SPECIAL REPORT: OTC speakers see new era for the oil and gas industry

This report was reported and written by Judy R. Clark, senior associate editor; Paula Dittrick, senior staff writer; Uchenna Izundu, international editor; Steven Poruban, senior editor; Nina M. Rach, drilling editor; Guntis Moritis, production editor; and Angel White, associate editor.

The oil and gas industry has entered a new era characterized by diversity of energy supply, market uncertainty, and changing roles for oil companies, said speakers at the Offshore Technology Conference in Houston Apr. 30-May 3.

Among key elements of this new era are alternative energy sources subsidized by governments, increased concern about global climate change, soaring exploration and production costs, supply and demand uncertainties, and the need for maintaining price and market stability.

Those subjects received attention in several general sessions at the 2007 OTC, at which registration was expected at presstime last week to meet or surpass last year’s 24-year high of 59,236.

In other sessions, speakers addressed technical advances and trends in the Gulf of Mexico as well as regional developments in Norway, Nigeria, Nova Scotia, and Sri Lanka.

Panel discussion

In a panel discussion, Sadek Broussena, former Algerian Minister of Energy and current advisor at Société Générale, said the “new market” equals “uncertainty.”

Resulting from increases in oil prices, increasingly stringent environmental regulations, and geopolitics, uncertainty about future demand and the supply ultimately available from alternative sources complicates decisions about investments in oil production.

Broussena said the Organization of Petroleum Exporting Countries has an interest in keeping the market stable and tries to adjust members’ output to meet market requirements. But it also must develop spare capacity, which Brousenna estimated at 2-2.5 million b/d, primarily in Saudi Arabia.

Another panelist, Edgard Habib, chief economist at Chevron Corp., said a global oil-demand shift in the direction of Asia and an increase in nationalism worldwide are changing the geography of energy. “We are living in a very robust globalization,” he said, with great flows of trade, information, and money. “This environment is very good for the energy industry because of the balance of trade.”

Habib said, “Governments can alter the fuel mix. We’ll have to wait and see what happens with the climate change issue.” The US was the first nation to mandate reductions in the sulfur content of gasoline and diesel. But it will not accept the Kyoto Protocol on Climate Change, he said, “because it would shave 2% off US gross domestic product, which would not be tolerated” while China is growing at such a rapid pace and using so much coal.

Cornelia Meyer, chairman and vice-president, UK, the British Swiss Chamber of Commerce, said OPEC has emphasized that investment in infrastructure depends on demand security.

“One of the biggest threats to security of demand is high oil price,” said Meyer. “If it is too high, investors will go to renewables and nuclear.” Consistently high prices also stimulate conservation. She said energy efficiency can cut demand by 10% by 2030.

Keeping prices high enables investment in fossil fuel developments such as tar sands and shale that otherwise would be ignored as uneconomic, countered Broussena. He said OPEC cannot make or control prices because other market forces affect price, but it wants to “influence” prices. “OPEC’s one objective is to stabilize the market, and prices are very important to that end,” he said.

Hasan Qabazard, director of the OPEC Secretariat’s research division, said the price band OPEC targeted during 1989-98 was too low. It caused a surge in demand and a proliferation of sports utility vehicles until 2003, when spare production capacity decreased and the price of oil rose. “It killed investment, basically. We are not defending any price,” Qabazard said. Broussen added, “If prices will stay at this level [$50-60/bbl], OPEC will be very happy.”

Habib said, “Sixty-five dollar oil has not affected the world economy in the least.”

Faud Al-Zayer, head of the OPEC Secretariat’s statistics division, said balance is the key to creating security of supply and demand and to developing cooperation between national oil companies and international oil companies.

Al-Zayer said the organization is committed to ensuring adequate oil supply and is investing heavily in new capacity because spare capacity helps stabilize the market.

Nimat Abu Al-Soof, OPEC Secretariat upstream oil industry analyst, said OPEC has more than 130 projects in execution or planning stages, mostly downstream. He said planned upstream capacity expansion projects involve investments of $200-370 billion by 2020. “OPEC spare capacity could build to 6-9 million b/d before 2010,” while requirements for OPEC crude likely will drop or remain flat until 2009.

