntarily began to construct such roofs in 2004 though it was not required to do so, it added.

“The charges absolutely do not involve any releases or spills to the environment,” the company said. “Citgo is proud of its environmental record and is confident that the verdict on Counts 4 and 5 will be reversed on appeal. In fact, the waste water system of which the equalization tanks are a part has never had a permit violation on oil or grease since the tanks were built in 1994,” the company said.

DOJ said a federal grand jury on Aug. 9, 2006, indicted Citgo and its environmental manager Philip Vrazel on the four CAA counts, one felony count of false statements, and five misdemeanor counts of the Migratory Bird Treaty Act, which were later severed. It said the court has not determined whether the government will be able to go forward on the false statements charge.

Brazil steps up ethanol, renewables production

Brazil’s state-owned Petroleo Brasileiro SA (Petrobras) has identified $700 million in investments in biofuels and other renewables during 2007-11.

Petrobras Chief Executive Jose Sergio Gabrielli de Azevedo said much of the spending would be for pipelines, while a company spokeswoman said the firm is planning 3.5 million cu m/year of ethanol capacity for its pipelines and export vessels.

In February Petrobras signed a memorandum of understanding with Japan’s Mitsui & Co. and Brazilian Construciones e Comercio Camargo Correa SA to study the construction of pipelines for exporting ethanol (OGJ Online, Feb. 28, 2007). And in March the Japan Bank for International Cooperation signed a memorandum of understanding to provide Petrobras with $8 billion to help it export the ethanol to Japan (OGJ Online, Mar. 6, 2007).

Brazil is the world’s second-largest ethanol producer after the US and is the world’s leading exporter of ethanol made from sugar cane.

Answering environmentalists, Brazilian President Luiz Inacio Lula da Silva said in a national radio broadcast that his country’s stepped-up ethanol trade would not destroy rainforests or harm the Amazon region. Lula said Amazon weather conditions are not favorable for sugar cane crops and that increased ethanol production would not prompt more jungle clearing.

Gas projects to create regional gas grid in UAE

A regional gas grid is materializing in the Middle East with the completion of the Dolphin gas project in Qatar and the advancement of Shah sour gas field in Abu Dhabi.

The $3.5 billion Dolphin project, which includes a 370-km, 48-in. subsea gas export pipeline connecting Qatar with the UAE, is fully operational and delivering natural gas from its own production wells to customers in the UAE, said project partner Occidental Petroleum Corp.

The project enables gas from supergiant North field off Qatar to be transported to a processing plant in Ras Laffan and then to the Taweelah receiving facility in the UAE.

Additional deliveries to customers in Oman are expected to begin soon, Oxy said. Earlier reports said Qatar plans to export 200 MMcfd of gas to Oman starting in 2008 (OGJ Online, Mar. 8, 2007).

Initial production from the project is expected to ramp up by yearend, reaching nearly 2 bcfd.

For the Shah project, state-run Abu Dhabi National Oil Co. (ADNOC) has invited international oil companies Oxy, ConocoPhillips, ExxonMobil Corp., and Royal Dutch Shell PLC to submit revised bids to develop the onshore field’s sour gas reserves. Revised bids reportedly are to be submitted by the end of August.

The initial tender in April called for plans to develop gas reserves in Shah and Bab fields at an estimated cost of $10 billion. After it failed to attract enough international interest due to the complexity of developing both fields together, ADNOC split the project.

A decision for bids for Bab field development has been delayed for several months.

Other companies that bid for the Shah development but were not selected to continue in the competition are BP PLC, Total SA, Japan Oil Development Co., and BASF subsidiary Wintershall AG.

