Turkmen leader welcomes foreign investment

Gurbanguly Berdymukhammedov, Turkmenistan’s new president, is changing the country’s direction and is seeking foreign investment in his country’s oil and gas sector.

Berdymukhammedov, who came to power last December following the death of former President Saparmurat Niyazov, in a recent speech showed his determination to open the country to foreign investment, a policy that Niyazov did not observe.

“We pay great attention to cooperation with leading companies in [the development of oil and gas fields] on the sea, in expanding and upgrading the network of gas pipelines, forming a national tanker fleet, and constructing new sea terminals,” Berdymukhammedov said over Turkmen TV’s Altyn Asyr channel.

“Turkmenistan is successfully dealing with delivering its natural resources to the world market via various routes,” Berdymukhammedov said in televised remarks at a June 5 ceremony dedicated to the construction of a gas storage facility in western Turkmenistan.

“We are still adhering to our initiatives on the construction of Turkmenistan-China, Turkmenistan-Afghanistan-Pakistan-India gas pipelines as well as a Turkmenistan-Europe gas pipeline via the Caspian Sea,” Berdymukhammedov said.

State newspaper Neutral Turkmenistan said Berdymukhammedov and Lukoil Chief Executive Vagit Alekperov reached an agreement at a June 12 meeting in Ashgabat, the Turkmen capital, stipulating Russia’s OAO Lukoil Holdings to develop three fields in the Caspian Sea.

The paper said Lukoil plans to begin developing the “promising hydrocarbon fields” off Turkmenistan on the Caspian Sea shelf “in the near future.” It did not identify the fields.

Berdymukhammedov also met with TNK-BP Chief Executive Robert Dudley to discuss the Anglo-Russian firm’s interest in developing Turkmen oil fields.

A TNK-BP company spokesman said it was the first meeting of the company’s leadership with the Turkmen president and that further meetings should be held to discuss details of potential deals.

Nigeria to prioritize gas for domestic use

Nigeria’s new president, Umaru Musa Yar’Adua, has asked Nigeria National Petroleum Corp. (NNPC) to draw up a plan for providing gas for domestic needs, particularly power generation. Yar’Adua recently held a 3-hr meeting with senior NNPC officials, led by Group Managing Director Funsho Kupolokun.

Nigeria has 187 tcf of proved gas reserves, and Yar’Adua’s requirement of NNPC raises questions about supplies for future gas export projects. Nigeria currently utilizes 2,000 Mw of power and wants to increase its power generation capacity to 12-15 Gw. An NNPC spokesman told OGJ that Nigeria would continue to honor its international commitments for gas supplies that have been set aside for export either as pipeline gas or LNG.

Local reports quoted Yar’Adua as saying “We cannot begin to address, in a fundamental manner, the problems of the economy until we successfully tackle the power and energy issue. It is critical to all my plans. So I am more interested in how much gas we can tap for domestic use than what we can get for export. We must power this economy.”

Criminal activities in the Niger Delta have cut oil production by almost a quarter, with production shut-ins in May reaching a high of nearly 1 million b/d and averaging more than 800,000 b/d for the month (OGJ Online, June 11, 2007).

Yar’Adua has stressed that it is his priority to deal with these criminal activities through development in the region and enforcement of the law.

Meanwhile he will consult the National Assembly and stakeholders on the intervention plan.