Habib said the boom in investment will enable technology to unlock upstream and downstream production.

“The impression that we are running out of oil” is erroneous, Al-Zayer said, adding that OPEC has almost doubled its conventional resources since 1960. “We expect that to continue.”

A pessimistic view

A pessimistic view of offshore supply came in a separate OTC session from Matthew Simmons of Simmons & Co. International.

Peak offshore oil production is a reality, Simmons said, but the oil and gas industry isn’t certain when it will occur-or if it has already happened-or what to do about it. The debate over peak oil, he said, eventually will surpass global warming as an issue of general concern.

Even the rate of oil production decline is debatable because of “awful energy data.” Most rates of decline are based anecdotally on specific areas, he said, adding that the global decline is probably 10-20%/year.

Relying on oil sands and shales for future oil supply is like “turning gold into lead,” Simmons said, referring to the energy needed to produce from these unconventional sources.

If the industry is to stave off a rapid offshore oil production decline, Simmons said, its offshore drilling fleet will need to be replaced and refurbished. It can mitigate the decline in offshore oil production by drilling more rapidly, he said. Unless the rig fleet expands, however, the production decline eventually will accelerate.

The world’s 51 fourth-generation offshore rigs now average 18.7 years in age, while the 34 ultradeepwater rigs average 9.8 years, Simmons said. “The offshore fleet is getting long in the tooth.”

And how long refurbishment can last “is a mystery,” Simmons said. “Rust never stops; it can only be slowed down.”

The world’s drilling fleet currently has 126 new rigs or upgrades pending, some of which will start entering the fleet by 2008. Overbook, meanwhile, is stretched beyond 2011, he said.

While technological advances will stretch out the oil production decline curve, these “will be limited in scope,” Simmons said.

In the mid to long-term, life after the peak of offshore oil production will be based on energy from the ocean but not hydrocarbons, Simmons said.

Water covers 70% of the planet, but scientists know only about 5% of the ocean floor, which is “the last low-hanging energy fruit.”

Climate change

Although fossil fuels will continue to be vital energy sources worldwide well into the future, the oil and gas industry can adapt its business to help ensure a transition toward a low-carbon global economy, UK Energy Minster Peter Truscott told an OTC luncheon.

The UK has introduced its own climate-change legislation, and it acknowledges the need for international cooperation toward reducing greenhouse-gas emissions. Constraints on carbon emissions will be mandated sooner or later, and most businesses would prefer the certainty of a regime, Truscott said.

“In our view, government can never supplant business in providing technology solutions,” he said, adding that governments are in a position to work toward an integrated policy on energy security and climate change.

“In March, European leaders...announced an ambitious, integrated European climate and energy policy, including an independent target to cut greenhouse-gas emissions across Europe by 20% by 2020 in relation to 1990’s; also to introduce efficiency measures to cut by 20% total European energy consumption predicted for 2020,” Truscott said. “The objective that lay at the heart of these decisions was to set Europe on the fast-track to becoming the world’s first competitive, energy-secure, low-carbon economy.”

Climate change issues have been a UK priority since 2005 when Prime Minister Tony Blair deemed it an international priority issue. Recently, UK environmental officials outlined legislation setting a series of targets for reducing carbon dioxide emissions with a 60% reduction in CO2 emissions by 2050. The UK government expects to publish a white paper in May regarding domestic energy policy.

Truscott advocates a public-private partnership in which the UK government encourages the development of carbon pricing and trading schemes that ensure energy prices reflect all production and consumption costs, including environmental costs. The UK government also encourages technology development.

“We see government’s role as stimulating investment in a broad range of [research and development] activities,” Truscott said. “This will not only include the use of carbon pricing but also government funding aimed at accelerating the development and market penetration of new lower carbon technologies and supportive regulatory frameworks-for example by raising building and product standards and using public procurement to create market pull for the most efficient technologies.”

China’s growth

China’s economic growth poses great uncertainty for the global oil and gas business because it will affect oil supply and demand, said Fatih Birol, International Energy Agency chief economist.