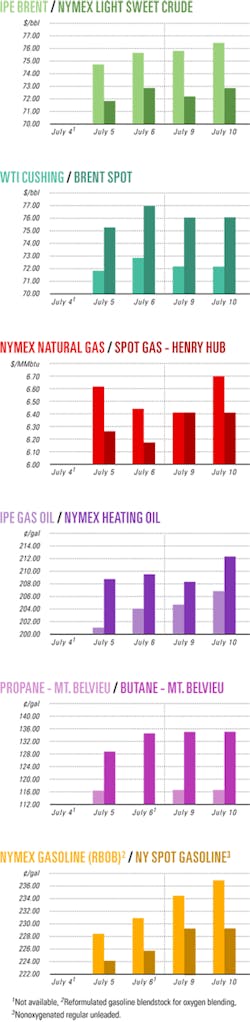

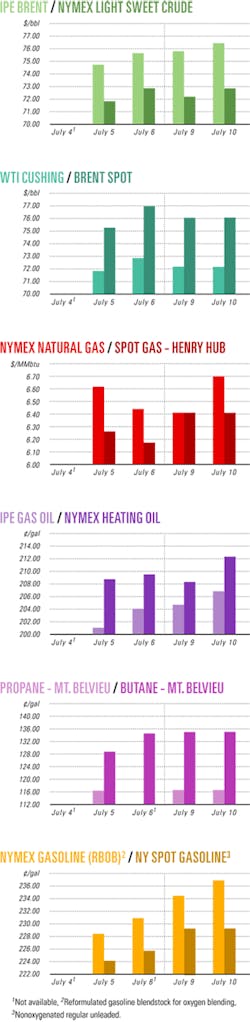

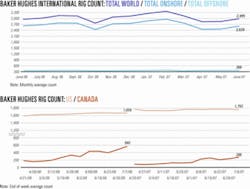

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesPioneer has fifth discovery, adds Tunisia girth

Pioneer Natural Resources Co., Dallas, which declared Tunisia a core area fairly recently, has notched a fifth discovery and is expanding its acreage position in the North African country.

The company plans to perforate and test Farrah, its fifth find on the Jenein Nord block in the Ghadames basin, in three intervals totaling 20 m starting in late August.

It will drill three more exploration wells on the block by the end of 2007 (see map, OGJ, July 2, 2007, p. 44). It will also acquire another 3D seismic survey adjacent to the five successful wells. Three exploration wells on adjacent nonoperated blocks are planned by yearend.

Pioneer’s average net production from Tunisia is expected to rise to at least 5,400 b/d in 2007 and to more than 10,000 b/d in 2008. Output from Jenein Nord is to start late in the 2007 fourth quarter.

Meanwhile, Pioneer is acquiring a further 15% interest in the 1.2 million acre Anaguid Block from Anadarko Petroleum Corp. Pioneer will become operator with 60% interest, half of which is subject to a back-in right by Tunisia’s state ETAP. ETAP has a 50% back-in right on Jenein Nord.

Following government approvals, expected in 60-90 days, Pioneer will shoot 3D seismic on Anaguid adjacent to the Jenein Nord and Adam blocks and expects to drill an Anaguid exploration well in 2008.

Statoil’s Ballena gas well tested off Venezuela

Statoil ASA said it has tested gas at “significant” rates in one of two intervals in its Ballena well, which it recently completed on Block 4 of Plataforma Deltana off eastern Venezuela. However, the company is unsure if the find is commercial.

“Further evaluation of the results will be done in the coming months, with a decision dependent on the outcome of the last well, [Orca, in the three-well exploration campaign on the block],”said Thore E. Kristiansen, Statoil Venezuela’s country president.

The Ballena well is the second well to be completed in the drilling program. Transocean Inc.’s Sovereign Explorer semisubmersible drilled the well in 350 m of water. No well has been drilled in deeper water off Venezuela to date, Statoil said.

The Sovereign Explorer is to be moved to the third well location.

The first well completed in exploration campaign on Block 4, Cocuina-2X, found dry gas in three intervals (OGJ Online, Jan. 8, 2007, Newsletter).

Interest holders in the license are Statoil (operator) 51% and Total SA 49%. PDVSA Gas has the option to participate with up to 35% ownership when commercial.

Drilling & Production - Quick TakesTurkey starts gas imports from Azerbaijan field

Turkey has started importing natural gas from Shah Deniz gas-condensate field in Azerbaijan via the South Caucasus Pipeline (SCP), said Statoil AS, commercial operator for that project.

Delivery was delayed by technical problems that the Shah Deniz partners encountered with production from the wells (OGJ Online, Jan. 23, 2007).

Turkey is importing varied amounts of gas depending on how much it nominates, a spokesman from BP PLC, technical operator of Shah Deniz, told OGJ. The field produces 8 million cu m/day of gas and 25,000 b/d of condensate from three wells. Another well will be brought on stream later this year, the spokesman said.

The SCP system transports gas from Shah Deniz field in the Azerbaijan sector of the Caspian Sea, through Georgia, and on to the Georgia-Turkey border. Following its commissioning, the pipeline was successfully tied-in with the Turkish pipeline system at the Georgia-Turkey border. Turkish gas firm Botas is responsible for transporting gas from the Turkish border through a new pipeline to the city of Erzurum.

BP expects to produce an average of 63,000 boe/d in 2007 from Shah Deniz. Plateau production from Stage 1 will be 8.6 billion cu m/year and approximately 30,000 b/d of condensate.

Gas output is expected to reach 12 billion cu m/year by 2012 during the project’s second stage, and 20 billion cu m/year by 2015 during the third stage.

Production restored from P-50 FPSO off Brazil

Oil and gas production was restored July 7 from Petroleo Brasileiro SA’s P-50 floating production, storage, and offloading unit in Albacora Leste field off Brazil following a July 4 fire that broke out on the vessel.