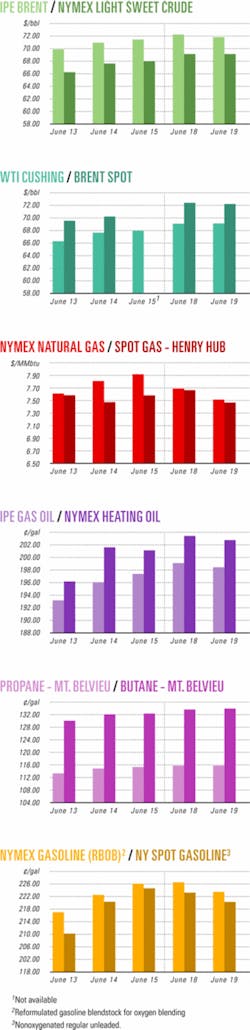

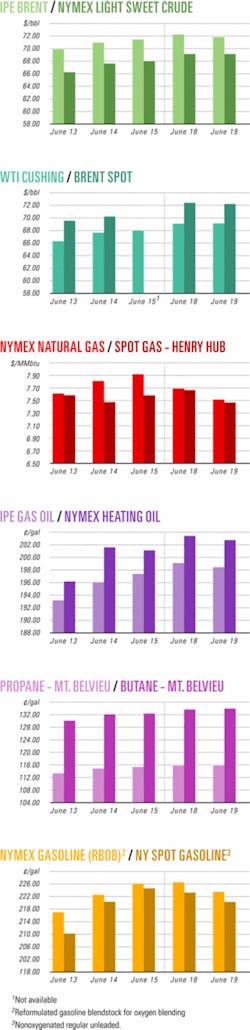

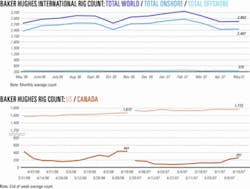

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesOil found in Ghana’s deepwater Mahogany-1 well

Anadarko Petroleum Corp. and its partners have discovered light oil with the Mahogany-1 exploration well drilled on deepwater West Cape Three Points block off Ghana. The well, a Santonian turbidite stratigraphic trap, opens a new play fairway in the Tano basin.

Mahogany-1 encountered a 885-ft gross hydrocarbon column with 312 ft of net stacked pay in a Cretaceous sandstone reservoir. The well has so far reached 12,083 ft and is aiming for a TD of 13,780 ft. An Anadarko spokesman told OGJ that the well was targeting a Cretaceous formation. West Cape Three Points block lies in 4,330 ft of water.

Once the partners hit TD, they will suspend the well pending further evaluation and appraisal drilling.

Mahogany-1 is being drilled by the Belford Dolphin deepwater drillship, which is under long-term contract to Anadarko. After finishing that well, Anadarko will use it to drill the Sota-1 well on Block 4 off Benin, in which it holds a 40% interest and is also the operator. Belford Dolphin will then move to the Gulf of Mexico to drill additional tests in Anadarko’s 2007 exploration program.

Anadarko is the technical operator of the well with a 30.875% interest. Kosmos Energy is the block operator and holds a 30.875% stake. Other partners are Tullow Ghana Ltd. 22.896%, Sabre Oil & Gas Ltd. 1.854%, and Ghanaian oil and gas company E.O. Group 3.5%.

Ghana National Petroleum Corp. will be carried through the exploration and development phases with a 10% participating interest.

Pertra to drill on Norwegian North Sea license

Pertra ASA of Trondheim, Norway, and its partners plan to drill two exploration wells in 2008 on Production License 321 in the Norwegian North Sea. The group will target a prospect in sandstone from the late Jurassic period, which was deposited on the western flank of Frøyhøgda, which is a basement high.

The well will be drilled to 2,000 m TD. Under the first phase of the work program, 800 sq km of 3D seismic data have been collected.

The group won the license in Norway’s 18th licensing round, which specified that the exploration period will extend until summer of 2010. License partners are Pertra 25% (operator), Talisman Energy 40%, Norsk Hydro 20%, and Aker Exploration 15%.

Aker Exploration will pay the cost for Pertra’s share of the two first exploration wells in this license, Pertra said.

Eni, Santos seek better terms in Indonesia

Eni SPA and Santos Ltd. are seeking to renegotiate their agreements with Indonesia for better incentives, according to an official with BP Migas, the country’s oil and gas regulatory body.

Achmad Luthfi, BP Migas director for planning, said Eni had requested a better split in connection with its operations on the Krueng Mane block in Nanggroe Aceh Darussalam, while Santos is seeking a better split together with additional incentives for its operations on the Jeruk block in East Java.

Luthfi said the companies’ requests, said to be for a split of 51:49 in favor of the government, were based on one that had been applied in Block A in Aceh, where operators, including Eni and Santos, had also encountered difficulties in developing the block. Luthfi said the two companies’ requests were informal and that official requests had yet to be filed.

Last month, Eni said it found significant oil and gas deposits in its Tulip-1 exploration well drilled in 800 m of water northeast of Kalimantan Island, Indonesia (OGJ Online, May 14, 2007).

Nexen developing Alberta Mannville coal gas

Nexen Inc., Calgary, has a $200 million budget in 2007 to develop 98 gross/41 net sections of Cretaceous Mannville coalbed methane in Alberta.

