Investment risky in Russia as politics affects profits

Increasing scrutiny this year of TNK-BP’s Siberian natural gas assets and actions subsequently taken follow unsettling patterns of behavior in the way the Russian government has been running its gas business.

The government has reneged on a number of previously signed business agreements with various companies and threatened to halt multibillion-dollar, internationally sponsored operations after significant amounts of time and money had been invested in those projects.

Russia’s Natural Resources Ministry, claiming that TNK-BP was not producing enough gas from massive Kovykta gas field in Eastern Siberia, threatened in late May to revoke the company’s license to develop the field, which reportedly has estimated resources of 2 trillion cu m of gas in place (OGJ, June 4, 2007, p. 32). The move would create the need to rebid the field in a competition that Russia’s state-controlled natural gas monopoly OAO Gazprom doubtless would win. Observers saw the move as part of a continuing move to return Russia’s oil and gas deposits to state control.

In late June, TNK-BP (owned and managed jointly by BP PLC and Alfa Access Renova Group) announced an investment alliance with Gazprom for major long-term energy projects of at least $3 billion in cost or a swap of global assets. TNK-BP, the third largest oil company in Russia, agreed to sell to Gazprom a 50% interest in East Siberian Gas Co., which is building a regional gasification project, and to sell its 62.89% stake in OAO Rusia Petroleum OJSC, the company that holds the license for Kovykta field.

TNK-BP reportedly may purchase a 25% plus one share stake in Kovykta later at an independently verified market price once specific criteria have been met, the companies said (OGJ, July 9, 2007, p. 27).

This acquisition of the majority interest in Kovykta and other indicators point to the Kremlin’s tightening grip on the strategic energy sector. These patterns of behavior indicate a potentially unstable business environment for international investors. The following two case studies demonstrate some of Russia’s other seemingly underhanded tactics used in dealing with international consortiums in order to achieve its end goal of obtaining strategic control over the sector.

The Shtokman story

Shtokman gas field, discovered in 1988 in Russia’s Barents Sea, is believed to have over 141 tcf of natural gas reserves, making it one of the largest gas fields in the world (Fig. 1).

In the early 1990s, test results from a feasibility study formed the basis for talks that would allow a group of five Western companies to participate in the field’s development. In 1992, however, the foreign consortium was pushed out by the ZAO Rosshelf consortium, a Gazprom subsidiary that comprised 19 Russian companies mainly engaged in defense production.

According to Yevgenny Velikhov, vice-president of the Russian Academy of Sciences and chairman of Rosshelf, the consortium would provide greater employment in Russia. This was viewed as a key factor in Rosshelf’s victory over the Western consortium. According to then-Russian President Boris Yeltsin, although the country’s industrial policy favored Russian companies and groups, the consortium was encouraged to work with foreign companies and consultancies for their technical capabilities.

However, Russia was neither technologically nor financially prepared to take on such a project solo, and in August 1995 Gazprom and Rosshelf signed a letter of intent with Norsk Hydro of Norway, Conoco of the US, Neste Oy of Finland, and Total SA of France to evaluate the possible joint development of Shtokman field.

One challenge of the project was trying to figure out the logistics of transporting the gas to its destination. In January 1996, a St. Petersburg company designed a $600 million floating liquefaction plant, which offered a potential solution to the problem.1 LNG would obviate the need for an underwater pipeline from Shtokman field through the Barents Sea.

Plans to build the LNG plant, however, never came to fruition. Instead, in March 2000, Rosshelf began developing plans for production and construction of a natural gas pipeline, rather than an LNG plant, with potential foreign partners. These plans included building a pipeline from the field via Murmansk to Vyborg on the Baltic, then on to Peenemunde in Germany. With such an undertaking the project would require great financial backing. By May 2000, Gazprom had still not established the ownership structure of the $20 billion Shtokman project.

Russian and Western partners shared an interest in developing Shtokman field. The gas was destined to be piped directly to Europe, satisfying the growing European demand for natural gas. Russia would benefit by increasing its business ventures with Europe.

In June 2003, Russia reconsidered the possibility of adding an LNG component to the Shtokman development project. This would allow Russia to direct supplies to the US via LNG tankers.

By May 2004, despite the 1995 letter of intent with Norsk Hydro, Conoco, Neste, and Total to evaluate the possibility of a joint development project, Gazprom had not yet made a firm commitment on which firms would actually participate in the consortium. Gazprom was in talks with ExxonMobil, ConocoPhillips, ChevronTexaco (to a lesser extent), and Royal Dutch Shell.

