REX pipeline start affects regional natural gas pricing

The Feb. 14, 2007, opening of the first leg of Kinder Morgan’s Rockies Express (REX) pipeline between Wamsutter, Wyo. and the Cheyenne Hub in northeastern Colorado, will narrow the Opal-to-Cheyenne pricing differential even while increased gas-on-gas competition in the region forces regional price differentials lower until completion of REX Phase III in 2009.

Kinder Morgan began flowing natural gas through the 192-mile section of the Rockies Express pipeline (REX) between Wamsutter and Cheyenne hub on Feb. 14. Completion of this first leg of REX along with several smaller projects extending the western end of the system from Wamsutter to Opal lets producers flow an additional 500 MMcfd from major Rockies basins to Cheyenne.

Since then, about 300 MMcfd of REX receipts from the Uinta-Piceance flowed directly to Cheyenne. At the same time, REX deliveries at Wamsutter dropped to zero. This shift in flows opened capacity on the Wyoming Interstate pipeline (WIC) through Wamsutter, letting WIC increase the flow of Green River (Opal) gas to Cheyenne.

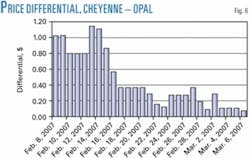

The additional flow of gas into Cheyenne has started to narrow the Opal-to-Cheyenne differential. On Feb. 14 and 15 the differential remained above $0.50/MMbtu due to support for the Cheyenne price resulting from high demand along the front range of Colorado. By Mar.15, the differential had dropped to less than $0.01 MMbtu.

This article examines the reasons behind this compression in differentials and discusses how completion of REX’s Wamsutter-to-Cheyenne leg is likely to affect the market.

Geography

REX Phase I’s initial segment went into service in February 2006 with completion of the length formerly called Entrega, a 136-mile leg connecting Uinta-Piceance production with WIC and Colorado Interstate Gas (CIG) pipeline at Wamsutter (Fig. 1).

The segment completed in February extends REX east to Cheyenne and west to Questar Corp.’s Overthrust pipeline at Kanda.

Through a long-term lease with Overthrust Pipeline, REX Phase I also can move up to 1.5 bcfd from the Green River-Overthrust area (around Opal) to Kanda and on to Cheyenne Hub.

REX Phase I is the first phase of a project that will become the largest natural gas pipeline built in the US in the last 20 years. REX West (Phase II) will begin operations in early 2008 and extend the system to Mexico, Mo. Addition of compression will also increase capacity at Cheyenne to 1.6 bcfd. REX East (Phase III), planned for completion in 2009, will extend the pipeline to Clarington, Ohio, and increase overall capacity to 1.8 bcfd. When completed, REX will span 1,663 miles and be one of the nation’s longest interstate pipelines.

Context

Seven other major interstate pipelines operate near REX:

- Cheyenne Plains. Owned by El Paso Corp., it carries gas from the Cheyenne Hub in Weld County, Colo., to Greensburg, Kan., interconnecting with Kinder Morgan Interstate Gas Transmission (KMIT), Natural Gas Pipeline Company of America (NGPL), ANR Pipeline Co., Southern Star Central Gas Pipeline Inc., Northern Natural Gas, Kansas Gas Service, and Panhandle Energy.

- CIG. Also owned by El Paso, it flows gas from the Uinta-Piceance basin in Utah and Colorado, the D-J in Colorado, and the Green River, Wind River, and Powder River basins in Wyoming, primarily to markets in Colorado and the Midwest. CIG can also deliver gas through Kern River Gas Transmission Co. (to Nevada-California) and Northwest Pipeline Corp. (NWP).

- NWP. Owned by Williams Companies, it carries gas from the Uinta-Piceance and Green River-Overthrust basins to the Pacific Northwest.

- Overthrust. Owned by Questar Corp., it extends from Whitney Canyon, southwest of Opal, to Kanda, where it connects with Questar, Kern River, CIG, and WIC.

- Questar Pipeline (QP). Also owned by Questar, it operates like a hub in northeastern Utah, western Colorado, and southwestern Wyoming. Questar connects with CIG, NWP, and TransColorado Gas Transmission to move gas south to El Paso and Transwestern Pipeline Co. LLC. Through connections to Kern River, gas can also move to California markets, and through connections with NWP it can move to Oregon and Washington and occasionally to the east via CIG and WIC.

- WIC. A subsidiary of CIG, it is also the middle section of the Overthrust-WIC-Trailblazer system designed to deliver gas from western Wyoming and the Powder River to eastern markets.