The World Bank and International Monetary Fund have continuously underestimated China’s economic growth, he said in a panel discussion on energy challenges and future directions. Assuming 6.7%/year GDP growth for China over the next 15-30 years in a reference case, IEA says Chinese oil demand might grow from 7 million b/d at present to 11 million b/d.

Birol cautioned that China expects its GDP growth to be higher, which would mean greater oil requirements. “China wants to move away from heavy industry to light services, and this could affect its oil demand,” he said.

Oil price elasticity of demand is losing importance, according to Birol, because member countries of the Organization for Economic Cooperation and Development have become richer and are less sensitive to energy prices changes compared with developing countries. Energy consumption is shifting to developing nations, and their governments are heavily subsidizing prices by about $100 billion/year.

“The oil demand is in the transportation sector,” Birol said. “Around 98% of growth for oil came from the transport sector, and we can’t switch to another fuel more easily.”

Birol stressed that vehicle energy efficiency is important, saying, “This could have more of an effect than turning to biofuels.” He said it was important that the government take the initiative to help develop biofuels, which cannot be left to market forces.

Another panelist, Clay Sell, US deputy secretary of energy, said research by the US government will find economic ways to produce ethanol from cellulose rather than corn within 5 years.

National oil companies

National oil companies (NOCs) will dictate the future rules of the global energy business, according to 69% of delegates who attended a special OTC roundtable discussion.

Speakers acknowledged that NOCs hold the majority of the world’s energy resources and are increasingly exerting control over development.

Olufisoye O. Delano, managing director of Nigerian Petroleum Development Co. (NPDC), said NOCs are similar to other commercial companies but focus on supplies and economic development for their own countries. “We don’t expect international oil companies (IOCs) to do that as they have a different agenda,” he said. “They will be committed to the GDPs of their own countries.”

Delano said NPDC has witnessed market growth in Middle East and the Far East, when 30 years ago Nigeria dealt primarily with the West. A key challenge for NOCs is balancing domestic supply needs with the economic compulsion to export oil, he said. “Customers are now driven by market issues and security of supply.”

Only 15% of delegates said IOCs will determine the future rules of doing business in energy, followed by 12% voting for those with breakthrough technologies, and 3% asserting it would be owners of assets, rigs, and large vessels.

Two main trends are shaping the ways NOCs do business, said Sell of the US Department of Energy. “Their governments see them as cash cows to gain revenues to invest in other social programs; they focus on control of the reserves and prohibit others from coming in to develop them.”

For Jesús Reyes-Heroles, director general of Petroleos Mexicanos, the challenge facing NOCs is developing the financial resources to meet investment needs. He said Mexico’s congress is discussing how Pemex, which historically has been heavily taxed, should evolve. The government now taxes Pemex profits rather than revenues, as in the past. The Mexican constitution prohibits private ownership of oil and gas resources.

“We don’t anticipate in the short term to have any private E&P companies come in, but there could be interesting opportunities in the downstream in the future,” Reyes-Heroles said.

Narrowing of the IOC role in international upstream projects will create opportunities for service firms, said Peter Goode, executive chairman of Aibel Group, a subsidiary of Vetco International Ltd. “Service companies will continue to encroach on IOCs-they carry the burden of technical development, responsible for capital investment in equipment and operations personnel. Consolidation will accelerate within the services sector,” he said.

Gulf of Mexico

The importance to the Gulf of Mexico of deepwater operations received attention in a US Minerals Management Service report released at OTC.

Deepwater leases last year produced 70% of the oil and 40% of the natural gas produced in the gulf, according to the report, Deepwater Gulf of Mexico 2007: Interim Report of 2006 Highlights. It said oil and gas operators announced 12 deepwater discoveries in 2006, with the deepest in 7,600 ft of water.

More than half of the active oil and gas leases in the gulf are in more than 1,000 ft of water, which MMS defines as deep water.