Following the fire, an undisclosed amount of oil and gas production was cut from the unit, which lies in the Campos basin about 120 km off Rio de Janeiro state. Production from the FPSO ramped back up to 160,000 b/d after restart. The unit is capable of processing 180,000 boe/d.

“Full production was retaken after the transformer room cleaning operation was wrapped-up and after all other platform systems were checked and determined as fully operational,” Petrobras said.

The blaze erupted in the gas compressor transformers room, forcing the company to shut down production. No injuries or oil spills were reported.

Total may hike oil output from Gabon field

Total Gabon SA is investigating boosting production from Anguille oil field in Gabon, adding more than 100 million bbl of proved and probable reserves and 30,000 b/d of oil in the first half of the next decade. Currently the field produces 7,000-8,000 b/d of oil.

A Total spokeswoman declined to give any more details, adding that the company plans to take a final investment decision at the end of 2007 following an update of its convention of establishment agreement signed with Gabon. Total will operate in Gabon for another 25 years and the agreement defines, among other things, the legal and tax system governing Total Gabon’s concessions, operating licenses, and crude transportation installations.

It covers 17 concessions and operating licenses representing an area of nearly 1,500 sq km and more than 60% of Total’s share of output in Gabon (more than 50,000 b/d in 2006).

Total will invest $260 million in 2007 on appraising and redeveloping existing fields to improve recovery and slow down the fall in oil production.

Pride orders ultradeepwater drillship

Pride International Inc. has ordered a newbuild drillship with advanced and dual-activity capability for use in ultradeep water.

The $680 million drillship, to be built by Samsung Heavy Industries Co. Ltd. (SHI) at its shipyard in Geoje, South Korea, will be capable of drilling to a TVD of 40,000 ft in as much as 12,000 ft of water. The rig initially will be equipped for drilling in 8,000 ft of water, Pride said.

The rig, yet to be named, is slated for delivery in third quarter 2010.

It will have an SHI-proprietary hull design measuring 750 ft long, 140 ft wide, with a variable deck load of 20,000 tonnes. It also will feature dynamic-positioning station-keeping with DPS-3 certification, expanded drilling fluids capacity, a 1,000-ton top drive, and living quarters for 200 crew.

Processing - Quick TakesCoffeyville refinery recovering after flood

Coffeyville Resources LLC in Coffeyville, Kan., estimates that 1,700 bbl of crude oil and a small amount of oil from the refinery’s sewer system were swept away by Verdigris River flood waters.

During June 30-July 1, heavy rains caused the Verdigris River to overflow its banks and protective levees, flooding Coffeyville. The river crested more than 10 ft above flood stage, setting a record for the river. About 2,000 citizens and more than 200 homes were affected.

The 100,000 b/cd refinery, under 4-6 ft of water on July 3, was shut down and evacuated. Workers were able to return to some administrative offices and warehouses on July 4 (OGJ, July 9, 2007, Newsletter).

Refinery management entered into an Administrative Order on Consent with the US Environmental Protection Agency to respond to the spill. The order describes Coffeyville’s commitment to conduct a timely cleanup of oil-impacted areas.

EPA conducted monitoring for volatile organic compounds in flood waters in Coffeyville and downstream, but has not indicated the presence of these compounds at a “level of concern,” refinery officials said.

Syria outlines plans for three refineries

Syria plans to build three refineries that would process a combined 350,000 b/d of oil, Syrian Oil Minister Eng. Sufian Al Alao told OGJ in London.

The first refinery, with a planned capacity of 70,000 b/d, is being built in Deir ez-Zor in eastern Syria in partnership with China National Petroleum Corp. The facility is expected to come on stream within the next 3 years. Investment is pegged at $1.2 billion.

Syria has signed a memorandum of understanding with Noor Financial Investment Co. from Kuwait for a second 70,000 b/d refinery in Deir ez-Zor, which also will cost $1.2 billion. It will be the first refinery in Syria to be developed and partly owned by private investors. Noor also plans to establish 50 retail outlets in Syria at an estimated cost of $100 million under its brand name.

Syria, Iran, and Venezuela also have agreed to build a 140,000 b/d refinery in the Homs, Syria, area, Al Alao said.

Syria is producing 400,000 b/d of oil, 50% of which is light oil and the other 50%, heavy oil. Gas production is 8-9 billion cu m/year. Omar Al Hamad, general manager of Syrian Petroleum Co., said SPC is trying to stem the fall in production by increasing recovery from fields it manages. “We have more than 13 contracts with companies, and we hope to get good results from these,” he said. “We are compensating with gas,” he added. SPC has called for bids by July 12 on seven onshore blocks covering 40,000 sq km.

About 24 companies have expressed interest in the acreage.