- TransColorado. Owned and operated by Kinder Morgan, it runs from the Greasewood Hub in Rio Blanco County, Colo. to the Blanco Hub in New Mexico.

Price, basis

REX is designed to expand export capacity for Rockies producers. The expectation that REX will improve Rockies pricing significantly, relative to prices in other producing regions of North America, underpins these expansion plans.

Opal, in southwestern Wyoming, and CIG Rockies are the primary pricing points for Rockies production. Cheyenne Hub is the primary pricing point for natural gas flowing east of Wyoming and Colorado.

Prices at Opal and Cheyenne historically have lagged prices in other production areas, primarily because of the limited ability to export gas, a problem compounded by rate stacking when gas enters the Midwest, and the rapidly expanding Rockies production base.

Earlier in this decade, severely constrained export capacity saw netbacks in the western Colorado, Utah, and Wyoming basins fall to $1.10/MMbtu. A 2004 expansion of Kern River that added 1 bcfd of export capacity to California initially addressed the capacity shortfall. Then, in January 2005, Cheyenne Plains began service, eventually adding more than 760 MMcfd of new capacity from Cheyenne to the Midwest. Although this new capacity prevented further pricing disasters in the Rockies, Opal and CIG Rockies prices continued to lag other production areas.

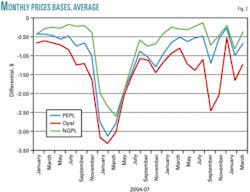

Fig. 2 shows the average basis at Opal about $0.73 below Henry Hub from January 2004 through the early summer of 2005. This value averaged $0.27/MMbtu below Panhandle Eastern and $0.49/MMbtu below NGPL during the same period. By August 2005, a price spike in Louisiana due to hurricanes Katrina and Rita caused these basis differentials to widen significantly. By spring, Opal basis again settled into a range averaging about $1.00 below Henry.

But in the summer of 2006, the specter of transportation curtailments started to rear its head. Unrelenting increases in production had again tightened capacity out of the region. By November 2006, Opal was running $2.50/MMbtu under Henry, spiking to $5.00/MMbtu below Henry Nov. 14 due to mechanical problems at Opal.

It is this kind of pricing pressure that REX will ultimately relieve.

Opal vs. Cheyenne

REX will also equalize pricing pressures within the Rockies region, reducing, if not eliminating, the differential that exists between Opal and Cheyenne.

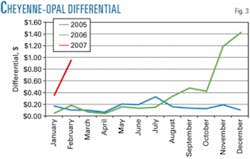

Opal typically trades below Cheyenne Hub. During 2005, Cheyenne exceeded Opal by an average of $0.16/MMbtu, increasing to $0.39/MMbtu in 2006 (Fig. 3). The differential has continued to grow in recent months, averaging $0.81/MMbtu since Sept. 1, 2006.

Cheyenne Hub connects to multiple Midwestern markets as well as markets along the front range of Colorado. Particularly with the completion of Cheyenne Plains in 2005, gas from Cheyenne has significantly improved access to Midwest and Eastern markets, which provide the highest value market for Rockies gas most of the time. Demand at Cheyenne Hub is typically strong, drawing supply from Rockies producing basins.

REX Phase I gives producers the opportunity to move more gas to the Cheyenne Hub, thereby increasing supply relative to demand and narrowing the differential between Opal and Cheyenne.

Gas flow effect

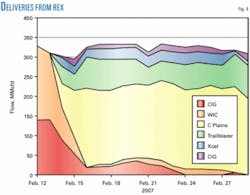

REX pulled volumes from WIC. Fig. 4 shows deliveries from REX to other pipelines from Feb. 12 through Mar. 1. Before Feb. 14, Uinta-Piceance gas received into REX in the Greasewood area moved to Wamsutter where there are two delivery options: Gas could be delivered into CIG at Bitter Creek or to WIC at Frewen Lake. Gas received at these two points either moved west to Kern River and Questar or east to Cheyenne.

New REX capacity has significantly affected these two points. By Feb. 16, volumes delivered to WIC fell to zero and CIG only received about 20 MMcfd at Bitter Creek (6% of REX’s total deliveries). By Mar. 7, both points had fallen to zero. Gas flows received at these two interconnects stayed on REX and moved to Cheyenne, delivering into Cheyenne Plains Gas Pipeline Co. at Crazy Bear, Trailblazer Pipeline Co. at Owl Creek, Xcel Energy at Chalk Bluffs, and CIG at Crazy Horse (Fig. 4, Table 1).

