OGJ Newsletter

Iraq study sees output hike, confirms reserves

Iraq could double oil production capacity to 4 million b/d in 5 years with little effort, according to a 12-month study of its reservoirs by IHS Inc., London.

The study, to be published in May as an Iraq Atlas, confirmed longstanding conventional wisdom that Iraq has 116 billion bbl of proved and probable oil reserves and 100 tcf of gas reserves. Basin studies indicated that another 100 billion bbl of oil and a large volume of gas can be recovered from the country’s hardly explored western desert.

The study group assessed 435 undrilled prospects and noncommercial discoveries and 81 producing fields and commercial discoveries. The group evaluated the reservoirs using new information and reassessed and validated all field reserves and production numbers.

The government, which needs $20-25 billion in investment in its E&P sector, is expected to launch a bid round for 65 exploration blocks and 78 fields in 2007.

The western desert estimate, which IHS said has a large error margin, was developed from new play concepts generated in a recent study of the Western Arabian platform. Iraq has made only one discovery in the region, which is expected to hold oil in Silurian rocks and gas in Ordovician formations.

Given a stable political and civil environment, Iraq could boost its capacity from just under 2 million b/d presently by restoring shut-in wells to production in northern fields and drilling infill wells in southern fields without using new technology or enhanced oil recovery methods, the group found.

IEA raises China’s 2007 product demand estimate

The International Energy Agency, Paris, has revised upwards its forecast for China’s 2007 total oil product demand by 6.1% to 7.6 million b/d due to refining and trade data showing stronger-than-expected apparent demand in the first 2 months.

IEA said its projections for Chinese apparent demand in the first quarter have also been revised upward by 300,000 b/d to 7.61 million b/d. The agency also said it lowered its second quarter demand projection by 600,000 b/d to 7.7 million b/d.

According to preliminary data, January’s apparent demand increased by 4.1% on an annual basis, IEA said. Apparent demand is defined as refinery output plus net oil product imports adjusted for fuel oil and direct crude burning, smuggling, and stock changes.

The Asian giant’s demand increases were driven mostly by naphtha (up 12.4%), gasoline (up 3.3%), gas oil (up 5.9%), and other products (up 27%).

“Following further revisions to last year’s monthly data, particularly in fourth-quarter 2006, we estimate that demand in 2006 averaged 7.2 million b/d, slightly higher than in our last report, bringing yearly growth to 6.9%,” IEA said.

The agency said January’s relatively modest-by Chinese standards-pace of growth is explained by the fact that oil product demand was particularly strong in January 2006, buoyed by Lunar New Year festivities, which prompt a surge in demand, particularly of gas oil as many Chinese citizens travel home.

The 2007 celebrations, by contrast, took place in February. In anticipation, the government ordered refiners to cut gas oil exports in February to meet the surge of domestic demand that month.

In late January, the government also reduced jet fuel surcharges for domestic airlines by 17-20% to encourage air travel-the surcharges had been raised in August 2006.

Meanwhile, citing recently released data from the China Electric Power News, IEA said that over the next few years the country is unlikely to see a repeat of its 2004 oil demand surge, when electricity shortages were met mostly by small diesel generators, especially in rural areas.

China expanded its generating capacity by 102 Gw in 2006 to a total of 520 Gw, IEA said. As a result, China’s generating margin-the spare capacity available to meet peak demand-is “likely to reach some 10 Gw this summer, compared with [a] 40 Gw shortfall in 2004.”

However, IEA said, 90% of China’s new power plants are coal-fired, while hydropower accounts for another 9%. It said nuclear and other forms of energy represent less than 1% of China’s capacity.

APPEA: Macfarlane nixes Aussie tax breaks

Australia Resources Minister Ian Macfarlane has rejected calls from the oil and gas industry for government to provide tax breaks to stimulate investment in LNG projects (OGJ Online, Apr. 17, 2007).

The minister told delegates to the Australian Petroleum Production & Exploration Association (APPEA) conference in Adelaide that the industry should seize the opportunity to expand its gas programs before overseas customers decided to “leapfrog” this fuel and go straight to the nuclear solution to greenhouse-gas emissions.

He said the Australian industry already has plenty of incentive in high world oil and gas prices, and that the government has given industry accelerated depreciation on upstream assets already and provided a 150% tax break for working in frontier exploration areas.

