IEA sees 2.6 million-b/d near-term gain in OPEC capacity

Members of the Organization of Petroleum Exporting Countries, led by Angola and Saudi Arabia, will increase total capacity to produce crude oil this year and next by a net 2.6 million b/d.

The International Energy Agency made that forecast in its April Oil Market Report, warning of uncertainty about developments in Nigeria, Venezuela, and Iraq and noting that the crude streams due on stream will be “relatively sweet.”

Net of assumed declines in existing fields, OPEC production capacity will rise to 34.8 million b/d by the end of this year from 33.9 million b/d at the end of 2006, IEA said. By yearend 2008 it will reach 36.5 million b/d.

The assessment assumes decline rates ranging from 1-5%/year for onshore fields in the Persian Gulf region to 12-15%/year for deepwater fields.

The projected increase for 2008 assumes partial resumption of the 450,000 b/d of production in Nigeria now shut in by political violence. The projection for both years assumes no change in capacities of Venezuela and Iraq.

“Clearly, developments in all three of these countries are surrounded by risks both on the downside and the upside,” IEA said. The agency also warned of development delays that might result from tight service and drilling markets.

Of nearly 4 million b/d of new crude supply coming onto production from OPEC members through 2008, 56% will have sulfur content of less than 1%, IEA said. Crude containing more than 2% sulfur will account for less than 20% of the new supplies.

The increment will be about evenly split between light, medium, and heavy grades. The high crude quality largely reflects increases in African crudes, some of which have high wax and acid contents.

Growth leaders

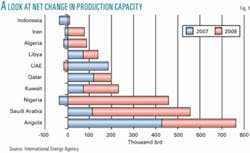

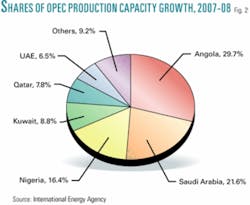

Angola and Saudi Arabia account for half of the projected net increase in OPEC production capacity (Figs. 1 and 2).

For Angola, IEA has lowered its estimate of current crude-production capacity to 1.6 million b/d by accounting for 50,000-100,000 b/d of output from Bomboco field as condensate. Condensate flow will not count against Angola’s quota when OPEC assigns one to its new member, possibly as early as September.

IEA expects Angolan crude-production capacity to jump to 2 million b/d by mid-2008 and 2.14 million b/d by late 2008 and to stay at 2-2.2 million b/d through 2011.

Capacity increases will come from the Dalia, BBLT, Rosa, Greater Plutonia, and Kizomba C projects.

In Saudi Arabia, capacity increases this year and next will come from Khursaniyah, Nuayyim, and Shaybah fields, pushing the total to 11.4 million b/d by the end of 2008 from 10.8 million b/d at present.

IEA excludes from its capacity estimates crude from Abu Safah field, which Saudi Arabia produces on behalf of Bahrain, and condensates added to crude streams.

It expects Saudi capacity to reach 12.5 million b/d by 2012. Later capacity additions will involve lower-quality crude than those due on stream by yearend 2008.

Because many of the new developments are linked with associated-gas projects, IEA said Saudi NGL and condensate output might increase by 500,000 in the next 2 years.

Other growth

In Nigeria, IEA said, capacity will rebound to 2.9 million b/d by 2008 from 2.5 million b/d at the end of 2006, with all the growth occurring next year.

The agency assumes that EA and Forcados production of 450,000 b/d remains offline this year but phases back online next year and in 2009. After late next year, Chevron Corp.’s deepwater Agbami field is expected to add to capacity growth.

“Nigeria’s new, lower capacity target of 3.2 million b/d by 2011 in our opinion represents a more realistic level (compared with an earlier 4.1 million b/d), assuming deepwater projects such as Bosi, Usan, Akpo, and Bonga Southwest proceed,” IEA said.

The agency expects capacity gains of 200,000 b/d each from Kuwait, Qatar, and the UAE in 2007-08.

Expansion and refurbishment in Minagish and Burgan fields account for most of the expected Kuwaiti growth. Expansion of Sabriyah field has been approved but isn’t likely to boost capacity until 2010, IEA said.

The agency added that continuing bans on direct foreign participation in Kuwaiti exploration and production will limit capacity to 3 million b/d, although the emirate has a long-term goal of 4 million b/d.

Qatar’s increase will come from expansion of Al-Shaheen oil field to 240,000 b/d, taking total crude-production capacity to 1.1 million b/d by late 2008.

In the UAE, most capacity growth in the next 2 years will occur in onshore Abu Dhabi fields, which might raise the emirate’s total to 2.9 million b/d by the end of 2007.

Capacity will stay at that level through 2010, after which growth in offshore fields will raise the total to 3.4 million b/d by 2012.

Limits on growth

IEA sees limits on near-term expansion of production capacity in Algeria, Libya, and Iran.

“There has been an apparent change in tone in the past couple of years from Algeria and Libya as regards receptiveness to capacity expansion itself and license terms in particular,” it said, adding that Iran’s prospects are limited by unattractive investment climate and political problems.

Each country will have capacity growth of 70,000-135,000 b/d during 2007-08. Algeria’s growth will come from Hassi Messaoud field, Libya’s from Elephant and El Shahara fields.

Iran has expansions under way in Darkhovin, Masjid e Suleiman, Rag e Safid, Salman, Foroozan, Doroud, and Abuzar fields, but total growth of 350,000 b/d will be offset by declines elsewhere and leave the country’s capacity at 4 million b/d through the end of next year. Declines are possible after that.

“Any step change in Iranian capacity would require greater outside investment at fields such as Azadegan, Yadavaran, and South Pars,” IEA said. It called a government capacity target of 5.2 million b/d by 2011 “wholly unrealistic in the current political and regulatory environment.”