OGJ Newsletter

ROV industry to see increased spending

The work-class remotely operated underwater vehicle (ROV) industry has had strong growth as a result of recent sustained high oil prices. Particularly since 2002, expenditure on work-class ROV operations has more than doubled, and further strong growth is expected over the next 5 years, said Douglas-Westwood Ltd. analysts in a recent report.

Total expenditures for the ROV market is forecast to reach $1.46 billion/year by 2011, according to the report entitled “The World ROV Report 2007-11,” which is based on analysis of demand drivers. “Offshore utilization and ROV dayrates have increased dramatically over the past 5 years and stand at an all-time high,” said lead analyst Rod Westwood. “Between 2002 and 2006 alone, the work-class dayrate increase was around 30%,” he said.

In 2006, Westwood estimates, $827 million was spent on the operation of work-class ROV units worldwide, an increase of 86% on the 2002 value. This is forecast to increase by a further 76% to a 2011 value of about $1.46 billion-more than three times the market over the 10-year period, he said.

The study suggests that North America and Western Europe are expected to account for the largest proportion of ROV activity. About half of the total ROV units expected to operate in 2007 are associated with these regions, the report said.

High oil prices have resulted in high levels of drilling activity and increased installations of subsea wells, pipelines, control cables, and other hardware. Increasing underwater resources, therefore, are required to service the growing numbers of underwater installations, progressively more in deep waters beyond the economic reach of manned intervention. This all manifests itself in the building of new drilling rigs and offshore construction vessels, all of which use ROVs in subsea operations, Westwood said.

The report contends that by the end of the period, more than 120 work-class ROVs/year will need to be built to meet demands of market growth and attrition of the existing fleet.

“Based on an average cost per unit” the study predicts that “work-class ROV capex will increase from its 2006 level of $186 million to $247 million by 2011-an increase of 33% over the period.” Cumulative expenditures, meanwhile, are expected to be slightly higher than $1 billion over the forecast period.

RIK gas sale to bring in $1 billion in revenues

The US Treasury will gain more than $1 billion in revenues following the latest federal royalty in-kind natural gas sale, the Minerals Management Service said on Mar. 27.

Ten companies submitted successful bids in the Mar. 8 sale for the 13 contracts involving 137.5 bcf of gas produced from federal leases in the Gulf of Mexico. The gas will be delivered over 7-month or 12-month terms beginning Apr. 1, MMS said.

Winning bidders included Bear Energy LP, Eagle Energy Partners, Coral Energy LP, Louis Dreyfus Energy Services, National Energy & Trade LLC, Williams Power Co., BG Group, Total Gas & Power North America Inc., Fortis Energy Marketing & Trading, and Constellation Energy Commodities Group Inc.

MMS said bidding was strong in the sale, as 20 companies submitted 152 offers for the RIK gas. It said it based its revenues estimate on the current $7.50/Mcf gas price.

Chavez, Manning sign cross-border gas treaty

Trinidad and Tobago has signed a cross-border treaty with Venezuela, following an agreement concluded in March to jointly develop an estimated 30 tcf of natural gas in offshore fields straddling the borders of the two nations (OGJ, Mar. 12, 2007, Newsletter). It is the first such agreement in the Western Hemisphere and is designed to provide for the production of gas out of the Deltana area.

Venezuela President Hugo Chavez and Trinidad and Tobago Prime Minister Patrick Manning, who signed the agreement in Caracas, hailed the treaty as a major step forward, allowing the countries to develop one of the world’s most prolific gas regions.

The first fields to be developed will be Loran and Manatee, which are estimated to hold 10 tcf of gas-7.3 tcf on the Venezuelan side and 2.7 tcf on the Trinidad and Tobago side. Chevron Corp. operates Loran and is a partner with BG Group on the Trinidad side (Manatee), which BG Group operates.

The treaty sets the framework for taxation and other production issues. However markets for the gas have yet to be determined.

The two countries will decide by mid-April where Loran-Manatee gas will be piped for processing. Manning wants it processed as LNG in the Caribbean island nation, where it would form the basis for an additional LNG train.

“We are a producer of LNG at this time and can do it much quicker than in any other route,” Manning explained. The country is conducting talks with BG about adding another LNG train at Point Fortin (OGJ Online, Mar. 23, 2007).