Because Shtokman was located 342 miles from shore, analysts anticipated that a number of technical innovations and solutions would be implemented in the effort. This would push up development costs and make the gas more expensive. As a result, some analysts were skeptical of the project’s feasibility.

On June 20, 2005, Russia and Norway signed a number of agreements intended to finally pave the way for development of Shtokman field. France also signed a memorandum with Russia 8 days later, and in August 2005, Gazprom received bids from nine foreign companies to develop the field: ConocoPhillips, ExxonMobil, Norsk Hydro, Statoil, Mitsui, Sumitomo Corp., Shell, and Total. Gazprom ultimately planned to retain a 51% stake in the project and select two foreign companies to participate.

In September 2005, Gazprom short-listed five companies-Chevron, ConocoPhillips, Norsk Hydro, Statoil, and Total. Gazprom planned to announce the two winners on Apr. 15, 2006. That announcement never came.

In June 2006, Gazprom began suggesting that it might not include US companies in the list of winners. According to Gazprom Chairman Alexei Miller, “I can assure you that Gazprom does not want to establish a pattern of selecting particular companies just because they come from a particular country.”2

WTO leverage?

Analysts speculated that Russia might use the tender as leverage in its talks with the US over its entry into the World Trade Organization (WTO), which the Kremlin believed was being held up by Washington. After the Group of Eight leading economies summit in St. Petersburg ended in July 2006 with no breakthroughs made in Russia’s talks with the US to join the WTO, Gazprom further pushed back the decision on who would win the project, while Russian President Vladimir Putin began hinting that the Norwegian companies had a good chance of being selected.3

The one saving grace for the US was that Russia required access to the American gas market. Norsk Hydro and Statoil had allegedly offered stakes in Norwegian fields and LNG gas export projects in their bids, while Conoco and Chevron allegedly offered stakes in US LNG terminals in their bids.4

Gazprom continued to hold back its announcement of the winners. Then, in September 2006, Putin reportedly told French and German leaders that Gazprom was considering shipping some LNG to European markets. While these comments offered reassurances to Europe, it upped the stakes in an already strained relationship with the US, and analysts began speculating that US companies would be omitted from the list of winners.

Then, on Oct. 9, 2006, Gazprom stunned the gas industry by announcing that it would develop Shtokman alone, without any foreign partners, and ship the gas directly to Europe via pipelines rather than including an LNG component to export to North America. Any foreign firms wishing to participate in the project would have to do so as contractors rather than equity stakeholders.

Two months later Gazprom changed its decision yet again, reexamining the possibility of developing the project as an LNG export project. Not coincidentally, after the US and Russia reached a deal for the US to support Russia’s WTO membership bid, Gazprom said that there was still a chance of opening the door to foreign companies as stakeholders. The final outcome of the project has yet to be determined as Russia changes its decisions. However, political undercurrents are apparent, especially when viewed side-by-side with events unfolding around other major gas fields, such as the Sakhalin-2 project.

The Sakhalin-2 story

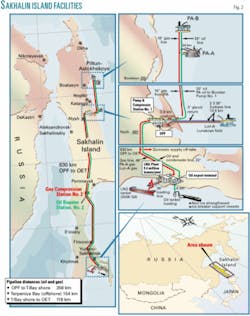

The Sakhalin project, located along Sakhalin Island on the eastern coast of Russia, is a massive, multiphased project (Fig. 2). Phase 1, or Sakhalin-1, was first declared commercial in 2001 and began operations in October 2005. Sakhalin-2 will include the world’s largest gas liquefaction plant and will draw upon two fields.

The first, Piltun-Astokhskoye (PA), is primarily a massive oil field, with some associated gas, in the northern waters off eastern Sakhalin Island. The second field, Lunskoye, is primarily a gas field about 90 miles south of PA.

On June 22, 1994, Russia and Marathon signed a production-sharing contract for the Sakhalin-2 project. On Dec. 4, 1994, the deal became official when Yeltsin signed the law covering production-sharing agreements (PSAs). Japan also signed on to be part of the consortium.

Problems with Sakhalin-2 were inherent from its initial stages. For example, the 1994 PSA law raised a few issues with Japan. One, of major concern to Japan, was the possibility of unilateral contract revamps by Russia that could include a declaration for the Russian government to take over fields “considered of strategic importance.” This concerned Japan greatly because Japan viewed Sakhalin gas and oil as part of its energy security policy.