“If the industry does not get down and go hard, companies may find customers go straight to the one proven base-load, zero-emission technology for the production of electricity,” he said. “That’s nuclear.”

He said, “The oil and gas industry needs to ensure it develops projects quickly to optimize the high gas prices, particularly for LNG, that we are now seeing around the Asia-Pacific Rim.”

Macfarlane was responding to a 64-point strategy document released on the eve of the conference that called for stimulation of the industry by providing tax relief and depreciation allowances.

He said his comments were delivered to industry as a caution rather than a warning.

Chevron, Weyerhaeuser jointly assessing biofuels

Chevron Corp. and Weyerhaeuser Co. agreed to jointly assess the feasibility of commercializing biofuels production from cellulose sources. The companies will focus on developing technology that can transform wood fiber and other nonfood sources of cellulose into biofuels for cars and trucks.

The venture combines Chevron’s technology capabilities in molecular conversion, product engineering, advanced fuel manufacturing, and fuels distribution with Weyerhaeuser’s expertise in the collection and transformation of cellulosics into engineered materials, land stewardship, crop management, and biomass conversion.

Feedstock options include a wide range of materials from Weyerhaeuser’s existing forest and mill system and cellulosic crops planted on its managed forest plantations.

Chevron already was involved with biofuels research through alliances with the Georgia Institute of Technology, the University of California at Davis, the Colorado Center for Biorefining and Biofuels, and the US Department of Energy’s National Renewable Energy Laboratory.

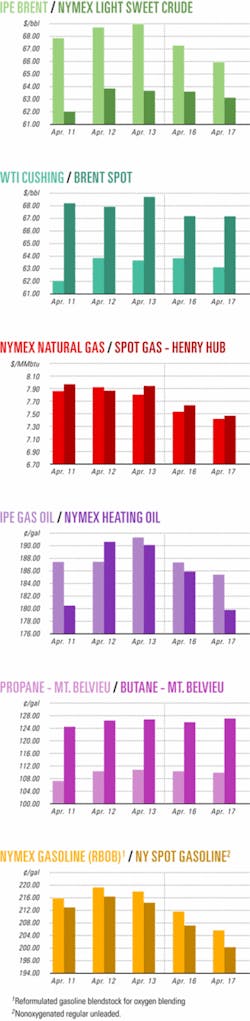

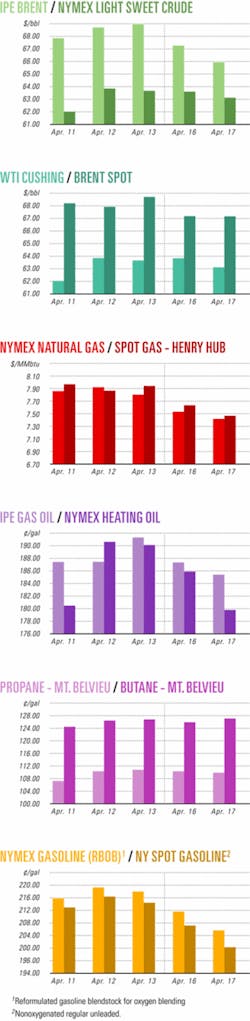

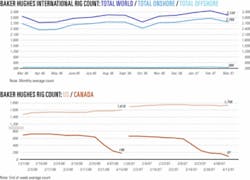

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesApache tests Zaina-2 oil well in Egypt

Apache Corp.’s Zaina-2 well in Egypt’s Western Desert tested 1,067 b/d of oil from 12 ft of pay in the Abu Roash G-10 sand, the company reported. Zaina field, which Apache operates, is in the company’s East Bahariya concession.

The discovery well, Zaina-1, flowed on test 1,165 b/d of oil in July 2005 from 55 ft of oil pay in the Upper Bahariya sand. The Abu Roash G-10 sand is a new producing zone in the field. The Abu Roash G-10 and G-20 sands, with 39 ft of total indicated oil pay, are behind-pipe recompletion targets for Zaina-1, which currently produces 560 b/d of oil.

Apache, which had acquired a 50% interest in the East Bahariya concession in 1997, became operator and gained its 100% contractor interest in 2001. Apache and Repsol YPF SA made the first discovery on the concession, the Karama-1X, in early 1997. The concession has produced 21 million bbl of oil since Apache began operations, with 18,500 b/d currently flowing. The company plans to drill 39 development wells there this year.