The company is drilling single and multileg horizontal wells in the Corbett, Doris, and Thunder areas near Fort Assiniboine.

The company estimated 3 tcf of gas in place on more than 700 net sections of CBM lands it holds in Alberta. Its production goal is to be producing at least 150 MMcfd by 2011.

CBM production is nearing 25 MMcfd and is projected at 50 MMcfd by yearend. Breakeven gas price for the CBM developments is $5 (Can.)/Mcf, the company told the Canadian Association of Petroleum Producers.

Drilling & Production - Quick TakesHeritage starts oil production from Siberian field

Heritage Oil Corp. has begun oil production from one well at its Zapadno Chumpasskoye field in Western Siberia. Russian federal and local authorities have approved a pilot development project for the field that includes the drilling of more than 50 wells.

The producing well-No. 226-flowed freely at a rate of up to 540 b/d of 39° gravity oil through an 8-mm choke, with wellhead pressure of 4,140 psi. The well produced a total of 4,086 bbl of oil with no water over 10 days of tests through various choke sizes.

It currently is producing 400 b/d of oil, and test results indicate that its production rate could be increased by installing a downhole pump. Before deciding on pump installation, the company is conducting further analysis and reservoir modeling to evaluate stimulation potential and assist in reservoir characterization.

The produced crude is being sold locally.

Following the recent completion of the Zapadno Chumpasskoye oil separation and testing facility, the next stage of field facility construction, including the export pipeline tie-in, are being fast-tracked to coincide with expected production increases.

Meanwhile, the deviated appraisal well P No. 3, which was spud in May, is due to reach its target depth of 3,490 m (2,800 m TVD) in a late Jurassic sandstone reservoir in about 10 days.

The well will then be logged, cased, and suspended prior to skidding the rig to the next surface location for drilling the second deviated appraisal well. A workover rig will be used to test P No. 3 in July. The company intends to complete the well as a future oil producer. It is the first to be drilled in a program comprising three appraisal wells and an initial 16 development wells.

The Zapadno Chumpasskoye field development plan includes significant production growth with the drilling of more than 50 wells and the future installation of waterflood injection facilities, Heritage said.

Petrobank starts third well pair at Whitesands

Petrobank Energy & Resources Ltd., Calgary, has begun air injection into its third well pair in the Whitesands pilot project in the oil sands region of Alberta. The company is using its “Thai” in situ combustion technology for recovery of the bitumen and heavy oil.

The company also has initiated a debottlenecking and expansion project that involves drilling three additional well pairs later this year.

Through the implementation of additional development phases, Petrobank said it expects to achieve an ultimate production level of 100,000 b/d from its existing Whitesands leases.

Petrobank’s proprietary Thai technology is a new combustion process that uses a vertical air injection well combined with a horizontal production well. The process allows a portion of the oil in the reservoir to be burned, generating heat that reduces the oil’s viscosity for easier flow through the production well. This method recovers an estimated 80% of OOIP while partially upgrading the crude oil in situ, Petrobank said.

Air injection in the first well pair began in late July 2006 and in the second well pair in early January 2007.

Mechanical problems with the temporary steam generator used in late December 2006 for the preignition heating cycle delayed air injection in the third well pair for 6 weeks, but Petrobank said that composition of produced gas indicates that combustion from the third well pair has been initiated and early gross fluid production capability is similar to that of the first two well pairs. Each well pair is capable of producing up to 2,000 b/d of fluid. During the first quarter, oil cuts in the wells rose to more than 50%.

Higher-than-anticipated sand production volumes required the use of a very low choke setting on the wells, but Petrobank installed a test sand knockout vessel on the first well pair that removed sand from produced fluids.

Petrobank since has designed a larger vessel that will allow the wells to be produced at their demonstrated capacity. The company expects to begin installing these units for each well pair early in the third quarter.

Meanwhile, the additional wells planned in the company’s expansion project are expected to be 200 m longer than the existing 500 m well pairs. They will incorporate Petrobank’s “Capri” technology, which allows a catalyst bed to be added around the outside of the horizontal production well bore to enhance the upgrading of the oil in situ.

The company also plans to implement a modified downhole completion to reduce sand production. It said it will incorporate lessons learned from the current project into the design of the three-well expansion, as well as the design of its first 10,000 b/d project-its initial full-scale development beyond current operations.

