Clarke resigns as BLM director

US Bureau of Land Management Director Kathleen Clarke resigned to rejoin her family in Utah, Sec. of the Interior Dirk A. Kempthorne said on Dec. 28.

Clarke, who became BLM director on Jan. 2, 2002, was the first woman to head the DOI agency, which manages 258 million acres of federal land and 700 million acres of subsurface mineral resources.

Prior to her federal appointment, Clarke was executive director of Utah’s Department of Natural Resources. During 1987-93, she worked for then-Rep. James V. Hansen (R-Ut.) as constituent services director and executive director of the federal lawmaker’s Ogden, Utah, office.

There was no indication when Clarke will be leaving or who will run BLM until her successor is nominated, confirmed by the US Senate, and sworn in.

MMS begins environmental review of Sale 181 area

The US Minerals Management Service will begin the necessary environmental reviews of about 580,000 acres in the eastern Gulf of Mexico opened for oil and gas leasing by legislation signed by President George W. Bush on Dec. 20, the Department of the Interior agency said.

MMS will immediately begin an environmental review of the so-called Sale 181 area, comprised of 2 million acres in the central GOM as well as 580,000 acres in the eastern gulf, which are 125 miles from Florida’s coastline and west of the US Military Mission Line, MMS Director Johnnie Burton said on Dec. 21.

Public meetings will be held in Florida and other involved states as part of the environmental review, she indicated. The 2 million acres in the central gulf were reviewed in a November 2006 draft environmental impact statement and will be offered in federal Outer Continental Shelf Lease Sale 205, scheduled early this fall.

A second sale area to the south and in deeper water, comprised of about 5.8 million acres, will come under environmental review later, Burton said.

EPA issues final oil spill prevention rule

The US Environmental Protection Agency has issued a final rule on oil spill prevention, control, and countermeasures (SPCC) that will provide compliance alternatives for some facilities.

The new SPCC rule provides streamlined options for specifically qualified facilities and exemptions from the regulations for certain vehicle fuel tanks and other onboard bulk oil storage containers.

EPA indicated that mobile refuelers also are exempt from the sized secondary containment requirements for bulk storage containers under the final rule, which also removes requirements for animal fats and vegetable oils pertaining to onshore and offshore oil production, drilling, and workover facilities.

In the final rule, EPA said it extended the compliance date for farms to either prepare and implement new SPCC plans or amend existing plans until the agency publishes a specific rule addressing how farms should be regulated under the SPCC rule.

EPA also proposed extending the compliance deadline for facilities other than farms to July 1, 2009, to give the covered entities time to implement the modifications. The latest rule does not remove the requirement for facilities in operation before Aug. 16, 2002, to develop, implement, and maintain an SPCC plan under regulations in effect at that time, EPA emphasized.

Gazprom’s Sakhalin-2 buyin to offset damage

OAO Gazprom Deputy Chief Executive Alexander Medvedev said Dec. 28 that a portion of the $7.45 billion his firm spent to acquire a controlling stake in the Sakhalin-2 oil and gas project would go toward correcting alleged environmental damage caused by the development (OGJ Online, Dec. 21, 2006).

“All environmental issues will be agreed within the framework of a commission that will be set up by the Ministry of Natural Resources and Sakhalin Energy shareholders, including Gazprom,” Medvedev said.

“We naturally valued potential expenditure for environmental compensation when the cost of our entry (into Sakhalin Energy) was being agreed,” he said.

Medveev said a preliminary March 2007 deadline had been set for Gazprom to pay the $7.45 billion for its stake in Sakhalin Energy, the project’s operator, a joint venture of Royal Dutch Shell PLC, Mitsui & Co., and Mitsubishi Corp.

He said the agreement is expected to be completed no later than February and that payment for Gazprom’s participation in the venture is due no later than the end of the first quarter.