Egypt continues Meleiha concession until 2024

Egypt has extended until 2024 the length of its concession agreement with the group developing Meleiha Block in the Western Desert. The group plans to produce 840,000 tonnes of oil in 2007 compared with 800,000 tonnes in 2006.

Melehia holds 34 million tonnes of initial oil reserves. On the block are 129 operating wells that have produced more than 17 million tonnes of oil during the past 30 years.

Partners in the Meleiha production-sharing agreement are ENI Group unit IEOC Production 56%, Lukoil Overseas 24%, and International Finance Co. 20%.

Agiba-a joint venture of state-owned Egyptian General Petroleum Corp., IEOC, and IFC-operates the development project.

Partners spud Golitza-1 well in Bulgaria

JKX Bulgaria Ltd., a wholly owned subsidiary of JKX Oil & Gas PLC, has spudded the Golitza-1 exploration well targeting Jurassic sands, Triassic limestones, and Triassic sands on the B-Golitza exploration permit in Bulgaria, said Aurelian Oil & Gas PLC. Aurelian’s wholly owned subsidiary Balkan Explorers Bulgaria Ltd. is 50% partner on the permit.

The onshore well aims to reach 4,900 m TD and will hit a large tilted fault block through near vertical drilling during the next 120 days, Aurelian said. Romanian driller Dafora SA will use a 2,000-hp rig to drill Golitza-1.

B-Golitza is on the southern edge of the Moesian platform where the Miocene Balkan Thrust Front strikes east-west across Bulgaria. A number of wells have been drilled in the area, but none has penetrated the target formations in a comparable structural setting, according to Aurelian.

Aurelian said nothing has been tested to date along the trend that Golitza-1 will target. “We are therefore not underestimating the risk of the play,” it said. “However, all the required elements for a discovery are interpreted to be present.”

Drilling & Production - Quick TakesExxonMobil to maintain Bass Strait output

Bass Strait’s future as a major oil province will continue for some years, according to operator ExxonMobil Corp. The company’s lead country manager Mark Nolan said he is confident that the area’s 140,000 b/d of liquids output can be held steady.

Speaking at the Australian Petroleum Production & Exploration Association conference in Adelaide, Nolan said ExxonMobil and its 50% partner BHP Billiton were under constant production pressure because of Bass Strait’s annual 20%-plus natural production decline rate.

Thanks to high oil prices, however, production from wells flowing as little as 1,000 b/d has become attractive.

After completing a $100 million (Aus.) 3D seismic program early this decade, ExxonMobil has carried out extensive infill drilling in Bass Strait.

Nolan said the company was still working with BHP Billiton on proposals to develop Scarborough gas field on the Exmouth Plateau off Western Australia.

The project has not been affected by California’s rejection of BHP’s proposals to build an LNG terminal at Cabrillo Port off Malibu, he said.

Contracts let for work in Ursa, Princess fields

Shell Offshore Inc. has selected Technip to install water injection flowlines and risers for deepwater Ursa and Princess oil fields. They lie in the Gulf of Mexico’s Mars basin 140 miles southeast of New Orleans.

The work is scheduled to start in the fourth quarter and will take a month to complete.

Separately, Shell has let a $30 million contract to Technip to tie back four subsea water injection wells to the Ursa platform, anchored on Mississippi Canyon Block 854 in 3,780 ft of water. Princess also lies in water deeper than 3,000 ft.

The contract covers project management, engineering, fabrication, and installation of flowlines and steel catenary risers, and installation of pipeline end terminations.

A Shell spokeswoman said the work will boost production and extend the life of the field. Peak production during Princess’s initial development stage is pegged at 55,000 b/d of oil and 110 MMcfd of gas (OGJ Online, Jan. 6, 2004). Shell estimates that the Princess project will yield the ultimate recovery of 175 million total gross boe.

The partners in Princess and Ursa are Shell, operator, with 45%, BP PLC 23%, ExxonMobil Corp. 16%, and ConocoPhillips 16%.

Tabu field production begins off Malaysia

ExxonMobil Exploration & Production Malaysia Inc. has begun production of nonassociated gas from Tabu field, 200 km off Terengganu, Malaysia. Production is expected to peak at 150 MMcfd.

Gas from the unmanned facility will be transported via a new 16-in. full-well-stream, corrosion-resistant alloy pipeline to the manned Jerneh A platform for compression and processing.