Syria has asked CNPC and Canada’s Dublin International Petroleum Co. to improve production and recovery factors of Tisheen, Roudeh, and Kubibe oil fields under previous agreements. CNPC is working on Kubibe field, which produces 11,000 b/d of oil and currently has a 20% recovery factor. Dublin is working on the other two, with heavy oil field Tisheen having a recovery rate of 16%. “Dublin is using steam injection for Tisheen,” Al Hamad said.

Valero to pay fines, upgrade Delaware City refinery

Valero Energy Corp. agreed to pay $445,000 in penalties and spend $5.6 million on improvements and environmental projects at its 190,000 b/cd Delaware City, Del., refinery in a settlement over alleged air and water violations.

The Delaware Department of Natural Resources and Environmental Control (DNREC) announced the settlement on July 5. Valero acquired the high-conversion refinery of heavy, sour crude while acquiring Premcor Refining Group Inc. (OGJ, May 2, 2005, p 46).

A Delaware administrative order covers instances of alleged noncompliance with state air quality, hazardous waste, and water quality regulations from May 1, 2004, through Sept. 30, 2006. The water issues concern the refinery’s wastewater treatment plant.

Most of the settlement involves problems with carbon monoxide boilers for the coker unit and the fluid catalytic cracking unit. Valero agreed to spend $4.5 million on boiler improvements and to conduct enhanced monitoring of nitrogen oxide emissions from two process heaters.

Valero also will spend $1.2 million to reroute hazardous hydrogen sulfide sulfur pit vapors into marketable sulfur. The company will spend $60,000 for a Fort Delaware power system, $40,000 for community yard waste sites, and $10,000 to improve fish habitats.

A company spokeswoman said Valero approached DNREC in an effort to resolve environmental issues lingering from previous owners. Premcor acquired the refinery from Motiva Enterprises LLC in 2004.

Transportation - Quick TakesTransCanada to expand Keystone oil pipeline

TransCanada Corp. has secured 155,000 b/d of additional long-term, firm capacity contracts on its planned 1,845-mile Keystone oil pipeline, enabling a 294-mile extension to Cushing, Okla., and facilitating plans to move forward with a further extension to the US Gulf Coast. The $1.7 billion (Can.) Keystone project will deliver oil from Alberta’s growing oil sands regions to the US.

When the mainline enters service in late 2009, it will have an initial nominal capacity to transport 435,000 b/d of oil from Hardisty, Alta., to the US Midwest at Wood River and Patoka, Ill. The $445 million (Can.) expansion to Cushing includes construction of the lateral from the Nebraska-Kansas border to Cushing and installation of additional pump stations. Provided that all regulatory approvals are received, lateral construction could begin in early 2008 and operations start-up, in late 2010.

With the acquisition of the long-term contracts, which total 495,000 b/d, capacity of the system will be expanded to 590,000 b/d.

TransCanada received approval in February from Canada’s National Energy Board to transfer a portion of its Canadian mainline gas transmission facilities to the Keystone pipeline subject to the approval of a facilities application to construct and operate Keystone’s $664 million (Can.) Canadian facilities, which will consist of 371-km of oil pipeline, terminal facilities at Hardisty, Alta., and pump stations.

ESPO project on track, energy minister says

Russian Industry and Energy Minister Viktor Khristenko said there will be enough oil for the first phase of his country’s East Siberia-Pacific Ocean (ESPO) pipeline project.

Khristenko said ESPO’s Phase 1, expected to be complete by yearend 2008, envisages transportation of as much as 30 million tonnes/year of oil from Tayshet to Skovorodino, on the border with China, an amount equal to current supplies.

So far Russian pipeline monopoly OAO Transneft has built 940 km of the pipeline, whose total projected length is more than 4,770 km.

Khristenko said construction of the Chinese spur from Skovorodino would start after the completion of the project design work. Under the contract, the design work should end 208 days after the first payment from China, which was received in June.

With regard to the project’s Phase 2, which will extend from Skovorodino to Russia’s Pacific coast, Khristenko said 2007 would be “important” as a “significant number of auctions for new sections will be held this year.”

Khristenko made the statements in Beijing where he is taking part in a meeting of the Russian-Chinese subcommittee on energy cooperation.

Holly, Sinclair to build Utah products pipeline

Holly Corp. and Sinclair Transportation Co. plan to jointly build a products pipeline that will extend from Salt Lake City to Las Vegas. The so-called UNEV Pipeline project includes the construction of associated terminal facilities in Cedar City, Utah, and northern Las Vegas.

The 430-mile, 12-in. line will cost about $300 million and have an initial capacity of 62,000 b/d, expandable to 120,000 b/d. It will serve refineries and shippers along its route and interconnect to the Pioneer Pipeline. The system is slated for completion by yearend 2008.