Japan also was concerned about a requirement to use Russian technology to build the LNG plant because it was Russia’s first liquefaction plant, and the Russians had no experience with the technology required to complete the project successfully.5 Despite these pitfalls, Japan hung on.

On Feb.11, 2000, Sakhalin Energy Investment Co. Ltd., operator of the Sakhalin-2 project, began seeking bids to construct the LNG plant. Consortium members at this time were Marathon 37.5%, Mitsui 25%, Mitsubishi 12.5%, and Shell 25%.6 A few months later, Shell and Marathon signed a nonbinding letter of intent to transfer Marathon’s 37.5% interest in the project to Shell, which gave Shell a controlling stake in the project.

Environmental issues

Russia’s Natural Resources Ministry approved the Sakhalin-2 feasibility study in 2003, and construction on the LNG plant began. However, ecological organizations began accusing Sakhalin Energy of harming the environment, claiming the company’s project was damaging the population of gray whales because the equipment was so close to their breeding grounds. Sakhalin Energy pointed out that it had spent $5 million since 1996 to ensure that the project did not hurt the whales. In March 2005, Sakhalin Energy rerouted the offshore pipelines to protect the whales.

In July 2005, Shell signed a major asset swap with Gazprom. The deal would cut Shell’s stake and give Gazprom a stake of up to 25% in Sakhalin Energy in exchange for a 50% share of Gazprom’s Zapolyarnoye gas field in West Siberia.7 One week after the deal was announced, Shell reported that it had made a mistake in its previous calculation to construct and develop Sakhalin-2. Shell now increased the cost estimate by about $10 billion. This blunder caused Gazprom to pull out of the deal with Shell.

Russian state ecological experts ruled in favor of proceeding with construction of the Sakhalin-2 project. However, in August 2006, the Russian Natural Resources Ministry dealt a serious blow to Sakhalin Energy by seeking legal action to cancel the environmental license that permits construction. The ministry cited a high risk of mudslides that could cause water pollution, equipment destruction, or fatalities.8

A report by the Far East branch of the Russian Academy of Sciences claimed the “existing threat of oil and gas pipeline destruction is the result of unqualified project decisions taken by Sakhalin Energy.” According to a Sakhalin Energy spokeswoman, however, the company had not received any previous notice on the environmental concerns from the Ministry. She further noted that Sakhalin Energy, having already been aware of potential risks associated with the construction of pipelines, had already taken into consideration construction solutions to prevent such damage from occurring.9

According to an environmental audit, only two minor infractions were cited.10 The first involved a breach of limits set for the discharge of water from one of the production platforms. The fine for this infraction would not amount to more than $7,500. In the second violation, an audit conducted during March and November 2005 showed that the water near one of the floating storage units exceeded the maximum permissible concentration of oil products in the sea. This amount was deemed “close to negligible.” Sakhalin Island had even experienced an earthquake with a magnitude of 6.0 on the Richter scale, during which the Sakhalin-2 pipelines were nearly 90% complete, and there were no adverse effects, according to Sakhalin Energy.11

A few days later, the Natural Resources Ministry ordered Shell to stop work on the onshore pipelines and rework the design.12 Then, during the first week of September 2006, the Ministry dealt another blow to Sakhalin Energy when it revoked the approval it had granted in 2003 to proceed with the project. At this point, the project was about 75% complete.13

The unfolding scenario had fingers pointing in opposite directions, with Russian officials describing their viewpoint as “pure business” and Western analysts accusing the Russian government of trying to force a halt to the project to defend its interests. Yuri Trutnev confirmed the Western assumption when he pointed out that Moscow had to “defend its interests” only after Shell last year doubled the project’s expected costs to $20 billion.14

Because the Sakhalin-2 project cost suddenly and unexpectedly increased by $10 billion, the Russian government saw this as a financial blow. In addition, under the PSA law, the cost increase would delay and reduce payments to the Russian government. Suddenly, the Russian government felt it was being trampled upon by a consortium of foreign companies that were given extremely favorable terms under a PSA drawn up 12 years earlier.

Russia did not feel it was receiving its due share of financial gain in a timely manner. According to one source, as of September 2006, $18 billion had been invested in the three PSA projects-Sakhalin-1, Sakhalin-2, and Kharyaga, an oil exploration and production venture operated by Total in the northern Timan-Pechora region. Meanwhile, the state had received only $500 million in revenue.15 One account described this amount as “laughable.”