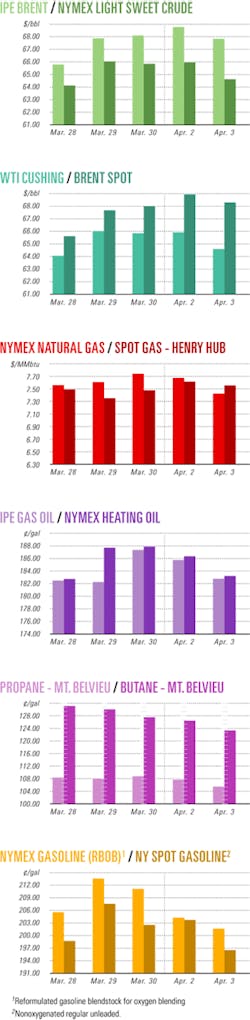

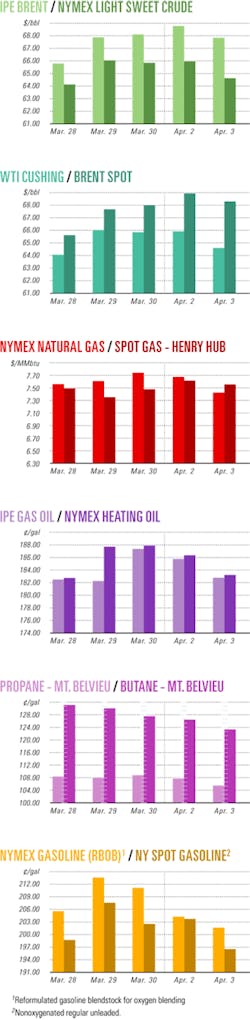

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesRoyale targets Rio Bravo Monterey shale oil

Royale Energy Inc., San Diego, plans to begin work by the end of May to further develop Rio Bravo field west of Bakersfield in Kern County, Calif.

Royale signed a letter agreement with Matris Exploration Co. LP to acquire 50% of Matris’s interest in the field and fund future development. Royale will target the shallow, unconventional Monterey shale and more-conventional deeper reservoirs.

The first project is to complete the Weber 27-27 well in Monterey shale, source rock for the San Joaquin basin. The vertical well had good oil and gas shows in several intervals before being drilled horizontally in the deepest of the show zones.

Texas Crude, EOG Resources, and Chevron have produced more than 7 million bbl of light, sweet oil from Monterey shale in North Shafter field, the closest analog to Rio Bravo, Royale said.

Pacific Stratus details Colombian finds

Pacific Stratus Energy Ltd., Toronto, started production tests at a Llanos basin multizone oil discovery and reported final drillstem test results at a gas discovery in the Lower Magdalena basin.

The company, operator of the Moriche Block, said the Mauritia Norte-1 wildcat went to 10,000 ft TMD and cut 6 ft of net pay in Carbonera C7 topped at 8,726 ft, 5 ft of net pay in Mirador topped at 8,973 ft, 9 ft of net pay in Gacheta topped at 9,520 ft, and 23 ft of net pay in Ubaque topped at 9,693 ft.

Oil quality is 38.5° gravity in Mirador and 12.8° gravity in Ubaque. The Carbonera C7, Gacheta, and Ubaque reservoirs had 253, 214, and 296 ft of gross thickness, respectively.

Pressure gradients were made based on repeat formation test data, and well-defined water oil contacts were confirmed in Ubaque and Mirador.

Meanwhile, Pacific Stratus plans to spud the La Creciente-2 appraisal well in early April. Calculated absolute open flow at the discovery well was 208.1 MMcfd of gas based on reservoir depth pressure data vs. the initially estimated 71.8 MMcfd based on wellhead surface pressure from Tertiary Cienaga de Oro at 10,933-11,572 ft.

Colombia’s National Hydrocarbons Agency awarded Pacific Stratus 100% working interest in the 216,123-acre Guama Block near La Creciente.

The company committed to reprocess 300 line-km of seismic surveys and shoot 200 line-km of new 2D surveys in the first 18 months. The commitment for the second phase is to drill a well.

Pacific Stratus has mapped five gas and oil prospects in the block. One prospect was proved almost 20 years ago when the Ligia-1 well flowed 500 Mcfd of gas and 450 b/d of 39° gravity oil on short tests.

Chevron, partners awarded acreage off Australia

Chevron Australia Pty. Ltd., Perth, and partners have been awarded exploration rights to the W06-12 permit area in the Carnarvon basin off northwestern Australia.