“There’s solid evidence in both leasing and exploration activities to confirm the oil and gas industry’s continued interest and motivation to explore and develop the deepwater frontier in the Gulf of Mexico,” Lars Herbst, acting GOM regional director, told reporters at an OTC news conference.

In gulf Outer Continental Shelf lease sales, the number of tracts in 1,500-4,999 ft of water receiving bids increased by 32% from 2005 to 2006. The number of tracts in 5,000-7,499 ft of water receiving bids increased by 29%.

“MMS granted 30 new technology approvals in 2006,” noted Herbst. “This set a record for the number of approvals for first-time use of technology in deep water.”

Examples of technology advancements that MMS approved for use on federal leases during 2006 include:

- A high-integrity pressure-protection system (HIPPS). Although a HIPPS has not been proposed for a specific development, MMS did approve the general concept in July 2006. The system allows use of pipelines not rated for the well’s full shut-in tubing pressure (SITP). The HIPPS employs valves, logic controllers, and pressure transmitters to protect the unrated section before the pipeline is overpressured or ruptured (rather than relying simply on steel strength). A section of pipe upstream of the well and downstream of the HIPPS valves-as well as a short section of pipe upstream of the HIPPS values-will be rated to the full SITP.

- The use of preset polyester moorings for deepwater drilling rigs. The use of polyester mooring lines on production facilities still is considered a new technology in the gulf even though it is common practice to use this type of mooring line on mobile offshore drilling units. One stipulation for allowing the use of polyester moorings traditionally has been that the polyester moorings may not come in contact with the seafloor. After studying the polyester moorings, MMS granted approval for preset moorings with the stipulation that the lines be inspected and tested every 6 months.

- Various forms of subsea boosting such as a subsea pump allowing enhanced oil recovery. Shell Exploration & Production Co. proposed a separation and boosting system that will separate production fluids at the seafloor and direct them to the surface host via a pump at the base of a production riser for use at the Perdido development. BP Exploration & Production Inc. received approved to use electric subsea multiphase pumps at King field. The pumps will boost operating system pressure, lowering flowing tubing pressures at each well. This increases flow rates, which will extend the field’s life by an estimated 2 years and will increase ultimate recovery.

- A conceptual plan for a floating production, storage, and offloading vessel. Petrobras America Inc. submitted a conceptual deepwater operations plan for installation of an FPSO with two wells in Cascade field and one well in Chinook field. Initial production from these fields is expected in 2009. A single point disconnectable turret mooring system will ensure the FPSO can leave in case of hurricanes. Another new technology involved was the use of free-standing hybrid risers.

Gulf production

Oil production in the Gulf of Mexico is forecast to rise to as much as 2.1 million b/d by 2016 from current levels of 1.35-1.4 million b/d, MMS said.

Total gulf oil production is expected to exceed 1.7 million b/d from existing shallow and deepwater commitments by operators. If announced discoveries and undiscovered resources realize their full potential, production could reach 2.1 million b/d.

Natural gas production is forecast to recover in the next 3 years to a possible high of 8.3 bcfd from 8 bcfd today, MMS said in its “Gulf of Mexico Oil and Gas Production Forecast: 2007-16.”

Activity used for the forecast included 16 deepwater projects scheduled to come on stream by Dec. 31. Independence Hub, expected to start gas production during the second half of 2007, is forecast to be the biggest single contributor to gas production.

Independence Hub involves a consortium of companies gathering gas from seven deepwater fields. Anadarko Petroleum Corp. is the operator.

Oil production in the gulf increased steadily during 1991-2001, leveled off through 2003, and declined in 2004-05, partly because of hurricanes.

Shallow-water production declined steadily after 1997 but was offset by increasing deepwater oil production during most of that time.

Gas production has followed a similar trend, but increasing deepwater gas production hasn’t prevented an overall decline in total gulf gas production during 2006, MMS said.

Deepwater expandables

During OTC, Nexen Petroleum USA Inc. said it installed 6,867 ft of an openhole solid expandable tubular (SET) system in Aspen oil field on Green Canyon Block 243 off Louisiana.

Enventure Global Technology provided the system, which was installed Mar. 25 in what company officials called a world record water depth for a SET system. Aspen 1 is in 3,143 ft of water.

