Energy and venture capital

As a business reporter covering the peak of the dot-com craze years ago, I wondered how start-up companies intent on making a fortune off the internet could attract millions of venture capital dollars while oil and gas companies could raise little, if any, VC financing.

Today, renewable and alternative energy is attracting VC dollars. US Energy Sec. Samuel W. Bodman acknowledged this during his February speech to a Cambridge Energy Research Associates conference in Houston.

“I can honestly say that for the first time in my life we are seeing the venture capital community put sizable amounts of money into energy,” Bodman said. “This is real money. They are betting, if you will, that clean, safe, affordable energy represents the new innovation frontier.” Formerly, Bodman worked for a VC firm before he was chief operating officer of Fidelity Investments.

VC contributions

The National Venture Capital Association is forming a committee of its members who invest in alternative energy. One committee goal will be to educate lawmakers about VC’s contribution to energy-related innovations, a NVCA spokeswoman said.

Although representing a fraction of today’s energy supply mix, renewable and alternative energy is generating growing revenues and attracting escalating investments, reports Clean Edge Inc., a research and consulting firm.

Clean Edge collaborated with Nth Power LLC, an energy technology VC firm, on Clean Edge’s annual report “Clean Energy Trends.” Both firms are in San Francisco.

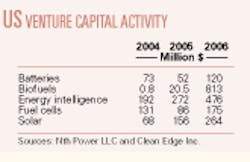

The report shows US VC investments in energy technologies rose to $2.4 billion in 2006 from $917 million in 2005. Of total VC investments, energy tech increased to 9.4% in 2006 from 4.2% in 2005. Over the last 7 years, investments in energy technologies have increased from less than 1% of total VC investments to nearly 10% (see table).

Nth Power principal Rodrigo Prudencio said many VC funds have found ways to apply their skills and knowledge to energy-tech deals in solar and batteries “without straying too far from their IT and biotech roots.”

“Biofuels, at $813 million, grabbed the lion’s share of energy-tech dollars as investors clamored for an opportunity to play in ethanol and biodiesel against the rising price of petroleum-derived fuel,” Prudencio said of 2006 investments. Solar attracted $264 million, and fuel cells raised $175 million. An energy-tech bubble is unlikely because investors appear to be realistic about valuations, Prudencio said. One “curious” trend last year was that VC firms invested $1 billion primarily for infrastructure plays associated with ethanol, biodiesel, and solar rather than for technology development, he said.

The Clean Edge report said global annual revenue for four benchmark technologies-solar photovoltaic (PV), wind power, biofuels, and fuel cells-“ramped up nearly 39% in 1 year-from $40 billion in 2005 to $55 billion in 2006. We forecast that they will continue on this trajectory to become a $226 billion [worldwide] market by 2016.”

Clean Edge cofounder and principal Ron Pernick attributed annual revenue growth rates in these technologies to various factors, including growing concern about response to climate change. He said market growth for solar and wind has been “more akin to the computer, wireless, and internet than traditional energy sectors like coal, natural gas, oil, and nuclear.”

Costs rising

Pernick noted increased production costs for some energy-tech elements. “Solar PV companies saw momentary increases in their prices as the high cost of silicon raised module pricing. And profit margins for ethanol in the US all but collapsed in 2006 as the price of corn nearly doubled in just 2 years.”

This reporter sees numerous economic, regulatory, and technical challenges for renewable and alternative energy firms. To avoid the fate of defunct dot-com companies, energy-tech companies must hold their own in a competitive business environment worldwide amid evolving US and international government policies. It’s a fascinating time to be covering the energy industry.