SPECIAL REPORT: US drilling growth slower as Canada faces large decline

Rising costs are slowing the recent rate of drilling growth in the US and savaging drilling in Canada.

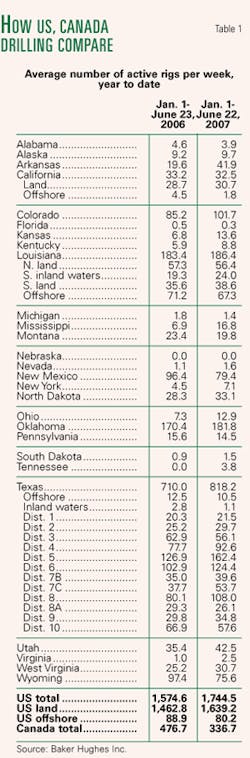

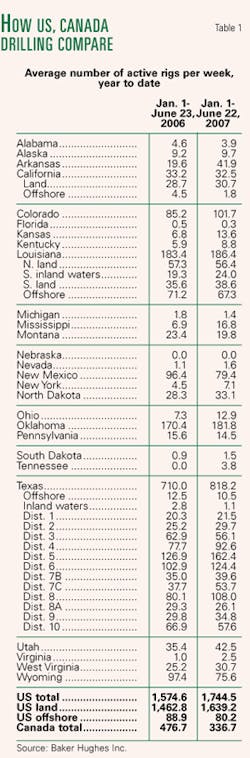

Active rig counts in the first half of 2007 were 11% higher than the same period in 2006 in the US compared with full-year increases of 19% and 16% the previous two years, respectively.

Canada’s rig count ran almost one third lower in January through June 2007 than in the first half of 2006.

Here are highlights of OGJ’s midyear drilling forecast for 2007:

- Operators will drill 47,343 wells in the US, up from the 47,003 OGJ estimated in the early-year forecast (OGJ, Jan. 15, 2007, p. 31).

- Operators will drill 3,815 exploratory wells of all types, up from an estimated 3,550 last year.

- The Baker Hughes Inc. count of active US rotary rigs will average 1,780 rigs/week this year, up from 1,649 in 2006 and 1,383 in 2005.

- Operators will drill 19,164 wells in western Canada, down from an estimated 24,105 wells in 2006.

Drilling rates

Onshore gas plays seemed to be driving most of the gains in US drilling.

Arkansas, its Arkoma basin Mississippian Fayetteville shale gas play gaining momentum, averaged 41.9 rigs/week in the first half, 116% of the 2006 first half total (Table 1). The lead Fayetteville operator, Southwestern Energy Co., Houston, was running 19-20 rigs in the play, 15 of which are capable of drilling the curves and laterals of the horizontal wells.

With net acreage of 1,400 sq miles to evaluate and rigs still working 10 miles from each other in many areas, Southwestern is probably no more than 50-60% along the learning curve with the Fayetteville shale that Mitchell Energy & Development Corp. climbed with the Barnett shale in the Fort Worth basin, Southwestern Chairman, Pres., and Chief Executive Officer Harold M. Korell said in June.

Barnett shale drilling helped in North and West Central Texas. North Texas Dist. 9 was up modestly at 35 rigs/week, while West Central Texas Dists. 7B and 7C combined for a 29% increase on the year to a total of 93 rigs. It is reported that 6,600 wells have been drilled in the Barnett shale play through mid-2007 since 1981.

Operators in East Texas Dists. 5 and 6, with the Bossier and numerous other vertical and horizontal plays going strong, fielded a combined 287 rigs/week, 46% more than in the first half of 2006.

Mississippi’s first half average was nearly 17 rigs, almost three times the 2006 figure.

Oklahoma had a respectable 7.7% gain to 182 rigs/week.

Colorado averaged 102 active rigs in January through June, 18% more than in the same period a year earlier.

Utah averaged 42 active rigs in the first half, up 22% on the year.

North Dakota picked up rigs while Montana lost ground as the Bakken horizontal oil play moved east.

Wyoming averaged 76 rigs/week in the first half, down 22%. Other declines occurred in New Mexico and the Gulf of Mexico.

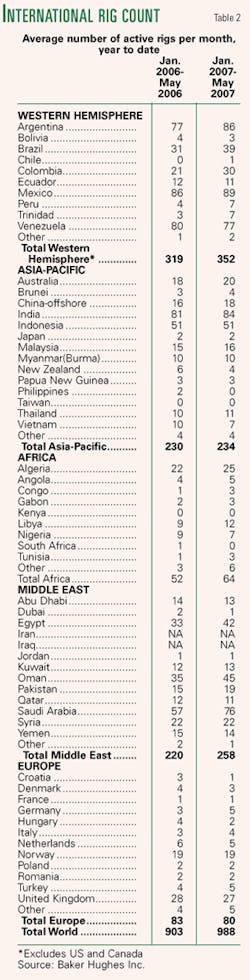

The international rig count excluding the US and Canada was about 9% higher at 903 rigs/month in the first half of 2007 compared with a year earlier. Most of the increase came in the Middle East and Latin America (Table 2).

Canada’s status

Canada’s outlook is bleaker as many producers became squeezed between several years of rising costs and lower natural gas prices.

Gas prices in Canada have largely recovered from weakness in 2006, but the fallout in lower drilling persisted well into the second quarter in the Western Canada basin.

Initial production at western Canadian gas wells is around 200 Mcfd, only one-fourth of what it was in the late 1990s. Unconventional gas wells are being drilled in great numbers, and their expected ultimate recovery is often greater than that of conventional wells, but they start out at low levels.

OGJ counted only four well bores drilled off Atlantic Canada in the first half of 2007, all of them off Newfoundland.

The Canada-Nova Scotia Petroleum Board, however, announced changes in April aimed at streamlining the licensing process and making the Scotian shelf a more attractive basin to explore (OGJ Online, Apr. 30, 2007).

The changes are designed to make more geological data available, keep companies from retaining blocks without exploring, and improve terms for new licenses.