Weather is always an important influence on propane supply-demand trends during the winter heating season. With mild winters during past 4 years, US propane marketers and wholesalers were probably lulled into complacency about the impact of truly cold weather on propane supply and the distribution system.

Heating degree-days during winter 2006-07 totaled 4,915 for the Northeast, 5,315 for the Midwest, and 2,356 for the Southeast-key regional markets for retail propane sales. The 30-year averages for heating degree-days in these regional markets were 5,262 for the Northeast, 5,580 for the Midwest, and 2,581 for the Southeast. During winter 2006-07, the Northeast had 6.1% fewer heating degree-days, the Midwest had 4.8% fewer heating degree-days, and the Southeast had 8.7% fewer heating degree-days. During February, however, these regional markets had 10-20% more heating degree-days than the 30-year average.

The period of colder-than-average temperatures during late January through early March tested propane supply, the distribution system, and the market’s ability to adjust to strong space-heating demand. Neither the full winter nor February, however, revealed the full impact of the gradual decline in US propane production on retail propane markets in the US. During an average cold winter, retail propane sales will probably be 30-40 million bbl more than during winter 2006-07, but total production during 2006-07 was almost 20 million bbl less than in 1999-2000.

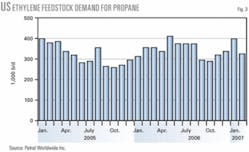

Feedstock demand

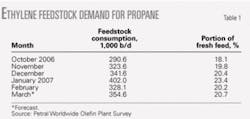

During October 2006, feedstock demand for propane tracked the typical seasonal pattern. Ethylene producers used only 290,000 b/d vs. 348,000 b/d during third-quarter 2006. Feedstock demand diverged from the typical seasonal pattern in November and December. Feedstock demand increased to 324,000 b/d in November and 341,000 b/d in December.

Propane’s share of fresh feed averaged 18% in October and then increased to 19.8% in November and 20.4% in December. For fourth-quarter 2006, propane accounted for about 19% of fresh feed. During 2000-04, propane’s share of fresh feed during the fourth quarter averaged 16-17%.

Feedstock demand for propane jumped to 402,000 b/d in January 2007 (consistent with typical seasonal patterns) but declined to 328,000 b/d in February. Based on a rebound in ethylene plant operating rates, Petral estimates that feedstock demand averaged 350,000-360,000 b/d in March.

Propane’s share of fresh feed jumped to 23.4% in January 2007 but declined to 20.2% in February. Historically, propane’s share of fresh feed during the first quarter averaged 18-20% during 2002-04. The industry’s historical proven minimum propane demand was 190,000 b/d (December 1996), or only 12% of fresh feed. In today’s market, 12% of fresh feed would be 200,000-210,000 b/d.

Petral estimates that the ethylene industry, operating at minimum propane consumption during a normally cold winter, could have reduced feedstock demand by 25 million bbl vs. actual demand.

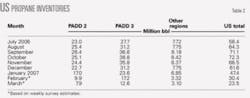

Table 1 summarizes trends in ethylene feedstock demand for propane.

Ethylene plants will operate at 92-93% of capacity rates during second and third-quarter 2007. Total feedstock demand will average 1.73-1.75 million b/d, and propane consumption in the ethylene feedstock market will average 350,000-370,000 b/d.

Fig. 1 illustrates historic trends in ethylene feedstock demand.

Retail demand

Winter 2006-07 was warmer than normal in every month except February. During November and December 2006, heating degree-days in the Northeast, Southeast, and Upper Midwest were 10-30% below the 10-year average and were also below the 30-year average.

In January 2007, heating degree-days were again well below average. February 2007, however, proved to an unusually cold month with heating degree-days 18-30% above the 10-year and 30-year averages. Heating degree-days were again below average in March 2007.

Petral estimates that total retail propane sales averaged 800,000-820,000 b/d in fourth-quarter 2006, or 15,000-25,000 b/d lower than in fourth-quarter 2005. We estimate that total retail propane sales increased to 1.1-1.12 million b/d in first-quarter 2007, or 60,000-70,000 b/d higher than in first-quarter 2006. Although demand in January 2007 was about 100,000 b/d lower than in January 2006, the cold weather in February boosted demand to 1.3 million b/d, or about 150,000 b/d higher than in February 2006.