Petrobank expects to file application for this project by yearend.

Eni calls force majeure in Nigeria after attacks

Italy’s Eni SPA said it declared force majeure June 17 at its Nigerian Ogobinbiri oil flow station after an attack by a group of militants.

Peak production at the facility is 37,000 b/d of crude oil, with Eni’s share standing at 5,500 b/d, a company spokesman said.

Unidentified gunmen occupied the oil flow station, holding two dozen Nigerian workers and soldiers captive.

Eni, which did not know of any fatalities in the attack, said there were 24 Nigerian workers and 51 soldiers in the flow station. It said 8 workers and 40 soldiers were able to escape from the attackers.

The attack is the latest in a series stretching back some 18 months, with some 200 workers kidnapped during that time. The attacks have been stepped up in 2007, with more than 100 workers being kidnapped this year alone.

Processing - Quick TakesPrivate Hyperion plans Midwest US refinery

Hyperion Resources Inc., a privately held Dallas exploration and production company, announced plans to build a 400,000 b/d refinery in Union County, SD, or elsewhere in the US Midwest, according to the South Dakota Governor’s Office of Economic Development (GOED).

The refinery, part of what the company calls the Gorilla energy complex, would be the first such facility constructed in the US in more than 30 years.

Hyperion Project Executive J.L. Frank confirmed that a tract of land in Union County is one of the sites in the Midwest being considered for the “green energy center.” Frank called the Union County site “sufficiently attractive that we’ve taken several options on land there, and we may take a few more.”

The energy center’s refinery would produce transportation fuels including ultralow-sulfur gasoline and ultralow-sulfur diesel from heavy oil from Canada.

If built in Union county, the refinery could receive crude from TransCanada’s proposed 2,965-km Keystone oil pipeline, which will deliver 435,000 b/d of oil from Hardisty, Alta., to Wood River and Patoka, Ill. (OGJ, Feb. 19, 2007, p. 48).

TransCanada has oil pipelines between Patoka to the hub at Cushing, Okla.

The Keystone system, now in approval stages, is scheduled for construction by early 2008 and for operation in late 2009. The part of the proposed system that would extend through South Dakota would cross the Missouri River near Yankton, just 30 miles west of Union County.

Frank, former president of Marathon Ashland Petroleum, said, “Gas prices are the highest in US history, and the US refining infrastructure hasn’t seen a significant change since 1976. The fact is, refining capacity in this country has not kept pace with demand.”

The Gorilla project, reportedly to cost $6-8 billion, is being touted in the Union County area for its strong economic advantages. The refinery’s construction would employ about 4,500 workers over 4 years, Frank said, with a peak work force of about 10,000. When operational, the refinery would employ about 1,800.

The refinery would have an integrated gasification combined cycle plant, fed by petroleum coke from the refinery, to supply electricity, hydrogen, and steam, Frank said. Emissions would be substantially lower than those from conventional power generation plants.

A Hyperion executive involved with the Gorilla project was reported by the Sioux City Journal as saying the company hopes to select a site during the next year. Hyperion has not disclosed information about financing.

EPA fines California refiner in wastewater case

The US Environmental Protection Agency has fined a California refinery operator $1 million and has sentenced the company to 3 years of probation for breaking federal drinking water laws.

Santa Maria Refining Co. pleaded guilty on Apr. 12 and was sentenced in federal district court in California’s central district for posing a risk to groundwater supplies by disposing of contaminated wastewater in wells that did not have permits for that use.

EPA said the wastewater contained benzene, which can cause anemia, excessive bleeding, and cancer as well as affect the immune system.

Santa Maria Refining, which is a Greka Energy Corp. subsidiary operating in Santa Maria, also was sentenced for making false statements to EPA and ordered to pay $15,000 in restitution and implement an independently audited environmental program, EPA said on June 15.

It said three individual defendants also pleaded guilty to making false statements to EPA. They each face 5-year federal prison terms, EPA said. Sentencing is pending.

EPA said it has been investigated allegations that Santa Maria Refining officials knowingly and routinely discharged refining waste into underground wells that only hold permits for the disposal of brine, which is separated from oil during the refining process.

It said it fined the facility $127,500 in June 2006 for unauthorized refinery wastewater disposal into the plant’s injection wells.