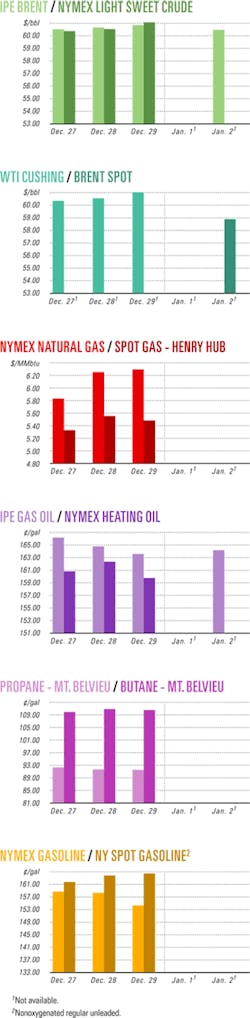

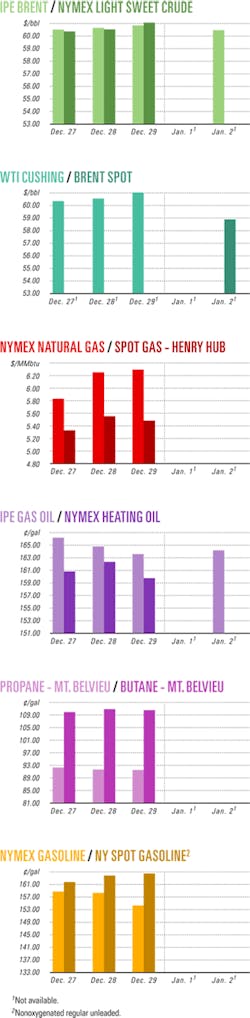

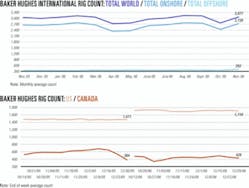

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesTotal has sixth oil discovery off Angola

Total E&P Angola, in participation with state-owned Sonangol EP, has made a new oil discovery with its Salsa-1 well, the sixth exploration well drilled on Block 32 in ultradeep water off Angola.

Salsa-1, drilled in the southeastern portion of the block in 1,806 m of water, tested 3,686 b/d of oil from a Miocene reservoir. The well is located 15 km southwest of the Mostarda-1 discovery, which tested 5,347 b/d of 30º gravity oil from one interval (OGJ, Feb. 20, 2006, Newsletter).

Complementary technical studies are under way to evaluate the test results. Further exploration drilling also is under way and more is planned across the block.

Interest holders in Block 32 are Total 30%, Marathon Oil Co. 30%, Sonangol 20%, Esso Exploration & Production Angola (Overseas) Ltd. 15%, and Petrogal 5%.

Anadarko to explore block off Mozambique

Anadarko Petroleum Corp. has signed a contract with Mozambique for exploration and production of a block in the Rovuma basin in northeastern Mozambique.

Anadarko was awarded the 2.64 million-acre block, known as Offshore Area 1, earlier this year in Mozambique’s second licensing round.

The block includes about 90,000 onshore acres and extends offshore 35 miles eastward in water as deep as 6,000 ft. It borders Tanzania to the north and extends southward about 100 miles.

Only two wells have been drilled in the area, said Bob Daniels, Anadarko senior vice-president of worldwide exploration.

The contract commits Anadarko to a 5-year initial exploration term, with options to extend that phase for 3 years, and permits a 30-year production term following any commercial discoveries.

Anadarko was awarded the block on the basis of a work commitment to acquire 2D and 3D seismic and drill seven wells during the initial exploration term.

“Through our regional evaluation and analysis of existing seismic data covering most of the block,” Daniels said, “we have already identified multiple leads across an area equivalent in size to 460 typical Gulf of Mexico lease blocks.”

Anadarko will operate the block initially with a 100% working interest.

Woodside has gas discovery in Libya

Woodside Energy (NA) Ltd., a subsidiary of Woodside Petroleum Ltd. and operator of the NC210 Block in the Murzuq basin in Libya, has made a gas discovery with its C1-NC210 exploration well on the block, said Repsol YPF, a joint venture partner.

The well, 1,000 km south of Tripoli and 150 km south of producing Al Wafa gas field, was drilled under an exploration and production-sharing agreement with National Oil Corp. Libya. TD is 808 m. Wireline logs indicate the potential for several hydrocarbon-bearing zones.

An initial production test of the Devonian Awaynat Wanin formation confirmed the presence of a gas column and flowed at 5.7 MMscfd through a 72/64-in. choke. Calculated absolute open flow is 10.7 MMscfd.

The Carboniferous Mrar M7 reservoir flowed 5.8 MMscfd of gas on test through a 72/64-in. choke. CAOF is 13 MMscfd.

Interests in the well are Woodside Energy 45%, Repsol Exploración Murzuq SA 35%, and Hellenic Petroleum SA 20%.