During a truly cold winter, retail propane sales will be significantly higher than during winter 2006-07. The record high for retail propane sales occurred during winter 2000-01 and totaled an estimated 210 million bbl, or about 35 million bbl more than this winter.

Retail propane markets in the US and Canada will face significant obstacles in meeting demand during a truly cold winter. Inventories in primary storage will almost certainly be fully depleted before the end of February in a winter with average heating degree-days.

Our estimates of retail propane sales are based on heating degree-days from the US National Weather Service’s Climate Prediction Center. We also estimated retail sales for winter 2006-07 based on results of the propane end-use sales survey for 2005 and conducted annually by the American Petroleum Institute.

Propane supply

Gas processors experienced record strong profit margins in all producing regions during fourth-quarter 2006 and first-quarter 2007. We have to conclude that US propane production was at full-recovery levels for both gas plants and refineries during fourth-quarter 2006 and first-quarter 2007.

Data published by the US Energy Information Administration show that total production from gas plants and net propane production from refineries averaged only 808,000 b/d. Production was 13,000 b/d lower than the average for third-quarter 2006 but was 81,000 b/d higher than during fourth-quarter 2005.

During winter 2006-07, domestic propane production totaled about 150 million bbl, or about 15 million bbl less than historic production during 1997-98 and 2001-02. Because the US has not had a normally cold winter during 2001-06, the decline in domestic production has had little direct impact on retail propane consumers.

Gas plants

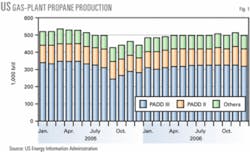

EIA statistics show that gas plant propane production averaged 504,000 b/d for fourth-quarter 2006. Propane production was at its high in November 2006 and averaged 513,000 b/d. Production in December 2006 averaged only 499,000 b/d, or 20,000-30,000 b/d lower than typical full-recovery volumes before 2005.

Petral expects gas plant production to average 490,000-500,000 b/d in first-quarter 2007, but EIA reported only 479,000 b/d for January 2007. Production is likely to average 490,000-500,000 b/d again in second-quarter 2007. Fig. 2 illustrates trends in propane production from gas plants.

Refineries

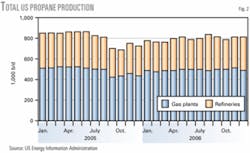

In fourth-quarter 2006, propane production from refineries (net of propylene for propylene chemicals markets) averaged 304,000 b/d, a decline of 15,000 b/d from net refinery supply in third-quarter 2006 but 27,000 b/d higher than year earlier volumes, according to EIA.

Net refinery production was at its lowest level in October 2006 and averaged only 288,000 b/d. Production increased during November and December and averaged 317,000 b/d in December 2006, or 27,000 b/d higher than year earlier volumes. Refinery operating rates and gasoline production volumes were at their lowest level in October 2006, but both increased during November and December. Hence the trend in net refinery propane production during fourth-quarter 2006 was consistent with trends in refinery operations.

EIA also reported that net refinery propane production increased to 324,000 b/d in January 2007, the second highest monthly refinery production volume since the industry returned to full capacity after the 2005 hurricane season. The increase in net refinery propane production in January was somewhat surprising in view of decline in refinery operating rates.

Petral expects propane supply from refineries to average 325,000-335,000 b/d in first-quarter 2007 and to increase to 335,000-345,000 b/d in second-quarter 2007. Fig. 3 illustrates trends in total propane production (gas plants and refineries).

Imports

Based on data from the US Census Bureau’s Foreign Trade Division, propane imports from Canada increased in fourth-quarter 2006, consistent with the seasonal pattern. Imports from Canada averaged only 162,000 b/d in fourth-quarter 2006, however, or about 8,000 b/d lower than year earlier volumes and about 10,000 b/d below the average for 2000-05.

Petral estimates that propane imports from Canada increased to 225,000-240,000 b/d in first-quarter 2007. Even though inventories of purity propane in underground storage were slightly below average at the end of December 2006, Canadian producers and marketers responded to the surge in space heating demand during first-quarter 2007.

Based on propane inventory statistics published by the National Energy Board of Canada, producers and marketers have demonstrated that they can pull Canadian inventories to less than 1 million bbl at the end of the winter heating season. Inventories of purity propane totaled 1.85 million bbl at the end of February.