Don Schultz, Nexen deepwater drilling manager, said the project involved a “tremendous technological advantage” that he expects other operators will use in the deepwater gulf in the future.

Nexen planned to drill through depleted sands at its producing Aspen project to 24,000 ft, but the first sidetrack to the original wellbore took an influx at 20,000 ft.

To preserve production of 5,000 b/d, Nexen wanted to maximize hole size for a second sidetrack and chose a SET system to reach 24,000 ft with a 7-in. flush-joint liner. Expandable tubulars enabled Nexen to isolate depleted zones and attain the hole size.

Enventure said the project involve specialty pipe and 191 expandable liner joints with threaded connections. A high-capacity launcher was built and run through the pipe, expanding the liner connections and the pipe at the same time.

Schultz said the SET system greatly reduced mechanical risks.

Hurricane preparation

Gulf of Mexico operators need to prepare for what is forecast to be another “very active” hurricane season, according to speakers in another OTC panel discussion.

The 2007 hurricane season could produce as many as 17 storms, 5 of which could be major hurricanes. Meteorologists estimate a 74% chance of a major hurricane hitting the US this year.

“Not all rigs are suited to work in the central Gulf of Mexico during hurricane season,” said Allen J. Verret, executive director of the Offshore Operators Committee, an industry trade association in New Orleans.

Also, companies need to “improve drilling planning to mitigate risks,” he said, explaining that some wells may need to be drilled when storms are not a threat. He reminded the conference attendees that the peak of the Atlantic hurricane season is in September.

Furthermore, Verret said companies must identify assets that are at risk, prioritize the risks, and evaluate methods to reduce exposure to storms, such as utilizing subsea operations. However, he pointed out that even subsea operations won’t make companies’ facilities totally safe from harm, as shown by damage to pipelines in the Gulf of Mexico from Hurricanes Katrina and Rita in 2005.

Frank Puskar, president of Energo Engineering Inc., Houston, said companies may need to increase deck elevation on new platforms and should be concerned about deck elevation of existing platforms. He explained that of 120 platforms destroyed during Hurricanes Ivan in 2004, Katrina, and Rita, “60% had wave in the deck.”

Puskar said platforms designed with modern American Petroleum Institute RP 2A guidelines with new design deck elevations had a “good chance of not being destroyed.” API RP 2A is the recommended practice for planning, designing, and constructing fixed offshore platforms.

MMS needs to work more closely with the industry and US Coast Guard to get information quickly when facilities are adrift, said Alex Alvarado, chief of pipelines for the MMS Gulf of Mexico office. He said about 20,000 miles, or 60%, of the pipelines in the gulf were affected by Hurricanes Katrina and Rita, and pipeline repairs are continuing.

In fact, 2-3% of gulf pipeline capacity is still down after the 2005 storms, said Allen S. Brown, associate editor of American Society of Mechanical Engineer’s Mechanical Engineer magazine.

Alvarado said the industry has completed most inspections to determine the full extent of pipeline damage. To date, 655 pipelines have been reported damaged, of which 142 have diameters of 10 in. or greater.

Of the 655 pipelines damaged, 216 were associated with platform damage, 13 were associated with third-party impact, 12 were displaced by currents, 72 were exposed, 142 were related to riser damage, 26 had crossing damage, and 173 were the result of other or unknown damage, he said.

“Katrina and Rita were the most difficult hurricane response and recovery effort [for the industry],” Alvarado said.

A first in Norway

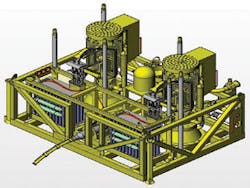

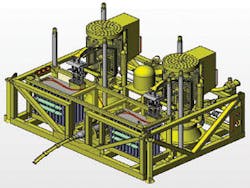

Among other regional reports, Statoil ASA issued a project update for the world’s first full-scale subsea separation system at Tordis field, off Norway.