On Sept. 28, 2006, Oleg Mitvol, deputy head of Rosprirodnadzor, Russia’s environmental watchdog, announced that environmental damage caused by the Sakhalin-2 project would cost Sakhalin Energy over $50 billion.16 According to Mitvol, “The construction cannot go on. We must stop the project and start over again. We want criminal cases for every destroyed tree or damaged river. If criminal cases are opened for everything, the company will read the criminal code, come to its senses and stop the barbarian activity.”17 Mitvol denied he was taking on Shell to assist Gazprom in achieving its goal of gaining a share in the project. “I’m doing it for my daughter and for the future of Russia,” he declared.18

Next, Natural Resources Minister Yuri Trutnev asked Rosprirodnadzor to submit details of the company’s environmental violations to the prosecutor general’s office within 2 weeks. The case could then be brought up to a criminal level status. According to Trutnev, the company violated at least five articles of the Russian criminal code.

While Sakhalin Energy tried to reach a solution, the project faced another environmental assault on Dec. 7. The Ministry suspended permits held by Starstroi, the main onshore contractor. This forced Sakhalin Energy to halt all work near river crossings for breaches of water legislation.19

Shell succumbs

On Dec. 21, 2006, Shell succumbed to the environmental and judicial pressure. After Gazprom had waged war with Shell for over a year to gain control of the Sakhalin-2 LNG project, it finally succeeded. Shell’s stake would be reduced to 27.5%, Mitsui’s to 12.5%, and Mitsubishi’s to 10%. Gazprom would now hold 50% plus one share in the company, making it the majority share owner and, therefore, bumping Shell from its position as controlling shareholder. Although Shell no longer has control over the project, it reportedly retains management and technical advisor status. Gazprom offered $7.45 billion in cash in the deal.

In what hardly seems a coincidence, the environmental issues disappeared once Gazprom became a shareholder. Russia swept the ecological shortcomings aside. According to Putin, all ecological issues can now be considered resolved. “I’m pleased that our environmental services and the investors have agreed on the way of resolving ecological problems,” Putin said during a televised appearance.20

With Gazprom the majority stakeholder in Sakhalin-2, Russian authorities geared up attacks on new fronts. This time the attacks were on the TNK-BP’s Kovykta project, in which Russia threatened to have the company’s license revoked. Additionally, Russia threatened to cancel Total’s Kharyaga project PSA. Finally, environmental authorities announced plans to “check up” on ExxonMobil’s Sakhalin-1 project.21

The real issue behind Sakhalin-2 was cost overruns. The Russian government’s lack of control over the project further exacerbated the problem. According to Andrew Neff, senior energy analyst with Global Insight, there may have been environmental violations-but not to the extent stated by the Russians.

In the long run, having Gazprom on the project may be better for Shell, although not ideal as was the original PSA deal, which is no longer an option. As of Sept. 6, 2006, the only options available were either to see the project stall, have the license revoked and lose the entire investment, or concede. At least the project will proceed, albeit less profitably.22

Strong foothold

Russia has an abundance of natural gas available and is just starting to come on board with the ability to develop and produce these resources. Western advanced technology, financial strength and high demand, coupled with Russia’s lack of capital and exceptional reserves seem to make the two countries ideal partners. The Kremlin, however, clearly intends to expand and maintain a strong foothold in its energy sector. Russia’s reneging on international deals creates a challenging and dangerous business environment for potential Western business partners.

As the number-one consumer of natural gas in the world and possessing only 3% of world reserves, the US needs to continue to diversify its sources of natural gas. The case studies described above are two examples that demonstrate the potential hazards of doing business in Russia. The Russian government stands firm in its desire to expand its monopoly on the natural gas sector and continues chiseling away at Western-dominated projects within its borders. In addition to the negative impacts stated in the case studies on those Western companies currently involved in these projects, Russia’s growing monopoly comes with other potential side effects:

- Increased political leverage. As Russia’s monopoly on natural gas grows, so too does its political strength. The Kremlin will undoubtedly be able to use its tightening grip over natural gas as political leverage over countries highly dependent on it for this resource.

- A strengthening of its military. Russia is using energy as a tool to restore its world-power status. No longer a military threat, Russia could use the monies earned from these development projects to revamp its military.

- Unfair control over pricing. Russia could opt at any time to increase its prices for natural gas during times of high demand. This not only would affect citizens of other countries but also could impact local economies or even global economies if the increases were substantial.