Consistent with seasonal supply trends, international imports averaged only 55,000 b/d during fourth-quarter 2006, as reported by the Foreign Trade Division. International imports were 110,000 b/d less than year earlier volumes but were about 6,000 b/d higher than the average for fourth-quarters of 2003 and 2004. Petral estimates that international propane imports averaged 35,000-45,000 b/d during first-quarter 2007, and all international cargoes but one moved into the US through East Coast import terminals.

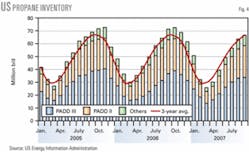

Overall inventory trends

Oct. 1 normally marks the beginning of the inventory liquidation season for the US. Occasionally, propane inventories have not reached their seasonal peak until mid to late October. In fourth-quarter 2006, however, propane inventory in primary storage reached its seasonal peak on schedule during the last week of October.

Propane inventory in primary storage reached a peak of 72.2 million bbl at the end of the last week of October, according to the EIA’s weekly inventory report. The EIA’s more accurate monthly inventory statistics, published in the Petroleum Supply Monthly, confirmed the weekly statistics.

For North America, overall, inventories reached a seasonal peak of 86.1 million bbl at the end of October, or 3.9 million bbl higher than the inventory peak in 2005. As the winter heating season developed, propane markets used all of the year-to-year inventory surplus and more.

During a typical winter, propane markets pull 40-44 million bbl of inventory from primary storage. During the 1980s and 1990s, the market considered 60 million bbl of inventory in primary storage at the beginning of the heating season to be adequate and more than 60 million bbl was surplus supply.

With a typical seasonal draw of 40 million bbl, however, inventories in primary storage declined to a seasonal low of about 21 million bbl on a few occasions. Accounting for pipeline fills, brine availability, and other distribution system constraints allows a seasonal minimum inventory of 20 million bbl to be viewed as a practical minimum.

Since 2001, however, inventories consistently reached seasonal peaks of 65-72 million bbl (a comfortable volume for the current market), but the cumulative withdrawal of product from storage exceeded 41 million bbl only during winter 2002-03. During that winter, inventories fell to a seasonal low of 21.6 million bbl at the end of March 2003 from a seasonal peak of 71 million bbl at the end of September 2002.

This year, total heating degree-days for the winter were again 5-8% below average. The combination of strong feedstock demand during November through January, however, and very strong retail demand during February resulted in a cumulative withdrawal of about 48.5-49.0 million bbl, based on EIA’s weekly inventory reports. Inventory in primary storage in the US declined to a minimum of 23.0-23.5 million bbl.

At the beginning of the heating season, purity propane in primary inventory in Canada totaled 11.5 million bbl at the end of August, or about 3 million bbl more than year earlier volumes. Based on statistics from the National Energy Board, Canadian companies withdrew 10 million bbl of propane from primary storage during the winter heating season and pulled inventories to a seasonal low of 700,000-800,000 bbl at the end of March.

Fig. 4 illustrates trends in propane inventory.

In a truly cold winter, retail propane demand will be 20-30 million bbl higher than winter 2006-07. Unless inventories are significantly higher than 72 million bbl, the market will pull inventories to record low levels. Furthermore, markets will require feedstock demand for propane to fall to near historically minimum levels to maintain the supply-demand balance.

Regional trends

On Oct. 1, 2006, propane inventory in primary storage in Petroleum Administration for Defense District (PADD) II (Table 2) totaled 26.4 million bbl, or about 2.4 million bbl above the average for 2001-04. By the end of January 2007, inventory in primary storage in PADD II totaled about 17 million bbl and remained 2.5 million bbl higher than the 3-year average.

By the end of February 2007, however, EIA’s weekly report indicates that inventories in PADD II declined to 9.5-10 million bbl, or almost 1 million bbl below the 3-year average. Inventories in PADD II continued their decline, falling to a seasonal minimum of 7.5-8.0 million bbl at the end of March 2007, and were 1.0-1.5 million bbl below average.

Propane inventory in primary storage in PADD III totaled 38.8 million bbl at the end of October 2006. Inventory in PADD III was about 4.7 million bbl above the 3-year average. By the end of January 2007, inventory in primary storage in PADD II totaled 23.6 million bbl and was 4.8 million bbl higher than the 3-year average.

Withdrawals of inventory accelerated during February, and inventories fell to a seasonal low of 12.4-12.8 million bbl at the end of March 2007. Inventories were about 2.5 million bbl below the 3-year average. The inventory swing during first-quarter 2007 (from surplus to deficit) totaled about 7.3 million bbl.