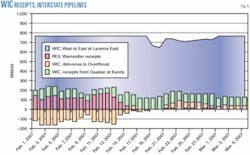

While REX captured volumes that had moved east on WIC prior to Feb. 14, total WIC continued to flow about the same volume west to Cheyenne Hub. The blue area in Fig. 5 shows WIC flows west through the Laramie East point between Wamsutter and Cheyenne Hub were essentially flat at 770 MMcfd.

The bars in Fig. 5 show the shift in certain WIC receipts since REX Phase 1 went into service. Receipts from REX at Wamsutter (the maroon bar) dropped to zero, while receipts from Questar at Kanda (shown in green) increased.

At the same time, WIC reversed deliveries into Overthrust and started receiving gas from Overthrust at the same point (Fig. 5, orange bars). The volumes received from Questar and Overthrust offset volumes lost to REX, maintaining the volume moving west through Laramie East at maximum capacity.

From these early results it seems clear that REX’s deliveries of Uinta-Piceance gas into Cheyenne has effectively increased WIC’s capacity to deliver incremental Green River Basin (Opal area) gas to Cheyenne. Thus, the total volume of Rockies gas that can move to Cheyenne and then on to markets in the Midwest and East has already increased.

Basis effect

After three weeks of operation, the anticipated compression of Opal and Cheyenne differentials became evident. Fig. 6 compares the average price at Cheyenne Hub and Opal from Feb. 13 to Mar. 7. Just after the pipeline went into service, Cheyenne prices remained high relative to Opal, but by Feb. 16 the premium had begun to shrink. During the next two weeks, the differential narrowed to less than $0.10/MMbtu.

The premium for the first few days portends an inter-Rockies pricing trend that will likely persist: local Rockies demand will swing the Opal to Cheyenne differential.

The price at Cheyenne will likely stay strong relative to Opal in spite of REX when it is cold along the front range of Colorado.

This is not just a winter phenomenon. During the summer, hot weather will also increase front-range demand, likely with the same result.

When Colorado needs gas, the extra demand still drives the price upward at Cheyenne. Conversely, when weather reaches extremes along the Wasatch Front, the differential may reverse.

The longer term implications of REX are less clear than its short-term effects. The changes in pipeline flow patterns since REX brought the Wamsutter-to-Cheyenne section online make clear at least two immediate benefits will accrue: improved ability to flow gas from southwest Wyoming to Cheyenne and a narrowing of the basis differentials between Opal and Cheyenne.

Whether REX drives a reduction in the spread between Rockies production and production in other regions of the country will depend on takeaway capacity east of Cheyenne, northwest and west of Opal, south of Greasewood, and local demand. In this regard, Rockies producers may be their own worst enemy.

Bentek estimates that between 2001 and 2006, the Rockies region generated 441 MMcfd/year of incremental production. During the last 6 months of 2006, incremental growth in the region exceeded 656 MMcfd. Bentek also estimates that all of the export options combined will create only 150-250 MMcfd of unused takeaway capacity. Weather along the Wasatch front and front range that is either hotter than last summer or colder than this winter might absorb another 100-150 MMcfd.

Bentek believes that by summer 2007 the disparity between production growth and unused takeaway capacity will cause gas-on-gas competition to intensify at Opal and Cheyenne, forcing cash prices lower. Once this situation develops, it is likely to persist until REX reaches Clarington in 2009.

The authors

Porter Bennett is president and CEO of Bentek Energy LLC in Golden, Colo. In his early career, Bennett held positions with consulting companies specializing in energy market analysis. He holds an MS in mineral economics from the Colorado School of Mines and an MA in international affairs from Columbia University in New York. He received a BA in history from Lewis & Clark College in Portland, Ore.

E. Russell Braziel is vice-president, marketing and sales, and chief technology officer for Bentek. He was previously vice-president of business development for the Williams Cos., vice-president of energy marketing and trading for Texaco, and president of Altra Energy Technologies. Braziel holds BBA and MBA degrees in business and finance from Stephen F. Austin University, Nacogdoches, Tex.

Jim Simpson is vice-president, operations for Bentek. Before joining Bentek, Simpson modeled large structured transactions in both gas and power for Enron North America. Subsequently he led natural gas marketing and trading at MarkWest Hydrocarbon Inc. Simpson holds a BBA in finance from Texas A &M University.