Statoil discovers dry gas off eastern Venezuela

Statoil ASA has found dry gas within three intervals drilled in its Cocuina-2X exploration well on Block 4 of Plataforma Deltana, off eastern Venezuela (OGJ, Sept. 4, 2006, Newsletter).

The well, 240 km from the Orinoco Delta, was drilled to 3,406 m TD. “The true potential of Block 4 cannot be confirmed until the whole exploration program has been completed,” Statoil said.

Transocean Inc.’s Sovereign Explorer semisubmersible will now proceed to the next well location, Ballena-1X, to drill in 350 m of water. No well has been drilled in deeper water off Venezuela to date, according to Statoil.

The Venezuelan government awarded the Plataforma Deltana Block 4 license to Statoil in 2003. Statoil is operator with a 51% share, and Total SA holds 49%. PDVSA Gas has the option to participate with up to 35% once a commercial discovery has been declared.

Statoil is a partner, together with PDVSA and Total, in the extraheavy Sincor oil project in the Orinoco Belt.

Aussie JV given nod to develop Woollybutt field

A joint venture led by ENI Australia has been given the green light to spend $180 million (Aus.) to develop the South Lobe section of Woollybutt oil field in the Carnarvon basin off Western Australia.

The new project, in production license WA-25-L, involves connection of two horizontal wells (Woollybutt 4 and 6) to the existing leased floating production, storage, and offloading vessel Four Vanguard via subsea pipeline.

Contracts have been secured for drilling and completion of the two wells, modifications to the FPSO, subsea wellheads, flowlines, manifolds, and control systems as well as installation and transport of the necessary equipment.

The wells will be drilled in midyear, and first production from the South Lobe is expected early in 2008.

The new development will boost oil production from the field by about 10,000 b/d and will increase field life. The FPSO contract runs until 2009, and there are optional extensions until 2013.

So far Woollybutt field has produced about 26.5 million bbl and is currently flowing at 11,000 b/d.

ENI Australia has 65% interest, with Mobil Australia Resources 20% and Tap Oil Ltd. 15%.

Drilling & Production - Quick TakesKvitebjørn field production reduced in North Sea

Natural gas and oil production from Kvitebjørn field in the Norwegian sector of the North Sea is being reduced by 50% for 5 months, effective Dec. 23, said operator Statoil ASA.

During that time, output will be reduced to 95,000 boe/d from 190,000 boe/d, in the interest of “sound reservoir management and safe drilling operations” for wells remaining to be drilled, based on reservoir conditions and available methods for drilling in reservoirs with high pressure and high temperature. That would amount to a net decrease of 15,000 boe/d in 2007 for Statoil, said company officials.

Meanwhile, Statoil will meet commitments to gas customers by increasing production from other fields.

Kvitebjørn has been on stream since fall of 2004. Located in 190 m of water, it was Statoil’s first high-pressure and high-temperature field and was expected to plateau in late 2005. However, in February 2006, estimates of recoverable reserves from the field were increased by 50%, or by 29 billion cu m of gas and 70 million bbl of condensate.

OMV begins first oil deliveries from Yemen

OMV AG has begun production of 1,000 b/d of oil from its Kharwah-1 well on Block S2 (Al Uqlah) in central Yemen, and it plans to deliver 11,000 b/d of oil by 2008.

OMV wants to expand oil production to 32,000 b/d by 2009-10 under the second phase of its development plan. The field, which has 50 million bbl of proved oil, “is expected to have a lifetime of at least 20 years,” OMV added.

Block S2, which spans 1,000 sq km, will initially cost OMV $85 million to develop, but costs are expected to rise to $250-350 million for Phases 1 and 2.

OMV has also won operatorship of Block 29 in the Jeza-Qamar basin under Yemen’s third licensing round. It will work with Pakistan Petroleum Ltd. on a joint venture partner basis, each taking a 50% share in this project. Block 29, in eastern Yemen, covers an area of 9,237 sq km. Exclusive negotiations for a production-sharing agreement will commence shortly, OMV said.

OMV is the operator of Block S2 with a 44.0% stake. Its partners are Sinopec International Petroleum Exploration & Production Corp. 37.5%, Yemen General Corp. for Oil & Gas 12.5%, and Yemen Resources Ltd. 6%.

Block S2 is situated close to Block 2 (Al Mabar), for which OMV signed a production-sharing agreement (PSA) on July 13, 2005. The Yemeni Parliament ratified the PSA for Block S2 on May 15, 2006, and President Ali Abdulla Saleh signed it June 7.