Pricing, economics

In most market situations, trends in crude oil prices and ethylene feedstock-parity values are the dominant influences on propane prices. Winter 2006-07 was not exceptional until March 2007.

At the beginning of the heating season, propane prices in Mont Belvieu averaged 93.7¢/gal in October 2006, or almost 20% lower than the July average of 116.3¢/gal. Despite the sharp decline in spot prices, propane’s ratio vs. West Texas Intermediate increased to 66.9% in October 2006 vs. 65.7% in July 2006. These comparisons indicate that propane simply tracked the decline in WTI prices during third-quarter 2006.

WTI prices stabilized in November 2006 and then staged a modest rally in December. Again consistent with crude oil pricing trends, spot propane prices in Mont Belvieu increased to 96.4¢/gal in December 2006 but were 65.3% of WTI.

Spot propane prices in Mont Belvieu dipped below 90¢/gal in January 2007 and averaged 89.3¢/gal. Propane’s ratio vs. WTI was stronger in January, however, and averaged 69.2%.

During sustained cold weather, propane prices in Mont Belvieu increased to 97.9¢/gal in February and an estimated 103.8¢/gal in March. Propane’s ratio vs. WTI was steady in February and averaged 69.4% but jumped to 71.9% in March.

Parity values

In view of the ethylene industry’s significant capability to adjust its consumption of propane within 1 or 2 months, propane prices vs. alternative ethylene feedstock values are a very good measure of the strength or weakness in spot prices in Mont Belvieu. During fourth-quarter 2006, spot prices in Mont Belvieu averaged 95.2¢/gal, but propane’s feedstock-parity value averaged only 89.7¢/gal. By this measure, propane prices were stronger than during third-quarter 2006.

During first-quarter 2007, spot prices averaged about 97¢/gal, but feedstock-parity values averaged 93.4¢/gal. Despite the surge in propane prices, spot prices for ethane and natural gasoline kept pace. Propane’s premium relative to average feedstock-parity values was consistently 3-4¢/gal during first-quarter 2007.

Spring, summer 2007 prices

If WTI prices average $58-62/bbl during second-quarter 2007, as forecast, spot propane prices in Mont Belvieu will likely average 97¢/gal but slide from 100¢/gal in April to 91-93¢/gal in June.

During third-quarter 2007, WTI prices will decline by $6-8/bbl and average $55-57/bbl. Based on the decline in WTI prices and the bearish trend in spot prices for light naphthas and other feedstocks derived from crude oil, propane prices will average 86-89¢/gal during third-quarter 2007.

The author

Daniel L. Lippe ([email protected]) is president of Petral-Worldwide Inc., Houston. He founded Petral Consulting Co. in 1988 and cofounded Petral Worldwide in 1993. He has expertise in economic analysis of a broad spectrum of petroleum products including crude oil and refined products, natural gas, natural gas liquids, other ethylene feedstocks, and primary petrochemicals. Lippe began his professional career in 1974 with Diamond Shamrock Chemical Co., moved into professional consulting in 1979, and has served petroleum, midstream, and petrochemical industry clients since that time. He holds a BS (1974) in chemical engineering from Texas A&M University and an MBA (1981) from Houston Baptist University. He is an active member of the Gas Processors Association, serving on the NGL Market Information Committee and currently serving as vice-chairman of the committee.

Propane feedstock demand is one of the most important balancing elements of the overall propane market in North America. When colder weather pushes sales and consumption in retail markets steadily higher, ethylene producers on the Gulf Coast have substantial capability to reduce their consumption and effectively offset some or all of the impact of a colder-than-normal winter. Historically, most of the seasonal decline in ethylene feedstock demand has occurred during the fourth quarter. Frequently, feedstock demand for propane rebounds during the first quarter.

Propane’s use as a space-heating fuel in residential and commercial markets reaches its seasonal peak each year during fourth and first quarter. Residential and commercial propane demand begins to increase during October and usually reaches peak demand during December-January.

Consistent with the seasonal increase in retail propane sales, propane imports from Canada typically increase to peak seasonal volumes of 150,000-175,000 b/d during the fourth quarter and 175,000-200,000 b/d during the first quarter. Additionally, propane imports from outside North America usually decline sharply during the fourth quarter. Imports from international sources typically remain at seasonally minimum levels during the first quarter.