The acreage, in the Greater Gorgon area of the basin, covers 1,150 sq miles and lies about 60 miles offshore.

Chevron will serve as operator, with a 50% interest in the permit, while partners Shell Development Australia and Mobil Australia Resources Co. Pty. Ltd. each will hold a 25% interest.

The 3-year work program for the permit includes geotechnical studies, the shooting of 110 miles of 2D seismic, and the drilling of an exploration well. Seismic work will begin this year.

Chevron said there also is potential for an additional 3-year work program.

Tower Resources to drill two wells in Uganda

Tower Resources PLC plans to drill two exploration wells on Block EA5 in western Uganda by 2008 and may also drill a contingent well under the second exploration phase of its Ugandan license. The government also has extended the company’s initial exploration period for another 6 months, meaning the license will now end on Mar. 28, 2008.

Tower Resources will shoot a 250 km, 2D seismic survey in July and hopes to drill the exploration wells in first half 2008. The extension of its license will “facilitate optimum management of the seismic program and implementation of an early exploration well,” Tower said.

Tower said the drilling program was appropriate, given the recent success in other similar licenses in the Rift Valley, in reference to Heritage Oil Corp.’s oil find in nearby acreage; Heritage is operator of the Kingfisher-1 exploration well in Uganda (OGJ Online, Feb. 16, 2007).

Tower’s onshore block covers 6,040 sq km and has Tertiary rift sediments that hold oil and gas-bearing segments to the south. The company said the main exploration risk for the unexplored block is the thermal maturity of source rocks.

Statoil, Sonatrach gauge Hassi Mouina well

Operator Statoil ASA reported its Hassi Mouina exploration and appraisal well in Algeria has produced gas at 7,083 standard cu m/hr from a depth of 1,131-42 m. About 9,012 standard cu m/hr of gas flowed at 1,113-29 m, Statoil said. These results were achieved through a 32/64-in. choke.

Hassi Mouina, drilled to a TD of 3,200 m, is the first onshore well for Statoil in Algeria. The Norwegian state company partnered with Algeria’s Sonatrach. The well targeted Devonian reservoir rocks.

The Hassi Mouina license was awarded in June 2004. It comprises four blocks within an area of 23,000 sq km in the Gourara basin. The area lies in Algeria’s western desert, northwest of the In Salah gas field, where Statoil has a 31.85% share.

Statoil and Sonatrach are now drilling their second well, Hassi Tidjerane West 1 (HTJW-1), in the Sahara Desert. Statoil’s share in Hassi Mouina is 75% and Sonatrach holds the other 25%.

ExxonMobil signs PSC for Mandar block

ExxonMobil Exploration & Production Indonesia (Mandar) Ltd. has signed a production-sharing contract with Indonesia for Mandar block in the Makassar Straits off West Sulawesi.

ExxonMobil was the successful bidder for block in Indonesia’s 2006 exploration tender round; the company holds 100% participating interest.

Mandar block, which covers 4,200 sq km, is in the Southern Makassar basin in water as deep as 2,000 m.

ExxonMobil said Mandar block ownership augments its acreage position in the Makassar Straits, where it also has a PSC in place for Surumana block from a previous tender round.

BHP to explore deepwater blocks off Malaysia

Malaysia’s state-owned Petronas awarded BHP Billiton two deepwater blocks, Block N and Block Q, which lie 175 km off Sabah state capital Koto Kinabalu in 1,600-2,800 m of water.

In contracts signed with Petronas, BHP holds a 60% interest in both blocks and will serve as operator. Petronas Carigali holds 40% interest.

The 7-year exploration period includes a schedule for seismic acquisition, seismic data reprocessing, and exploration drilling.

Drilling & Production - Quick TakesTiman-Pechora joint venture producing oil

The OOO Naryanmarneftegaz (NMNG) joint venture has begun oil production from six wells in Yuzhno Khylchuyu field in the northern Timan-Pechora basin of the Russian Arctic.

Unspecified volumes of oil are being trucked to an existing terminal on Varandey Bay on the Barents Sea for export via tanker to international markets. An 80-mile pipeline to replace the truck shipments is due for completion this winter or next winter.

Interests in the joint venture formed in 2005 are OAO Lukoil 70% and ConocoPhillips 30% (OGJ Online, July 1, 2005). ConocoPhillips also has an equity interest in Lukoil.