Statoil’s Hans Kristiansen told OGJ that Subsea 7 was to begin drilling the injector well May 4 using the Bjorland Dolphin rig. Drilling to 1,000 m will take about 40 days, to get to the Miocene Utsira formation, Europe’s largest saltwater and carbon dioxide storage formation. This will reduce future water discharge into the sea.

The subsea separation station was built by Kongsberg FMC and is scheduled for installation in August. The 1,200-tonne module will be installed in a single lift by the Saipem 7000 heavy-lift vessel. Commissioning is expected to take about 6 weeks, with first production by Oct. 1.

Statoil expects to recover an additional 35 million bbl of oil from Tordis using the new subsea separation system.

Tordis has been producing oil since 1994 through a tieback to Staoil’s Gullfaks C platform. Water production has increased to 70-80% over the last few years and sand production to about 500 kg/day. In 2003, Statoil began to plan a subsea separation, boosting, and injection system in order to prolong production 15-20 years. In 2005, Statoil awarded a $100 million contract for the separation, boosting, and injection system to FMC Technologies Inc. (OGJ Online, Nov. 10, 2005).

In 2006, CDS Engineering BV and FMC Kongsberg were recognized with an OTC Spotlight award for their Tordis compact subsea separator with integrated solids handling (OGJ, May 8, 2006, p. 25).

FMC’s Ann Christin Gjerdseth told OGJ that Statoil installed a small pipeline inline manifold at Tordis in 2006 to reroute the Tordis well stream to Gullfaks C via the new subsea separation station.

Gjerdseth said the design highlights of the Tordis separator are the internal level detectors for sand, emulsion, water, and oil and the gas bypass line, which allows the size of the separator to be greatly reduced. The integrated sand management system includes a gravity-based cyclonic device. The sand slurry will be injected downstream of the water-injection pump, which was qualified with tungsten carbide impellers, for increased wear resistance.

One of the most significant aspects of the engineering process was moving topside technology to the seafloor, said Gjerdseth. This required a shift to meld the differences between heavily instrumented topside design with the guiding principles of simple, easily replaceable component design for subsea installations, where equipment interaction is limited. FMC worked toward an acceptable level of process control and instrumentation within the short delivery time and limited weather window for installation.

While the current tank design is workable to 1,500 m, the material limit is only about 2,000 m. Ultradeep installations will require inline separation, Gjerdseth said. Future innovations for deepwater projects will include subsea compression facilities and long-distance power transmission.

Brazilian gas

Petroleo Brasileiro SA (Petrobras) plans to increase gas production from the Espirito Santo basin in southeastern Brazil from 27.5 million cu m/day to 70 million cu m/day by 2011, the company reported at OTC. The basin holds over 1.5 billion boe, 11.5% of Brazil’s total reserves.

Brazil has made increasing domestic gas production a priority to help reduce reliance on imports, particularly after its relations with Bolivia-a major exporter-became strained when Bolivia exerted state control over its resources and changed participation terms.

In 2010, local production may exceed 20 million cu m/day, or 40% of the Brazilian gas offered in southeastern and southern Brazil, Petrobras said.

Producing fields in Espirito Santo basin are Golfinho (light oil) and Peroá Canapu and Camarupim gas fields. Golfino started production last May through the Capixaba floating production, storage, and offloading system. “The Cidade de Vitória FPSO will go into operation in the same field in the second half of 2007. Each of these units is capable of producing 100,000 b/d,” Petrobras said.

Separately, Brazil plans to launch its ninth bidding round in September or October, Energy Minister Silas Rondeau said. He explained that the bidding round has been delayed because of difficulties in allocating blocks but did not give details on how many would be offered or their locations.

Brazil’s President Luiz Inacio Lula da Silva is expected soon to announce a number of business initiatives to help develop the country’s oil and gas industry, Rondeau added.

Nigerian investment

Nigeria expects to see $60 billion of oil and gas investment across a variety of operations through 2008 and more after that, said Fisoye Delano, managing director of Nigerian Petroleum Development Co. Ltd.

The country is eager for investors to help develop its domestic gas infrastructure, Delano stressed at an industry breakfast. Nigeria’s gas demand is expected to grow from 1 bcfd in 2006 to over 10 bcfd by 2010 driven by power generation and industrial development.