UK firm to build biodiesel plant in China

British biodiesel producer D1 Oils PLC plans to build a biodiesel plant in China’s Guangxi Zhuang autonomous region, the country’s first such facilty using jatropha oil as a feedstock. Japan, India, and the Philippines already have plans under way for such plants.

D1 Oils said the plant would be built in a petrochemical industry park in Baise City in northwestern Guangxi. Expected to be online at yearend 2008 or early 2009, the facility will have an initial processing capacity of 10,000 tonnes/year, rising to 100,000 tpy over 5 years.

The plant will be fed by seed oil from an existing 1,667 hectares of jatropha plantations in Baise, rising to 30,000 hectares by 2008.

Transportation - Quick TakesJapan, Brunei sign free trade, gas agreement

Brunei has signed a free trade agreement with Japan, which had sought assurances of a stable supply of natural gas from the Southeast Asian producer.

Japan imports about 10% of its gas from Brunei, which has agreed to give Japan advance notice of any measures that would restrict the gas exports.

The agreement also stipulates the establishment of a government-level subcommittee on energy, provides that the two countries will honor existing energy agreements, and gives consideration to environmental concerns. The accord within 3 years will eliminate the 20% tariff imposed by Brunei on cars and almost all auto parts from Japan, while Japan will immediately end tariffs on agricultural and fishery products from Brunei.

In 2006, Japan imported some ¥252.5 billion worth of goods from Brunei, almost all of it gas and crude oil, while some 70% of Japan’s exports to Brunei are comprised of cars and auto parts.

Hungary seeks LNG from Indonesia

The Hungarian government, as part of a wider effort to diversify the country’s energy sources away from Russia, has approached Indonesia seeking LNG supply purchases.

Hungarian Economcs and Transport Minister Janos Koka made the request of Indonesia’s Trade Minister Mari Elka Pangestu, saying supplies from Indonesia could be shipped to an LNG terminal under development by his country and Croatia.

Koka said the two sides would “touch on this further in October” during his visit to Indonesia. Meanwhile, Mari said she would discuss the request with Jakarta’s ministries.

Hungary’s request follows earlier efforts to increase gas supplies ahead of pending liberalization of Hungary’s gas market.

In May, Hungarian oil and gas company MOL Nyrt said it was considering expanding capacity along the domestic stretch of the “Friendship” gas pipeline that carries Russian gas to Europe via Ukraine.

According to a report in the daily Nepszabadsag citing MOL Nyrt sources, the expansion would increase capacity to 10 billion cu m by increasing Russia’s gas supply until other supply routes come on line by 2015.

The move is aimed at ensuring sufficient capacity available to new market entrants following liberalization on the gas market in 2008, according to MOL Nyrt, which earlier announced plans to enter the liberalized gas market in Hungary.

In May MOL Nyrt announced plans to team with ExxonMobil Corp. to undertake a joint survey of “unconventional” gas resources in Hungary.

Indonesia reneges on some Sempra LNG supplies

Indonesia, reversing an earlier decision, is reallocating supplies of Tangguh LNG originally earmarked for Sempra Energy LNG Marketing Corp. in order to boost the amounts available to state-owned utility Perusahaan Listrik Negara (PLN).

PLN power generation director Ali Herman Ibrahim said the decision was made during a June 14 meeting with the upstream oil and gas executive agency BP Migas. Ali said BP Migas will allow PLN to receive a portion of the LNG supply previously allocated to Sempra, but he did not specify the amount. In March, to obtain higher prices for its LNG exported from Tangguh in Papua New Guinea, Indonesia’s Energy and Mineral Resources Minister Purnomo Yusgiantoro said the country wanted to renegotiate LNG contract terms with South Korean buyers and was seeking to divert to Japan supplies contracted for the US West Coast.

In particular, Purnomo said Indonesia was planning to talk to Sempra, with which it had agreed to deliver 3.7 million tonnes/year of LNG from Tangguh for 20 years at $5.90/Mcf. (OGJ Online, Mar. 6, 2007). The Tangguh LNG plant is expected to become operational by fourth quarter 2008.

Recently Indonesian media quoted Purnomo as saying the government is considering the possibility of diverting as much as 50% of Sempra’s LNG supply to the Asian market.

According to operator BP, the Tangguh LNG plant has already secured long-term LNG sales to four customers: the Fujian LNG project in China, SK Power Co. Ltd. in South Korea, Posco Korea, and Sempra.