ConocoPhillips said it expects to spend $1 billion in 2007 in Russia, split evenly between NMNG and its 9.3% interest in supergiant, Eni-operated Kashagan field in the Caspian Sea.

ConocoPhillips has booked 170 million bbl of reserves or 15% of the combined ultimate expected bookings from the two projects. Yuzhno Khylchuyu field is the anchor field on the NMNG acreage block.

The terminal is to be expanded to 240,000 b/d capacity by the end of 2007. NMNG is expected to be producing and shipping about 200,000 b/d of oil at peak.

GOSP work starts in Shaybah expansion

Construction has begun on a gas-oil separation plant (GOSP) that will boost production capacity of Saudi Arabia’s Shaybah oil field to 750,000 b/d from 500,000 b/d.

SNC Lavalin Group Inc., Montreal, is designing and building Shaybah Central Processing Facilities GOSP-4 under a contract let by Saudi Aramco last year (OGJ, Apr. 24, 2006, Newsletter). Other contractors and subcontractors are Hyundai Heavy Industries, NEC, and Saudi firms NESMA, NCC, and Al-Falak.

Completion of the expansion project is due in 2008. Shaybah field is 900 km southeast of Dhahran in Saudi Arabia’s Empty Quarter.

Total expects production from Jura field in 2008

Total SA reported that production from Jura gas-condensate field in the UK North Sea is expected to start in second quarter 2008.

The company will produce 45,000 boe/d at plateau and will connect the field via a 3-km pipeline to the Forvie North subsea wellhead, itself connected to the Alwyn North processing platform. “The additional output should enable the Alwyn facilities to continue producing at full capacity until early next decade,” Total said.

Jura, discovered 4 months ago, holds more than 170 million boe of proved and probable reserves in the Alwyn area, 160 km east of the Shetland Islands and 440 km northeast of Aberdeen. The Alwyn area holds the Alwyn North, Dunbar, Ellon, Grant, and Nuggets fields.

Total is continuing exploration in the UK North Sea with an appraisal well on Kessog, a high-temperature, high-pressure field near Elgin Franklin, followed by another exploration well on the Jura East prospect. Recent discoveries lifted Total’s proved and probable reserves in the UK to over 1 billion boe in 2006.

Pokohura platform off New Zealand on stream

Gas and condensate production from the first of six planned offshore wells in Pokohura field off New Zealand has begun.

The other wells will be drilled from the production platform, completed, and tied in to the pipeline to shore during the next 12 months. After drilling, the platform will be unmanned and controlled from onshore facilities.

Three extended-reach wells drilled from onshore locations into the southern part of the Taranaki basin field started up last September.

Pokohura output will bring the onshore processing plant near New Plymouth in the North Island to its full capacity of 20 MMcfd of gas plus condensate during first-quarter 2008.

Pokohura has an estimated 750 bcf of gas reserves. The condensate content is rich, believed to be around 50 million bbl.

The field is operated by Shell Exploration New Zealand Ltd. with 48% interest. Todd Energy and OMV New Zealand hold 26% each.

Aramco lets contracts for ancillary platforms

Saudi Aramco has let contract to National Petroleum Construction Co. (NPCC) of the UAE for ancillary platforms in Zuluf and Marjan oil fields off Saudi Arabia.

NPCC will fabricate, transport, and install two tie-in platforms in Zuluf field, including two bridges, pipe spools, and associated work, and three scraper decks, two in Zuluf and one in Marjan.

Completion is due by January 2009.

Processing - Quick TakesEni, Petrobras sign MOU for biofuel production

Italy’s Eni SPA and Brazil’s Petroleo Brasileiro SA (Petrobras) plan to assess developing a partnership to produce biofuels in Brazil and worldwide.

Under a memorandum of understanding signed Mar. 27, the companies will combine their proprietary technologies to jointly produce biofuels in other countries and may work together in commercializing biofuels in the international market.

Petrobras is experienced in large-scale production of bioethanol in Brazil. Eni plans to construct at its Livorno refinery a 250,000 tonne/year plant that would produce high-quality biodiesel. Eni also is looking to develop biofuel projects in other countries.

Eni said the two companies will study joint projects to assess together the application of the Eni Slurry Technology in Brazil in the framework of a broader partnership involving both upstream and downstream joint initiatives. EST will allow deep conversion of residues and heavy oils-typical of those produced in Brazil-into diesel and gasoline.