Although the oil and gas operations in the country have been disrupted by attacks on equipment and kidnappings, the government has ambitious plans. It wants a gas pipeline connecting the south of the country to the north and an interconnector between eastern and western grids. “We want gas processing plants, at least three or four, to support growth,” Delano said. He said the government is offering incentives for investment.

Nigeria plans to eliminate gas flaring in 2008, Delano added. It presently flares 32% of its gas production with LNG projects and new pipelines.

“Nigeria wants to grow its [oil] reserves to 40 billion bbl by 2010 and production capacity to 4.5 million b/d by 2010. We want our gas revenues to match crude oil revenues,” Delano said. Over 2 million b/d of additional production from offshore fields in 2006-11 is planned.

Susan Farrell, senior director of corporate advisory services at PFC Energy, raised questions about future deepwater production in Nigeria. “As new discovery sizes fall and companies develop their portfolios faster than they find new fields, there is a predictable peak to the current investment and production growth cycle,” she said.

Farrell said the geological potential of Nigeria is high but noted that political risks limit onshore and shallow-water prospects.

“Nigeria has 500,000 b/d of oil shut in, and we think it will stay offline until the end of the year,” she said.

Delano assured delegates that the government is working to engage rebellious Niger Delta communities and share value from oil and gas developments in those areas.

The Niger Delta receives only 13% of the wealth generated from oil and gas in their region. Militants from the Niger Delta are pressing for 50% of the proceeds, while the government has proposed 18%.

Sri Lanka

Sri Lanka is preparing to launch an offshore licensing round and expects to have bid documents available in August as it starts a road show in Houston, said Neil DeSilva, director general, Petroleum Resources Development Secretariat.

DeSilva said Sri Lanka will offer three parcels in the Mannar basin off the west coast. The basin has been divided into eight blocks. India and China’s state oil companies have been promised one block each.

DeSilva said Sri Lanka’s oil and gas potential is supported by its shared geology with countries that have commercial oil and gas production.

The Mannar basin has thick sedimentary rocks with large structures that are compared geologically to Brazil, he said. It also contains regions of shallow gas. The source rocks are of Cretaceous and Jurassic age.

Petroleum Minister A.H.M. Fowzie said Sri Lanka is soliciting cooperation from the US as it begins to develop its oil and gas industry. He said the country needs technical resources to exploit its oil and gas.

During 2001 and 2005, over 6,000 km of 2D seismic data have been acquired. These data, along with interpretation reports and well data, will be included in the bid packages that will be available by midyear, De Silva said.

He explained that earlier exploration efforts in Sri Lanka were unsuccessful as they were in the shallowest parts of the basin.

Nova Scotia

Also announcing plans at OTC for an offshore licensing round was Nova Scotia. The province plans to launch the round in November with flexible terms aimed at attracting midsize companies in particular, said Diana Lee Dalton, chair of the Canada-Nova Scotia Offshore Petroleum Board.

Dalton said high costs have prevented midsize independent companies from pursuing exploration, and the petroleum industry has complained that Nova Scotia has a burdensome regulatory regime. “We want to offer smaller companies terms that mean they can get out in 3 years if they don’t find something,” she said. Nova Scotia recently implemented initiatives to streamline its regulatory process.

Nova Scotia, a proven oil and gas province, is relatively underexplored with only 127 exploration wells drilled on the Scotian Shelf. Producers have a 7-month window in which to drill wells in harsh conditions, which increases costs. Most exploration has been in shallow water.

Dalton was unable to give details of how many blocks would be offered and in what basins, adding that geologists are carrying out a study to collect geological information and analyse it before offering comprehensive data packages to potential bidders. “There has been a downturn in exploration, and we feel that we’ve got a lot of potential,” she said.

Alison Scott, deputy energy minister for Nova Scotia, said the ministry would offer attractive terms for companies to develop their discoveries under its newly revamped regulatory regime. She told OGJ that potential explorers have been reluctant to drill because they do not know the geology.