ExxonMobil said the $182 million project was developed under its gas production-sharing contract with 50% joint venture partner Petronas to help meet increasing gas demand in Malaysia.

The announcement coincides with other recently announced developments aimed at increasing Malaysia’s gas production.

In late March Kejuruteraan Samudra Timur Bhd. said ExxonMobil awarded it a 4-year contract valued at $17.4-20.4 million to provide tubular handling equipment and services.

In early March ExxonMobil awarded a 52 million-ringgits ($15 million) contract to Brooke Dockyard & Engineering Works Corp., Sarawak, for construction of the Jerneh B gas production platform 230 km off eastern Peninsular Malaysia.

The Malaysian company will fabricate and construct the platform jacket and topsides and undertake associated host tie-ins and offshore hook-up and commissioning works.

Anadarko lets FEED study contract for K2 Unit

Anadarko Petroleum Corp. has let a contract to Intec Engineering to perform the conceptual engineering and front-end engineering and design study phases of a proposed single-well tieback in the Gulf of Mexico Green Canyon area from Block 606 to Anadarko’s K2 Unit on Block 562.

The flowline will connect to K2 at an existing connection at the south fault block. The addition to the K2 Unit will be controlled from the Marco Polo platform on Block 608, which also is operated by Anadarko.

Intec will provide flow assurance analysis and operability planning, system design and vender coordination for the flowline, manifolds, jumpers, subsea tree, and production control system. Intec also will assist in the regulatory and permitting process.

Last month, Anadarko agreed to sell a 23.2% portion of its interest in the K2 Unit for $1.2 billion to two undisclosed companies (OGJ Online, Mar. 13, 2007).

K2 currently averages 37,100 boe/d of production from six wells. Anadarko retains a 41.8% working interest in K2 and serves as operator.

Petrobras lets subsea contract to Cameron

Petroleo Brasileiro SA (Petrobras) let a $127 million contract to Cameron for the supply of subsea systems for the Gas Production Anticipation Plan (Plangas) project, which aims to increase “significantly” domestic natural gas production in southeastern Brazil, Petrobras said.

Cameron’s contract scope covers the supply of 22 subsea christmas trees, control systems, and related equipment.

Initial delivery and installation is expected to begin in second quarter 2008, with additional deliveries to continue through 2009.

The trees for the project will be manufactured in Cameron’s facility in Taubate, Brazil, Cameron said.

Processing - Quick TakesBP lets contract for Whiting refinery upgrades

BP Products North America Inc. has let two major engineering, procurement, and fabrication packages to Jacobs Engineering Group Inc. for work associated with a planned upgrade project to increase Canadian heavy crude processing at BP’s 399,000 b/cd refinery in Whiting, Ind.

The $3 billion upgrade project is scheduled for completion in 2011 (OGJ Online, Oct. 26, 2006).

Jacobs’ work scope for one of the packages includes licensing, design, and fabrication of sulfur recovery facilities. Jacobs will execute the licensing portion of this award from its offices in Leiden, the Netherlands, and will use its Comprimo Sulfur Solution technology. The modular fabrication portion will be executed through the company’s facility in Charleston, SC. The scope of the second package includes revamping several hydroprocessing units, which Jacobs will execute from its Houston location.

Federal judge fines Sinclair Tulsa Refining

A federal judge ordered Sinclair Tulsa Refining Co. on Apr. 4 to pay a $5 million criminal fine and sentenced two of its former managers to 6 months of home detention and 3 years of probation for violating provisions of the US Clean Water Act (OGJ Online, Dec. 19, 2006).

US District Judge Claire V. Eagan also ordered the Sinclair Oil Corp. subsidiary to make a $500,000 community service payment to the River Parks Authority, which strives to maintain, preserve, and develop the Arkansas River and adjacent land. She also sentenced the company to 2 years of probation. Eagan fined one former manager, Harmon Connell, $160,000 and ordered him to provide 100 hr of community service. The other, John Kapura, was fined $50,000 and ordered to provide 50 hr of community service.

The company and its two former employees previously admitted to knowingly manipulating refinery processes and wastewater flows and discharges to create unrepresentative samplings during mandatory sampling under the National Pollutant Discharge Elimination System permit program. The US Department of Justice said the manipulated samples were intended to influence analytical testing results reported to the Oklahoma Department of Environmental Quality and the US Environmental Protection Agency.