Statoil secures rig for Gjøa project

Statoil ASA, development operator of Gjøa oil and gas field off western Norway, has signed a 3-year contract with Transocean Offshore for the Transocean Searcher semisubmersible.

The $427 million contract allows for the drilling of 13 production wells, with options for an additional three, at the North Sea field. Drilling is planned to begin in October 2008.

Lying on Blocks 35/9 and 36/7 in 380 m of water, Gjøa is scheduled to come on stream in 2010 at which time Gaz de France will become operator with a 30% stake.

The field, proved in 1989, has estimated reserves of 40 billion cu m of gas and 83 million bbl of oil and condensate.

Statoil recently signed an agreement for construction of the semisubmersible production platform deck and supply of subsea installations for Gjøa (OGJ Online, Dec. 6, 2006). The next major contract will be for building the platform’s jacket, Statoil said.

Total investment for the Gjøa project is estimated at 27 billion kroner.

DNO to produce oil in northern Iraq

Norway’s DNO ASA will begin production from its Tawke crude oil project in northern Iraq in the first quarter, the company said Dec. 28.

The company stands to earn more from this production because it recently signed an agreement with the Kurdistan regional government whereby DNO will assume 100% of the funding obligations of its production-sharing agreements in return for an additional 15% increase in its working interest.

DNO can recover its well costs from future Tawke oil production under the cost oil entitlement because the well is located within the Dihok PSA area. In the government negotiations, DNO said it made some adjustments to its Dihok PSA area.

“Some areas at the eastern border have been removed in return for receiving some new acreage to the south,” DNO said. “Another area has also been relinquished, and no further relinquishments will be required until June 2011.”

To deliver Tawke oil to the main northern pipeline, DNO has installed 8 km of a 42-km pipeline, and central processing facilities with a 50,000 b/d capacity will now be transported to the Tawke area for installation and commissioning.

This year DNO plans to drill 18 development wells, which include oil producers and water injectors. Three rigs will be dedicated to Tawke for most of 2007.

DNO said that its Tawke No. 2 appraisal well was an oil producer following an oil flow test of 3,840 b/d. Tawke-2 is 2 km west of the Tawke No.1 discovery well.

DNO has moved its rig to the Tawke No. 4 location some 0.8 km to the northeast of Tawke No.1 and will develop Tawke-4 as an oil producer in early 2007.

Processing - Quick TakesAramco to cut ethane in petrochemical feeds

Saudi Aramco expects to reduce the proportion of ethane in petrochemical feedstock to 60% by the end of the decade, down from 100% during the 1980s, said Khalid A. Al-Falih, the company’s industrial relations senior vice-president.

Speaking during a Gulf Petrochemical and Chemical Association Forum in Dubai late last month, al-Falih discussed evolving regional feedstock parameters.

Al-Falih said associated gas has an ethane content of 18-20% while nonassociated gas has an ethane content of 4-6%. Saudi Aramco’s incremental gas production capacity is not expected to yield significant quantities of associated gas.

Industry has developed effective feedstock with lower ethane content by using propane and butane. Ethane accounted for 100% of regional petrochemical feedstock from the 1980s through 1990, he said. In 1992, Arabian Petrochemical Co. mixed propane with ethane as a cracker feedstock.

Air Products starts up Port Arthur hydrogen plant

Air Products & Chemicals Inc. has brought on stream a second hydrogen production facility at Port Arthur, Tex.

The facility supplies high-purity hydrogen to Valero Energy Corp.’s 250,000 b/cd Port Arthur refinery and other Gulf Coast refiners. It is part of Air Products’ Gulf Coast hydrogen pipeline network, which has a capacity of more than 900 MMscfd, following the recent completion of several projects. Jeffry L. Byrne, Air Products’ vice-president and general manager for tonnage gases, said the company plans to add additional capacity to the network as needed.

Air Products also plans in 2008 to bring on stream a second hydrogen facility at Edmonton, Alta. This facility will be the first commercial plant in Canada to provide hydrogen for upgrading Canadian oil sands.

Shell lets effluent plant EPC to Saipem, partners

Qatar Shell Ltd. awarded Saipem SPA and two partners a €255 million contract for the engineering, procurement, and construction of an effluent treatment plant to serve the planned 140,000 b/d Pearl gas-to-liquids (GTL) project in Qatar (OGJ Online, July 27, 2006). Saipem will partner with Abu Dhabi-based Al Jaber and will participate in a 50-50 joint venture with OTV, a subsidiary of France’s Veolia Environment.