Holly lets EPC contract for hydrocracker unit

Holly Corp., Dallas, has let a $53 million engineering, procurement, and construction (EPC) services contract to Benham Constructors for a gas oil mild hydrocracker at its 26,000 b/cd Woods Cross, Utah, refinery.

The new unit will have a capacity of 15,000 b/d of gas oil. The unit is a major component of an expansion project at the refinery and, when combined with the desalting equipment, will expand the facility’s crude processing capabilities to 31,000 b/d enabling the refinery to process a wider slate of crude oils.

Holly recently awarded the license and process design package of the unit to Process Dynamics Inc. (OGJ, Mar. 19, 2007, Newsletter).

Nova, Aux Sable to build ethane extraction plant

Nova Chemicals Corp. and Aux Sable Canada Ltd. have signed a letter of intent to jointly develop a 40,000 b/d ethane extraction plant in Fort Saskatchewan, Alta. The plant would have a capacity to process as much as 1.2 bcfd of natural gas, which will be transported via the Alliance Pipeline system.

The ethane will be piped to Nova Chemicals’ Joffre, Alta., petrochemical complex to be used as a feedstock.

Aux Sable will own and operate the plant, which is expected to begin operating in mid-2010.

EPC contract let for Bavarian refinery upgrades

BP PLC subsidiary Bayernoil has let a detailed engineering, procurement, and construction management services contract to Jacobs Engineering Group Inc. for work related to a $60 million upgrade project at the Vohburg refinery in Bavaria.

The contract calls for Jacobs to provide logistics and revamp an existing Merox unit.

The project is scheduled for completion in early 2009.

Transportation - Quick TakesOneok to lay NGL pipeline in Oklahoma, Texas

Oneok Partners LP plans to build a $260 million natural gas liquids pipeline from southern Oklahoma through the Barnett shale gas play in northern Texas and continuing on to the Texas Gulf Coast.

The proposed 440-mile Arbuckle Pipeline will originate in Stephens County, Okla., and be designed to initially transport 160,000 b/d of raw NGL for delivery into Mont Belvieu, Tex.

The line will interconnect with Oneok Partners’ existing fractionation facility at Mont Belvieu and other Gulf Coast-area fractionators.

Following receipt of permits, construction of the 12-in. and 16-in. line is currently expected to be complete by early 2009.

Last year Oneok Partners proposed another NGL line, Overland Pass, which will be a 750-mile line extending from southwestern Wyoming to Conway, Kan. (OGJ Online, May 5, 2006). The $433 million project is a joint venture of units of Oneok and Williams Cos. Inc.

BG eyes Trinidad and Tobago LNG export train

BG Group has signed a memorandum of understanding with Trinidad and Tobago for a joint study to determine the feasibility for an additional LNG export train at the liquefaction plant at Point Fortin, Trinidad (OGJ, Feb. 19, 2007, Newsletter).

“We have an unrivalled ability to put together gas chains: working with the government, our [Trinidad & Tobago LNG] joint venture will open up new possibilities for the country’s gas-and perhaps also Venezuelan gas-to reach markets,” said BG Chairman Robert Wilson.

Wilson delivered the keynote address at a luncheon hosted by BG in Trinidad, where the entire BG Group board assembled to hold its first ever meeting outside London-“to understand the importance of [Trinidad and Tobago] in the global gas market and the part that we play here,” said Wilson.

He also said BG has just concluded a heads of agreement with National Gas Co. of Trinidad & Tobago LLC to commit an additional 1.2 tcf of gas to the domestic market.

Wilson said BG is awaiting the result of its bid to develop shallow-water Block 2 in the North Coast Marine Area. The company declined to bid for deepwater acreage under current terms, but Wilson said he “believes that future investment will demand exploration of these areas” in order to meet the needs of new downstream industries.

GCLP selects operator for Calhoun LNG project

Gulf Coast LNG Partners LP (GCLP), Houston, has signed a memorandum of understanding for Port Lavaca LNG Services LLC to become operator of the Calhoun LNG terminal under development at Port Lavaca-Point Comfort in Calhoun County, Tex.

Port Lavaca LNG Services has also agreed to participate as an equity owner in the project.

Pending regulatory approvals, full operation of the terminal is scheduled for late 2009 to early 2010 (OGJ Online, Jan. 26, 2006).

Port Lavaca LNG is a consortium of Korea Gas Corp., LG International Corp., and EMS Group of Houston.