Transportation - Quick TakesConsortium plans Papua New Guinea LNG plant

Santos Ltd. has joined a consortium of ExxonMobil Corp., Oil Search Ltd., and Nippon Oil in planning a 5-6.5 million tonne/year gas liquefaction plant in Papua New Guinea.

In joining the consortium, Santos signed a cost-sharing agreement to carry out a preliminary front-end engineering and design study for the stand-alone LNG plant that would rely primarily on gas feedstock from Hides field in the central highlands.

The $60 million pre-FEED phase, to be completed by yearend, will evaluate the technical and commercial merits of establishing the LNG facility, planned to come on stream by 2012-13.

The study also will determine the best development concept, select a preferred site-likely to be on the Papuan Gulf coast-determine the best field configuration and unitization framework, and examine fiscal terms with the Papua New Guinea government.

Although Hides would be the primary gas supply, additional feedstock could come from nearby Angore and Juha fields (OGJ Online, Apr. 3, 2007).

Santos agreed to buy FEED data previously undertaken for the upstream part of the now-defunct Papua New Guniea gas pipeline to Queensland and to reimburse ExxonMobil for a proportionate share of costs already incurred for LNG studies.

ExxonMobil, which holds 49% interest, will operate the plant. Oil Search will have a 32% interest, Santos 17%, and Nippon Oil 2%.

Petrobras unit to add to oil tanker fleet

Petroleo Brasileiro SA (Petrobras) shipping subsidiary Transpetro, following a favorable court order last month, has signed contracts valued at $866 million for the construction of nine oil tankers.

Petrobras said the Rio Naval consortium will build five Aframax tankers for $517 million and four Panamax tankers for $349 million. The ships, part of a $2.48 billion program to buy 26 oil vessels, will join Transpetro’s fleet in 2009-11.

The signing was enabled by a Mar. 23 ruling of Brazil’s Tribunal de Contas da Uni’o (TCU), which lifted an earlier suspension of contracts for 16 tankers. The court reversed its earlier decision after consideration of a detailed submission presented to Brazil’s internal auditor on Mar. 9, as well as a presentation by Transpetro Pres. Sergio Machado on Mar. 12.

Aroldo Cedraz, the minister responsible for the TCU, had blocked the contracts at the end of February, claiming that was a clear possibility of damage to the company due to the absence of detail of the indirect costs and inadequate criteria to fight and forecast any readjustment in prices.

Petrobras wants to increase the number of its oil vessels to 42 under a plan financed by Brazil’s National Development Bank. Under the plan, BNDES aims to reduce Petrobras’s costs for chartering foreign ships and revitalize Brazil’s shipbuilding industry.

The Rio Naval consortium comprises Brazilian shipbuilders MPE, IESA, and Sermetal, in partnership with South Korea’s Hyundai Heavy Industries.

China mulls formation of two LNG shipping JVs

Chinese authorities are considering plans to establish two LNG shipping ventures, both to be under the supervision of the state-owned Assets Supervision and Administration Commission (SASAC).

The official Shanghai Securities News said China Shipping (Group) Co. Ltd., China National Petroleum Corp. (CNPC), and China Petroleum & Chemical Corp. (Sinopec) plan to set up an LNG shipping joint venture, with an initial agreement to be reached by the end of June, according to China Shipping Group Pres. Li Shaode.

Li told the newspaper the JV will order carriers from Hudong Shipyard, which is controlled by China State Shipbuilding Corp.

The second JV, Hong Kong-based China LNG Shipping Holdings Co. Ltd. (CLNG)-a JV of China Ocean Shipping (Group) Co. and China Merchants Group-is talking with China National Offshore Oil Corp. (CNOOC), the newspaper said.

CLNG has ordered five LNG shipping vessels from Hudong Shipyard, one of which is due for delivery in November, the paper said. Current plans call for three of the vessels to ship LNG imported from Australia to Guangdong, while the other two will ship LNG imported from Indonesia to Fujian.

The paper said that under SASAC requirements, the two JV firms will supply different regions of the country.

The China Shipping, CNPC, and Sinopec JV will ship imported LNG to terminals in northern China such as Qingdao, Dalian, and Yingkou.

The CLNG and CNOOC JV will ship imported LNG to terminals in Shanghai and the southern provinces, including Guangdong, Fujian, and Zhejiang.