The plant, to be located in Ras Laffan Industrial City 85 km north of Doha, will treat water coming out of the two-train GTL complex. The effluent plant will be completed in two phases-in summer 2009 and summer 2010, respectively.

The $18 billion Pearl GTL also will be developed in two phases, with the first phase to begin producing 70,000 b/d of GTL products in 2009 and the second phase to be completed less than 2 years later.

Transportation - Quick TakesBreak shuts Venezuela’s ICO gas line

Venezuela’s Interconnection Centro Occidente natural gas pipeline, which experienced a rupture at a joint on Dec. 6, 2006, is under repair and likely to remain shut-in until early February.

The 36-in, 70-km line carries gas from the East Falcon fields to the Paraguana Peninsula refining complex.

The PetroCumarebo mixed company began shipping 10 MMcfd of gas into the ICO pipeline last year from Cumarebo field (OGJ Online, Aug. 8, 2006).

Cumarebo field is operated by the PetroCumarebo mixed company, a joint venture of Petroleos de Venezuela SA (60%) and Vinccler Oil & Gas CA, a subsidiary of PetroFalcon Corp., Carpinteria, Calif. (40%).

Saipem to expand Dampier-Bunbury pipeline

Saipem SPA has received a $328.6 million contract from the DBP Group to expand the Dampier-Bunbury pipeline in Western Australia by first quarter 2008. The contract signals further capital expenditure in electric power generation and value-added processing in southwestern Western Australia (OGJ Online, Feb. 21, 2006).

Saipem will design, install, and precommission 570 km of nominal bore pipeline and associated facilities. Construction will occur alongside half the existing mainline, Saipem said. The proposed Stage 5A expansion will handle an extra 100 TJ/day of natural gas.

Saipem originally built the Dampier-to-Bunbury pipeline in the 1980s.

In September, DBP Group said the timing of Stages 5B and 5C depends on a range of issues, including the price and availability of gas to support new resource processing and power generation developments.

PGN solicits bids for Riau-North Sumatra gas line

Indonesia’s state-owned gas distributor PT Perusahaan Gas Negara (PGN) plans to invite bids for construction of a $600 million, 360-km gas pipeline to link Riau and North Sumatra.

The pipeline, which will carry 200-300 MMscf of gas from Duri, in Riau, to Medan, in North Sumatra, is expected to come on stream by yearend 2007.

PGN Pres. Sutikno said the projected pipeline would connect with two other lines currently under construction.

One will extend between Grissik in South Sumatra and Rawa Maju in West Java, while the other will join Pagardewa in South Sumatra and Cilegon in Banten. The two lines, spanning 1,106 km, will be able to transport 950 MMscfd of gas.

Indonesia has come under pressure to accelerate development of the country’s gas infrastructure.

In October, the Indonesian Chamber of Commerce and Industry (Kadin) asked the government to draw up a policy to accelerate development to ensure domestic gas supply to meet rising demand.

“Gas distribution infrastructure which has already been planned should be built soon,” said Gito Ganindito, Kadin deputy chairman for mining affairs, responding to reports on the sluggish construction of Indonesia’s gas infrastructure and its shortages of gas for the domestic market.

China begins receiving oil via Mekong River

China has begun receiving oil shipments from Thailand via the Mekong River, marking the start of an experimental program announced earlier this year (OGJ, Apr. 10, 2006, p. 28).

Two ships, each carrying 150 tonnes of oil, arrived in southwest China’s Yunnan Province on the Mekong River, which is being viewed as an alternative to the Strait of Malacca as a regular route for shipping oil to China.

China in March signed an agreement with Laos, Myanmar, and Thailand on shipping oil on the waterway, with an initial shipping quota of 1,200 tonnes/month.

But the three Southeast Asian nations later agreed to raise the quota after China set up an emergency response team to ensure the safety of the shipments.

Experts said as much as 200,000 tonnes of oil would be shipped to Yunnan via the Mekong when the quota was scrapped and the transportation cost was about $25/tonne less than for shipping by land.

Because of the increased quota, Qiao Xinmin, chief of the Yunnan provincial maritime affairs bureau, said China would ship about 70,000 tonnes/year of oil from Thailand alone via the river.

According to Qiao, more than 20 experts from China, Laos, Myanmar, and Thailand are checking ports and oil shipping facilities along the river, studying the feasibility of shipping even larger volumes of oil.