Future deals

Although Russian technology has been improving over time, it has yet to achieve the same capability as that of the Western majors. Knowing this, Western companies might still find future deals attractive. These companies need to be shrewd in their business dealings with Russia, keeping in mind that at any time the tide can turn and politics can play a key role in ousting them from part or all of a project. This could result in billions of dollars in lost revenues.

Russia still has many unexplored gas fields. Any Western company willing to participate in exploration of these fields should heed three warnings:

- First, companies must understand the differences between “Western capital laws” and “Kremlin socialist laws.” At any time, like Shell, they could be forced into a costly compromise.

- Second, Western companies must be prepared for Russia to take advantage of capital and technology, some of which might even be proprietary, before Russia assumes the upper hand in a project.

- Finally, future Western investors must first be able to balance risk and reward. The risks are many.

Russia continues striving toward complete domination of its industry, which likely will one day exclude foreign companies altogether. For now, however, Russia will continue to include foreign companies as long as it needs the technology they bring.

References

- “LNG floater eyes Shtokman gas,” FT Energy Newsletters-International Gas Report, Jan. 19, 1996, p.10.

- “Gazprom may exclude US firms,” Oil Daily, June 7, 2006.

- Elliott, Stuart, “Shtokman reserves to rise,” Platts Oilgram News, July 25, 2006, Vol. 84, No. 140, p. 4.

- “Gazprom nears Shtokman pick,” International Oil Daily, Sept. 5, 2006.

- Stein, George, “Sakhalin-2 partners eye 2/3 cutback in production,” Platt’s Oilgram News, Feb. 14, 1996, Vol. 74, No. 32, p. 5.

- “Sakhalin announces LNG plant tender,” Interfax, Feb. 11, 2000.

- Zapolyarnoye is a massive gas field near Russia’s Urengoy field. As a result of its proximity to Urengoy, much of the infrastructure is already in place, which would make the cost of bringing Zapolyarnoye on stream a fraction of other development projects. “Russia poised to dominate European energy,” Strategic Forecasting, Oct. 11, 2001.

- “Sakhalin-2 faces new problem,” Oil Daily, Aug. 7, 2006.

- “Sakhalin squabbles,” World Gas Intelligence, Aug. 9, 2006.

- It is unclear which agency conducted the audit that cited only two infractions, but it was not Rosprirodnadzor, which oversees Russia’s environmental protection. The two infractions might have been cited during an internal audit.

- Sharushkina, Nelli, “Moscow plans challenge to Sakhalin-2 over minor violations,” International Oil Daily, Aug. 25, 2006.

- “Shell must rework Sakhalin-2,” Oil Daily, Aug. 31, 2006.

- Isachenkov, Vladimir, “Russian environmental regulator files lawsuit against Pacific Island oil project led by Shell,” The Associated Press, Sept. 5, 2006.

- Bierman, Stephen, “Moscow pulls permit for Shell’s Sakhalin-2,” International Oil Daily, Sept. 19, 2006.

- According to some independent experts, this sum was underestimated. However, the author of a Russian commentary placed the amount at no more than $700. “Production Redistribution,” The Russian Oil and Gas Report, Sept. 22, 2006.

- There was limited press citing Oleg Mitvol’s accusation of the environmental impact resulting in $50 billion worth of damage. However, later reports said damage estimates were $10-20 billion.

- “Service to demand suspension of Sakhalin-2 project-Mitvol,” Interfax Financial & Business Report for Sept. 29, 2006, Sept. 29, 2006.

- Ritchie, Michael, “Russian inspector details Sakhalin issues,” International Oil Daily, Oct. 3, 2006.

- Graham, Rachel, and Shiryaevskaya, Anna, “Russia pulls Sakhalin-2 contractor permits,” Platts Oilgram News, Dec. 8, 2006, Vol. 84, No 237.

- “Gazprom deal ends claims against Sakhalin-2,” Platts International Gas Report, Jan. 15, 2007.

- Neff, Andrew, “Gazprom secures controlling stake in Sakhalin-2 project in $7.45-billion deal,” Global Insight, Dec. 22, 2007.

- Neff, Andrew, e-mail message to author, Feb. 2, 2007.

The author

Cindy Hurst is a political-military research analyst with the US Army’s Foreign Military Studies Office. Her research is centered on various energy issues. She is a lieutenant commander in the US Navy Reserve and currently is writing a book on potential implications of LNG.